Daily Market Outlook, February 12, 2024

Daily Market Outlook, February 12, 2024

Munnelly’s Market Minute…“Quiet Start To A Data Heavy Week”

Asia was quiet on Monday with several centers on holiday. It's also a public holiday for Lunar New Year in New York State for the first time, but that doesn't seem to include Wall Street. U.S. stock futures, European equity and Treasury futures are barely changed, and the dollar is a bit softer.

Looking ahead, major central banks, including the US Federal Reserve and the Bank of England, have gradually transitioned from hawkish positions to more neutral stances, signaling potential interest rate cuts later this year. However, they are cautious about prematurely declaring victory over inflation and advocate for patience, seeking further evidence of inflation’s decline before considering policy easing. In the UK, heightened concerns about persistent inflation may explain why markets anticipate a slightly delayed start to policy easing by the BoE compared to the Fed and ECB. The first rate cut is fully anticipated in August, rather than June. The release of January CPI data on Wednesday is expected to show a rise to 4.3%, marking a second consecutive increase.

Today's data docket lacks significant data releases. However, speeches from various central bank members may offer insights to financial markets. BoE Governor Bailey, who voted with the majority to maintain rates unchanged at 5.25% in February, is scheduled to deliver a lecture at Loughborough University this evening. Additionally, several ECB members, including de Cos, Lane, and Cipollone, are set to speak. In the US, Fed officials Bowman, Kashkari, and Barkin are also on the agenda.

Early tomorrow morning, the first of several key UK reports this week will be published, shedding light on developments in the UK labor market. The quality of the UK Labour Force Survey (LFS) remains uncertain due to low survey response rates. Revised figures published last week lowered the unemployment rate to 3.9% in the three months to November, suggesting a tighter labor market. Expectations suggest the updated unemployment rate to tick up to 4.0% for the three months to December. The BoE is likely to prioritize wage data, which are not LFS-based, anticipating a further decline in headline pay growth to 5.7% from 6.5%, and in regular pay growth to 6.0% from 6.6%. While the wage data are moving in the right direction from a monetary policy perspective, further progress is needed.

The main event Stateside is U.S. consumer price report for January, out on Tuesday, will impact the markets' expectations for Federal Reserve rate cuts in March or May. Headline CPI is expected to rise by 0.2% month-on-month, with core CPI up by 0.3%. Annual CPI is forecasted to return to 3.0%, while core CPI is expected to slow to 3.8%. Prices for used cars are expected to have a significant negative impact, and there is anticipation for a slowdown in rent growth. The range of estimates for core CPI suggests a downside risk. Futures indicate a reduced likelihood of a March rate cut (17% chance) and an increased likelihood of a May easing (around 80% chance). The market implies a total of 121 basis points of cuts for the year, down from 145 basis points a couple of weeks ago.

Overnight Newswire Updates of Note

ECB’s Panetta: Time For Interest Rate Cuts Is ‘Fast Approaching’

