Daily Market Outlook, December 5, 2023

Daily Market Outlook, December 5, 2023

Munnelly’s Market Commentary…

Asia - Stocks saw declines as they followed a mostly negative trend from Wall Street. Major indices on Wall Street were choppy and weighed down due to a rebound in yields ahead of important data releases. In Japan, the Nikkei 225 continued to weaken and fell below the 33K handle, despite Tokyo inflation data being softer than expected. The Hang Seng and Shanghai Composite also retreated, with the latter testing the downside at the 3,000 level due to ongoing geopolitical tensions. China criticised the U.S. for considering it a threat, and this was followed by Commerce Secretary Raimondo's call for more funds to support chip curbs. The Caixin Services PMI data, which showed a three-month high at 51.5 (compared to an expectation of 50.7), only provided a brief boost.

Europe - The market is expected to closely observe the latest survey on inflation expectations conducted by the European Central Bank. The data was collected prior to the release of November's CPI figures, which showed greater-than-anticipated decreases in both overall and core inflation. Despite this, it is expected that inflation expectations for the next year will slightly decrease to 3.8% compared to the previous update's 4.0%. However, expectations for inflation three years ahead are predicted to remain unchanged at 2.5%. These figures indicate that inflation expectations are still higher than pre-Covid levels and exceed the ECB's target of 2.0%, making it unlikely that there will be a change in the ECB's policy makers' stance that interest rates will not decrease anytime soon. Additionally, second readings of November's PMI services data for both the UK and Eurozone will also be released, which are not expected to be revised. The initial outturns showed an increase in headline measures for both economies compared to October. The Eurozone's increase was modest, with the index remaining below the 50 expansion/contraction level for the fourth consecutive month. In contrast, the UK's index rebounded more strongly, surpassing 50 for the first time since July. The second report for November will provide further insight into the reasons for this recovery.

US - Stateside,the new data on the ISM services index for November will provide insights into the performance of the services sector in the US. Despite concerns about the US economy potentially entering a recession, the ISM services index has managed to stay above the 50 level, indicating ongoing economic activity. However, the October reading saw a significant decline from September, raising questions about the pace of economic growth in Q4 compared to the robust expansion seen in Q3. The alternative US PMI services measure showed a slight increase in November, and analysts anticipate a similar uptick in the ISM reading. Additionally, the October JOLTs report on labour market turnover is scheduled for release today. This report will offer valuable information on job openings, hires, and separations, providing insights into the dynamics of the US labour market. The data from the JOLTs report will play a role in shaping expectations about the overall health of employment conditions in the US, particularly ahead of the release of the November labour market report on Friday.

