Daily Market Outlook, December 14, 2023

Munnelly’s Market Minute…

Asia - Following the Federal Open Market Committee (FOMC) decision to maintain unchanged rates and introduce a dovish adjustment to its statement guidance, most stocks in the Asia-Pacific region experienced gains. The FOMC's decision to cut its 2024 median dot by more than anticipated, indicating a potential three rate cuts in 2024, contributed to the positive market sentiment. Fed Chair Powell's dovish tone during the press conference further supported the upward trend. Initially, the Nikkei 225 saw an increase but struggled to sustain its gains due to losses in the banking sector and a strengthening currency. On the other hand, the Hang Seng and Shanghai Composite both opened higher, with the former benefiting from the Hong Kong Monetary Authority's decision to keep rates unchanged in alignment with the Fed. However, gains in the mainland were limited due to disappointing loans and aggregate financing data.

Europe - Investors are preparing for rate cuts in several developed countries, as a dovish sentiment spreads. The European Central Bank (ECB), Bank of England (BOE) expected to have steady outcomes in their upcoming meetings. The ECB meeting was already anticipated to be eventful due to slowing inflation, and now markets expect any opposition to rate cuts by ECB hawks to be minimal. EURIBOR futures for December 2024 have surged, indicating an expectation of over 100 basis points of easing by September. The market has also priced in rate cuts by the BOE in 2024.

US - Stateside, the Federal Reserve kept interest rates unchanged and Jerome Powell, the head of the central bank, stated that their previous tightening of monetary policy is likely over due to inflation decreasing faster than expected. The majority of Fed officials predict that the policy rate will be lower by the end of 2024 compared to its current level, with the median projection showing a decrease of three-quarters of a percentage point. As a result of the Fed's decision, there is an increased likelihood of rate cuts starting as early as March, according to the CME’s FedWatch. The market has already factored in over 150 basis points of easing next year.

FX Positioning & Sentiment

The US Federal Reserve's pivot to a more dovish stance has created an opportunity for the People's Bank of China to provide some much-needed stimulus to their struggling economy. The Fed's unexpected change in policy has led to lower Treasury yields and a weaker US dollar, which should alleviate some of the downward pressure on China's yuan. Previously, the PBOC had been hesitant to further ease their monetary policy due to concerns about widening yield gaps and added pressure on the CNY. However, with the threat of the Fed's higher rates now removed, the PBOC may surprise markets by cutting the one-year MLF rate by 15 bps to 2.35%.

CFTC Data

During the period from November 29 to December 5, the net speculative position for the USD shifted from long to short. The $IDX increased by 1.35% during this period. The EUR$ decreased by 1.77% and speculators now hold 152,360 long contracts. The $JPY decreased by 0.24% and speculators now hold 104,956 short contracts. The Yen gained value after the period ended due to more hawkish talk from the Bank of Japan (BoJ), with a BoJ meeting scheduled for December 19. The GBP$ decreased by 0.88% and speculators now hold 11,665 long contracts. The AUD$ decreased by 1.4% and speculators now hold -57,681 contracts. The $CAD increased by 0.15% and speculators now hold -57,848 contracts. Bitcoin (BTC) increased by 15.6% during this period, with speculators reducing their contracts by 505 into new highs for 2023.

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0790 (EU2.74b), 1.1005 (EU2.37b), 1.0515 (EU2.16b)

USD/CNY: 7.2450 ($1b), 7.2320 ($815.5m), 7.2380 ($786.3m)

USD/JPY: 152.00 ($1.1b), 148.00 ($1b), 147.50 ($875.6m)

AUD/USD: 0.6700 (AUD2.21b), 0.6600 (AUD1.74b), 0.6245 (AUD1.44b)

USD/MXN: 17.00 ($765m), 17.09 ($500m)

USD/CAD: 1.3680 ($300m)

GBP/USD: 1.2125 (GBP835.4m), 1.2660 (GBP829.4m), 1.2825 (GBP630m)

NZD/USD: 0.6190 (NZD1.13b), 0.6090 (NZD750.4m), 0.5980 (NZD750.3m)

USD/KRW: 1400.00 ($307.1m)

EUR/GBP: 0.8882 (EU300.6m)

