Daily Market Outlook, December 11, 2023

Daily Market Outlook, December 11, 2023

Munnelly’s Market Minute…

Asia - Stocks in the Asia-Pacific region traded mixed as investors processed recent data releases, including strong US jobs data and worsening deflation in China. This week's upcoming risk events, such as US CPI data and central bank updates, added to the cautious mood. The Nikkei 225 was the biggest gainer, following a pushback on recent Bank of Japan (BoJ) speculation, The BoJ does not see a need to end negative interest rates in December. They plan to make a decision based on data up until the last minute. This is because there is no proof of sustainable inflation and they have not seen enough evidence of wage growth to support sustainable inflation. The officials believe that the potential cost of waiting for more data is not very high. Hang Seng and Shanghai Comp were pressured by weakness in tech and property, and China's consumer inflation and factory gate prices declined more than expected, suggesting weak demand in the world's second-largest economy.

Europe - Market expectations for the European Central Bank (ECB) indicate a 60% probability of a rate cut by March. In the Eurozone, two 25 basis point cuts are projected by June, with a total reduction of around 125 basis points expected for 2024. Similarly, the United States is also expected to see two 25 basis point reductions by June and a total of five by the end of 2024. Rate cut expectations in the UK are less aggressive, with the first 25 basis point reduction not fully priced until June. However, over 75 basis points of Bank Rate reduction is fully priced by the end of the year. This easing contradicts the rhetoric from Bank of England (BoE) policymakers, who suggest that rate cuts are not imminent. Tomorrow, the Office for National Statistics (ONS) will release limited labour market data, including job vacancy numbers and earnings growth. It is anticipated that job vacancy numbers will decline and earnings growth will have eased. Annual regular pay growth for the three months to October is expected to decrease to 7.4% from 7.7%..

US - Stateside, The Federal Reserve is widely anticipated to keep interest rates steady at 5.25-5.50% on Wednesday. However, the central bank's statement, economic projections, dot plot, and Fed Chair Jerome Powell's press conference will have a significant impact on the markets. Recent data from the United States suggests that investors are pricing in approximately five quarter-point rate cuts in 2024, and there is a 76.4% probability that the Fed will begin easing at the May meeting, according to the CME FedWatch Tool. Economists, on the other hand, are more cautious, with a slim majority in the latest Reuters poll predicting no easing until at least July. The Fed may attempt to sound cautious and refrain from declaring victory in its battle against inflation in order to counteract the aggressive market expectations. The release of U.S. Consumer Price Index (CPI) data for November, which will occur one day before the Fed's decision, is expected to influence market expectations. Other important U.S. data to watch includes Producer Price Index (PPI), weekly jobless claims, November retail sales and industrial production figures, NY Fed manufacturing data, and S&P Global flash December Purchasing Managers' Index (PMI) readings.

FX Positioning & Sentiment

CFTC data from Friday showed that there has been a shift in positioning, with the net GBP position turning long in the week ending December 5. This is the first time since September that there has been a net long position in GBP, as it was previously net short by 7,895 contracts in the week ending November 28. Prior to that, the net short position was even larger at 27,730 in mid-November. The pound has recently reached three-month highs against both the dollar and the euro, with a peak of 1.2733 GBP/USD on November 29 and a subsequent low of 1.2504 on December 8. The Bank of England will be making a monetary policy announcement this week, which is expected to be hawkish. Traders have placed bets worth over $20 billion on the EUR/USD increasing in value. One particular bet is larger than all the other bets placed on the USD increasing. Traders still have significant bets on the USD rising against the JPY, AUD, CHF, CAD, NZD, and DXY. However, due to this one bet in favour of the EUR, traders are now overall short on the USD compared to other major currencies. Despite the falling value of the pair, speculators are still buying EUR/USD. Prior to the surge in November, approximately $3 billion worth of long positions were added, and since then, an additional $3 billion worth of long positions have been added as the pair dropped to 1.0724.

CFTC Data

During the period from November 29 to December 5, the net speculative position for the USD shifted from long to short. The $IDX increased by 1.35% during this period. The EUR$ decreased by 1.77% and speculators now hold 152,360 long contracts. The $JPY decreased by 0.24% and speculators now hold 104,956 short contracts. The Yen gained value after the period ended due to more hawkish talk from the Bank of Japan (BoJ), with a BoJ meeting scheduled for December 19. The GBP$ decreased by 0.88% and speculators now hold 11,665 long contracts. The AUD$ decreased by 1.4% and speculators now hold -57,681 contracts. The $CAD increased by 0.15% and speculators now hold -57,848 contracts. Bitcoin (BTC) increased by 15.6% during this period, with speculators reducing their contracts by 505 into new highs for 2023.