FX Positioning & Sentiment

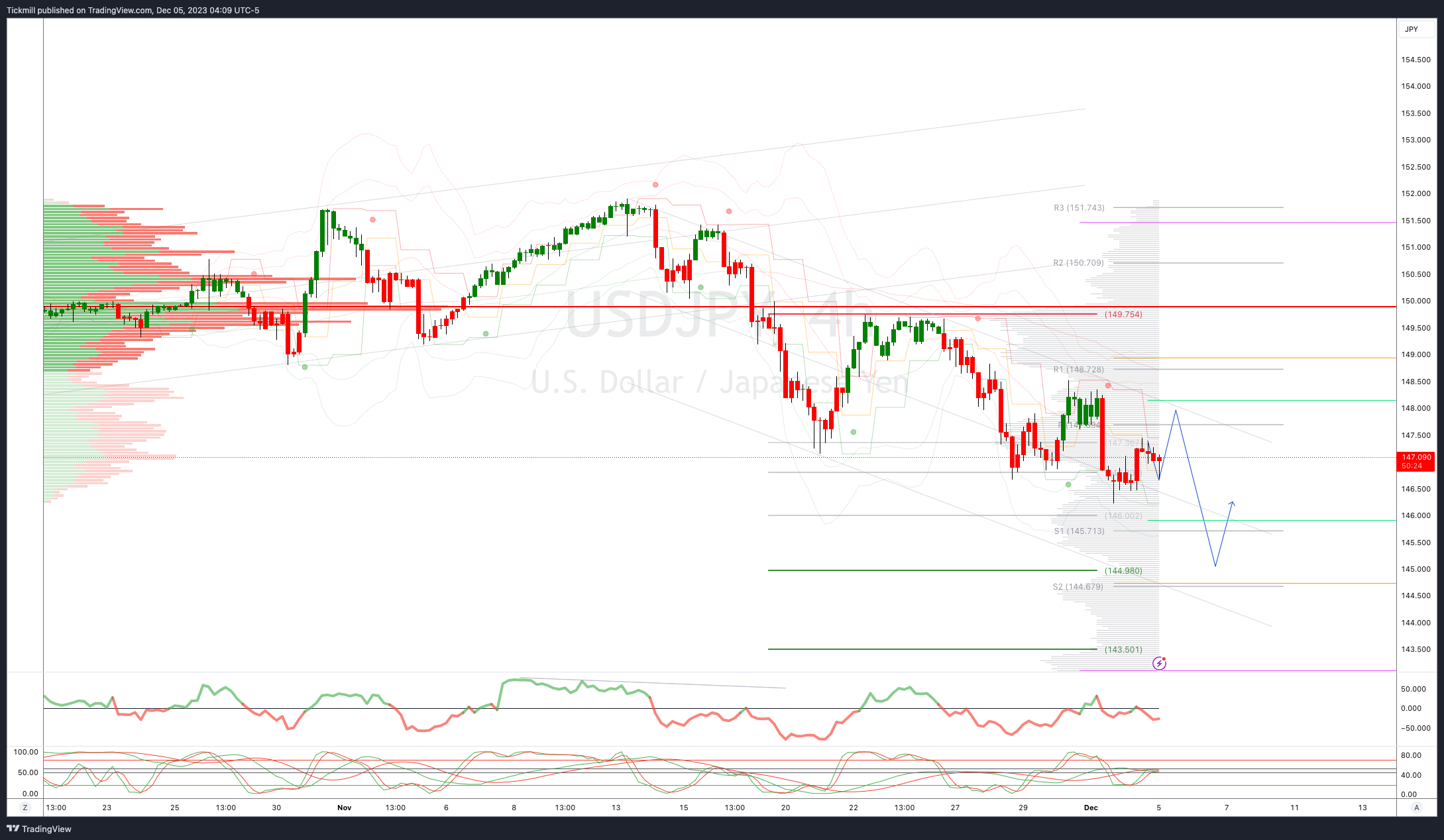

On Friday, the USD/JPY currency pair will face a crucial moment as the U.S. payrolls data is released, which is expected to determine whether there will be further pullbacks or consolidation above recent lows. The movement of U.S. yields will also be monitored closely. Consolidation between 146-148 is anticipated leading up to the release. Despite the recent dovish shift in Federal Reserve expectations and the drop in U.S. yields, there is scepticism among Tokyo players who view it as premature. Both the Bank of Japan and the Federal Reserve will continue to base their policies on current data, and a strong or weak U.S. jobs report could trigger significant changes. The USD/JPY is expected to trade within a range of 146-148 with limited upside due to option expiries and Japanese exporter sales.

CFTC Data

The net speculative long position for EUR has increased, while the short position for GBP has been significantly reduced. On Tuesday, the net speculative long position for EUR rose to 143,165 from the previous week's 129,654. The net speculative short position for JPY also increased to 109,237 from 105,454. Additionally, the net speculative short position for AUD decreased to 71,219 from 77,970. However, the short position for GBP decreased significantly to 7,895 from 26,098. Furthermore, there has been an increase in short positions for CHF and NZD.

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD:1.0800-05 (993M),1.0825-30(2.5LN)

1.0850-60, (1.41BLN), 1.0890-00(1.91BLN)

1.0940 (875M), 1.0985 (419M), 1.1000 (416M)

USD/JPY: 146.00 (988M), 146.50-57 (1.02BLN)

146.75 (410M), 147.00-10 (1.67BLN), 147.50 (1.54BLN)

148.00-10 (2.28BLN), 148.50-55 (1.0BLN), 148.75 (320M)

EUR/JPY: 160.00 (275M), 163.00 (371M)

USD/CHF: 0.8780-00 (705M)

GBP/USD: 1.2450 (338M), 1.2485 (268M), 1.2570-75 (292M)

1.2600 (360M)

EUR/GBP: 0.8475 (380M), 0.8585 (1.17BLN), 0.8650-55 (380M)

0.8675 (300M)

AUD/USD: 0.6445-55 (952M), 0.6520 (282M), 0.6550 (1.8BLN)

0.6635-40 (386M), 0.6660 (854M)

USD/CAD: 1.3460 (500M), 1.3505-25 (1.04BLN), 1.3550 (880M)