ECB’s March Projections Key For Rate Path, De Cos Says

EU Reaches Tentative Agreement On Fiscal Rules To Rein In Debt

CIPD Say UK Employers Plan Smaller Pay Rises For 2024

RBNZ’s Orr: Infl. Remains Too High, Is Why We've Kept Rates At 5.5%

New Zealand Government To Deliver Their Budget On May 30

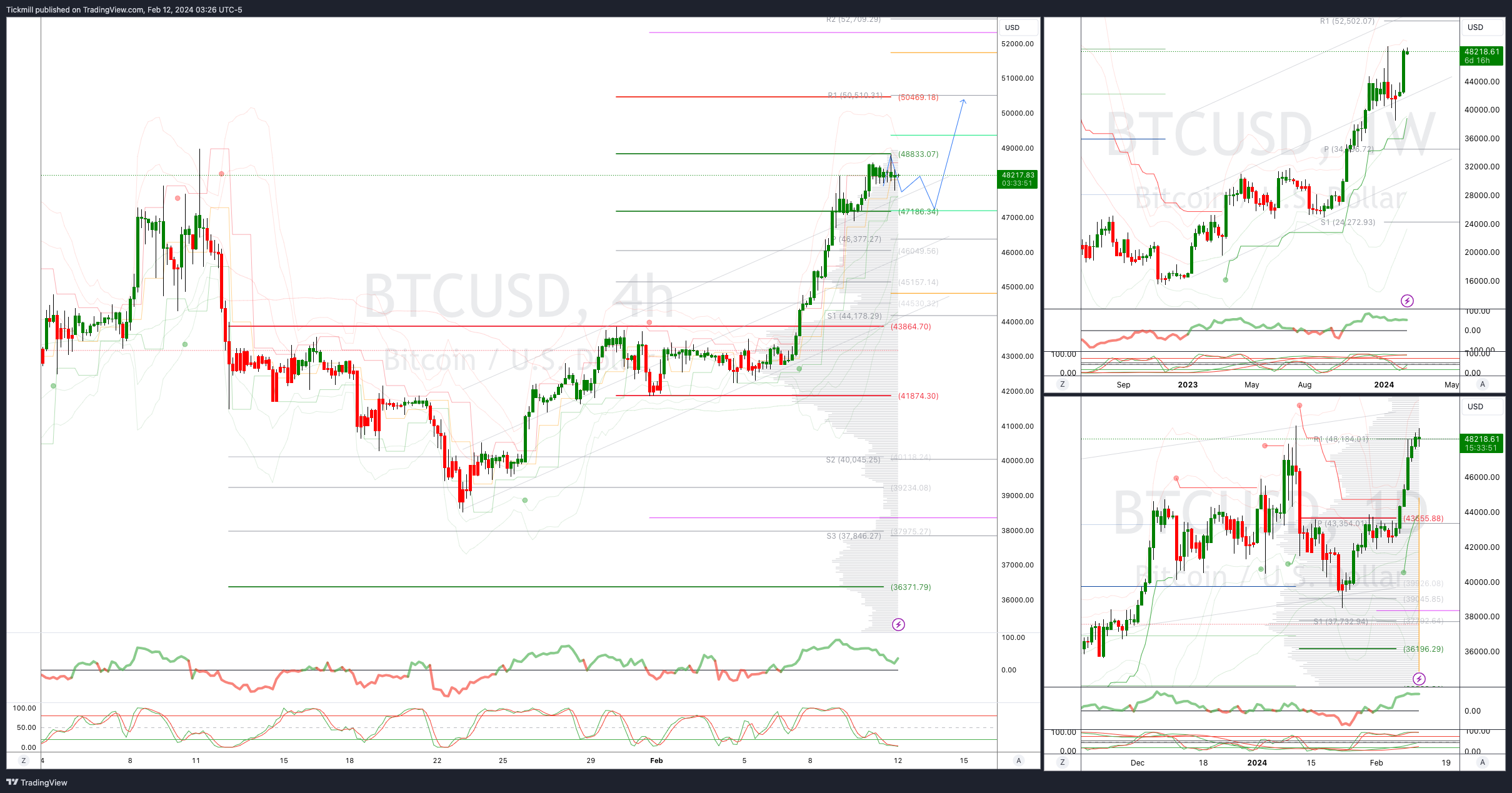

Bitcoin Eyes Longest Winning Run In A Year As ETFs Attracts Inflows

Permian Rivals Near Deal To Create $50 Billion Oil-And-Gas Behemoth

Defying Biden, Netanyahu Doubles Down On Plans To Fight In Rafah

IDF Rescues Two Hostages In Special Operation In Gaza's Rafah

Iran’s ForMin: Gaza Conflict ‘Moving Toward Diplomatic Solution’

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0725 (EU2.78b), 1.0800 (EU754.8m), 1.0925 (EU606m)

USD/JPY: 149.00 ($481.1m), 144.30 ($475m), 149.10 ($426.5m)

GBP/USD: 1.1800 (GBP300m)

NZD/USD: 0.6150 (NZD300.9m)

Euro sales had no impact this month as traders reduced around 30% of their bullish bets, resulting in a net long reduction from $12 billion to $8.3 billion. This is the smallest long position since October 2022. Although EUR/USD initially dipped to 1.0722, it later rebounded to the current level of 1.0796. In January, EUR/USD closed at 1.0818 after trading as low as 1.0795 on EBS. The EUR/USD rally in December was followed by profit taking, as bets on the rise exceeded $20 billion.

CFTC Data As Of 8/02/24

The British Pound had a net long position of 34,475 contracts.

