Daily Market Outlook, December 6, 2023

Daily Market Outlook, December 6, 2023

Munnelly’s Market Commentary…

Asia - Asian-Pacific stocks experienced widespread gains, driven by a more subdued yield environment, increased risk sentiment, and anticipation surrounding important data releases. The recent decline in US JOLTS job openings raised hopes for potential Federal Reserve rate cuts, further boosting the positive market atmosphere. The Nikkei 225 showed notable outperformance, surging and surpassing the 33K handle. This progress was supported by a decrease in the 10-year JGB yield, which reached its lowest point since August. On the other hand, the Hang Seng rose, aligning with the positive market sentiment. However, the Shanghai Composite had a more mixed performance, with the mainland market lagging behind. The nuanced dynamics were influenced by the ongoing liquidity drainage by the People's Bank of China and Moody's negative revision of China's credit outlook.

Europe - The Financial Stability Report of the Bank of England, along with a press conference, is expected to provide information on how the financial system is adjusting to the significant rise in interest rates since late 2021. While the BoE is likely to acknowledge a decrease in both the supply and demand of credit, it may emphasise that the overall financial industry is managing well without any major strains. The report's analysis of the housing market and the impact of higher mortgage rates will be closely examined, especially considering the growing optimism in the market regarding potential significant interest rate cuts in the coming year. Governor Bailey is not expected to give any hints about the upcoming monetary policy update.

The November construction data for the UK PMI will offer a timely evaluation of activity in a sector that is highly sensitive to changes in interest rates. The slight increase in the overall activity index from 45.0 in September to 45.6 in October, although still the second-lowest reading since May 2020, suggests some resilience. The weakest segment, housebuilding, has been consistently declining for 11 months, but there are signs of stabilisation in commercial activity despite a sharp decline in civil engineering.

For the Eurozone, preliminary data from major countries indicates a potential small increase in retail sales in October, which would be the first increase seen in six months.

US - Stateside, The ADP measure is a report that provides an estimate of the number of jobs added or lost in the US private sector. It is released two days before the official monthly employment report by the Bureau of Labor Statistics (BLS). The ADP report is based on payroll data from approximately 400,000 US businesses, and it covers about 24 million employees. While the ADP report is considered a useful indicator of the health of the US labour market, it is not always a reliable predictor of the BLS report. The BLS report is based on a much larger sample size and includes data on both private and public sector employment. Additionally, the BLS report includes a range of other labour market indicators, such as the unemployment rate and average hourly earnings. Despite its limitations, many economists and investors closely watch the ADP report as it can provide some insight into the direction of the labour market and the broader economy.

FX Positioning & Sentiment

The price of FX options has risen in the past week due to valid reasons. Both realised and implied volatility have increased as the USD has regained its previous strength. Implied volatility measures the risk of realised volatility and helps determine the premium. Option risk reversals have shown a preference for a higher implied volatility if the USD were to recover. Additionally, the upcoming US jobs data on Friday and the inclusion of the Federal Reserve, European Central Bank, and Bank of England in the one-week expiry implied volatility are also significant factors to consider.

CFTC Data

The net speculative long position for EUR has increased, while the short position for GBP has been significantly reduced. On Tuesday, the net speculative long position for EUR rose to 143,165 from the previous week's 129,654. The net speculative short position for JPY also increased to 109,237 from 105,454. Additionally, the net speculative short position for AUD decreased to 71,219 from 77,970. However, the short position for GBP decreased significantly to 7,895 from 26,098. Furthermore, there has been an increase in short positions for CHF and NZD.

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0770-80 (1BLN), 1.0800 (3.2BLN), 1.0850 (610M), 1.0900 (1BLN)

GBP/USD: 1.2500 (568M), 1.2570 (495M), 1.2590-1.2600 (406M), 1.2750 (210M)

NZD/USD: 0.6100-10 (2.3BLN). AUD/USD: 0.6450 (1.7BLN), 0.6770 (590M)

USD/CAD: 1.3600 (1BLN), 1.3640 (500M)

USD/JPY: 146.65 (525M), 146.90 (328M), 147.20-25 (1.2BLN)

147.50 (533M), 148.00 (634M)