1.3600 (492M)

EUR/SEK: 11.4800 (360M), 11.9750 (551M)

Overnight Newswire Updates of Note

Australia Holds Key Rate At 12-Year High As Prices Begin To Cool

Australia Records Current-Account Deficit For Third Quarter

Tokyo CPI Falls More Than Expected In Nov, Nears BoJ Target

China’s November Caixin Services PMI Rose To Three-Month High

ECB Hawk Schnabel Scraps More Hikes After 'Remarkable' Inflation Drop

Cautious UK Shoppers Cut Purchases In Run-Up To Christmas

Citi/YouGov: UK Public Inflation Expectations Rise In October

Bitcoin Holds Near $42,000 As Rally Weathers Retreat In Equities

Telecom Giant AT&T Drops Nokia For Ericsson In A $14 Billion Deal

China’s Key Stock Gauge Reaches Oversold Zone On Weak Sentiment

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4540

Below 4519 opens 4485

Primary support 4420

Primary objective is 4600

20 Day VWAP bullish, 5 Day VWAP bearish

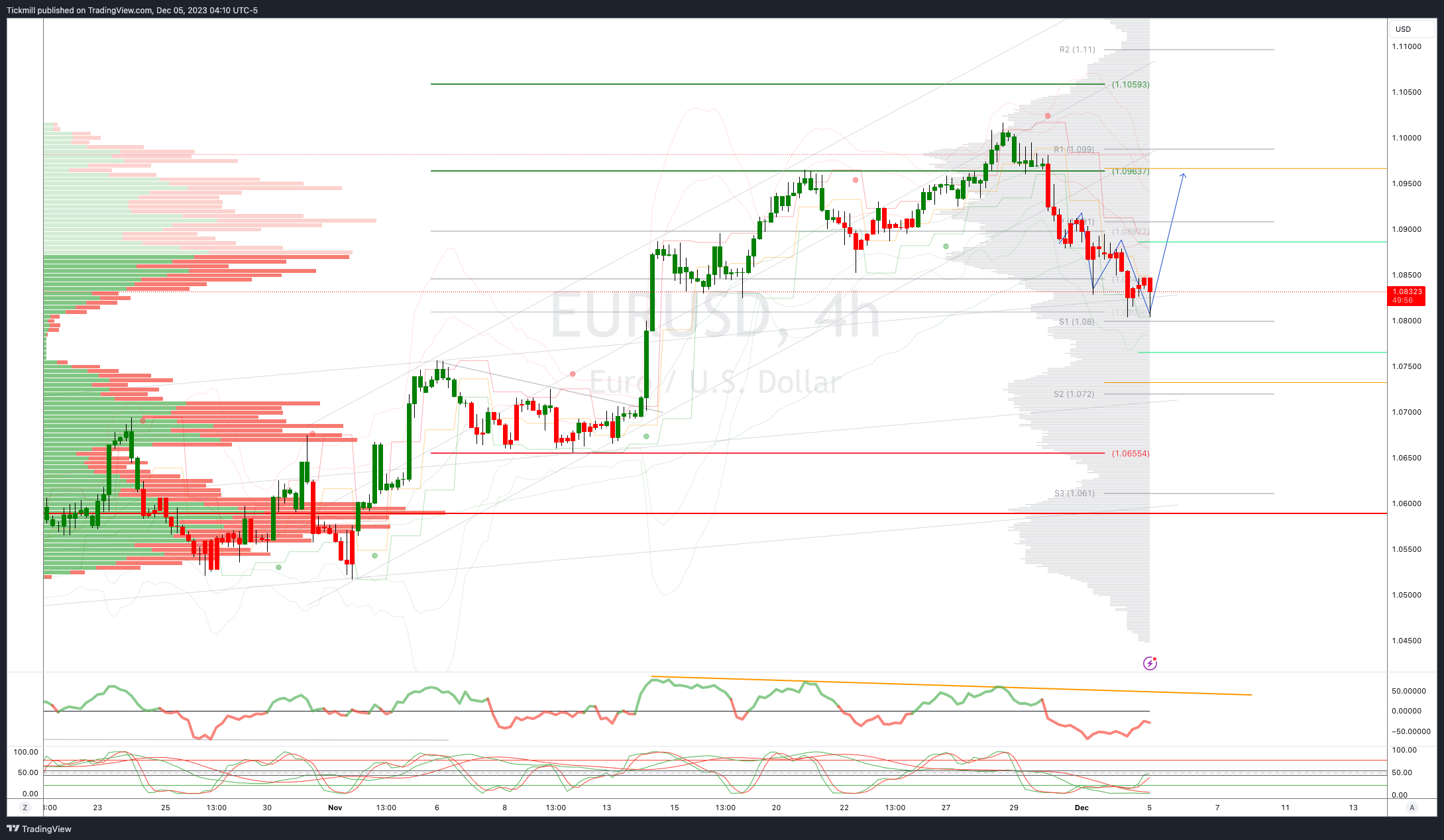

