Daily Market Outlook, December 4, 2023

Daily Market Outlook, December 4, 2023

Munnelly’s Market Commentary…

Asia - Stocks in the Asia-Pacific region had a mixed trading session with a slight inclination towards positivity following gains on Wall Street last Friday. The positive momentum on Wall Street was attributed to a decrease in yields and an increased likelihood of Federal Reserve rate cuts next year, despite Fed Chair Powell's reluctance. However, the region's upside was limited due to a lack of significant macroeconomic news over the weekend and in anticipation of key events scheduled for the upcoming week. Gold miners experienced a boost after the precious metal initially surged above USD 2,100 per ounce, reaching a fresh record high before retracing the majority of the initial spike. The Nikkei 225 index lagged, declining by 0.6%, and briefly approaching the 33K handle to the downside, influenced by recent currency strength. The Hang Seng index and Shanghai Composite index traded indecisively, with the People's Bank of China (PBoC) Governor Pan's repeated support pledges offset by a substantial net liquidity drain. Additionally, geopolitical frictions in the South China Sea added to the uncertainty. Attention was also on Evergrande's windup hearing in a Hong Kong court, which was adjourned to January 29th, providing the company with some breathing space to work on its restructuring proposal.

Europe - There are no major UK releases today. Dovish Bank of England Monetary Policy Committee (BoE MPC) member Dhingra is scheduled to speak this morning at the final report of The Economy 2030 Inquiry event. Overnight on Tuesday, there will be the release of an early 'unofficial' indication of November nominal retail sales from the British Retail Consortium (BRC), which is expected to incorporate Black Friday sales. In October, the organisation reported annual growth of 2.6% in like-for-like sales. These events and releases provide insights into the economic conditions and consumer spending trends in the UK. The data from the BRC, especially around the Black Friday period, can be closely watched as it gives an indication of consumer behaviour and the retail sector's performance during important shopping events. Additionally, speeches and comments from MPC members can offer insights into the central bank's perspectives on the economy and potential future monetary policy decisions. Later in the week, key releases for the Eurozone include German October industrial production and the final reading of Eurozone November services PMI. Today's Eurozone Sentix survey for December, while likely to attract limited attention, provides an early gauge of investors' assessment of economic activity and prospects. Remarks today from European Central Bank (ECB) President Lagarde and Vice-President Guindos will be closely watched for insights into the central bank's perspectives on economic conditions and potential policy considerations. Investors often analyse these releases and speeches to assess the current state and outlook of the Eurozone economy.

US - Stateside, this week's headline data release is the US November labour market report scheduled for Friday. Recent data suggest that both economic activity and inflation are softening, fostering hopes of a soft landing in 2024. There are no Federal Reserve speakers scheduled for this week ahead of the policy meeting on December 12-13. Indications from Fed officials suggest that the likelihood of any policy change is remote. While some Fed policymakers have pushed back against market expectations for an early 2024 rate cut, including comments from Chair Powell on Friday, markets continue to explore that possibility. Today's US factory orders data is forecasted to show a drop of 2.4% in October after the 2.8% increase in September. Investors and analysts will closely monitor these developments for insights into the economic trajectory and potential policy adjustments.

