Daily Market Outlook, August 9, 2024

Daily Market Outlook, August 9, 2024

Munnelly’s Macro Minute…

“Risk Sentiment Soothed By Jobs Data, Closing Out A Whipsaw Week”

Following Wall Street's robust rally overnight, Asian stock markets are mostly up on Friday. This is because data released yesterday showed a larger than expected decline in first-time claims for U.S. unemployment benefits, allaying fears that the world's largest economy may be heading into a recession. This increased the likelihood of several interest rate reductions in the months to come. The Japanese stock market was trading higher on Friday, reversing its losses from the previous session, although the momentum has started to fade. Index heavyweights and financial stocks are leading the advances across all sectors, as the benchmark Nikkei 225 is above the 35,200 mark.

As things stand, the yen is expected to end the week down roughly 0.5% against the dollar. On Monday, it surged to a seven-month high, which sparked the unraveling of yen carry positions, which in turn caused the recent collapse in global markets. But the carry trade is still very much alive; according to JPMorgan, it may have surpassed $4 trillion. Even the much-dreaded downturn narrative in China is starting to improve. Following trade statistics on Wednesday that revealed an unexpected acceleration in import growth, consumer inflation data released on Friday revealed prices increased more than anticipated in July. This implies that there is less chance of the second-biggest economy in the world completely deflationary.

What about the Fed's expectations? The market predicted a 23% possibility of a 50bp drop, as opposed to a 25bp shift, for the September FOMC the day before last week's jobs report. There is now a 50% likelihood of a 50bp decrease. The statement made by Kansas City Fed President Schmid overnight that "we are still not quite there" in terms of inflation declining reinforces the idea that market players have been overly sensitive to recent labour market statistics. At this point, the inflation data is likely more important than the employment market developments, as Powell stated at the July FOMC. The markets appear more susceptible to an upward surprise in the CPI data next week than to a miss, based on the starting point of nearly four 25bp cuts being priced for the remaining three meetings this year.

Overnight Newswire Updates of Note

China’s CPI Higher Than Expected In July, Up By 0.5%

Canadian Dollar Extends Recovery Ahead Of Jobs Report

Biden Sketches Out A New Blueprint For Next Six Months

Fed’s Barkin: We Have ‘Time’ To Assess Economy

Trump Says Presidents Have The Right To Influence Fed Policy

Market Gyrations Reflect Fears About The Unwinding Of QE

US Wants Japan To Co-Produce 100-Plus Patriot Missiles

RBNZ Preview: Hold Now, Bigger Cuts Later?

Oil Poised For Weekly Gain With Eyes On Middle East

Kyiv Advances In War’s Largest Counter-incursion

China’s Supply Chain Woes, HP Shifts Production Overseas

Seoul, Washington Discuss Clean Energy Ties

Cryptocurrencies Resume Their Rebound

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0865-75 (1BLN), 1.0895-1.0905 (4.1BLN), 1.0920 (626M)

1.0950 (404M), 1.0980 (524M), 1.1000 (616M)

USD/CHF: 0.8700 (539M). EUR/CHF: 0.9450 (331M)

GBP/USD: 1.2700 (339M). EUR/GBP: 0.8530 (266M)

AUD/USD: 0.6600 (3.2BLN)

AUD/NZD: 1.0900 (509M), 1.0930 (701M), 1.0955 (220M)

USD/CAD: 1.3700 (519M), 1.3730-35 (608M), 1.3750 (955M), 1.3850 (1.1BLN)

USD/JPY: 146.00 (862M), 147.00-05 (755M)

Implied volatility for FX options increased significantly at the start of the week, with the JPY leading the way. Though anxieties have subsided, it is still far above earlier levels even though it has peaked. Benchmark expiration of one month Pre-NPP implied volatility for the USD/JPY was 11.35. Monday saw it hit 16.0, the highest level since January 2023, and it is now 13.6 AUD/USD one month. Implied volatility for FX options changed from 9.1 to 11.1 to 9.65. 1-month EUR/USD: 5.1 to 7.1, currently 5.7. GBP/USD 1-month range: 6.2, 7.8, and 7.1. Large option expirations on Friday could reduce the volatility of the EUR and AUD FX.Since the release of the NFP report, carry trade unwinding and a decline in risk sentiment have been caused by fears of a US recession. The demand for FX options has surged due to the notable increase in FX volatility. As long as worries continue, implied volatility linked to the JPY has increased significantly, but it has now peaked and is still much higher than previous levels. AUD/USD 1-month implied vol increased from 9.1 to 11.1, now at 9.65; EUR/USD 1-month moved from 5.1 to 7.1, now at 5.7; and GBP/USD 1-month went from 6.2 to 7.8, presently at 7.1. Benchmark 1-month USD/JPY implied vol touched 16.0 on Monday, the most since January 2023, currently at 13.6. Future significant option expirations could restrict Friday's FX volatility in EUR and AUD.