EURUSD Bias: Bullish Above Bearish Below 1.0850

Below 1.08 opens 1.0740

Primary support 1.0650

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bearish

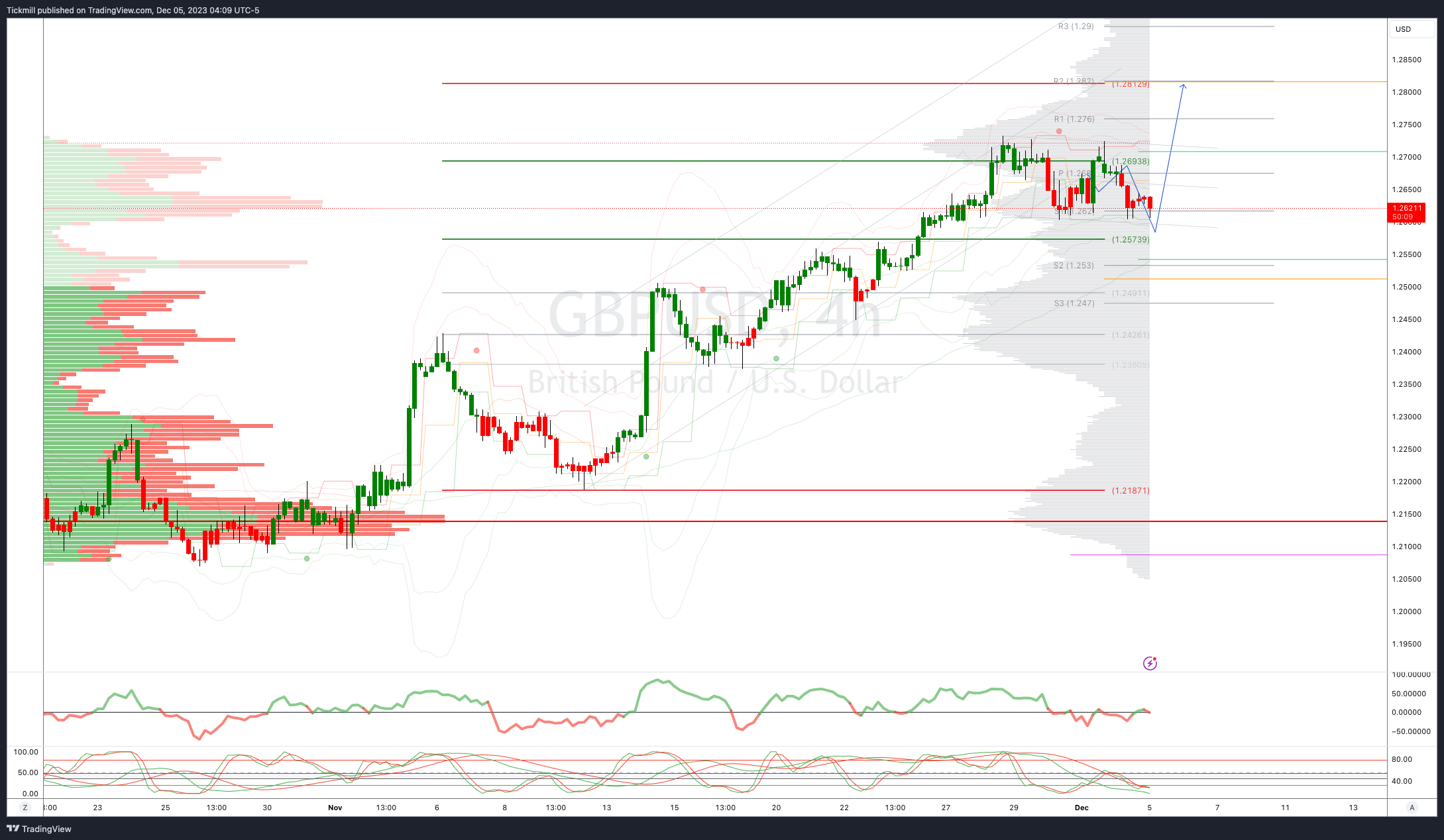

GBPUSD Bias: Bullish Above Bearish Below 1.2640

Below 1.2630 opens 1.2575

Primary support is 1.2185

Primary objective 1.28

20 Day VWAP bullish , 5 Day VWAP bearish

USDJPY Bias: Bullish Above Bearish Below 148

Above 148.10 opens 149

Primary resistance 149.70

Primary objective is 145