FX Positioning & Sentiment

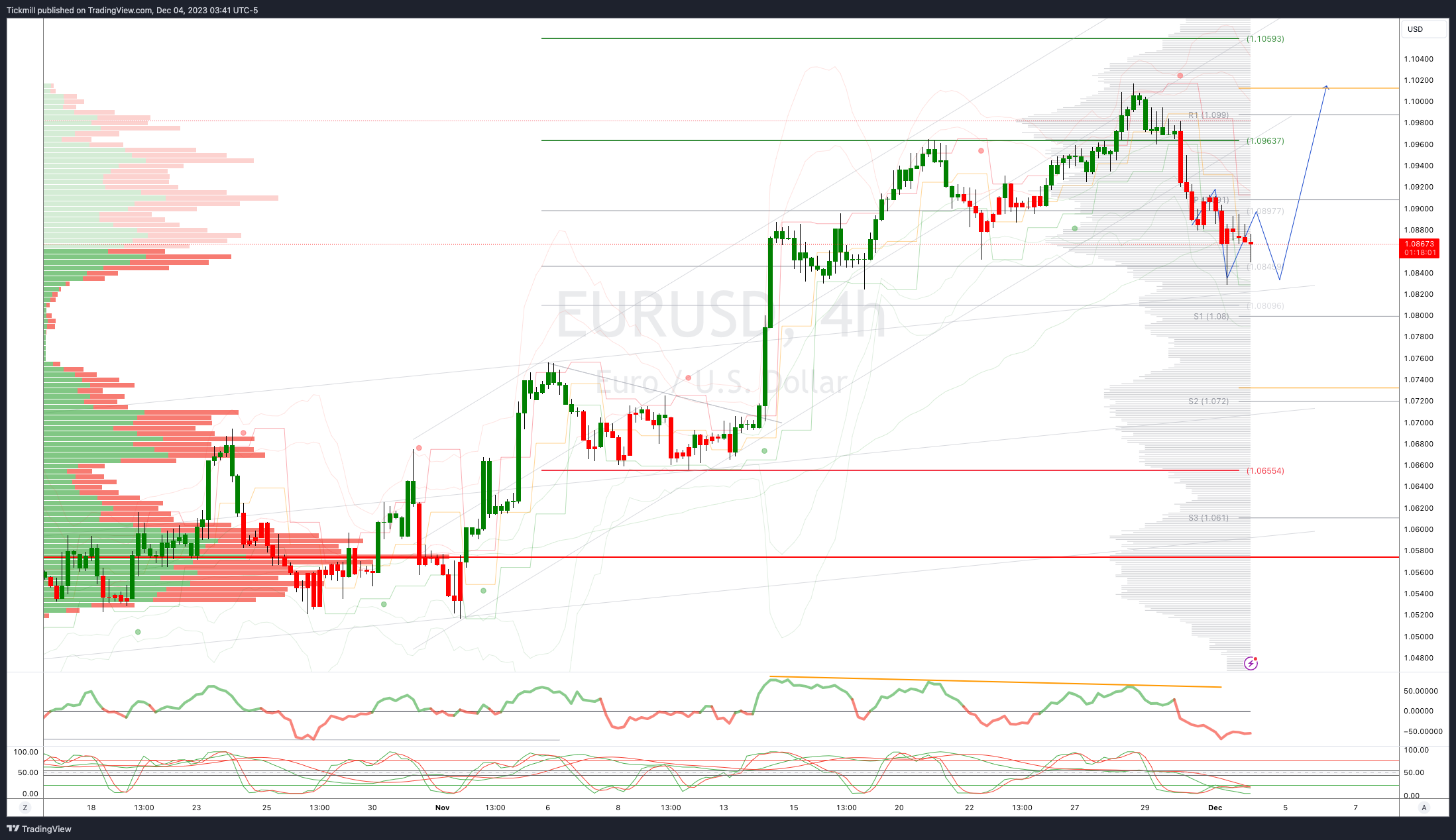

In December, a significant concern arises from the massive bet placed on the EUR/USD rising, as traders have wagered nearly $20 billion on this outcome. This large bet is likely to impede the upward trend. Traders tend to reduce their risk as the year comes to a close, which further exacerbates the impact of any flows on the market due to decreased liquidity. Throughout this year, the EUR/USD pair has remained within the range of 1.05-1.10. However, after reaching a point above 1.10, the EUR/USD has experienced a drop, possibly due to profit-taking.

CFTC Data

The net speculative long position for EUR has increased, while the short position for GBP has been significantly reduced. On Tuesday, the net speculative long position for EUR rose to 143,165 from the previous week's 129,654. The net speculative short position for JPY also increased to 109,237 from 105,454. Additionally, the net speculative short position for AUD decreased to 71,219 from 77,970. However, the short position for GBP decreased significantly to 7,895 from 26,098. Furthermore, there has been an increase in short positions for CHF and NZD.

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0785-90 (1.471BLN), 1.0820-35 (1.94BLN)

1.08580 (289M), 1.0860-65 (2.15BLN), 1.0875-85 (860M)

1.0900 (450M), 1.0925-30 (1.33BLN), 1.0950 (1.06BLN)

1.0975 (492M), 1.1000 (760M)

USD/JPY: 147.00-05 (1.35BLN), 147.75 (871M)

148.00 (2.13BLN), 148.50 (650M), 148.75 (390M)

USD/CHF: 0.8700 (320M), 0.8740 (200M), 0.8800-05 (280M)

0.8830 (322M), 0.8850 (550M). EUR/CHF 0.9500 (210M)

GBP/USD 1.2675 (465M). EUR/GBP: 0.8675-85 (231M)

AUD/USD 0.6525 (440M), 0.6550-60 (373M), 0.6575 (290M)

0.6650 (229M), 0.6670-80 (564M)

USD/CAD: 1.3500 (684M), 1.3550 (767M), 1.3570-75 (1.23BLN)

USD/ZAR: 18.35-45 (910M)