CFTC Data As Of 30/7/24

Equity fund managers CUT S&P 500 CME net long position by 55,687 contracts to 938,842

Equity fund speculators trim S&P 500 CME net short position by 32,188 contracts to 248,167

Euro net long position is 17,799 contracts

Japanese yen net short position is -73,460 contracts

Swiss franc posts net short position of -34,520

British pound net long position is 111,471 contracts

Bitcoin net short position is -1,002 contracts

Technical & Trade Views

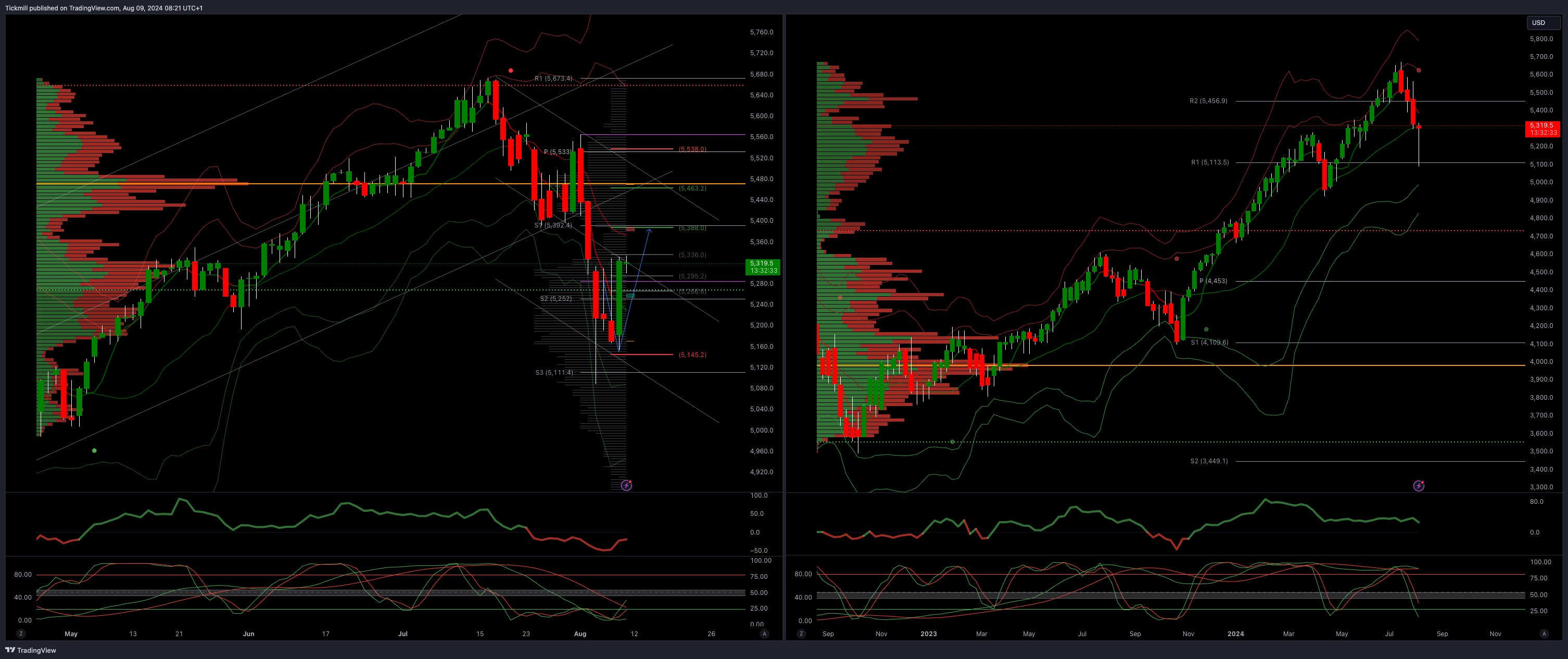

SP500 Bullish Above Bearish Below 5150

Daily VWAP bullish

Weekly VWAP bearish