Overnight Newswire Updates of Note

Australian Economy Surprisingly Slows As Rates Damp Spending

BoJ’s Deputy Chief Hints That End Of Negative Rate May Be Closer

Japan Bond Liquidity Worse Under Easing, BoJ Review Finds

S&P And Fitch Have Both Not Changed China's Rating Nor Outlook

US Job Data Suggests ‘Soft Landing’ Is Increasingly Likely, Economists Say

US Tsy’s Yellen: Soft-Landing Sceptics Are Now ‘Eating Their Words’

Traders Show Doubts Fed Will Cut As Fast As What They’re Expecting

EU To Consider Debt-Reduction Targets As Part Of Fiscal Revamp

PBoC Steps Up Yuan Support Via Fixing After Moody’s Outlook Cut

Bitcoin’s ‘Jet-Fuelled’ 16% Six-Day Jump Takes Token Past $44,000

Mastercard To Buy Back Shares Worth Up To $11 Billion

Apple Moves Towards India-Made iPhone Batteries In Push Away From China

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

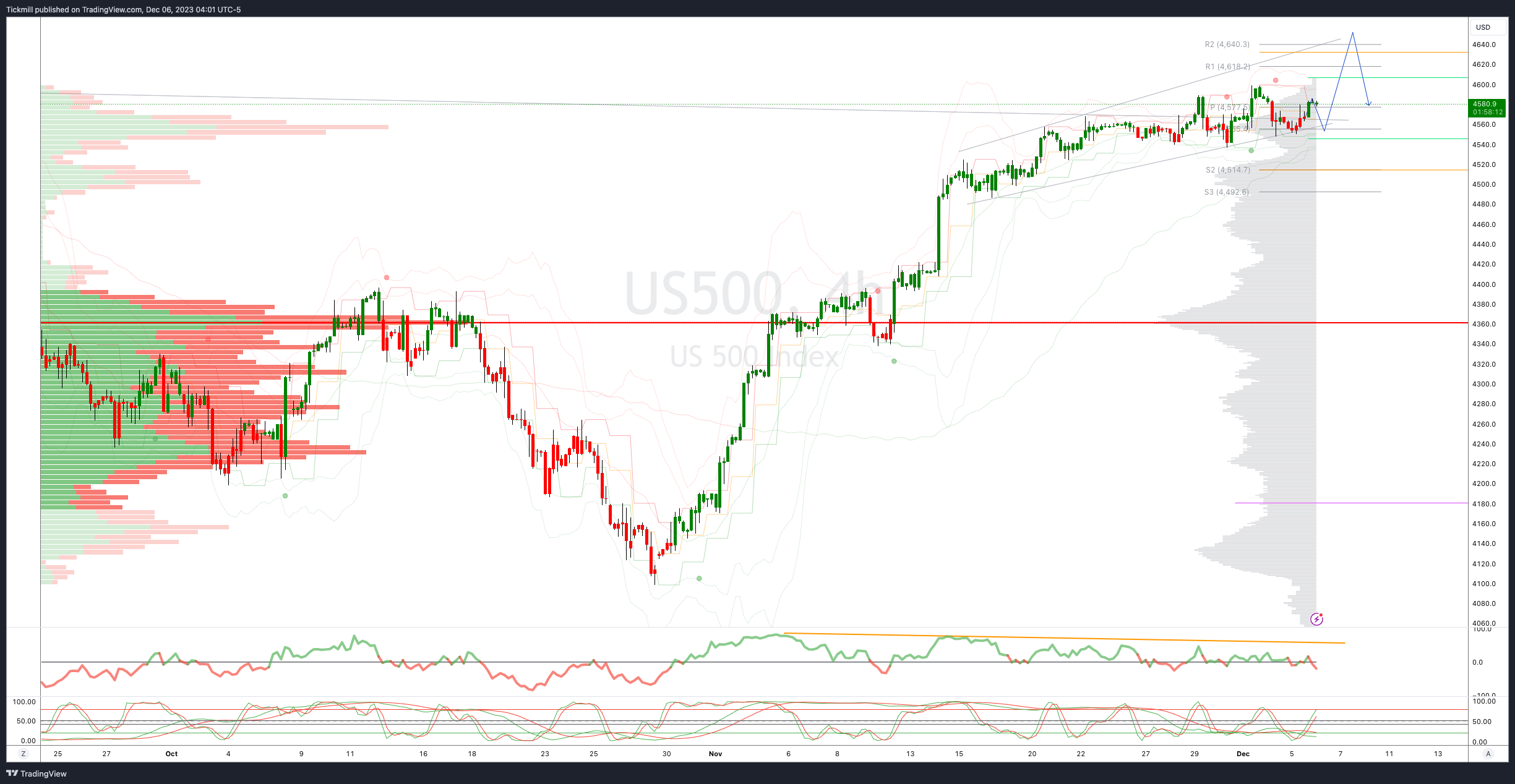

SP500 Bias: Bullish Above Bearish Below 4540

Below 4519 opens 4485

Primary support 4420