Overnight Newswire Updates of Note

US Warship And Commercial Vessels Attacked In Red Sea, Says Pentagon

US Payrolls Are Seen Picking Up After End Of United Auto Workers Strike

Chinese Borrowers Default In Record Numbers As Economic Crisis Deepens

Evergrande Winding-Up Hearing In Hong Kong Adjourned To Jan 29

BoJ's Noguchi Says Japan Yet To Achieve Wage-Driven Rise In Inflation

Australia’s RBA Set For Hawkish Hold As Global Price Pressures Abate

Hedge Funds Boost Bearish Bets On Yen To Most In 19 Months

Gold Hits A Fresh Record And Bitcoin Climbs Amid Fed Cut Bets

Oil Turns Lower As Market Fails To Shake Off Post OPEC+ Gloom

NATO Should Be Ready For ‘Bad News’ From Ukraine, Stoltenberg Warns

Talks Between Israel-Hamas Deal Stall As Fighting Ramps Up Again

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

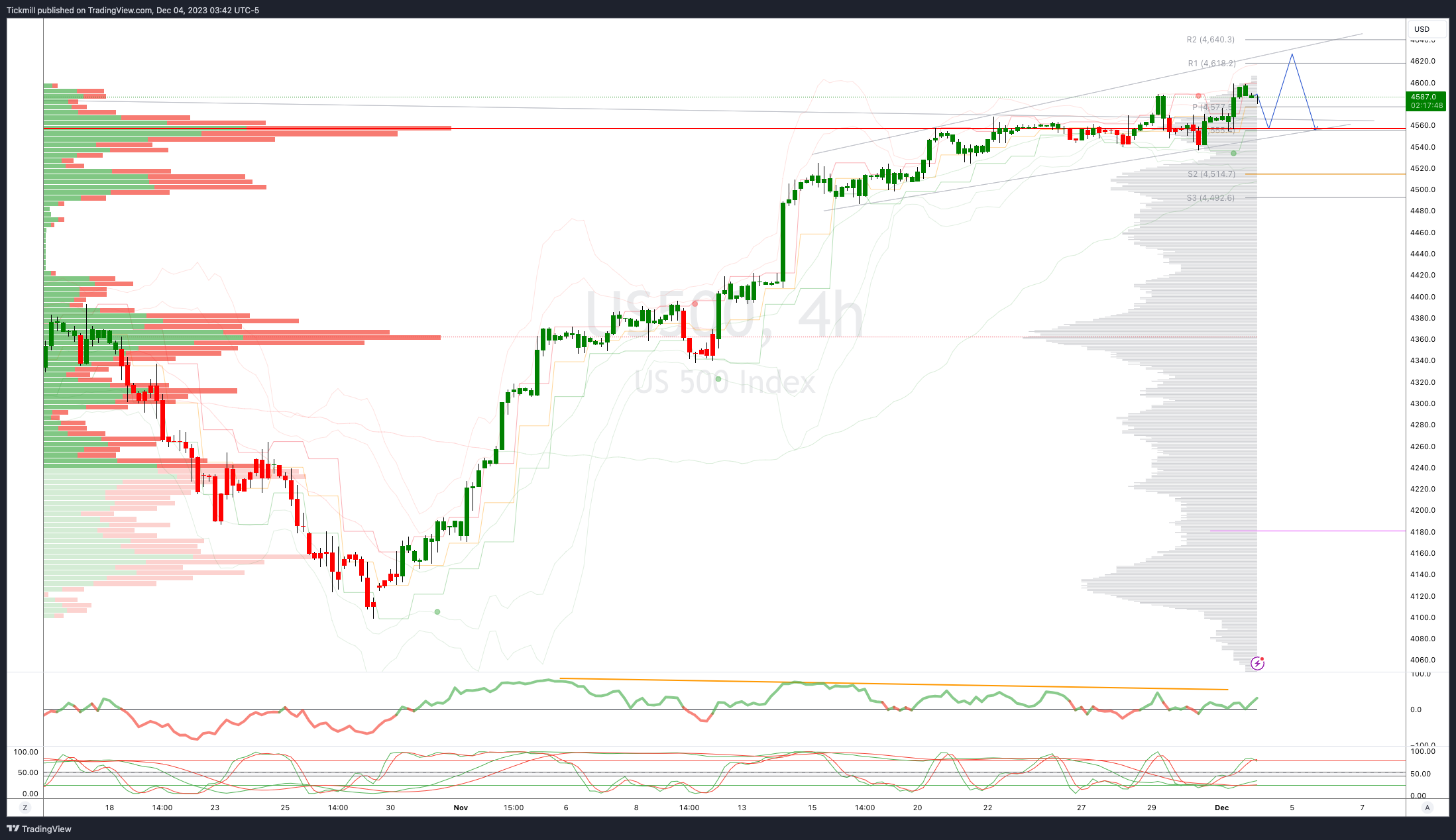

SP500 Bias: Bullish Above Bearish Below 4540

Below 4519 opens 4485

Primary support 4420

Primary objective is 4600

20 Day VWAP bullish, 5 Day VWAP bullish

EURUSD Bias: Bullish Above Bearish Below 1.0850

Below 1.0840 opens 1.08

Primary support 1.0650

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bullish

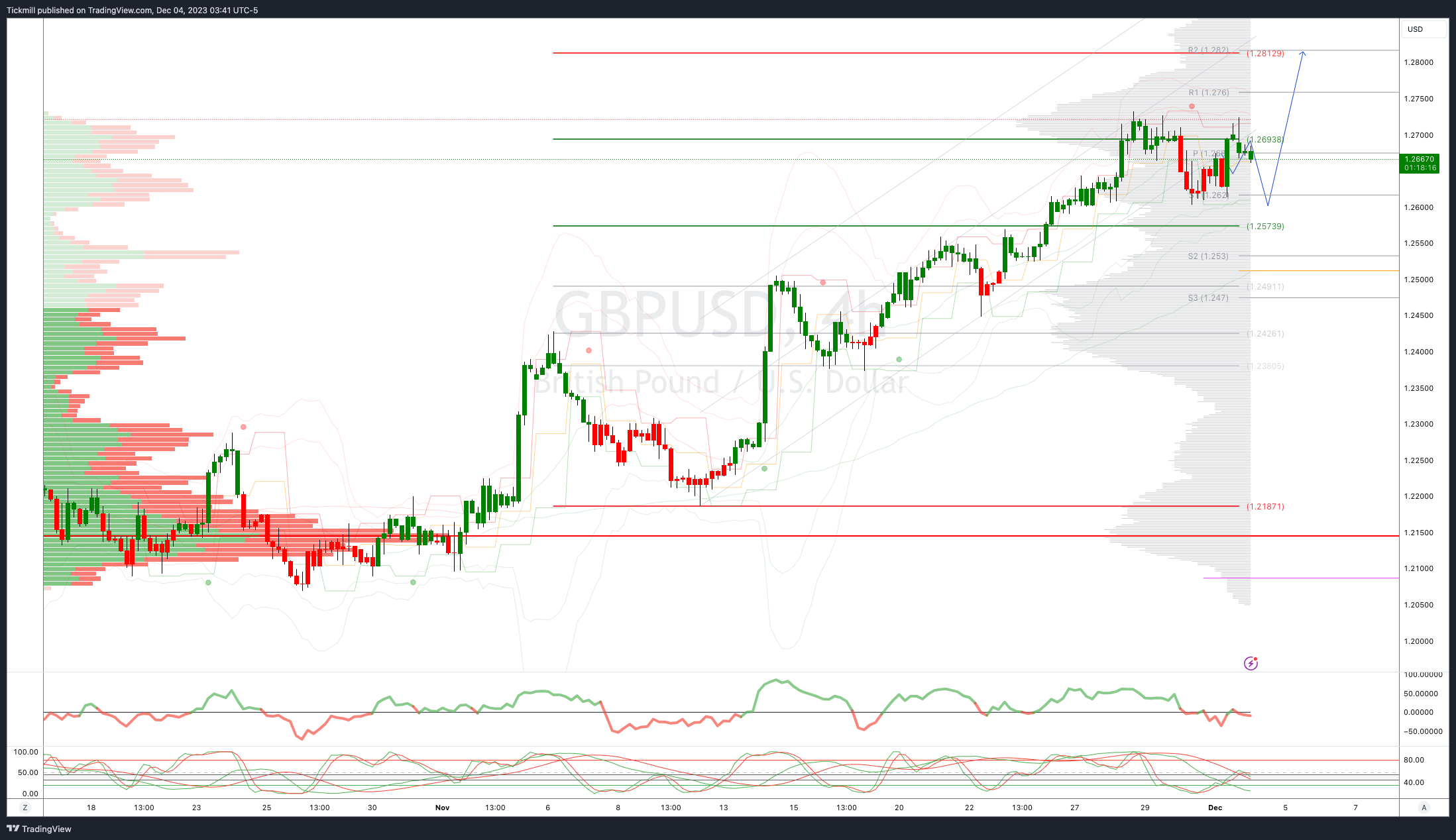

GBPUSD Bias: Bullish Above Bearish Below 1.2640

Below 1.2630 opens 1.2575