Overnight Newswire Updates of Note

Powell Under Pressure To Set Out Plan For Interest Rate Cuts

Senate Enters Crucial Week To Strike Deal On Ukraine, Border

Trump Takes 2024 Lead As Pres Biden Approval Hits New Low

China Consumer Price Drop Worsens, Fuelling Deflation Fears

China, Philippines Vessels Face Off Amidst Day Two Of Clashes

Political Shakeup May Smooth BoJ Hike Path, Economists Say

Goldman Sees BoE Cuts Coming From August At Quicker Pace

UK Housing Market Gloom Returns In Unexpected Price Rises

Goldman, Funds Boost Bullish Pound Bets As Fewer Cuts Seen

Bond Bulls Betting On ECB Interest Rate Cuts Face Lagarde Test

Bitcoin’s 2023 Rally Wobbles In Sudden Drop Toward $40,000

Oil Steadies After Glut Fears Drove Worst Losing Run Since 2018

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

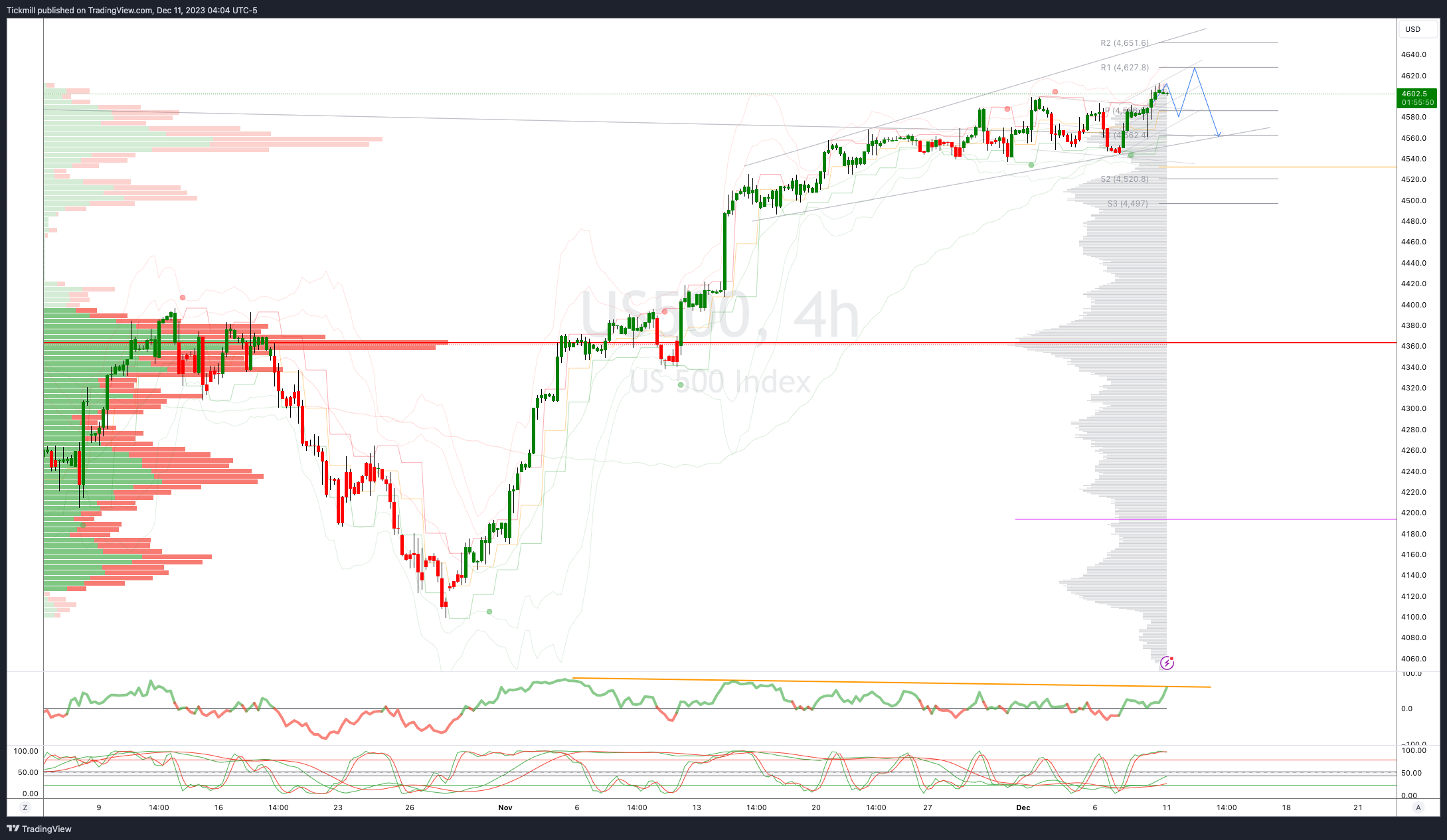

SP500 Bias: Bullish Above Bearish Below 4540

Below 4527 opens 4512

Primary support 4420

Primary objective is 4625

20 Day VWAP bullish, 5 Day VWAP bullish

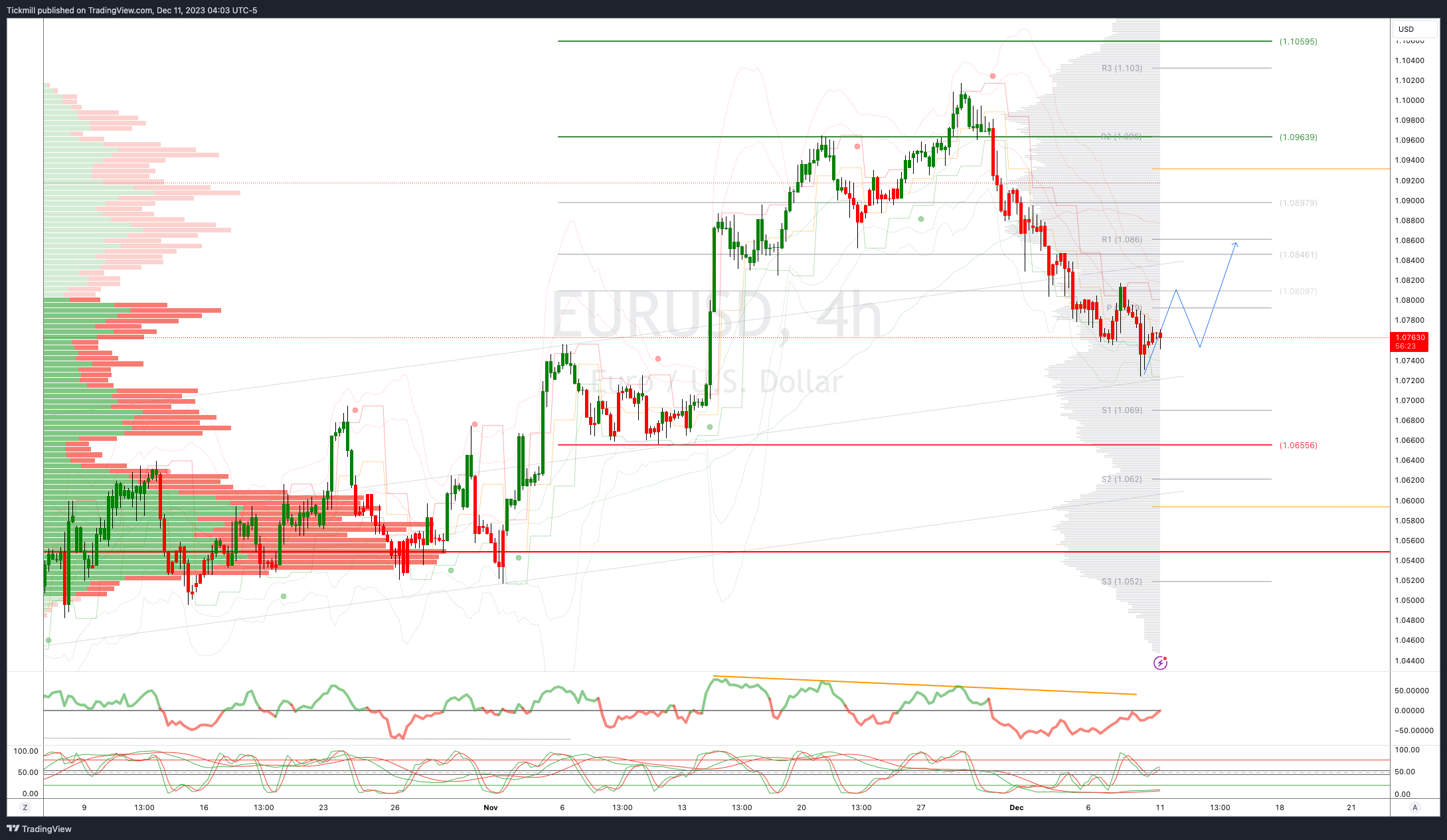

EURUSD Bias: Bullish Above Bearish Below 1.0740

Below 1.0740 opens 1.0650

Primary support 1.0650

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bearish

