Daily Market Outlook, December 12, 2023

Daily Market Outlook, December 12, 2023

Munnelly’s Market Minute…

Asia - Most Asia-Pacific stocks were positive following gains on Wall Street. The Nikkei 225 surged initially but steadily gave up nearly all of its gains as the effects of a firmer currency seeped through. Hang Seng and Shanghai Comp. were initially underpinned by China's Central Economic Work Conference and measures on integrated development of domestic and foreign trade, but the mainland index ultimately lagged.

Europe - The latest UK employment data indicates a shift in employment conditions and a more substantial than expected decline in wage growth. In October, the experimental unemployment rate held steady at 4.2%, but November saw a decrease in both payroll employees and job vacancies. Annual regular pay growth decelerated from 7.7% to 7.3% in October. As policymakers approach Thursday's Bank of England update, they may find encouragement in the easing of employment market pressures and the slowdown in wage growth. However, they are cognizant that wage gains, though moderating, still surpass levels consistent with sustaining the inflation target.The upcoming German ZEW survey is expected to provide an early insight into Eurozone economic trends in December. However, it should be noted that as a poll of financial analysts, its readings may be less reliable than other surveys such as the PMIs. In the previous month, there was a slight increase in the current conditions index and expectations rose for the fourth consecutive month. Despite these positive trends, both indices remain historically low. The forecast for December predicts a modest increase in both measures.

US - Stateside, this afternoon's update on US CPI inflation for November is the final significant data release preceding tomorrow's US Federal Reserve monetary policy announcement. In October, annual headline inflation experienced its first decline in four months, dropping from 3.7% to 3.2%, primarily due to lower oil prices. Core inflation, excluding food and energy, also saw a slight decrease from 4.1% to 4.0%. The November data is expected to be influenced by lower oil prices once again, projecting an overall inflation decrease to 3.1%, while the core rate may remain at 4.0%. This positive trend in inflation is likely to prompt the Fed to affirm on Wednesday that interest rates have likely peaked. However, the timing of when they will be confident enough to implement rate cuts remains uncertain.

FX Positioning & Sentiment

CFTC data from Friday showed that there has been a shift in positioning, with the net GBP position turning long in the week ending December 5. This is the first time since September that there has been a net long position in GBP, as it was previously net short by 7,895 contracts in the week ending November 28. Prior to that, the net short position was even larger at 27,730 in mid-November. The pound has recently reached three-month highs against both the dollar and the euro, with a peak of 1.2733 GBP/USD on November 29 and a subsequent low of 1.2504 on December 8. The Bank of England will be making a monetary policy announcement this week, which is expected to be hawkish. Traders have placed bets worth over $20 billion on the EUR/USD increasing in value. One particular bet is larger than all the other bets placed on the USD increasing. Traders still have significant bets on the USD rising against the JPY, AUD, CHF, CAD, NZD, and DXY. However, due to this one bet in favour of the EUR, traders are now overall short on the USD compared to other major currencies. Despite the falling value of the pair, speculators are still buying EUR/USD. Prior to the surge in November, approximately $3 billion worth of long positions were added, and since then, an additional $3 billion worth of long positions have been added as the pair dropped to 1.0724.

CFTC Data

During the period from November 29 to December 5, the net speculative position for the USD shifted from long to short. The $IDX increased by 1.35% during this period. The EUR$ decreased by 1.77% and speculators now hold 152,360 long contracts. The $JPY decreased by 0.24% and speculators now hold 104,956 short contracts. The Yen gained value after the period ended due to more hawkish talk from the Bank of Japan (BoJ), with a BoJ meeting scheduled for December 19. The GBP$ decreased by 0.88% and speculators now hold 11,665 long contracts. The AUD$ decreased by 1.4% and speculators now hold -57,681 contracts. The $CAD increased by 0.15% and speculators now hold -57,848 contracts. Bitcoin (BTC) increased by 15.6% during this period, with speculators reducing their contracts by 505 into new highs for 2023.