The Euro had a net long position of 62,153 contracts.

The Japanese Yen had a net short position of -84,230 contracts.

Bitcoin had a net short position of -1,523 contracts.

The Swiss Franc had a net short position of -5,567 contracts.

Equity fund managers reduced their net long position in S&P 500 CME by 53,941 contracts to 912,862.

Equity fund speculators decreased their net short position in S&P 500 CME by 8,669 contracts to 423,955.

Technical & Trade Views

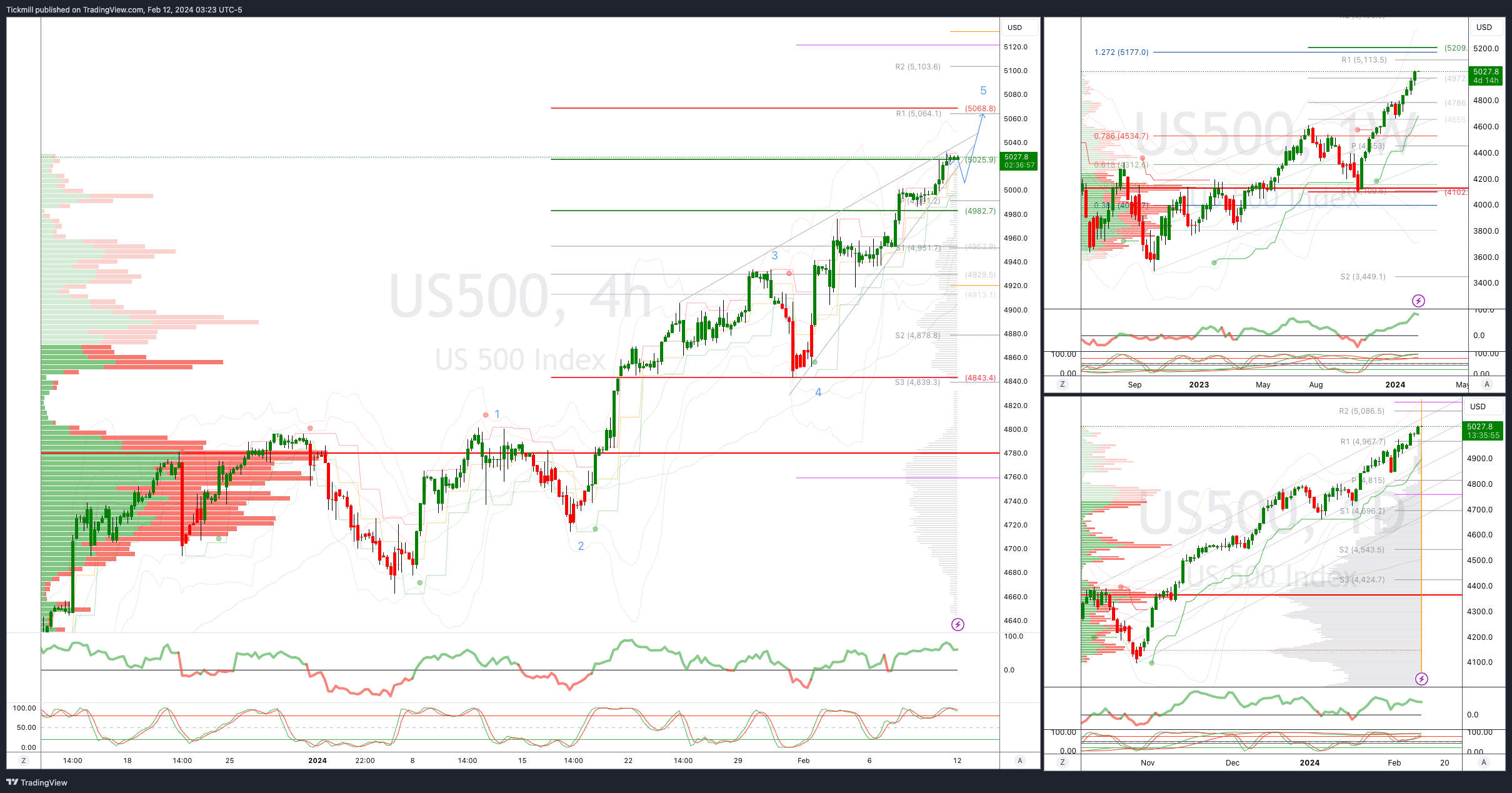

SP500 Bullish Above Bearish Below 4975

Daily VWAP bullish

Weekly VWAP bullish

Below 4970 opens 4950

Primary support 4840

Primary objective is 5060