20 Day VWAP bearish, 5 Day VWAP bullish

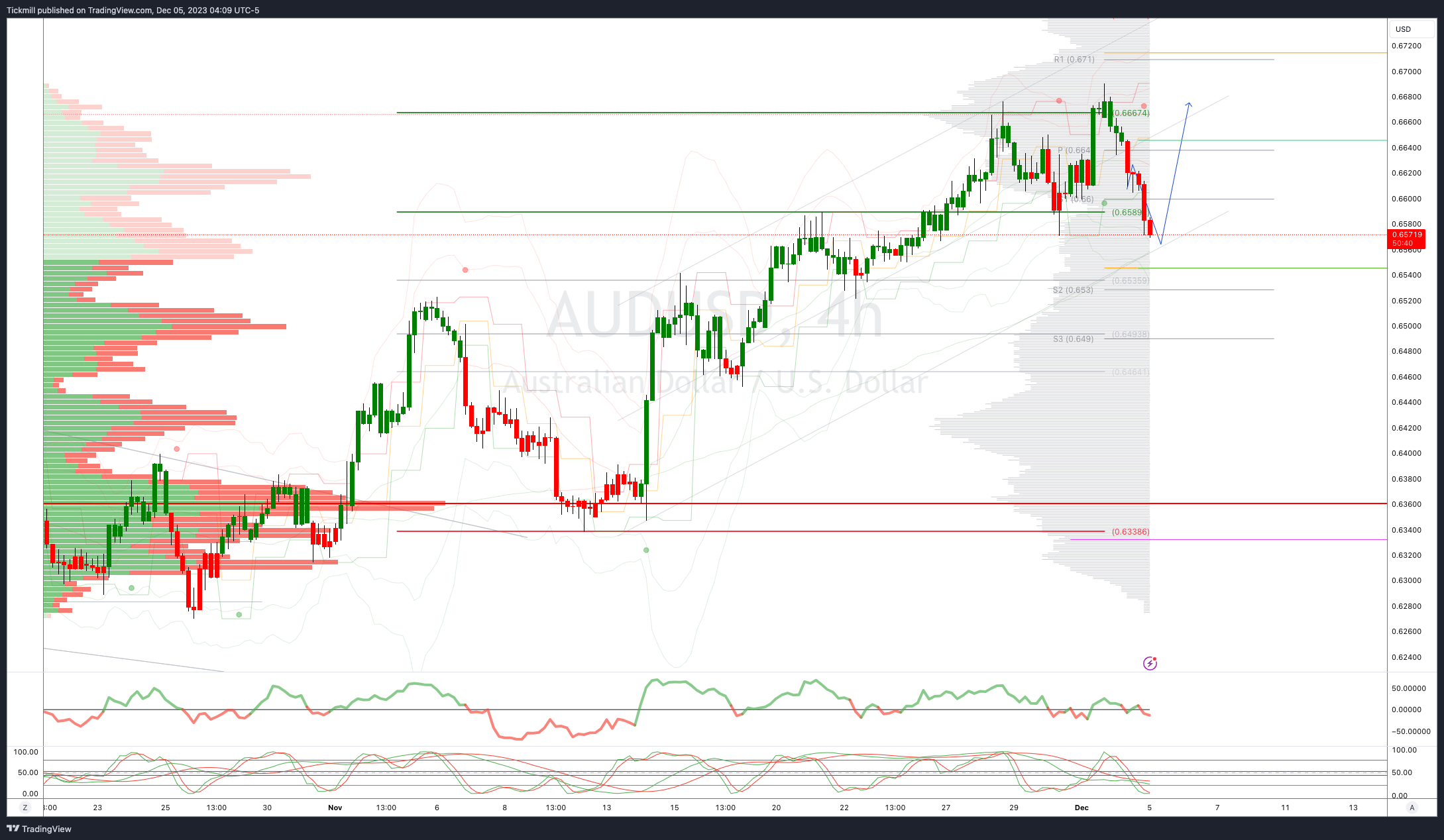

AUDUSD Bias: Bullish Above Bearish Below .6590

Below .6560 opens .6520

Primary support .6330

Primary objective is .6740

20 Day VWAP bullish, 5 Day VWAP bearish

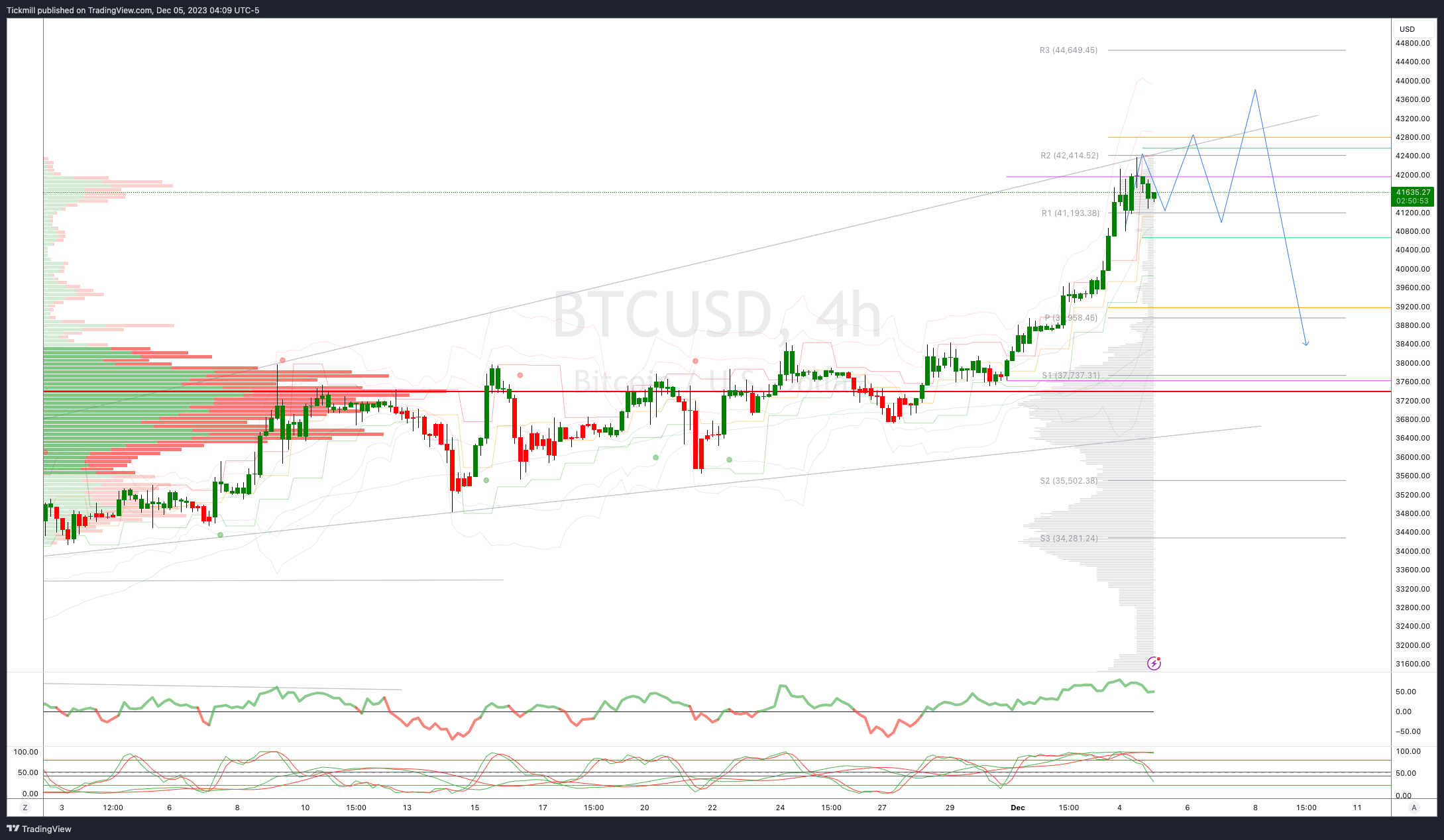

BTCUSD Bias: Bullish Above Bearish below 40000

Below 40000 opens 38000

Primary support is 36800

Primary objective is 44000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!