Daily Market Outlook, August 7, 2024

Daily Market Outlook, August 7, 2024

Munnelly’s Macro Minute…

“BoJ…The New Plunge Protection Team?”

After Wall Street's generally positive cues overnight, Asian stock markets are basically up on Wednesday. Traders are buying equities at a discount following the recent sharp sell-off that was sparked by concerns that the largest economy in the world will enter a recession.

The Bank of Japan appears to have taken on the role of the infamous ‘Plunge Protection Team’ from the Federal Reserve, as Nikkei investors hope. After an early 3% decline, the Nikkei rebounded 2.8% and nearly returned to its pre-Monday 13% crash level. BOJ Deputy Governor Shinichi Uchida's statement that the central bank would not raise interest rates amid market volatility saved the day and perhaps the fate of the yen carry trade. The dollar surged 2% against the yen, Japanese yields fell, and the probability of a BOJ rate hike in October dropped to just one-in-four, a marked change from last week when the BOJ hiked rates by 15 basis points and signaled further tightening, leading to a surge in the yen and the unraveling of the yen carry trade. As a result, the yen saw a spike in value and the collapse of the yen carry trade, in which investors borrowed money at cheap interest rates to purchase assets with greater yields. Almost everything was rose. Even China's trade figures surprised to th eupside with how strong domestic demand was, as imports exceeded forecasts. Export growth was strong even though it fell short of expectations.

Datawise trade numbers from Germany and the UK's home prices for July. Central banks speakers include Elizabeth McCaul, a board member of the European Central Bank, participating in a panel discussion, and Olli Rehn, the ECB, opens the Bank of Finland seminar.

Today's big earnings in Europe are mixed bag Siemens Energy increased its forecast for free cash flow for the second time in three months, while Novo Nordisk missed its profit margin for the second quarter. In the UK, Lloyd's of London insurer Hiscox H1 earnings is up 7%, while Legal & General has reported operating profit for H1 that is better than anticipated.The Financial Times also revealed that Swiss drugmaker Roche is thinking of selling off its cancer data expert Flatiron Health.

Overnight Newswire Updates of Note

BoJ Deputy Gov: Won’t Raise Rates When Markets Unstable

China Exports Growth Slows Slightly While Imports Boom

SEC Investigating Wall Street Banks Over Lost Interest Payments

New Goldman Sachs Index, Financial Stress Relatively Normal

IMF Reports Progress In El Salvador Talks, Flags Bitcoin Risks

Australian RBA 'Near-Term' Interest Rate Cuts Not On Agenda

US Has Communicated To Not Escalate Conflict

Hamas Picks Yahya Sinwar As New Political Leader

China Implements Tech Innovation National Guarantee Fund

Oil Prices Settle Higher; Signs Of Tighter Supply

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0825-35 (1.2BLN), 1.0840-45 (1.04BLN)

1.0850-55 (1.64BLN), 1.0900 (468M), 1.0945-55 (1.13BLN)

1.0960-70 (359M)

USD/CHF: 0.8555-60 (922M), 0.8725 (480M), 0.8750 (310M)

0.8825 (250M), 0.9000 (1.0BLN)

GBP/USD: 1.2650 (450M), 1.2750 (230M), 1.2830 (656M)

EUR/GBP: 0.8400 (557M), 0.8485 (907M), 0.8620 (669M)

AUD/USD: 0.6525-35 (539M), 0.6550 (301M), 0.6660-70 (497M)

0.6745 (861M). NZD/USD: 0.5870-80 (701M)

0.5950 (331M), 0.6015-20 (288M), 0.6085 (300M)

AUD/NZD: 1.0925 (380M), 1.0950-60 (1.04BLN), 1.0975 (382M)

1.1000 (263M)

USD/CAD: 1.3625 (729M), 1.3695 (230M), 1.3735 (220M)

1.3750 (620M), 1.3800-10 (377M), 1.3875 (631M)

USD/JPY: 146.00 (500M), 147.25-35 (1.57BLN)

147.75 (220M), 149.00 (600M), 149.25 (1.32BLN)

150.00 (427M)

CFTC Data As Of 30/7/24

Equity fund managers CUT S&P 500 CME net long position by 55,687 contracts to 938,842

Equity fund speculators trim S&P 500 CME net short position by 32,188 contracts to 248,167

