Daily Market Outlook, December 13, 2023

Daily Market Outlook, December 13, 2023

Munnelly’s Market Minute…

Asia - Asia-Pacific stocks traded mixed as investors were cautious ahead of the FOMC announcement. The Nikkei 225 increased modestly thanks to an encouraging Tankan survey, which showed improved sentiment among Japan's large manufacturers and non-manufacturers. On the other hand, the KOSPI fell due to an increase in the Unemployment Rate. The Hang Seng and Shanghai Composite also declined despite China's policy focus for next year and support pledges, as there were no major stimulus announcements in the statement from the Central Economic Work Conference.

Europe - UK GDP unexpectedly contracted by -0.3% in October on a 3m/3m basis, with all sectors (services, construction, and production) experiencing declines. Despite this, Pantheon Macroeconomics does not believe the MPC will signal a willingness to cut Bank Rate at this week's meeting. Looking ahead, Pantheon predicts that activity will pick up in November and December, leaving Q4 GDP unchanged Q/Q. For 2024 as a whole, Pantheon forecasts 1.0% Y/Y growth, while Capital Economics predicts just 0.1% due to the subdued economic climate.It is anticipated that industrial production in the Eurozone will decrease even more in October, although there is expected to be a slight improvement in the annual rate of decline.

US - Stateside,The FOMC is scheduled to make a policy announcement tonight, which will be followed by updates from the Bank of England and the European Central Bank tomorrow. Despite no immediate changes to interest rates being expected, the central banks' guidance on next year's policy actions will be closely watched since markets are anticipating significant rate cuts in 2024. The Fed's comments have been less forceful than their European counterparts, and some Fed policymakers have suggested the possibility of decreases before mid-year. The Fed will use Wednesday's forecast updates to shape expectations, and Fed Chair Powell's comments in his post-meeting press conference will also be important. Overall, market expectations are already bullish, and a small negative surprise seems likely, but a major market pullback is unlikely as the Fed is expected to provide support to rate cut hopes.