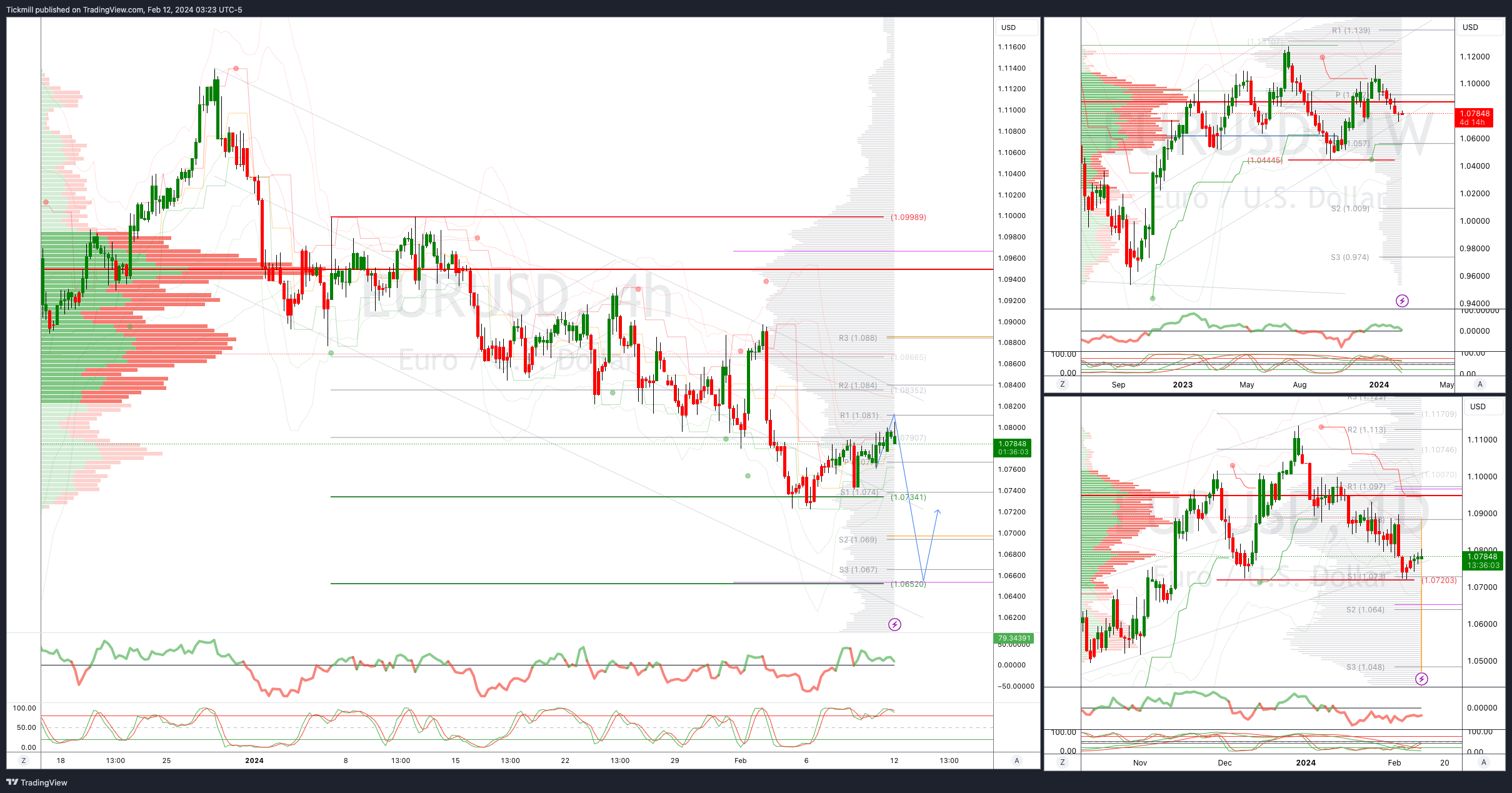

EURUSD Bullish Above Bearish Below 1.0830

Daily VWAP bullish

Weekly VWAP bearish

Above 1.109 opens 1.10

Primary resistance 1.0950

Primary objective is 1.0650

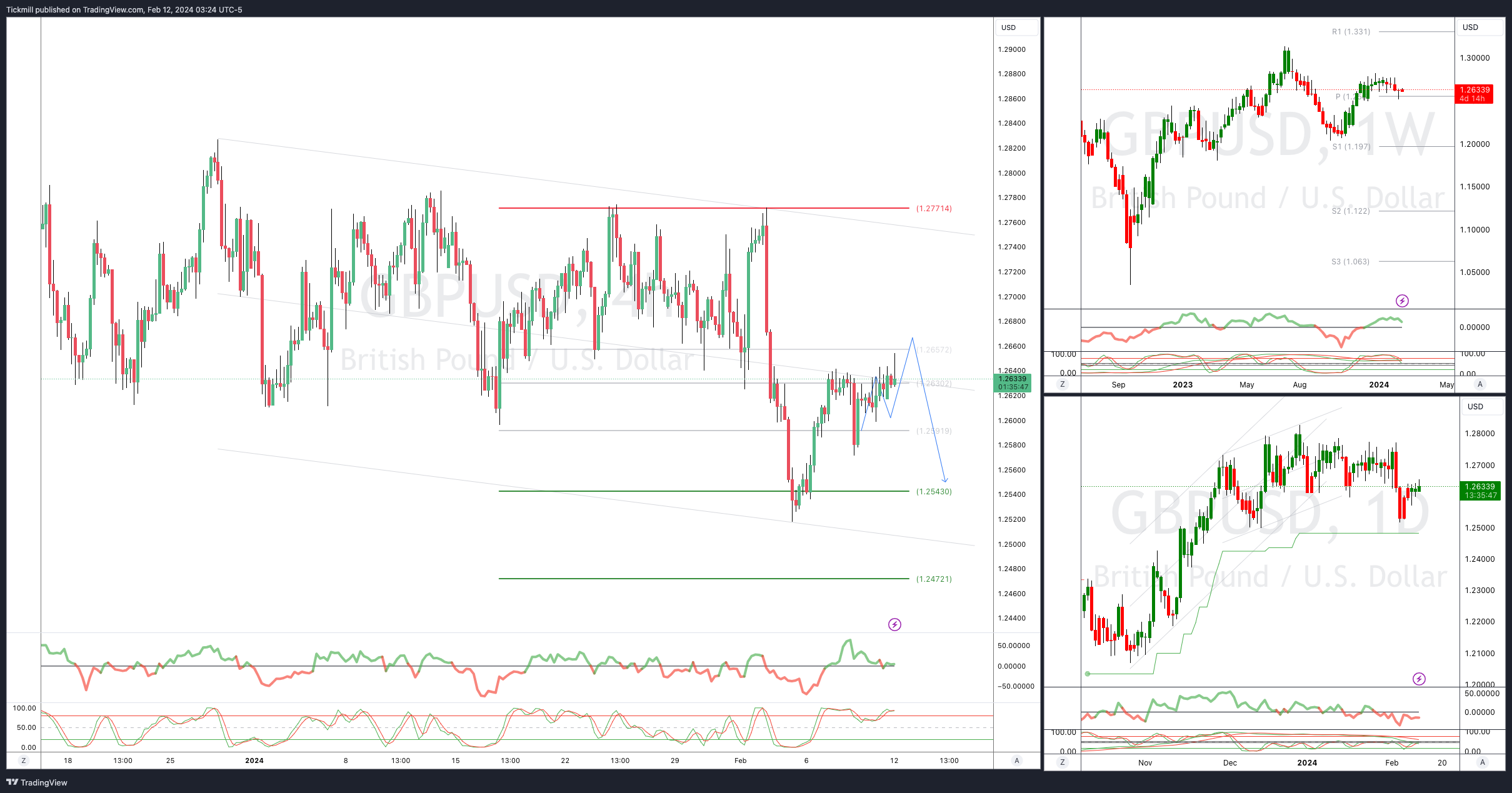

GBPUSD Bullish Above Bearish Below 1.2660

Daily VWAP bullish

Weekly VWAP bearish