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0685 (548M), 1.0695-00 (906M)

1.0725-30 (743M), 1.0750 (872M), 1.0785-90 (306M)

1.0800-10 (682M), 1.0830-40 (975M)

1.0845-55 (729M), 1.0860 (260M), 1.0875-80 (389M)

1.0900 (474M)

GBP/USD: 1.2530 (480M), 1.2555-65 (415M)

EUR/GBP: 0.8565-70 (368M), 0.8700 (300M)

AUD/USD: 0.6525 (354M). AUD/NZD: 1.0650 (290M)

1.0800 (296M)

EUR/AUD: 1.6400 (395M). USD/CAD: 1.3525-30 (380M)

1.3590-00 (476M), 1.3650 (216M)

USD/JPY: 144.50 (289M), 144.70-80 (750M)

145.35 (590M), 145.50 (240M), 146.15 (380M)

146.50 (371M)

Overnight Newswire Updates of Note

US Looking Into Nvidia’s AI Chips For China, Raimondo Says

Gazans Start To Voice Dissent Against Hamas, War Grinds On

Houthi Missile Hits Tanker Sailing Through Red Sea, US Report

Japan Input Inflation Eases Further To Slowest Pace Since 2021

Japan Slush Fund Probe Implicates Premier’s Faction, NHK Says

RBA's Bullock: Taking Cautious Approach With Policy, Watch Data

Australia Business Confidence Falls, Consumers Remain Gloomy