Primary objective is 4600

20 Day VWAP bullish, 5 Day VWAP bullish

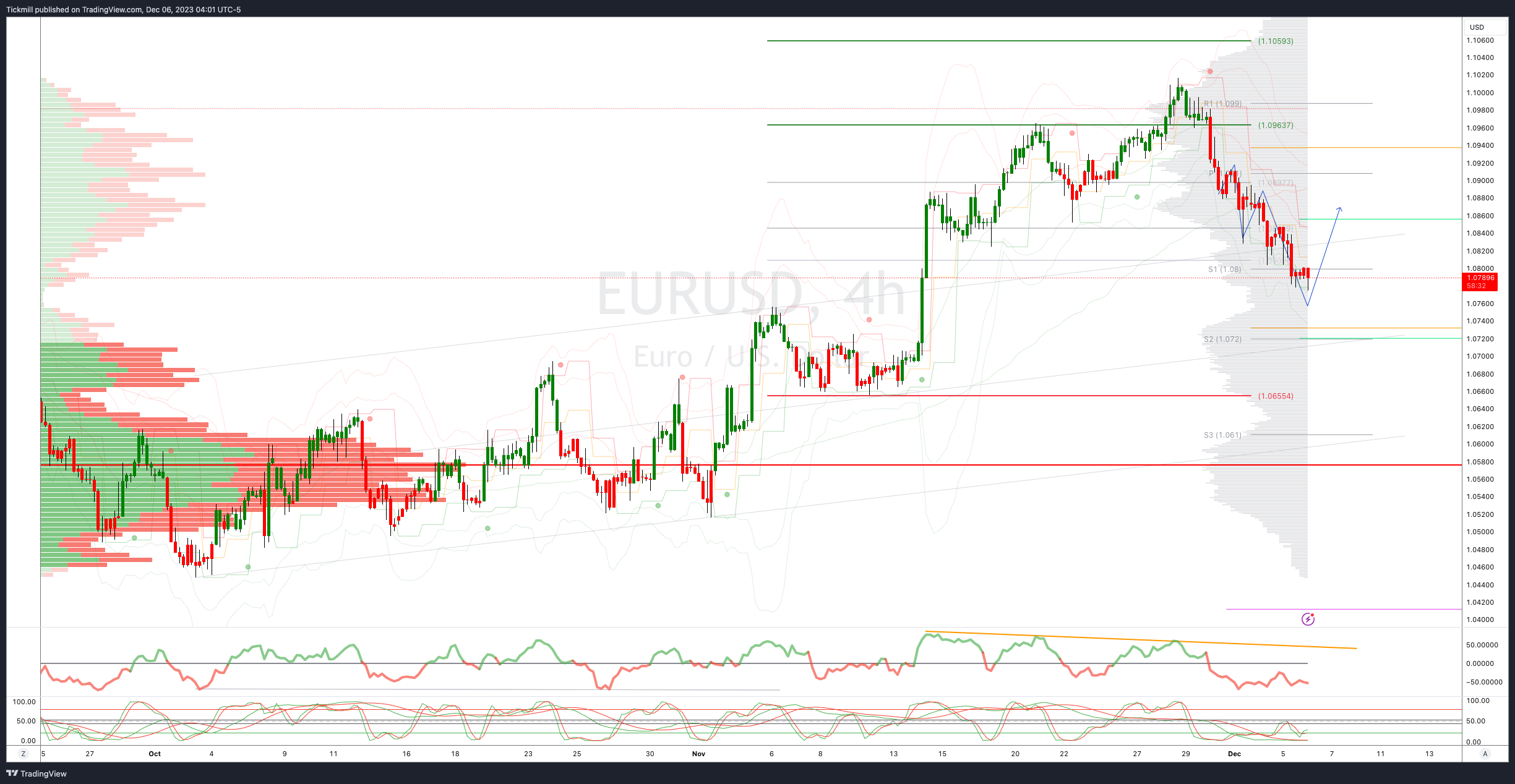

EURUSD Bias: Bullish Above Bearish Below 1.0740

Below 1.0740 opens 1.0650

Primary support 1.0650

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bearish

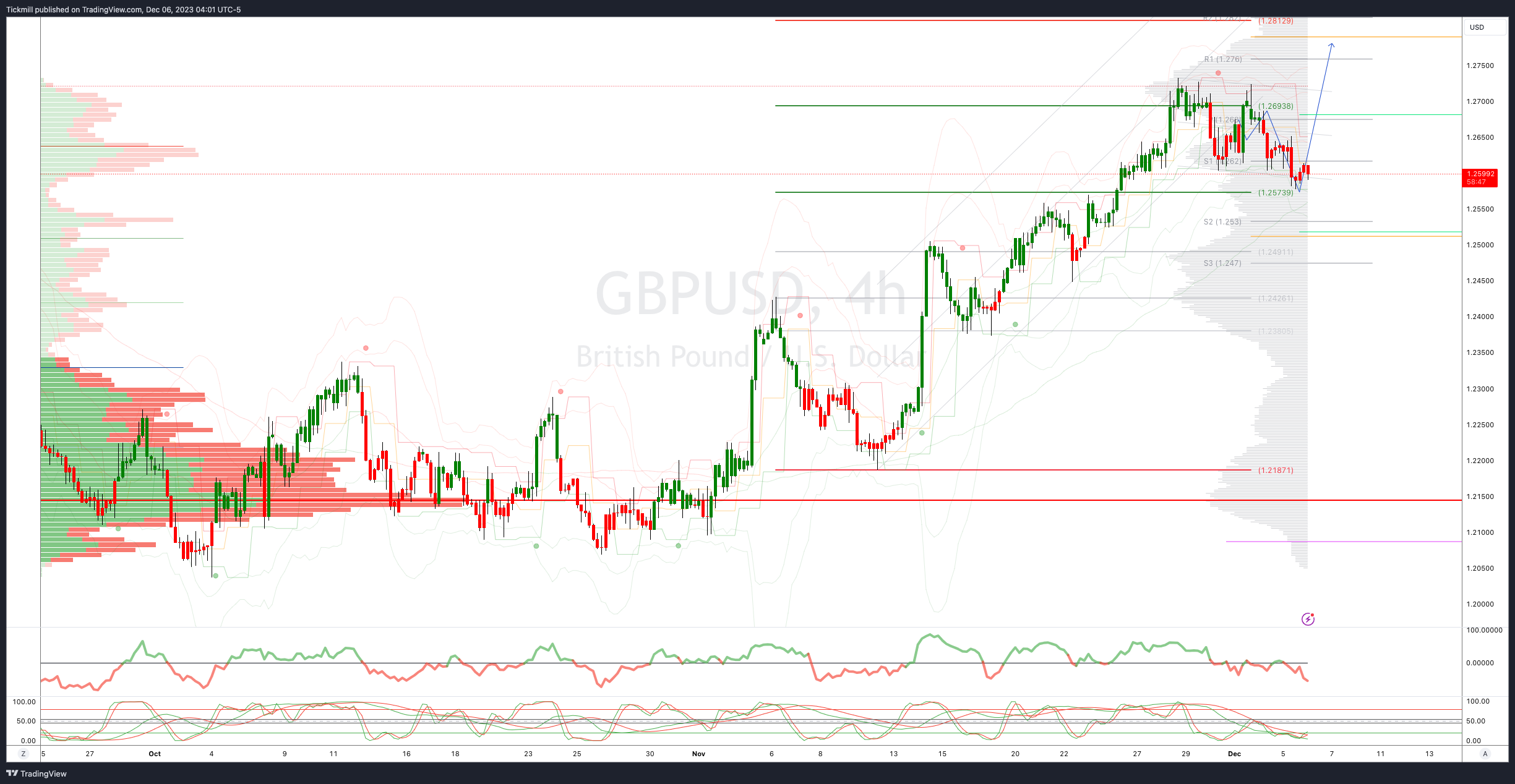

GBPUSD Bias: Bullish Above Bearish Below 1.2640

Below 1.2630 opens 1.2575

Primary support is 1.2185

Primary objective 1.28

20 Day VWAP bullish , 5 Day VWAP bearish

USDJPY Bias: Bullish Above Bearish Below 148