Above 1.27 opens 1.2770

Primary resistance is 1.2785

Primary objective 1.2570 - Target Hit New Pattern Emerging

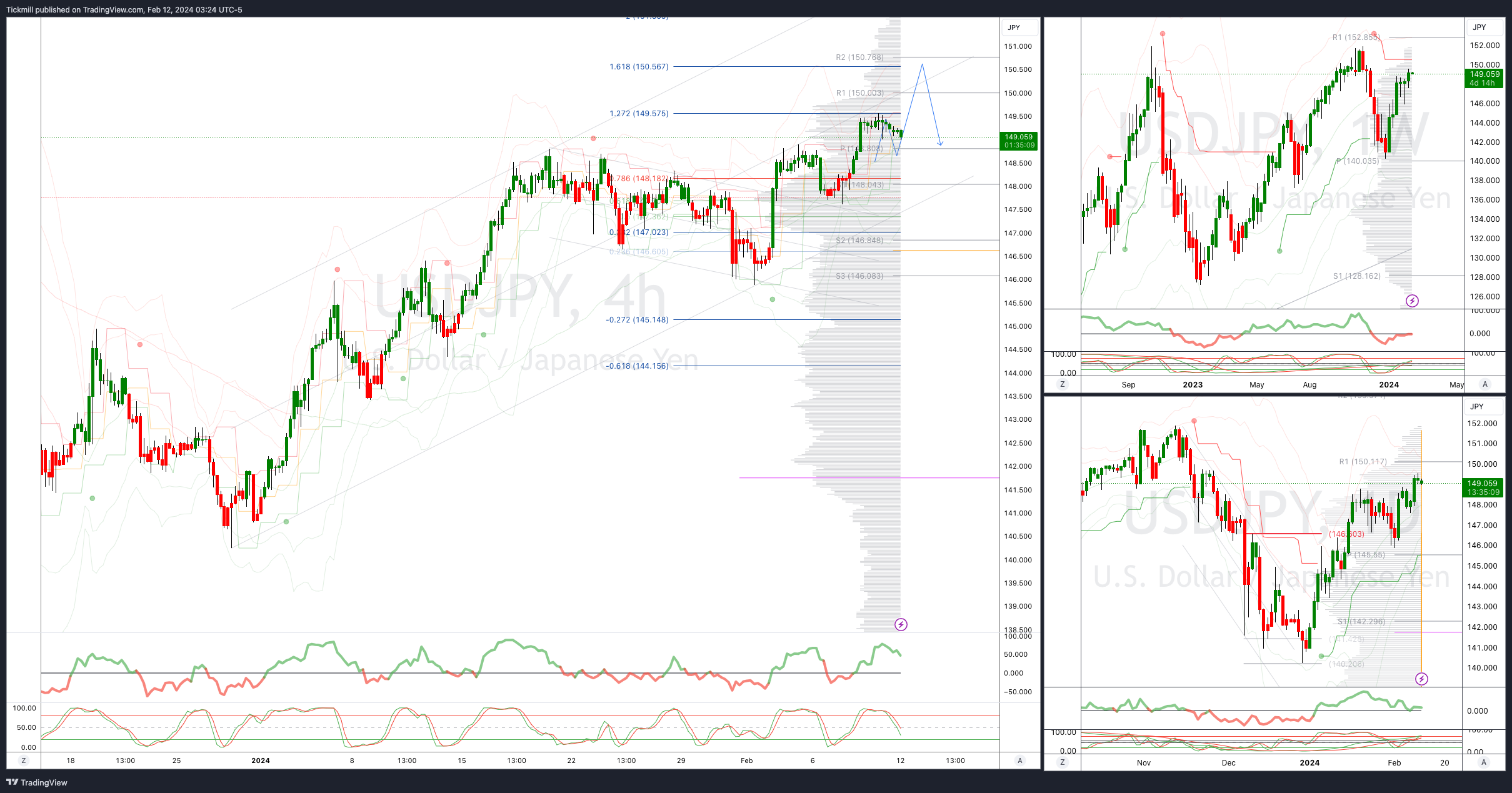

USDJPY Bullish Above Bearish Below 147.50

Daily VWAP bullish

Weekly VWAP bullish

Below 146 opens 145.50

Primary support 143.50

Primary objective is 149.50

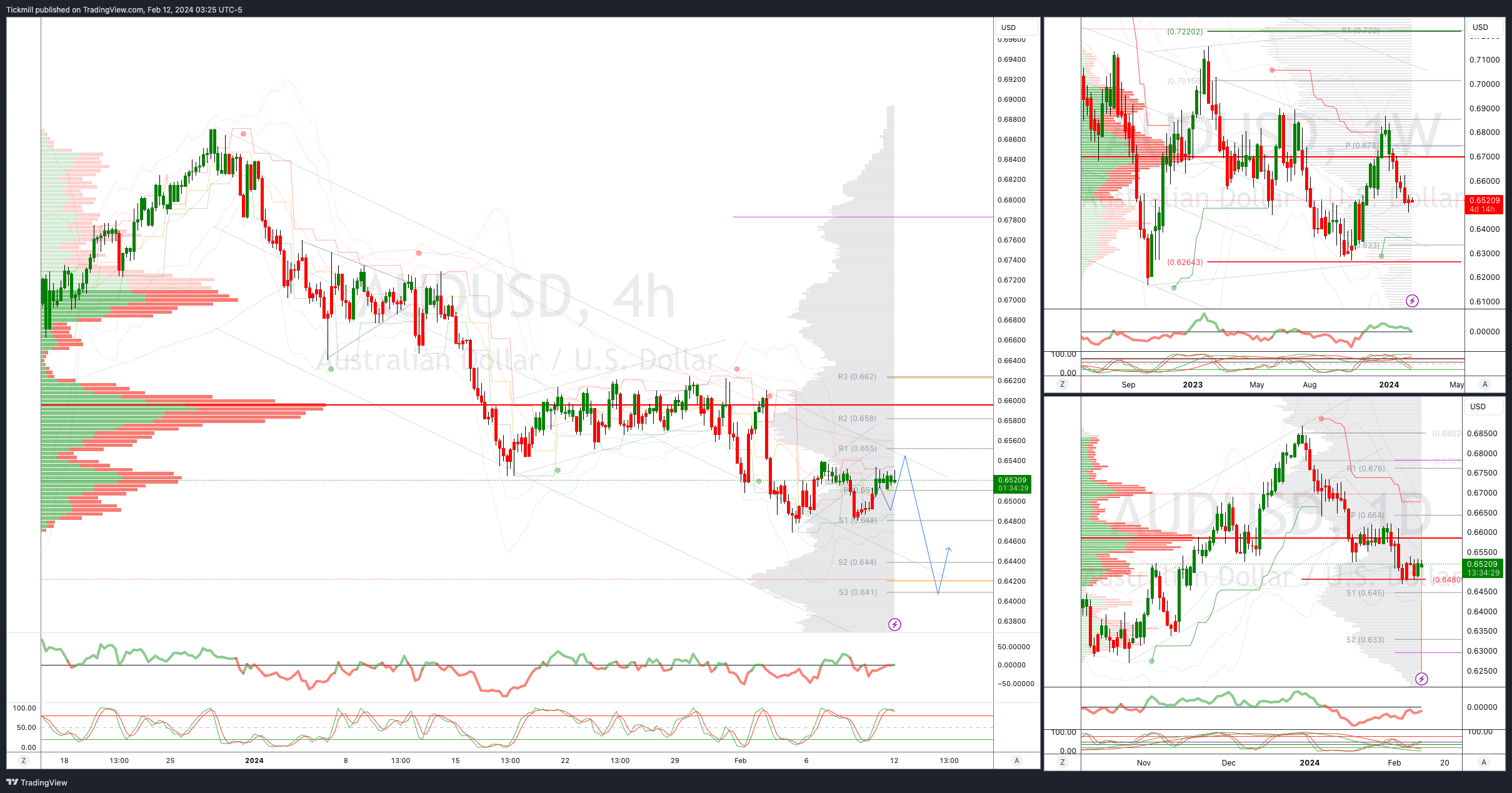

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6420

Primary support .6525

Primary objective is .6260

BTCUSD Bullish Above Bearish below 45000

Daily VWAP bullish

Weekly VWAP bullish

Below 44000 opens 42500

Primary support is 443900

Primary objective is 50000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!