UK PM Sunak Seeks To Charm Tory MPs To Avoid Rwanda Split

Bank Of France Sees Economy Dodging Recession On Services

ZEW German Investor Outlook Set To Ease After Recent Gains

Oracle See Disappointing Sales On Slowing Cloud Momentum

Alphabet Loses Google Play Antitrust Fight With Epic Games

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

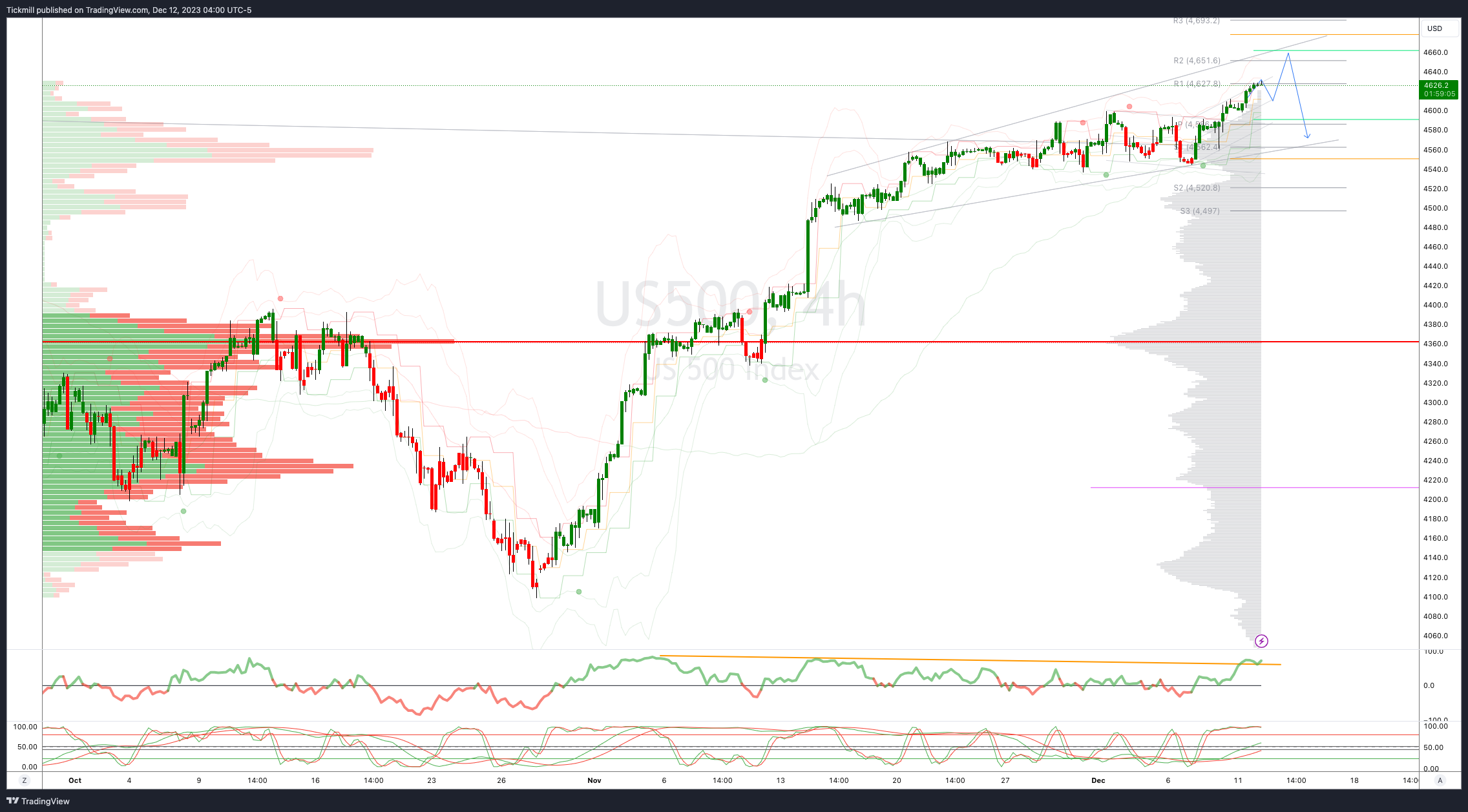

SP500 Bias: Bullish Above Bearish Below 4600

Below 4600 opens 4560

Primary support 4500

Primary objective is 4650