Overnight Newswire Updates of Note

Fed Prepares To Shift To Rate Cuts In 2024 As Inflation Eases

China Economy Seen Weakening On Deflation, Property Drags

Japan's Negative Rate Exit Scenario Muddled By FOMC Outlook

Japan PM Kishida To Purge Ministers To Bid To Save Premiership

Australian November Jobs Beat Estimates, Sends Currency Higher

New Zealand's Economy Unexpectedly Contracted In Third Quarter

ECB Set For Second Straight Hold As Markets Wait For Dovish Pivot

SNB Expected To Hold Rates Steady As Inflation Continues To Wane

Bank Of England To Hold Rate As Markets Raise Bets On 2024 Cuts

British Housing Market Stabilises But High Interest Rates Still Weigh

Treasuries 10-Year Yield Drops Below 4% After Fed Sees Rate Cuts

DoubleLine's Gundlach See 10-Year In Low 3% Range By Next Year

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

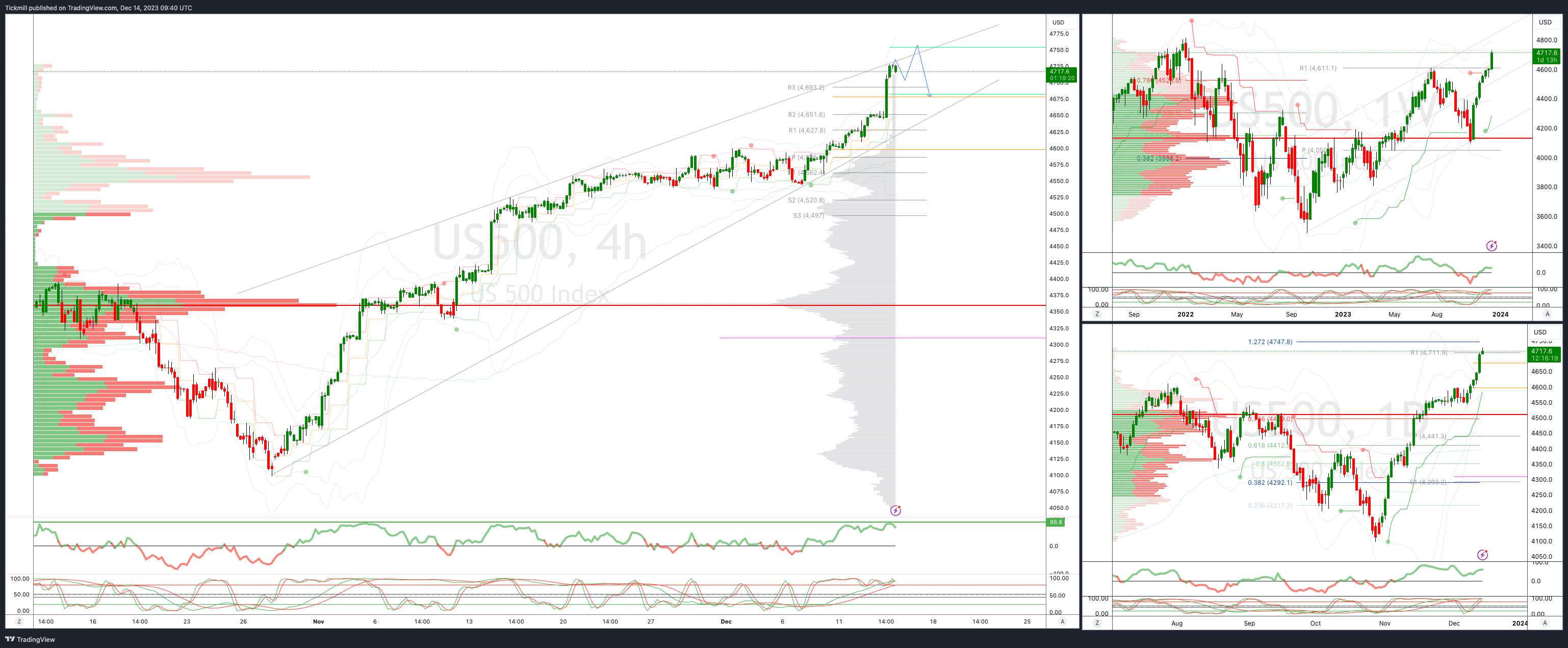

SP500 Bias: Bullish Above Bearish Below 4675

Below 4600 opens 4560

Primary support 4600

Primary objective is 4750

20 Day VWAP bullish, 5 Day VWAP bullish

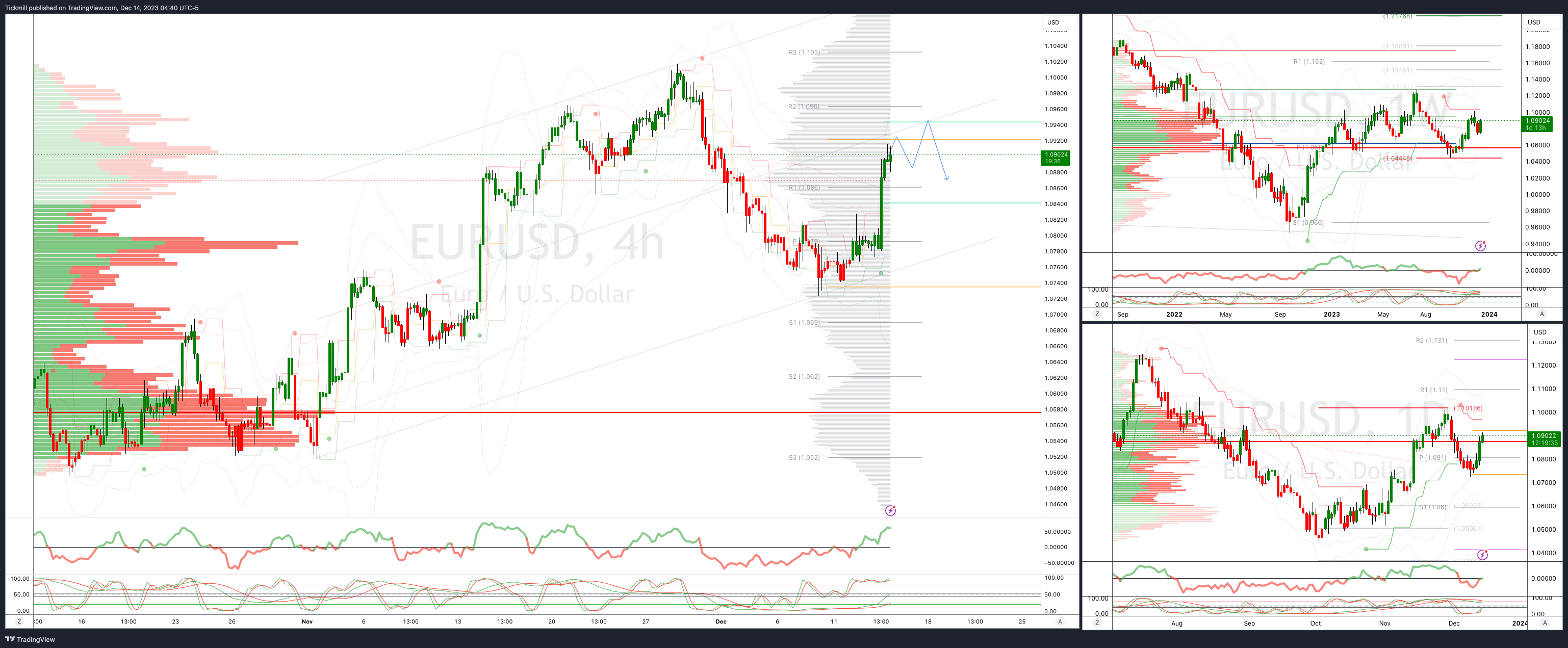

EURUSD Bias: Bullish Above Bearish Below 1.0840

Below 1.0840 opens 1.0780

Primary support 1.0650

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bullish