FX Positioning & Sentiment

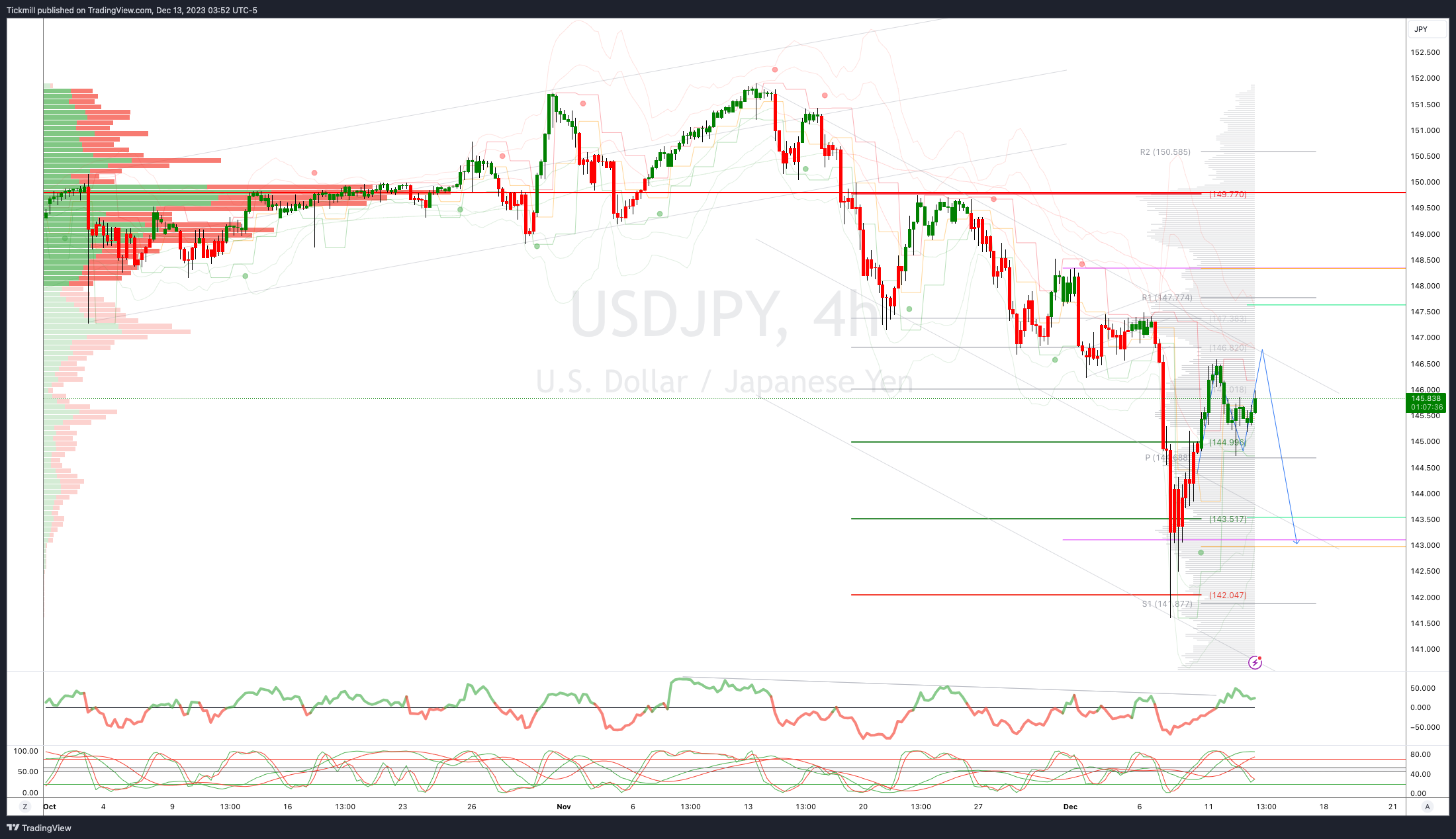

Japanese companies may actually be correct about the yen. Their expectations for the yen have been significantly different from reality. Currently, Japanese firms predict that the USD/JPY will reach 139.35 in the current financial year, whereas previously they anticipated an average of 135.75 for the year ending in March 2024. Due to profit-taking at the end of the year, the USD/JPY has dropped from 151.92 to 141.60. The new forecast for the USD/JPY represents approximately 50% of the rise seen in 2023. Additionally, Japanese firms expect the EUR/JPY to average 148.80, compared to 144.62 in September.

CFTC Data

During the period from November 29 to December 5, the net speculative position for the USD shifted from long to short. The $IDX increased by 1.35% during this period. The EUR$ decreased by 1.77% and speculators now hold 152,360 long contracts. The $JPY decreased by 0.24% and speculators now hold 104,956 short contracts. The Yen gained value after the period ended due to more hawkish talk from the Bank of Japan (BoJ), with a BoJ meeting scheduled for December 19. The GBP$ decreased by 0.88% and speculators now hold 11,665 long contracts. The AUD$ decreased by 1.4% and speculators now hold -57,681 contracts. The $CAD increased by 0.15% and speculators now hold -57,848 contracts. Bitcoin (BTC) increased by 15.6% during this period, with speculators reducing their contracts by 505 into new highs for 2023.

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0695-1.0700 (635M), 1.0775-80 (985M), 1.0790-1.8000 (1.5B)

EUR/USD: 1.0840-50 (1.7B), 1.0920-30 (1.5B)

USD/JPY: 145.00 (1.0B), 146.00 (1.3B), 147.00 (1.0B)

GBP/USD: 1.2645 (475M). EUR/GBP: 0.8700 (810M)

USD/CHF: 0.8600 (820M)