20 Day VWAP bullish, 5 Day VWAP bullish

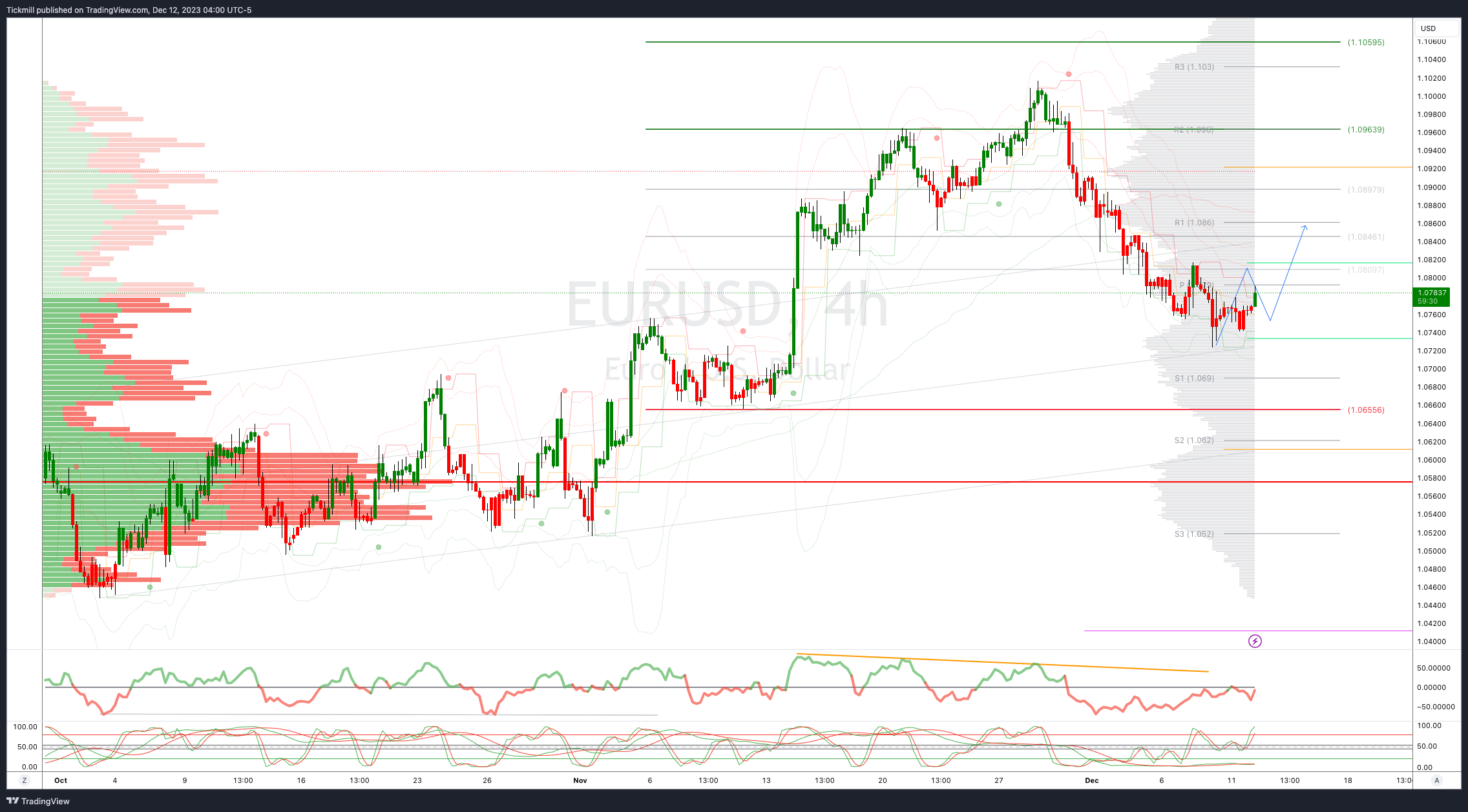

EURUSD Bias: Bullish Above Bearish Below 1.0740

Below 1.0740 opens 1.0650

Primary support 1.0650

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bearish

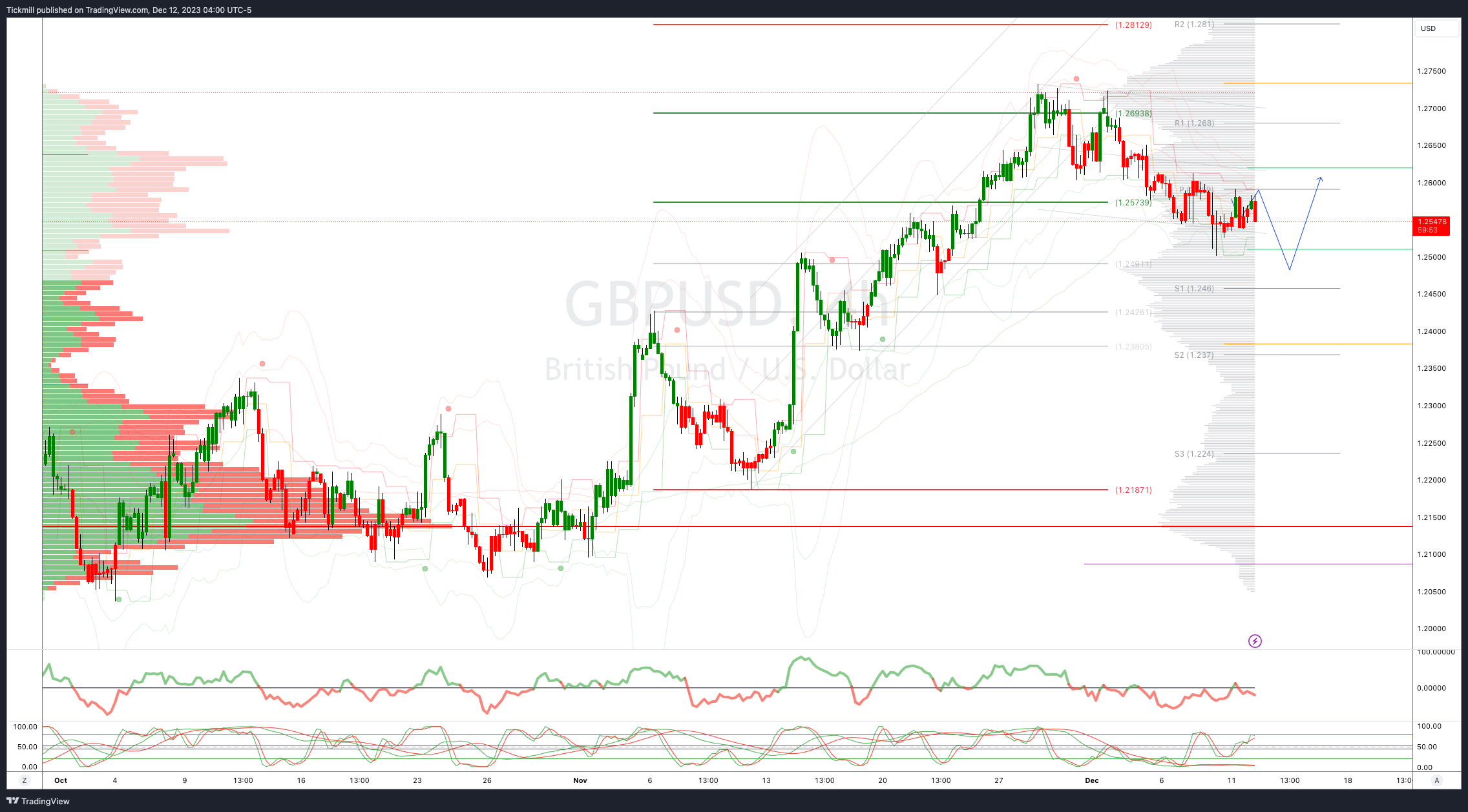

GBPUSD Bias: Bullish Above Bearish Below 1.2540

Below 1.2530 opens 1.25

Primary support is 1.2185

Primary objective 1.28

20 Day VWAP bullish , 5 Day VWAP bearish

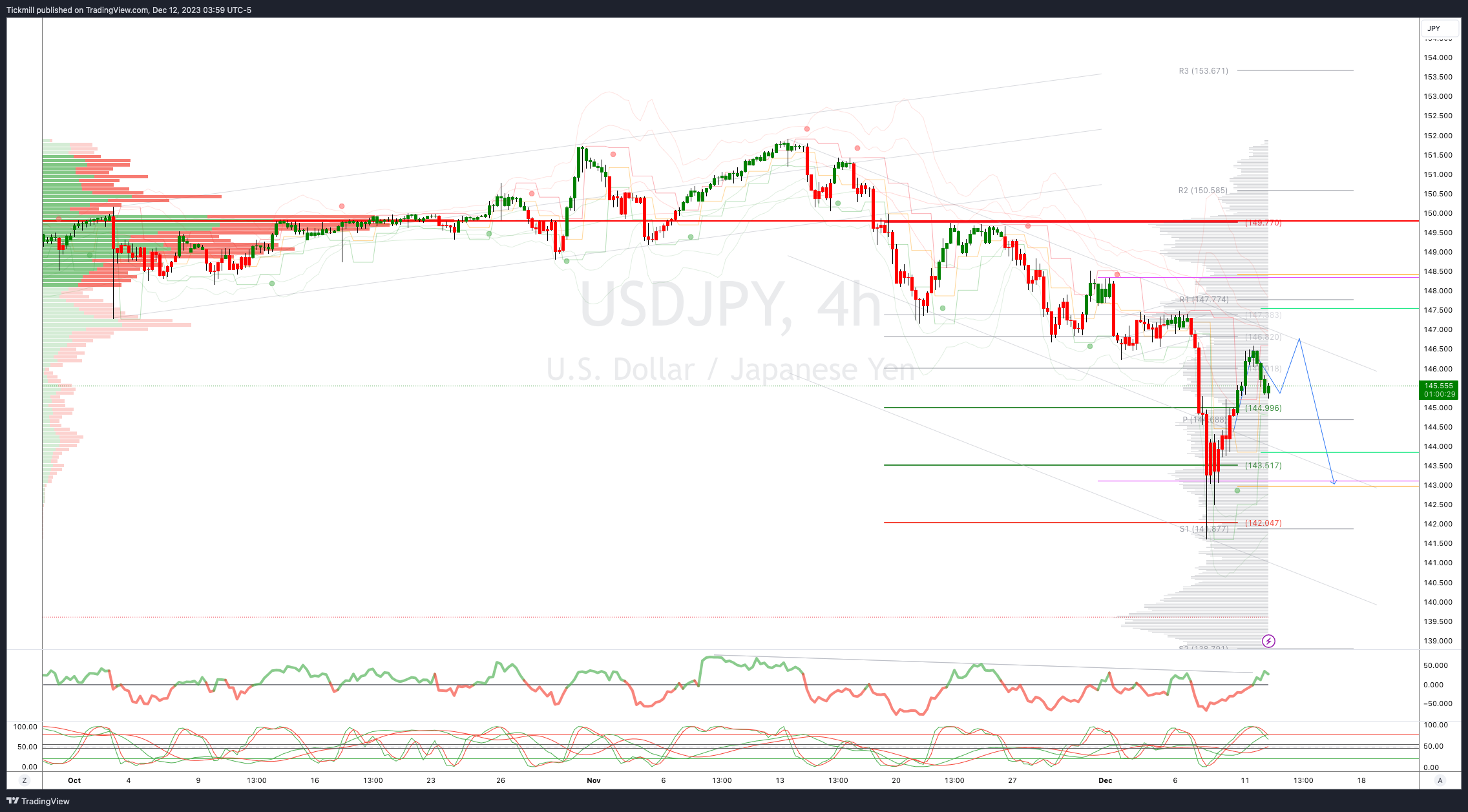

USDJPY Bias: Bullish Above Bearish Below 146