Euro net long position is 17,799 contracts

Japanese yen net short position is -73,460 contracts

Swiss franc posts net short position of -34,520

British pound net long position is 111,471 contracts

Bitcoin net short position is -1,002 contracts

Technical & Trade Views

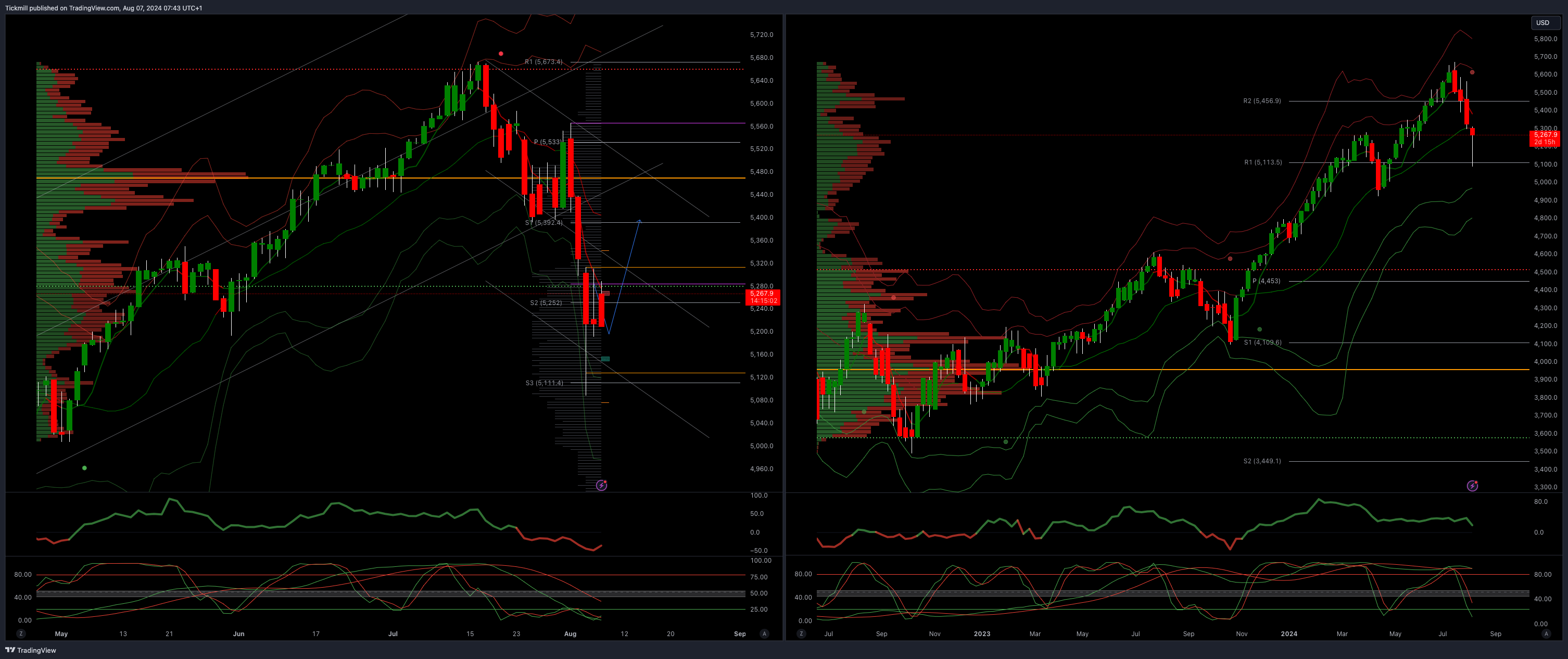

SP500 Bullish Above Bearish Below 5350

Daily VWAP bearish

Weekly VWAP bearish

Below 5400 opens 5289

Primary resistance 5470

Primary objective is 5000

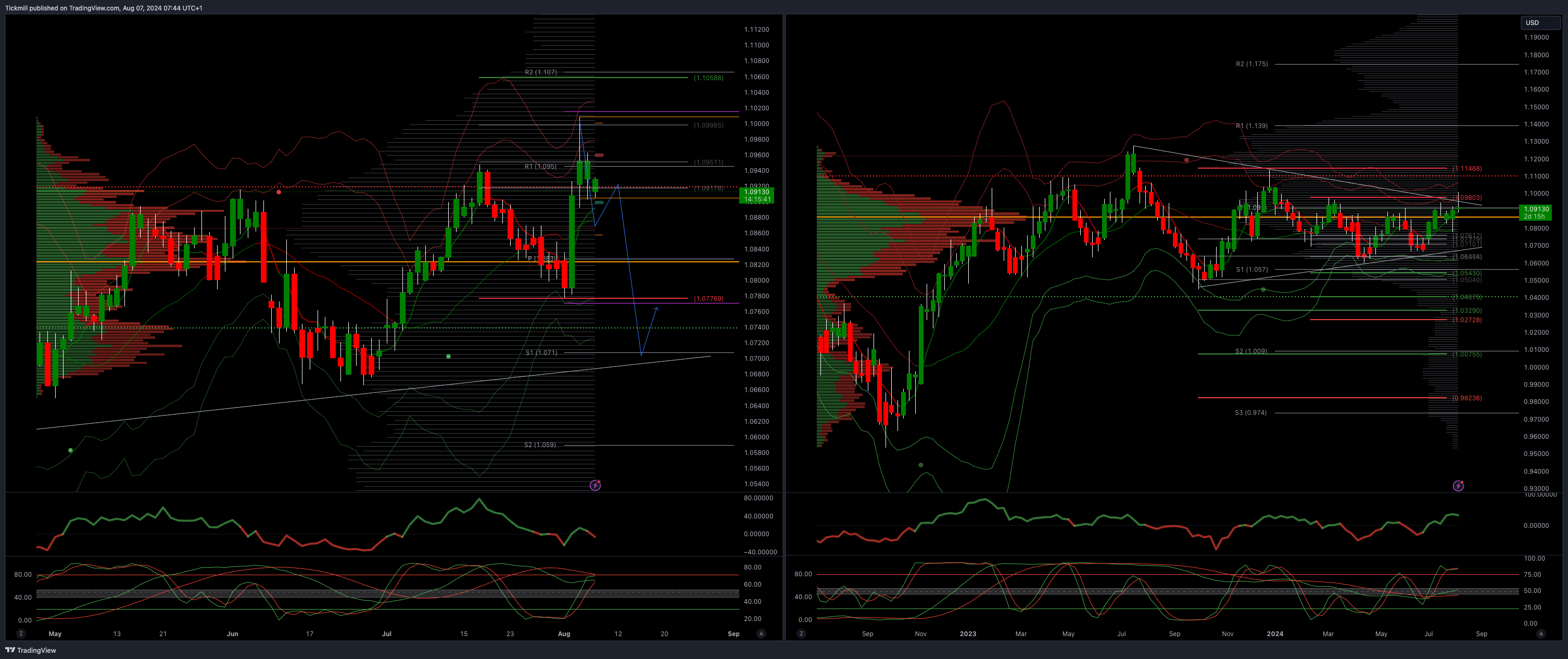