Above 148.10 opens 149

Primary resistance 149.70

Primary objective is 145

20 Day VWAP bearish, 5 Day VWAP bullish

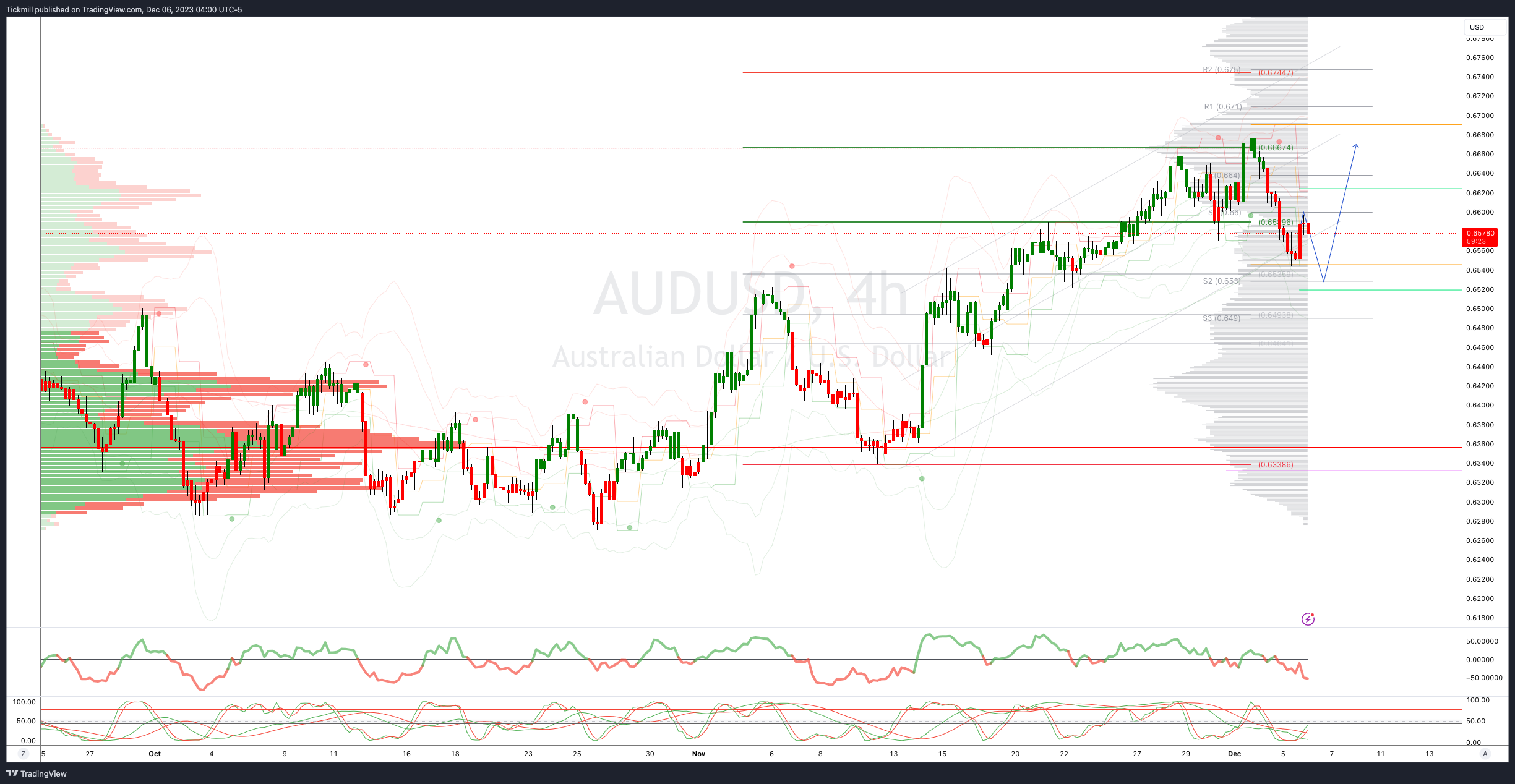

AUDUSD Bias: Bullish Above Bearish Below .6590

Below .6560 opens .6520

Primary support .6330

Primary objective is .6740

20 Day VWAP bullish, 5 Day VWAP bearish

BTCUSD Bias: Bullish Above Bearish below 42400

Below 41000 opens 40000

Primary support is 36800

Primary objective is 46000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!