Primary support is 1.2185

Primary objective 1.28

20 Day VWAP bullish , 5 Day VWAP bullish

USDJPY Bias: Bullish Above Bearish Below 148

Above 148.10 opens 149

Primary resistance 149.70

Primary objective is 145

20 Day VWAP bearish, 5 Day VWAP bullish

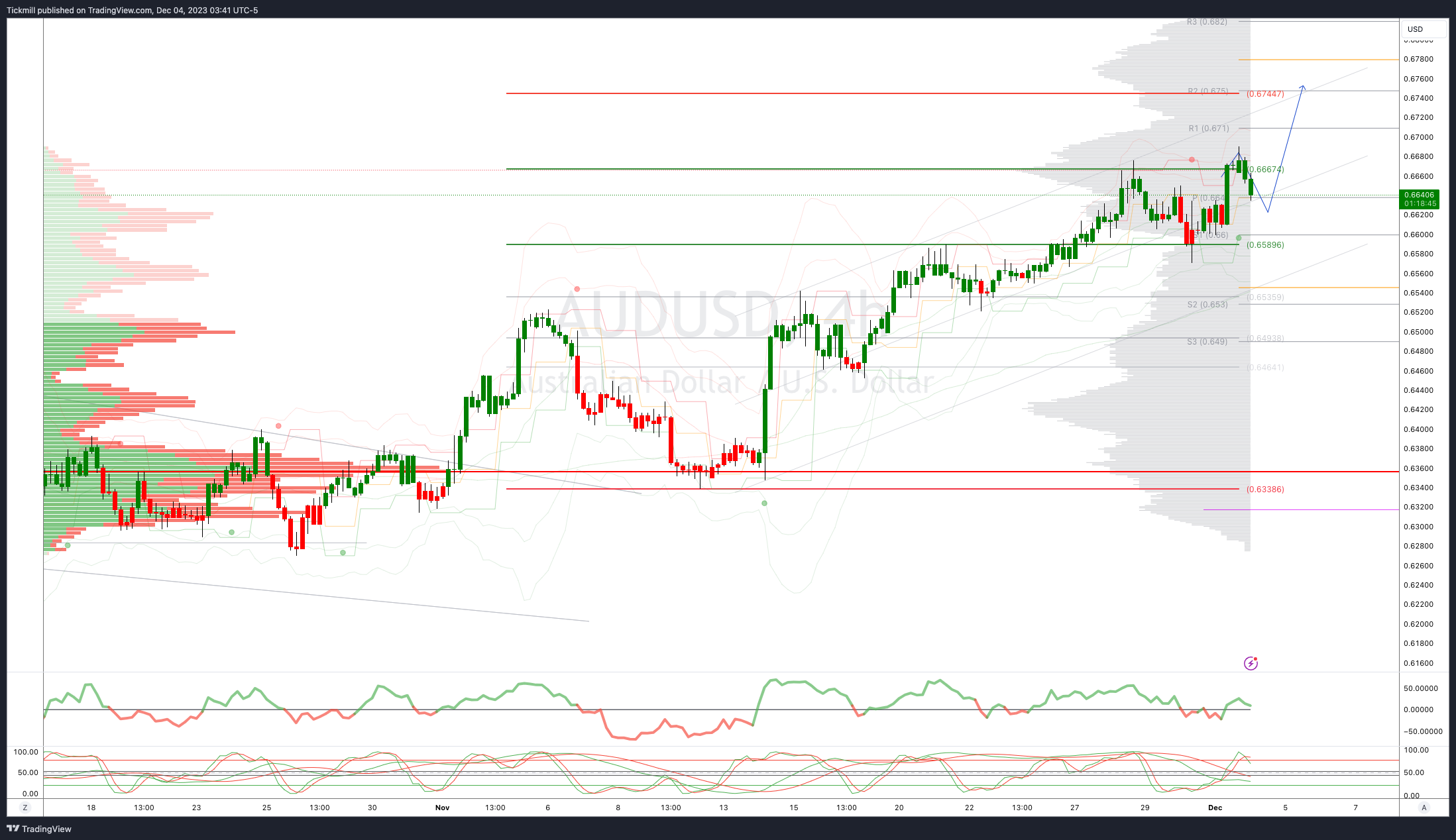

AUDUSD Bias: Bullish Above Bearish Below .6590

Below .6580 opens .6520

Primary support .6330

Primary objective is .6740

20 Day VWAP bullish, 5 Day VWAP bullish

BTCUSD Bias: Bullish Above Bearish below 38500

Below 33600 opens 32400

Primary support is 30000

Primary objective is 41500

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!