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0975 opens 1.1075

Primary resistance 1.0981

Primary objective is 1.07

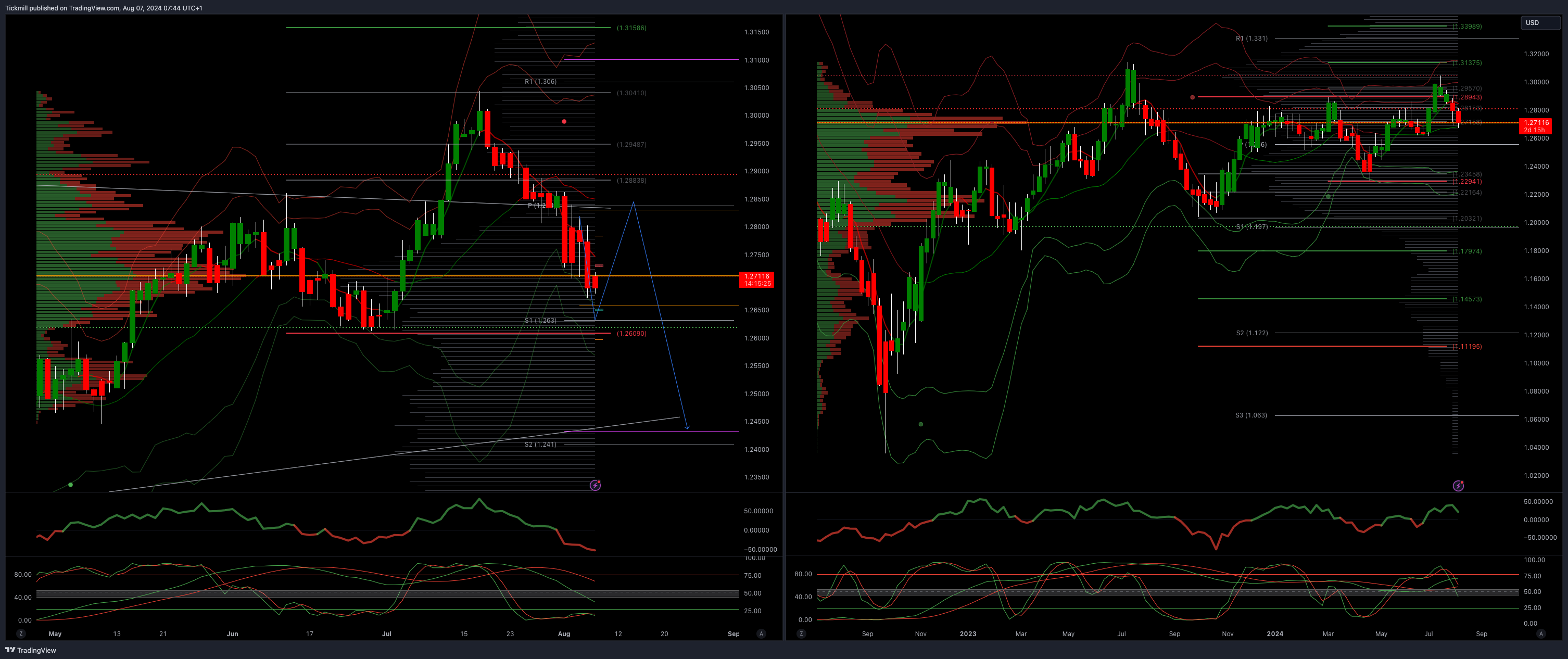

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bearish

Weekly VWAP bearish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.2450