Overnight Newswire Updates of Note

US Federal Reserve Set To Hold Rates, Soften Hawkish Tone

Treasury’s Yellen Says US Economy On Path To Soft Landing

Brainard Hails Recovery, Says Biden’s Top Focus Is On Costs

Higher Chinese Tariffs Urged By Bipartisan Lawmakers Group

PBoC Poised To Inject Cash To Aid Liquidity And Add Growth

Japan’s PM Faces Biggest Political Scandal In Three Decades

Japan Business Sentiment Rises Ahead Of BoJ Rate Decision

Australia’s Budget Seen Almost In Balance With Debt To Drop

Zelenskiy US Visit Falls Short As Ukraine War Aid Still Stalled

ECB’s Villeroy: Weakened EU Needs Bold Plan To Exit Crises

PM Sees Off Rebels To Win Vote On Rwanda Migration Plan

Oil Steadies After Almost 4% Fall On More Oversupply Signs

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

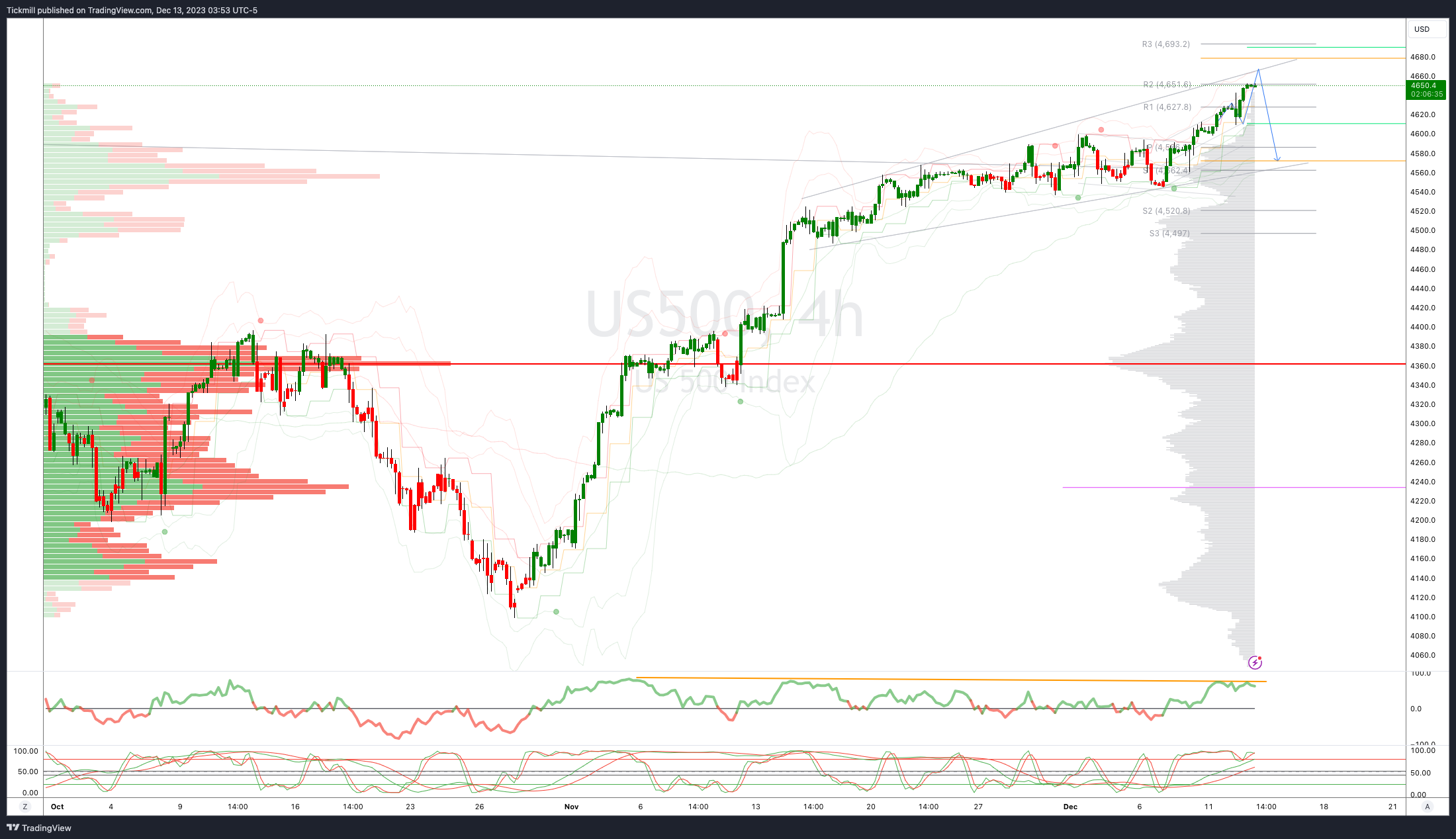

SP500 Bias: Bullish Above Bearish Below 4610

Below 4600 opens 4560

Primary support 4500

Primary objective is 4665

20 Day VWAP bullish, 5 Day VWAP bullish

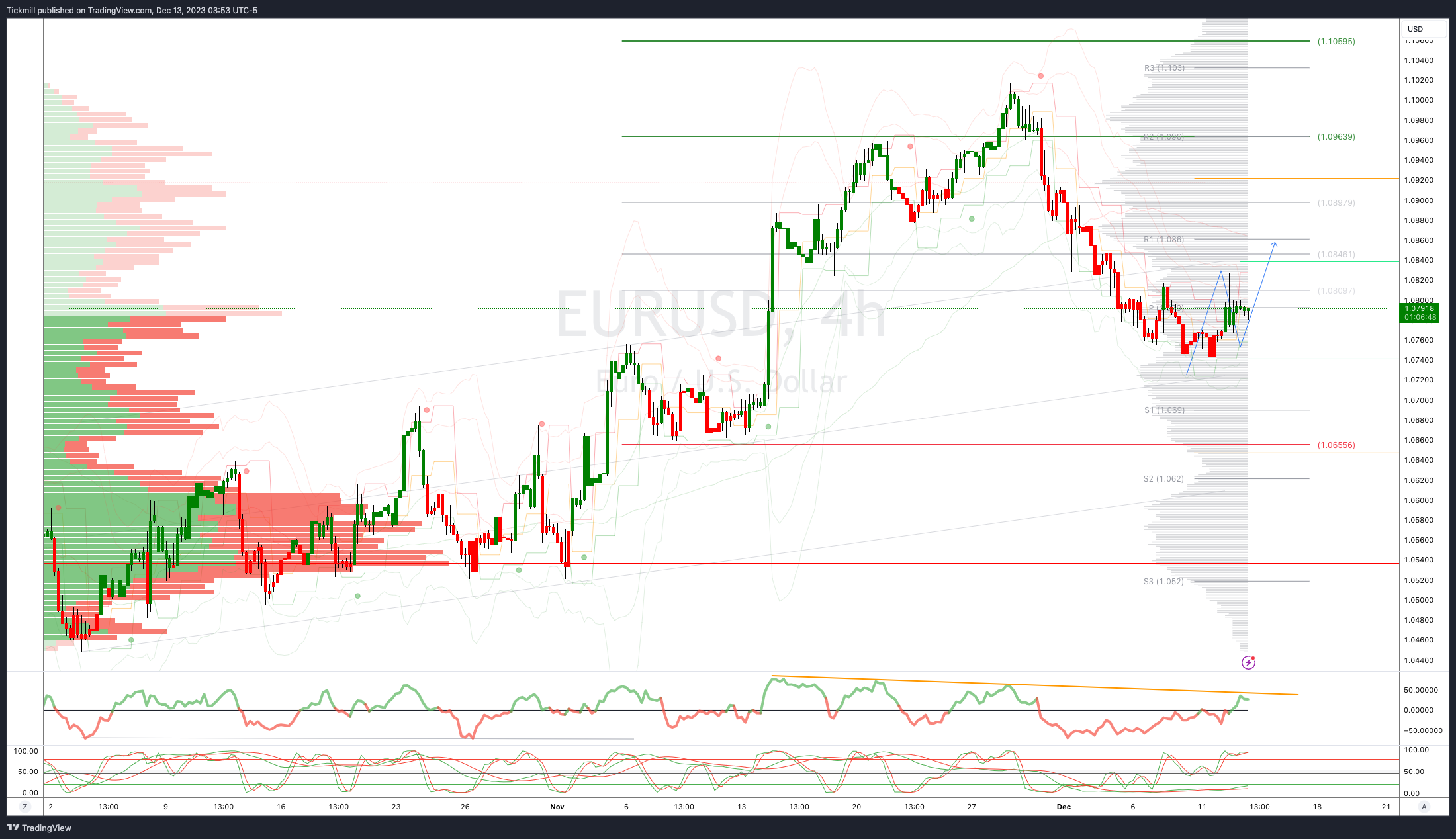

EURUSD Bias: Bullish Above Bearish Below 1.0740

Below 1.0740 opens 1.0650

Primary support 1.0650

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bearish

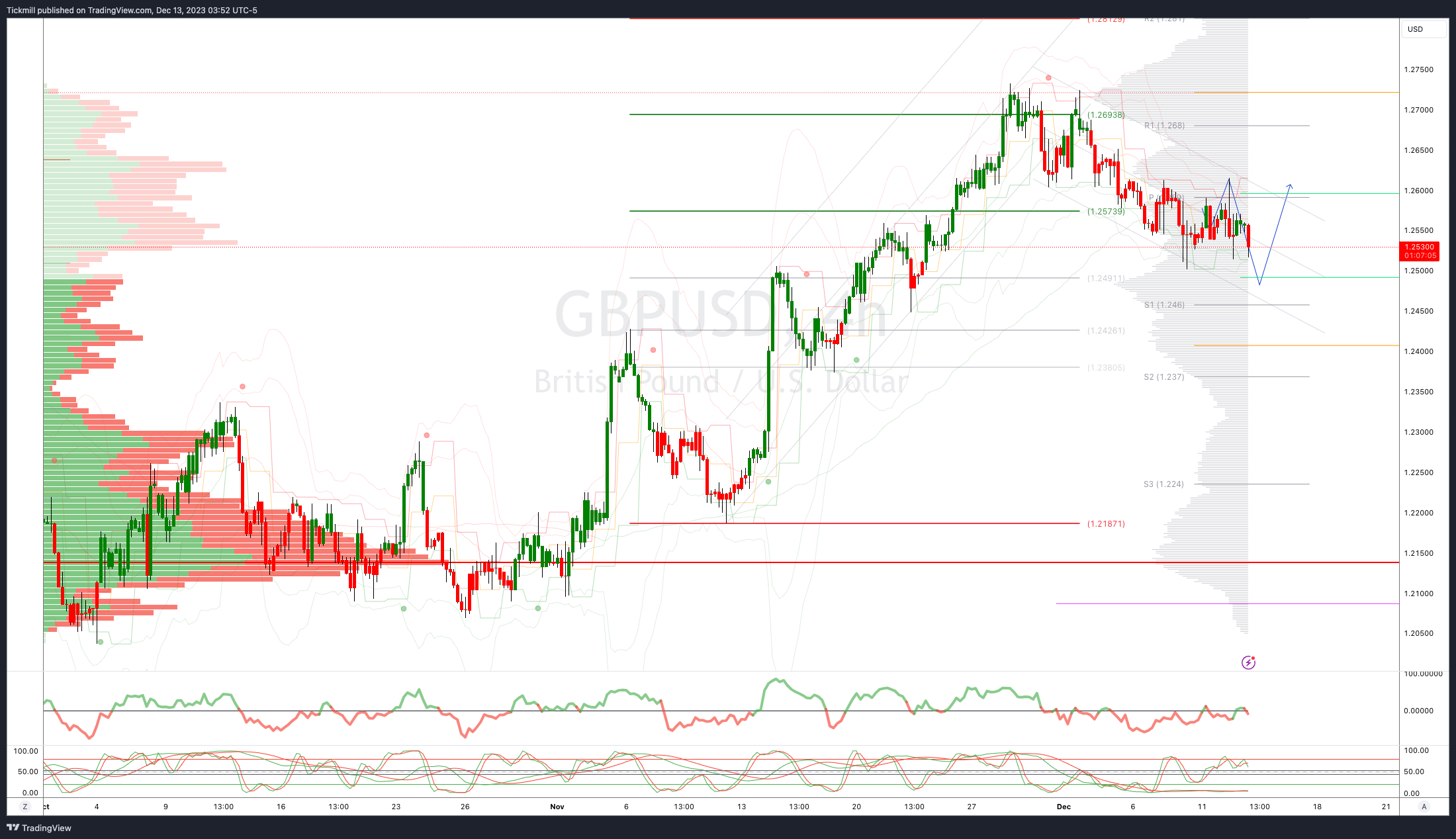

GBPUSD Bias: Bullish Above Bearish Below 1.2540

Below 1.2530 opens 1.25

Primary support is 1.2185

Primary objective 1.28

20 Day VWAP bullish , 5 Day VWAP bearish

USDJPY Bias: Bullish Above Bearish Below 146

Above 146.50 opens 147.10

Primary resistance 149.70

Primary objective is 140

20 Day VWAP bearish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish Below .6590

Below .6560 opens .6520

Primary support .6330

Primary objective is .6740

20 Day VWAP bullish, 5 Day VWAP bearish

BTCUSD Bias: Bullish Above Bearish below 42500

Below 40000 opens 38500

Primary support is 36800

Primary objective is 46000

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!