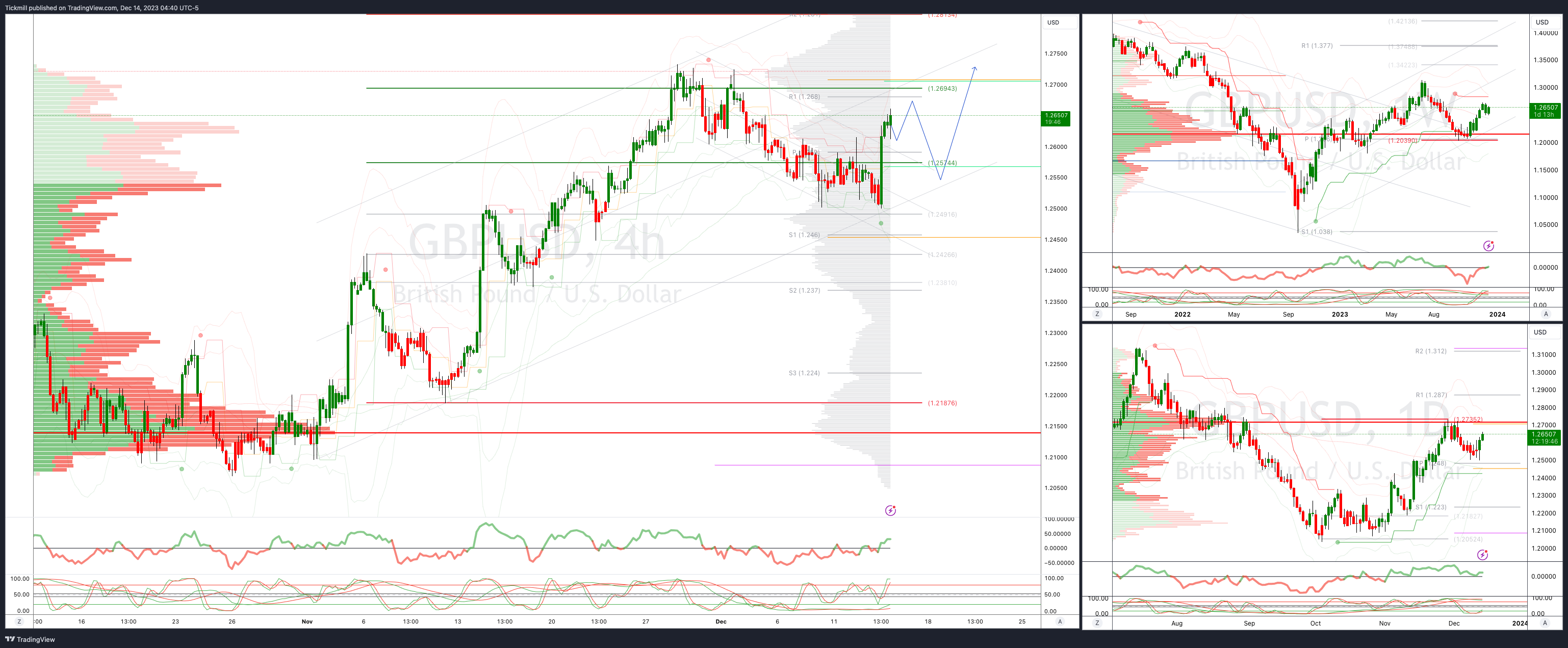

GBPUSD Bias: Bullish Above Bearish Below 1.2540

Below 1.2530 opens 1.25

Primary support is 1.2185

Primary objective 1.28

20 Day VWAP bullish , 5 Day VWAP bullish

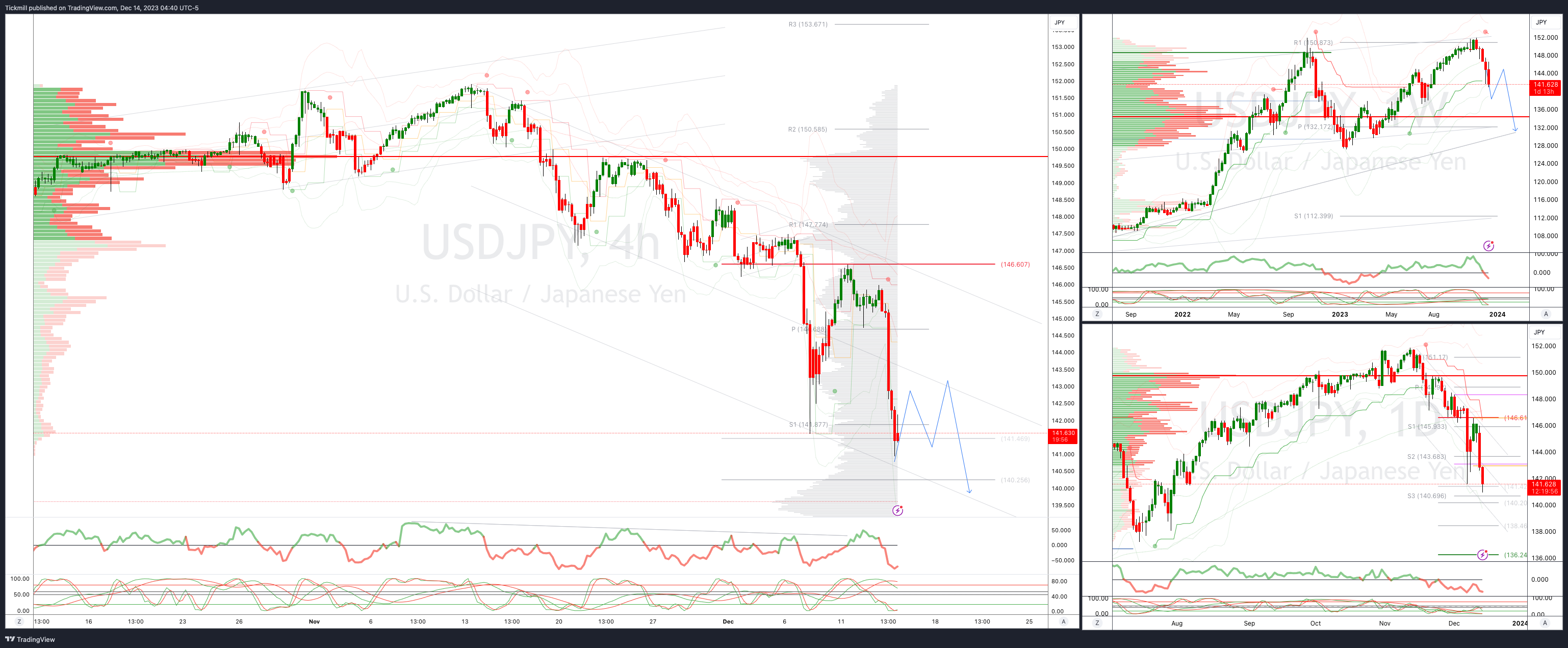

USDJPY Bias: Bullish Above Bearish Below 143

Above 143.50 opens 146

Primary resistance 146.50

Primary objective is 140

20 Day VWAP bearish, 5 Day VWAP bearish