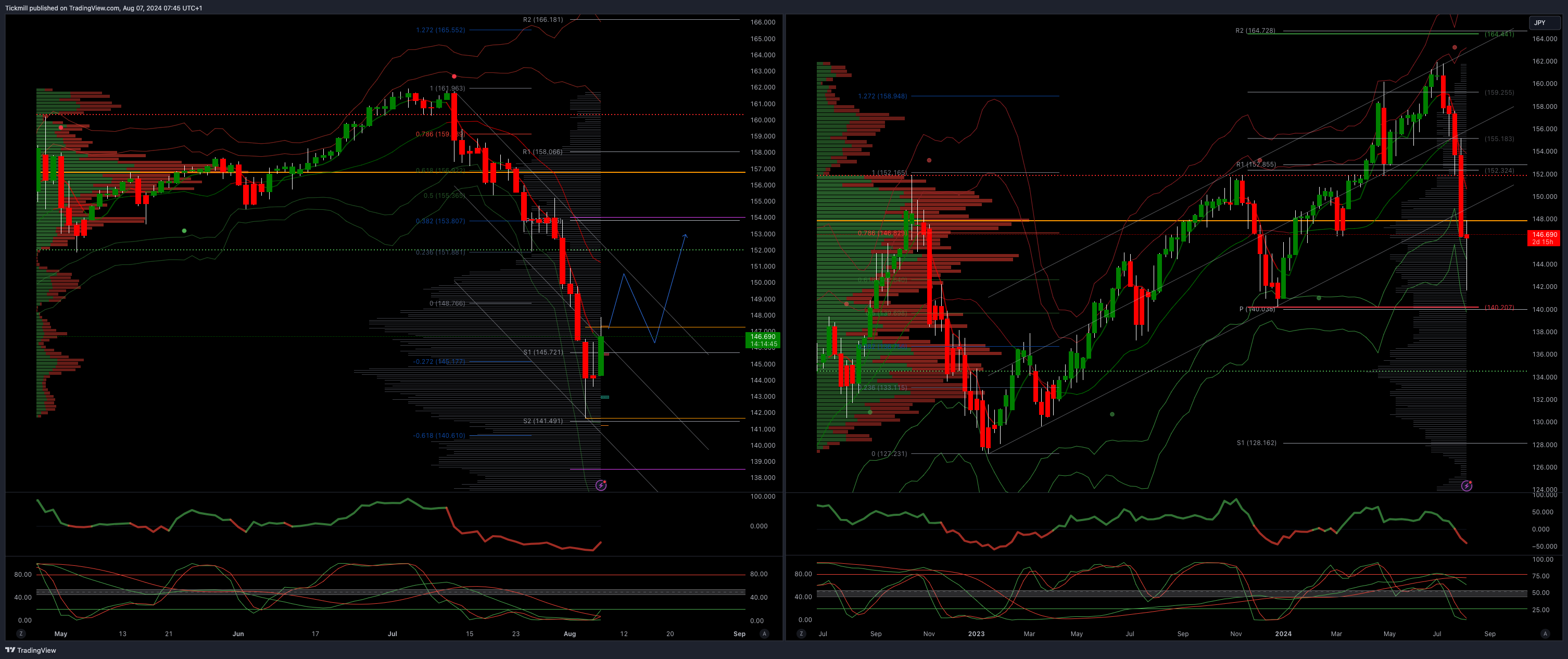

USDJPY Bullish Above Bearish Below 149

Daily VWAP bearish

Weekly VWAP bearish

Above 150 opens 153

Primary support 140

Primary objective is 153

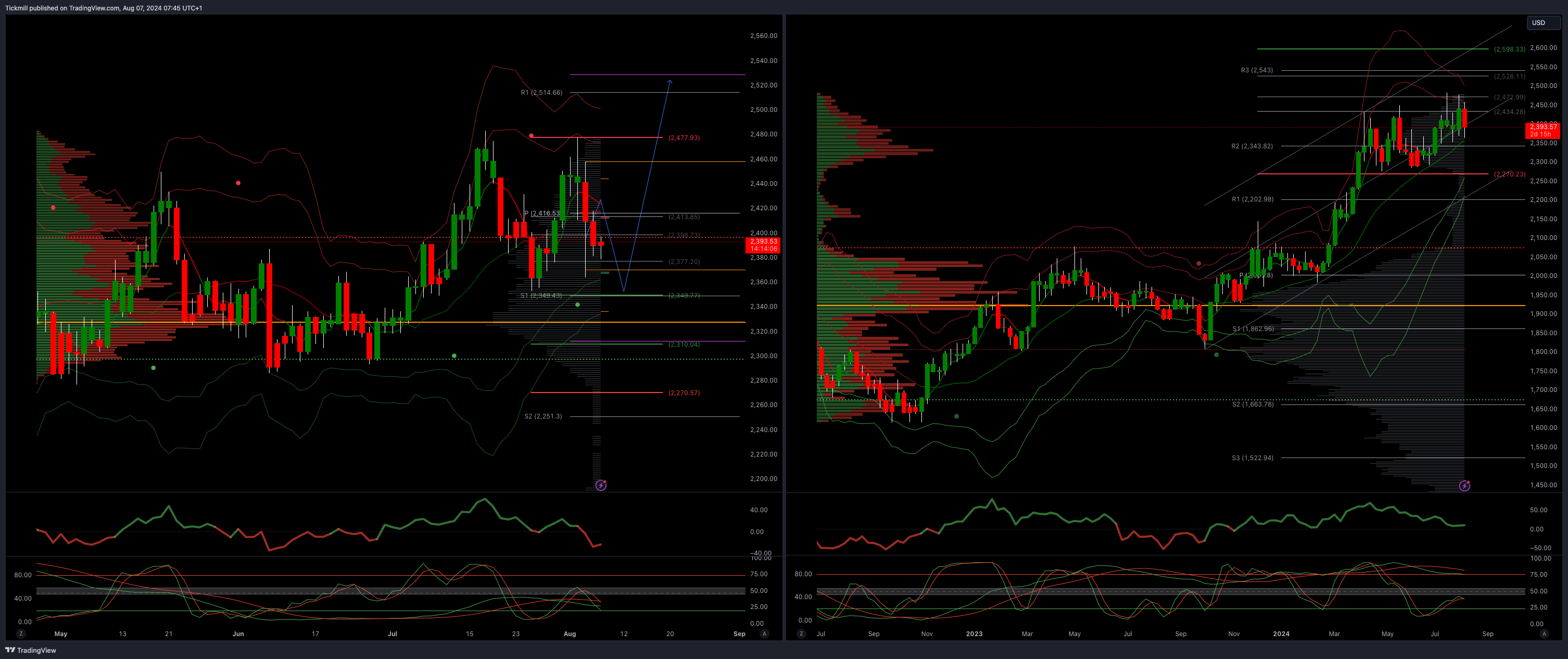

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