Above 5388 opens 5470

Primary resistance 5470

Primary objective is 5000

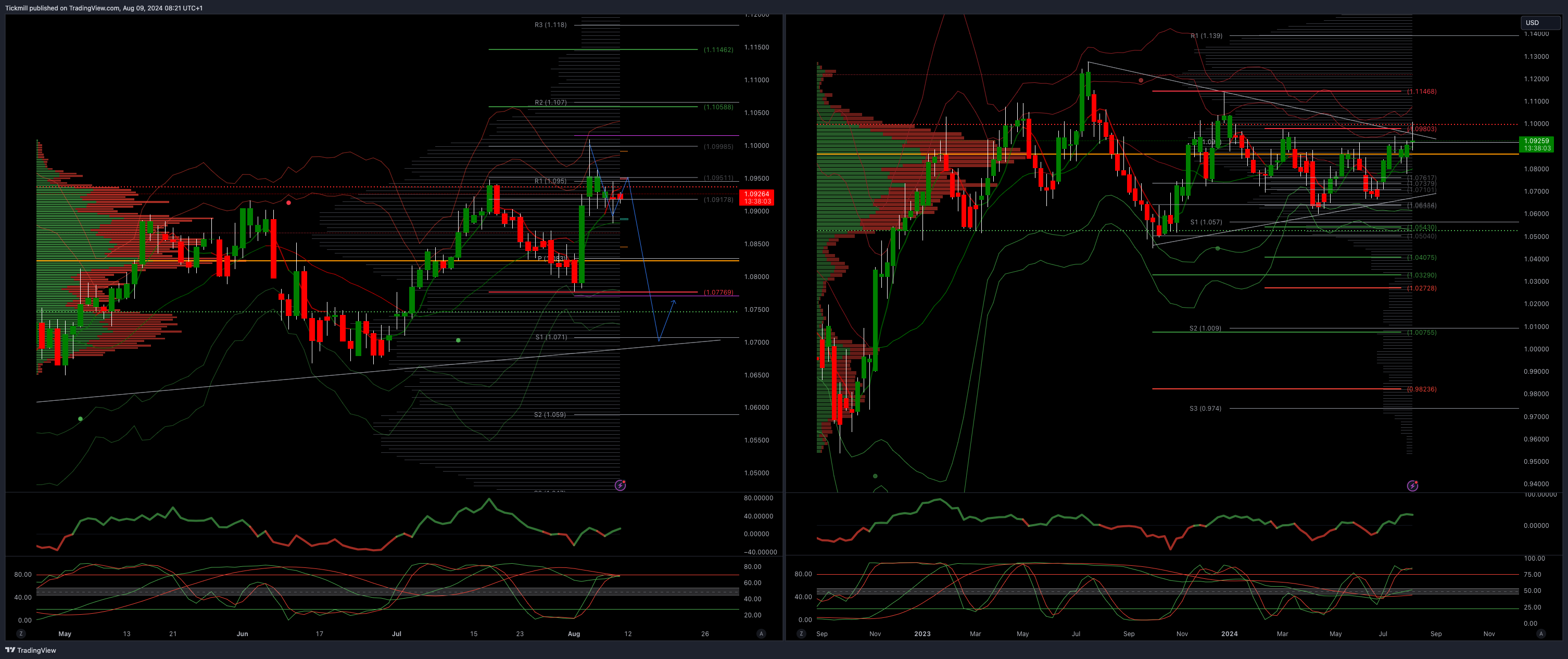

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Above 1.0975 opens 1.1075

Primary resistance 1.0981

Primary objective is 1.0

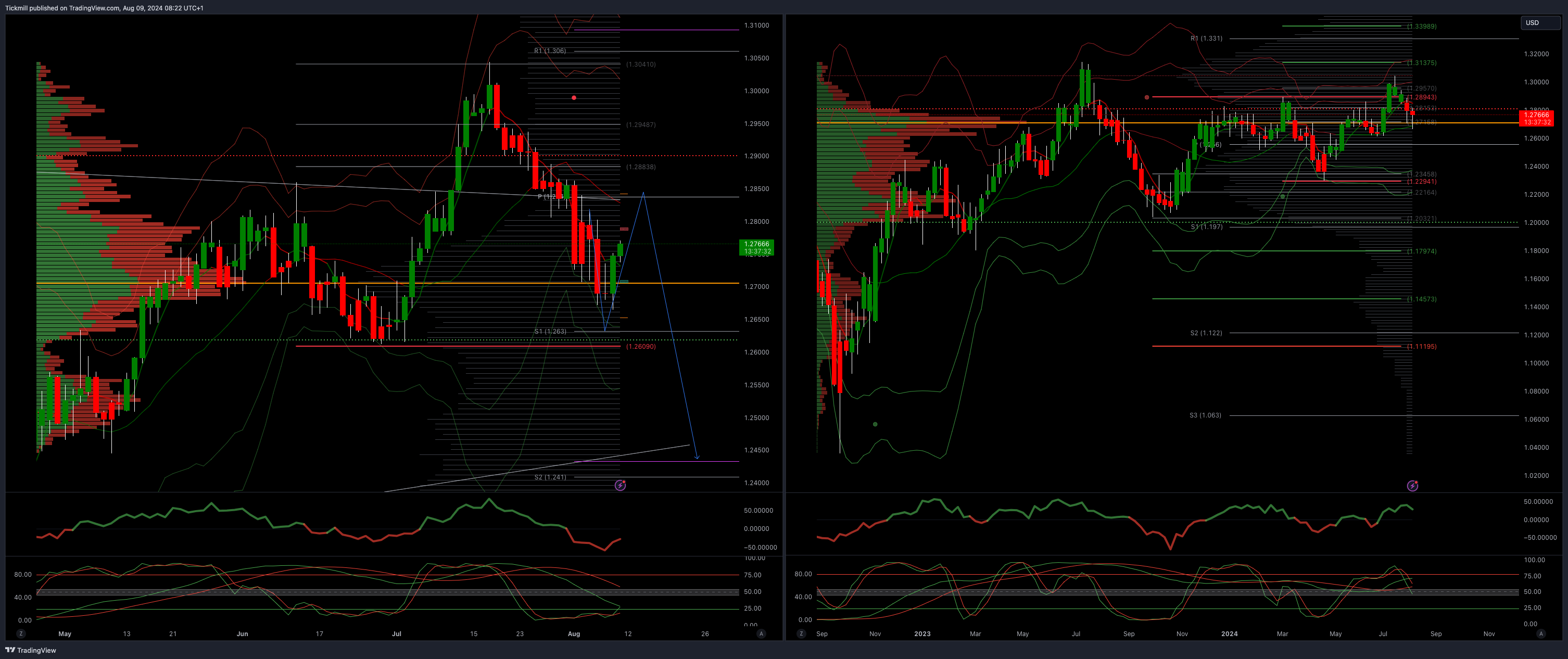