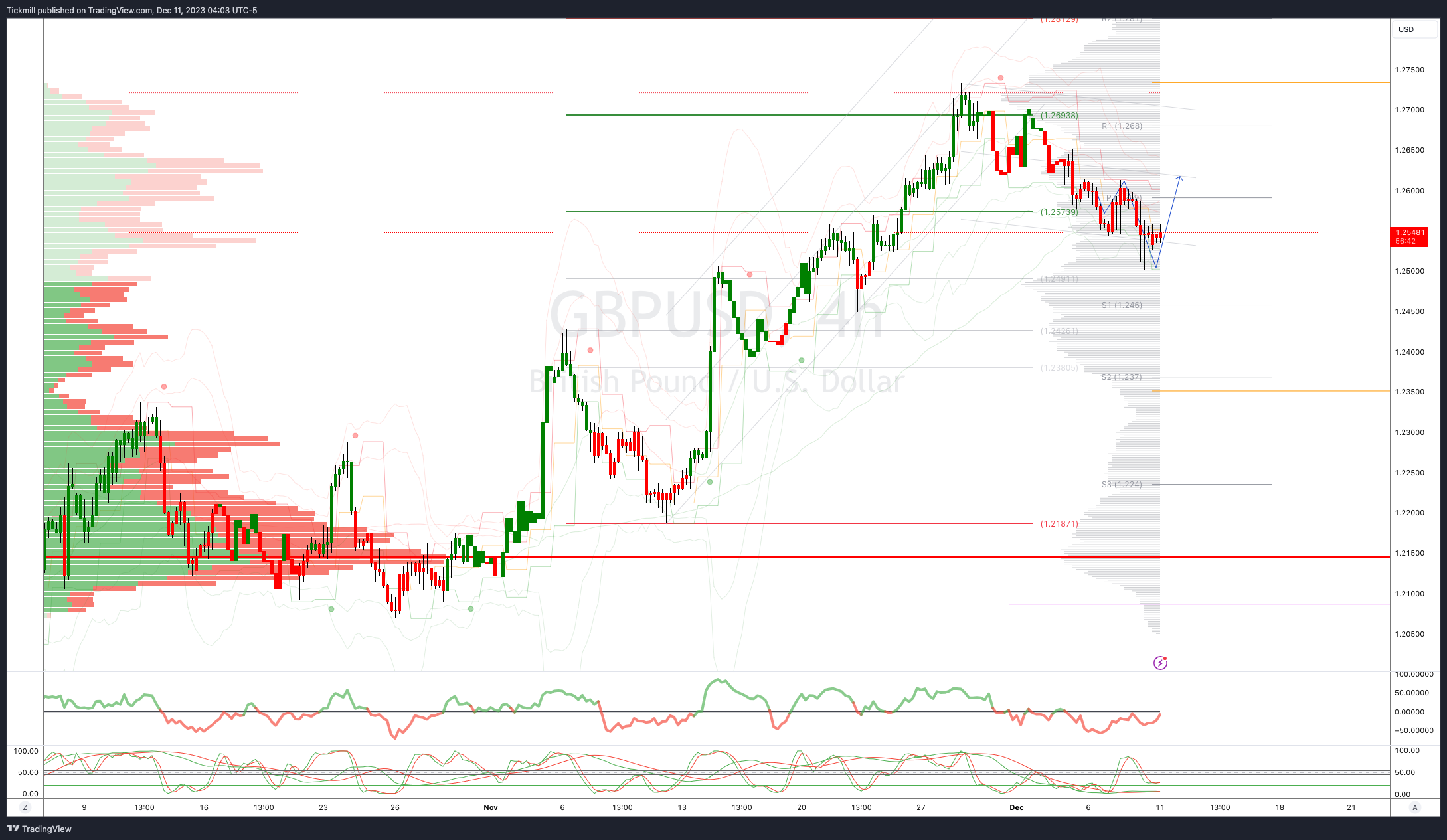

GBPUSD Bias: Bullish Above Bearish Below 1.2540

Below 1.2530 opens 1.25

Primary support is 1.2185

Primary objective 1.28

20 Day VWAP bullish , 5 Day VWAP bearish

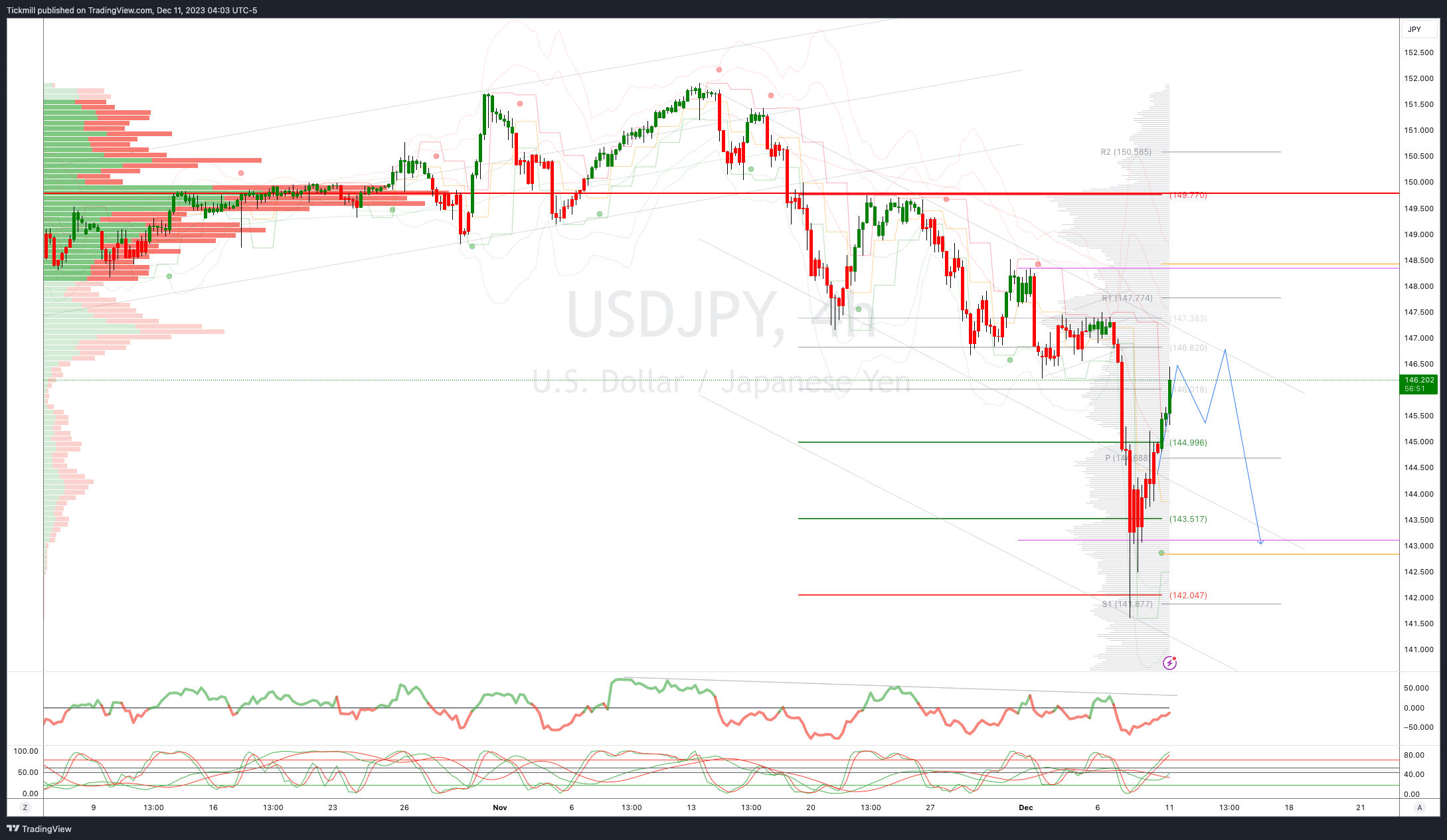

USDJPY Bias: Bullish Above Bearish Below 146

Above 146.50 opens 147.10

Primary resistance 149.70

Primary objective is 140

20 Day VWAP bearish, 5 Day VWAP bullish