bearish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

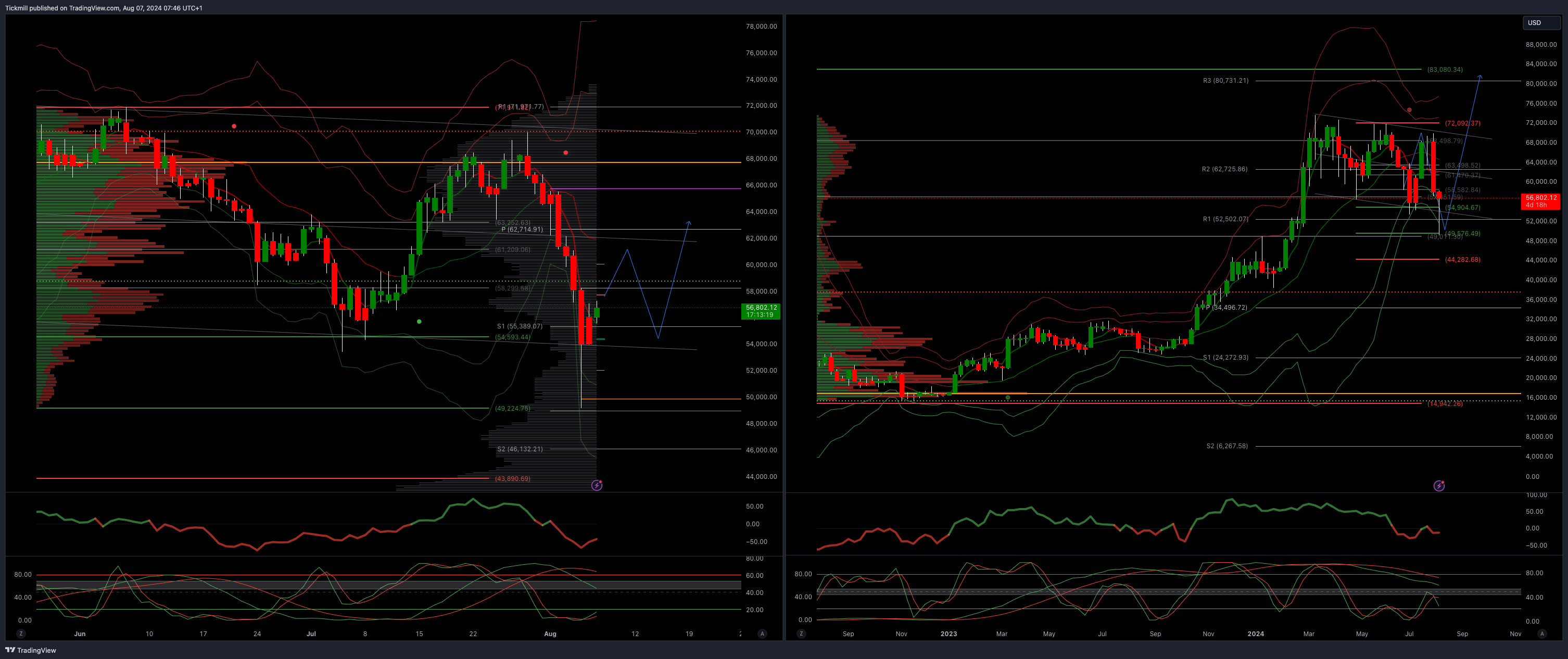

BTCUSD Bullish Above Bearish below 55000

Daily VWAP bearish

Weekly VWAP bearish

Above 61000 opens 68000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!