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bullish

Weekly VWAP bearish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.2450

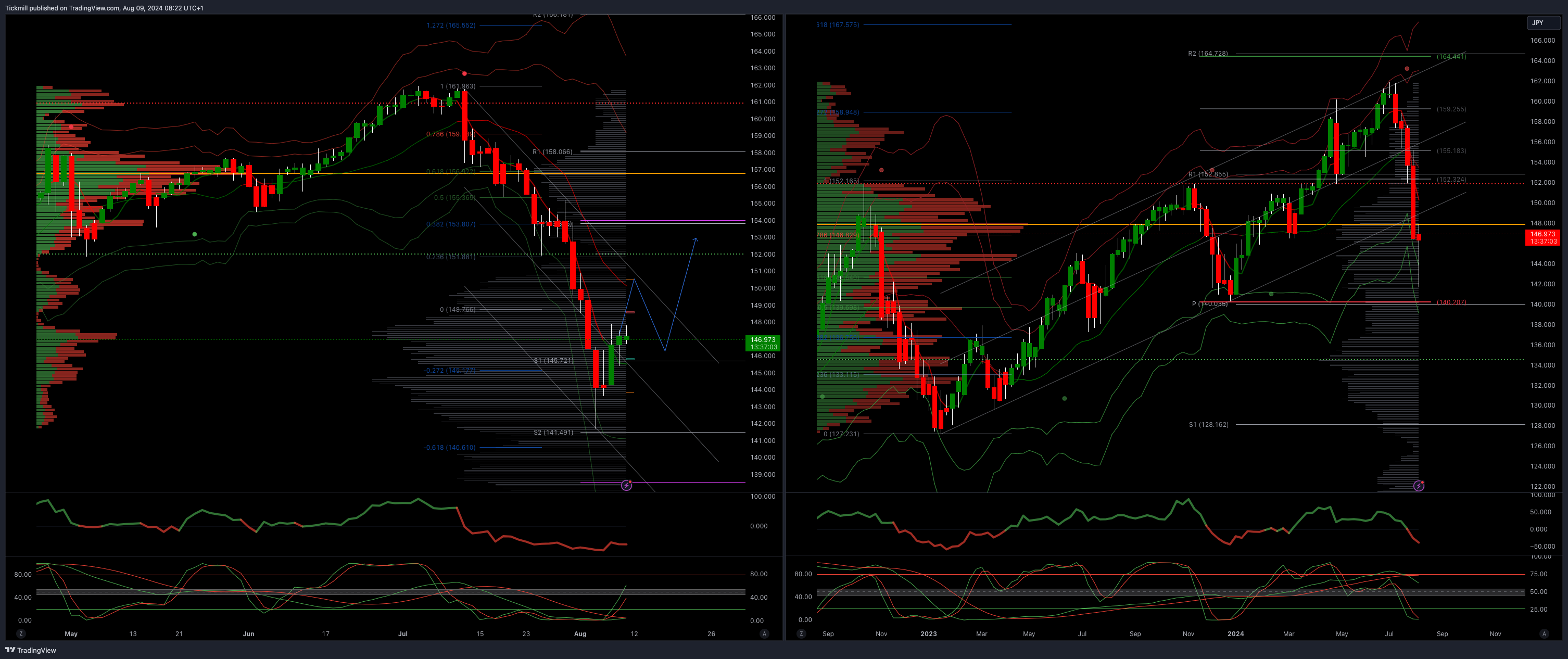

USDJPY Bullish Above Bearish Below 149

Daily VWAP bullish

Weekly VWAP bearish

Above 150 opens 153

Primary support 140

Primary objective is 153