Above 146.50 opens 147.10

Primary resistance 149.70

Primary objective is 140

20 Day VWAP bearish, 5 Day VWAP bullish

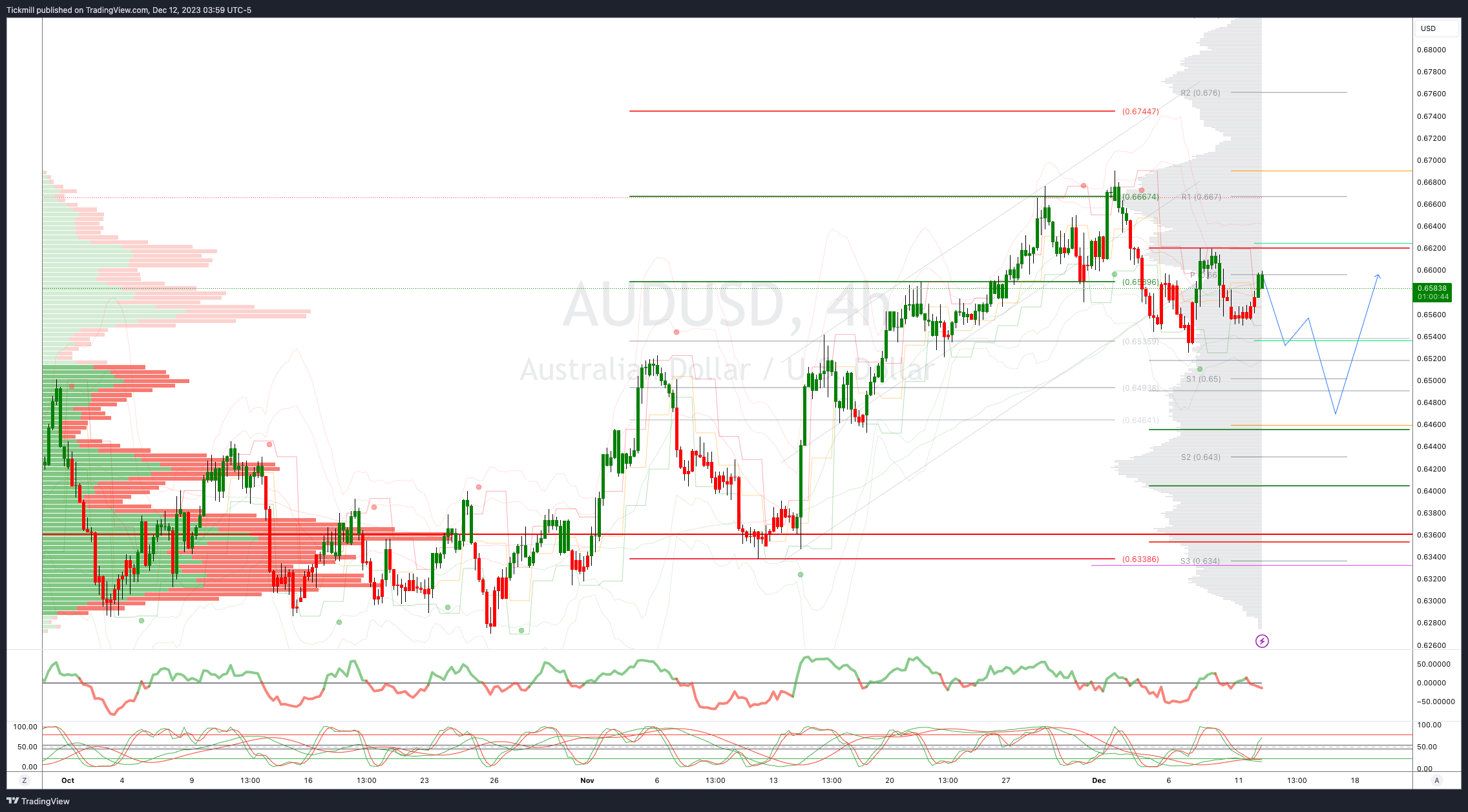

AUDUSD Bias: Bullish Above Bearish Below .6590

Below .6560 opens .6520

Primary support .6330

Primary objective is .6740

20 Day VWAP bullish, 5 Day VWAP bearish

BTCUSD Bias: Bullish Above Bearish below 42500

Below 40000 opens 38500

Primary support is 36800

Primary objective is 46000

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!