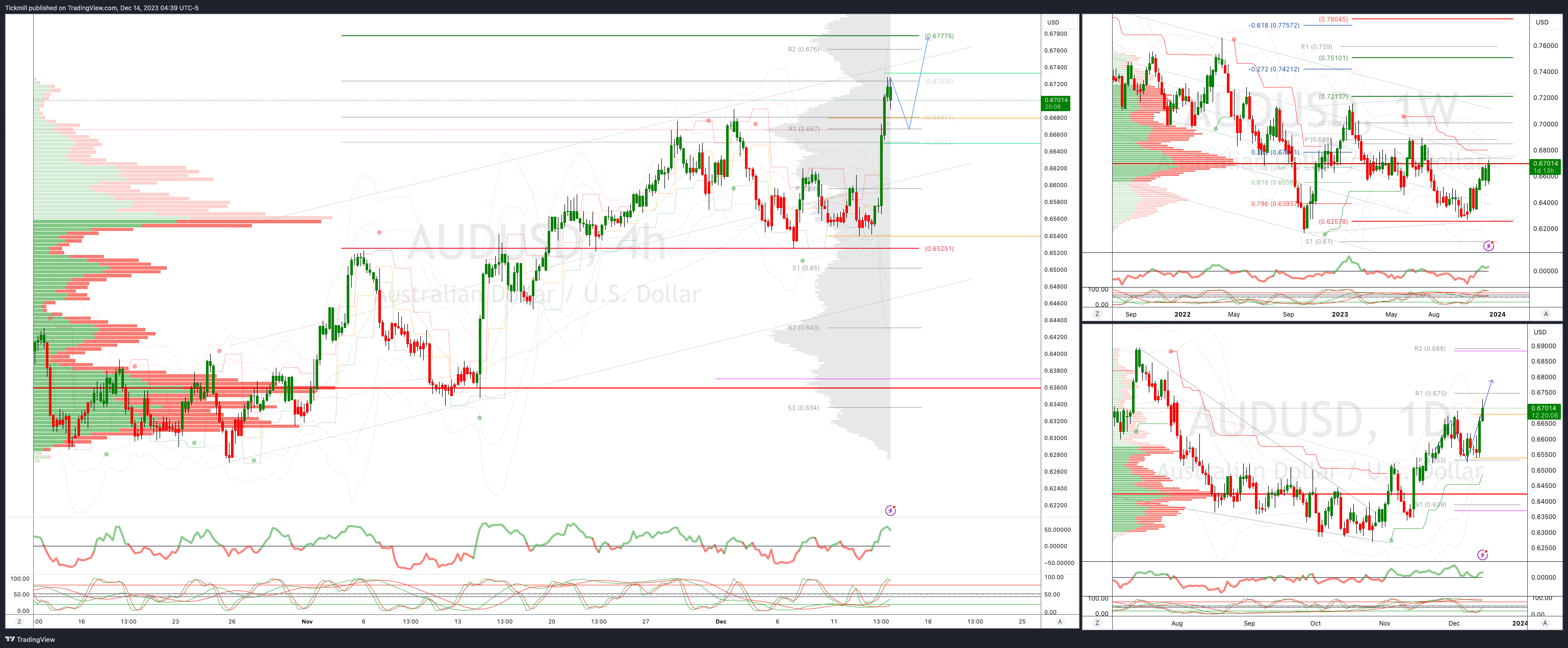

AUDUSD Bias: Bullish Above Bearish Below .6660

Below .6660 opens .6620

Primary support .6525

Primary objective is .6775

20 Day VWAP bullish, 5 Day VWAP bullish

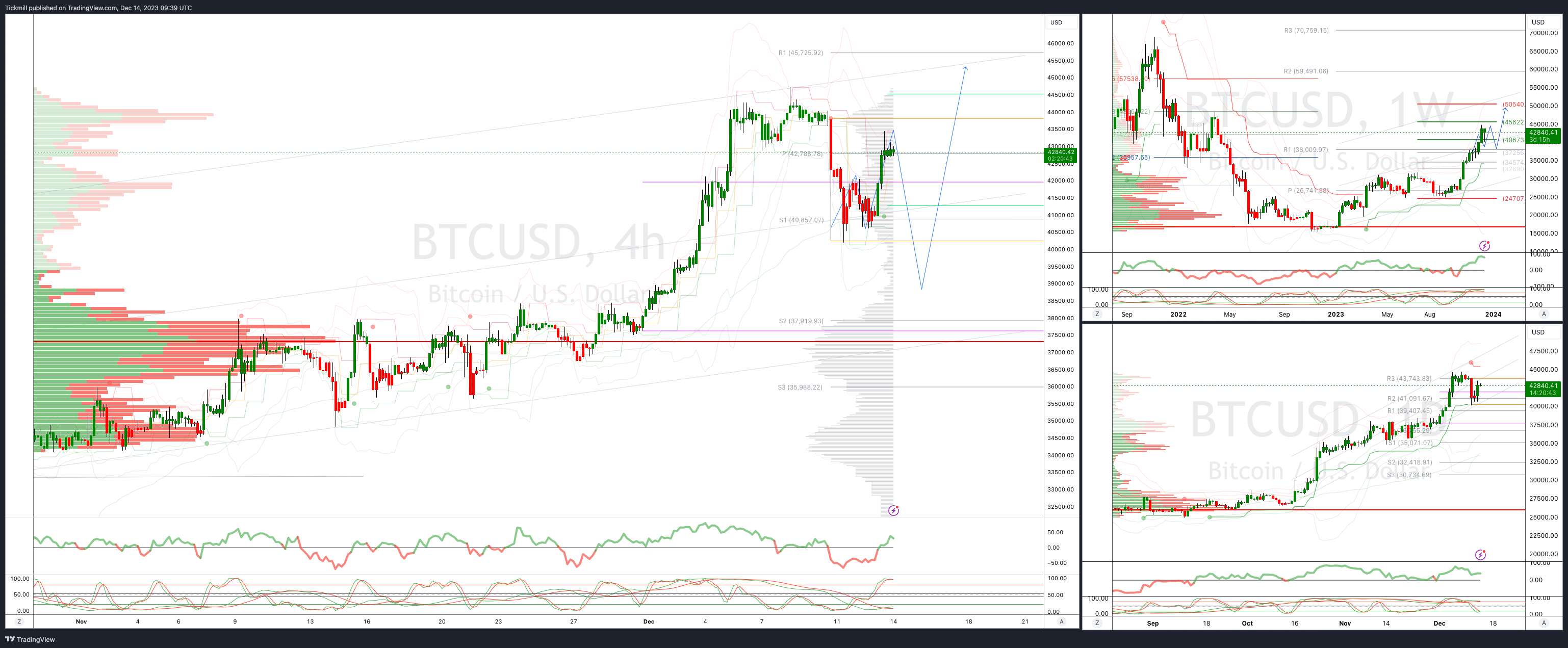

BTCUSD Bias: Bullish Above Bearish below 42500

Below 40000 opens 38500

Primary support is 36800

Primary objective is 46000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!