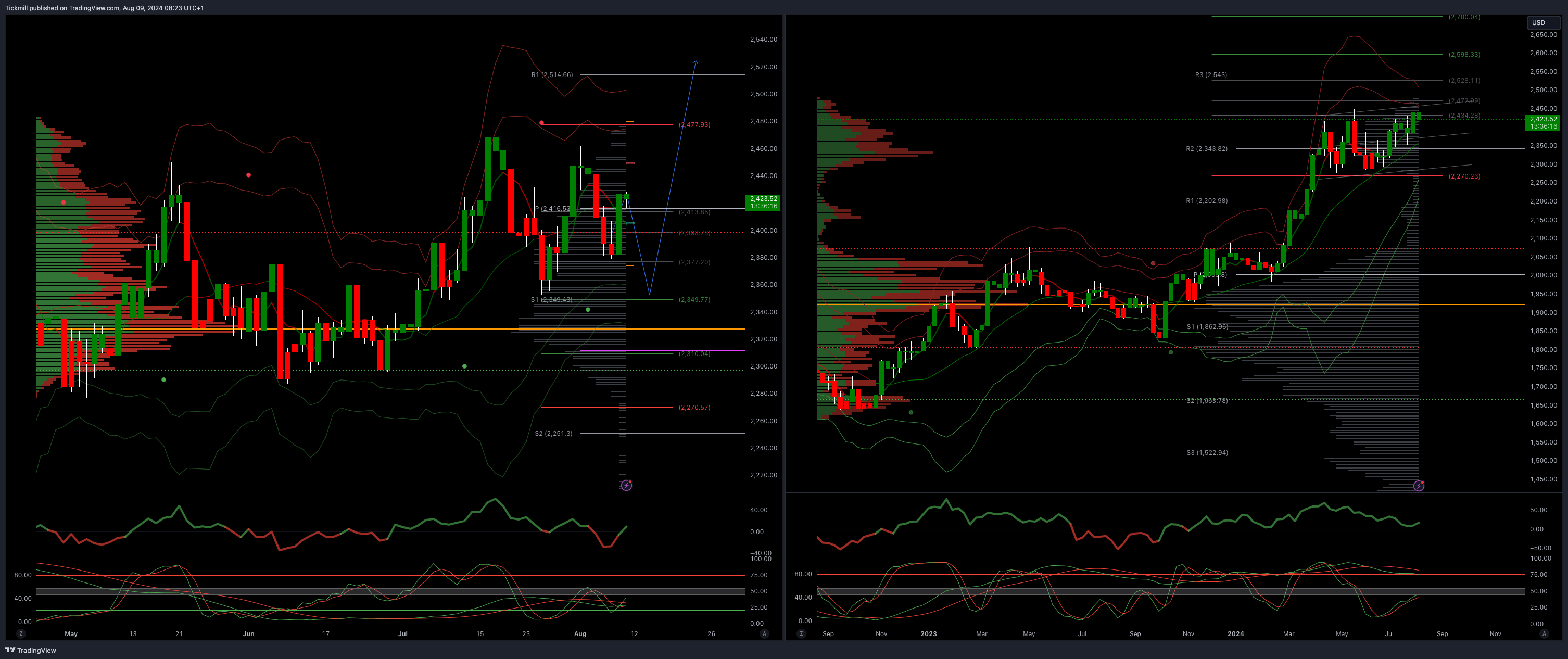

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

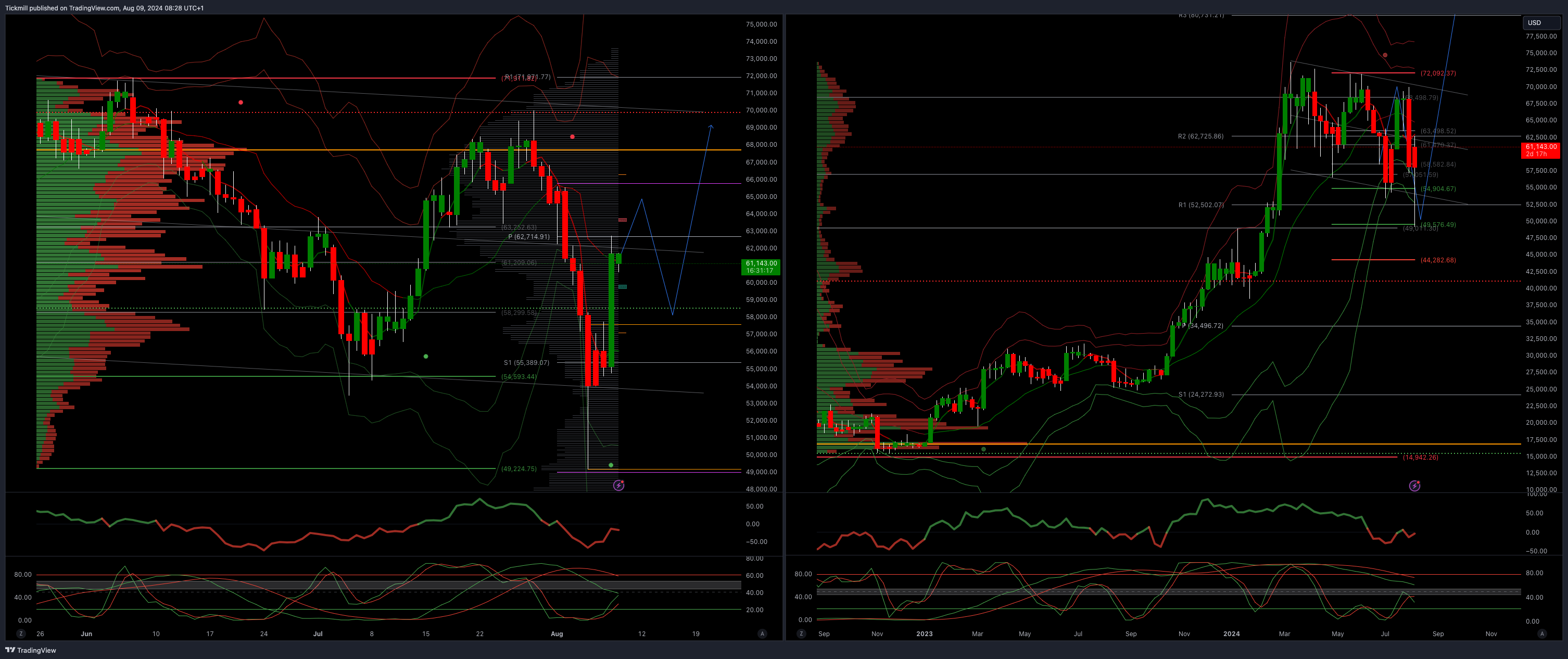

BTCUSD Bullish Above Bearish below 58000

Daily VWAP bearish

Weekly VWAP bearish

Above 61000 opens 68000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!