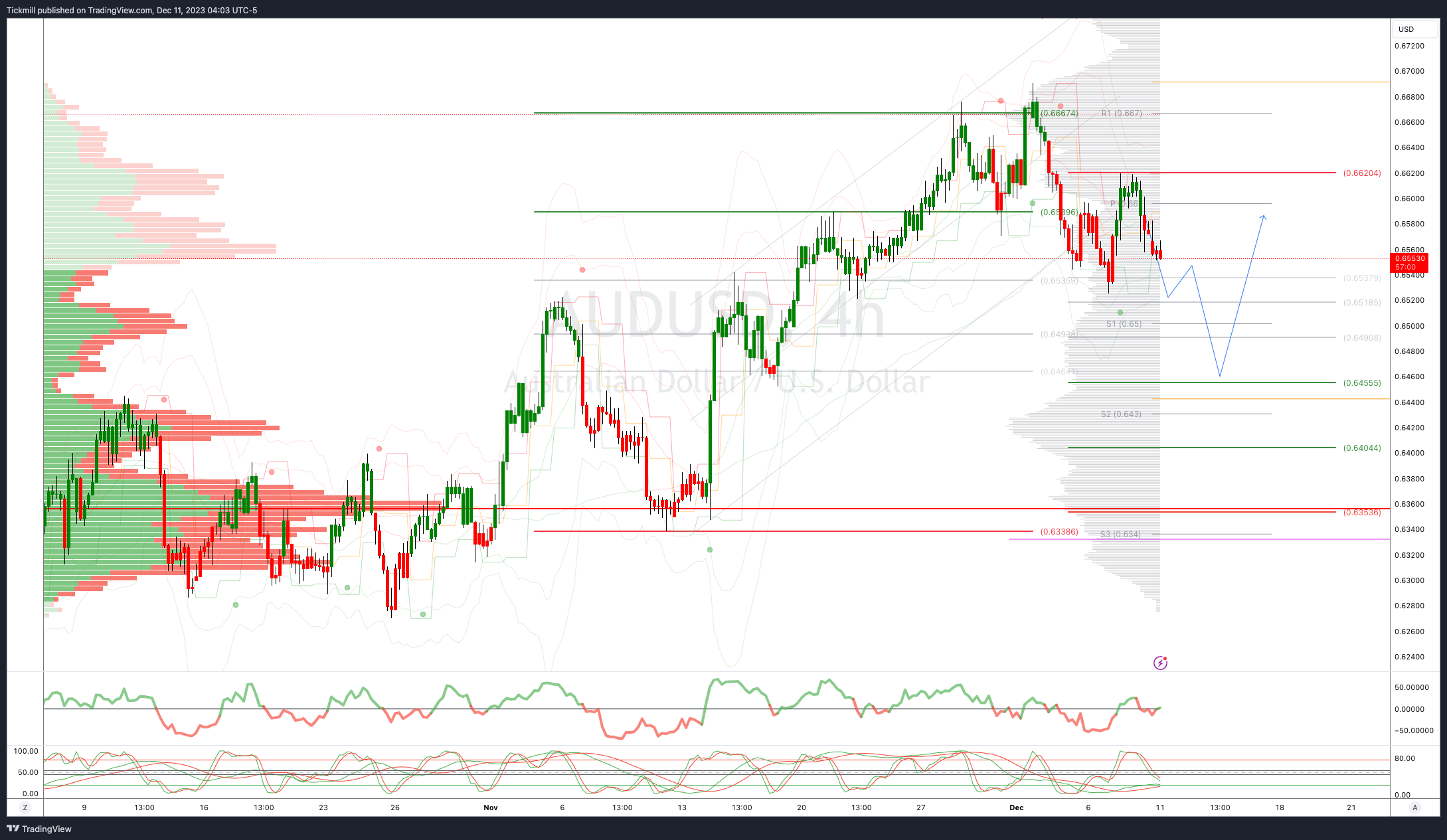

AUDUSD Bias: Bullish Above Bearish Below .6590

Below .6560 opens .6520

Primary support .6330

Primary objective is .6740

20 Day VWAP bullish, 5 Day VWAP bearish

BTCUSD Bias: Bullish Above Bearish below 42500

Below 40000 opens 38500

Primary support is 36800

Primary objective is 46000

20 Day VWAP bullish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!