Daily Market Outlook, August 6, 2024

Daily Market Outlook, August 6, 2024

Munnelly’s Macro Minute…

“Margin Call Monday To Turnaround Tuesday?”

Despite the generally negative cues from global markets overnight, Asian stock markets are mostly up on Tuesday. This is because most markets recovered strongly from the worst sell-off since 2008 amid concerns about the world's largest economy going into recession in the wake of some recent disappointing data on US jobs and manufacturing activity. After printing the largest losses since 1987,the Japanese stock market surged on Tuesday, reversing some of the sharp losses in the previous three sessions. The Nikkei 225 increased up 3,000 points to be well above the 34K level, with strong gains across all sectors led by index heavyweights and technology stocks. Remarkably, given the convergence of events that sparked the selloff, Japan's rate hike, an unwinding of global transactions financed by yen, weakening in U.S. jobs, and concerns in the Middle East, all it took was a reassuring statement from central bank officials to turn things around.

The first response from bears is to highlight that Japan is not the canary in the mine because it has consistently recovered quickly from sell-offs. The carnage could not be done given continuing worries about inflated tech earnings and the belief that the Fed may have kept rates too high for too long. In addition, there is still a significant excess of yen-funded assets worldwide, not only in US stocks but also in high-yielding emerging market currencies like the rand, peso, and rupee of South Africa, Mexico, and India.

The Nikkei volatility index remains twice as high as it was the previous week. While S&P volatility is still high, the STOXX volatility index closed on Monday near its highest point since March 2022. Germany's safe-haven two-year bond rate might rise much more when the anxiety fades. On Monday, it fell to its lowest point since March 2023. Datawise, markets will get June industrial orders in Germany; July UK S&P global construction PMI; June retail sales in the eurozone; Q2 consumer debt and credit report from the Federal Reserve Bank of New York; U.S. trade data

Overnight Newswire Updates of Note

RBA Leaves Interest Rates On Hold At 4.35%

Japan Real Wages Rise In June, In The Last 27 Months

US's Biden Convenes Security Team, Fears Of Iran Attack Grow

Fed's Daly: More Confident Inflation Is On Path To 2%

UK Chancellor Leaves Door Open To Higher Borrowing

Japan To Offer $2B In Trade Support For Asia Projects

Kiwibank Recommends RBNZ Cuts Rates Next Week

Japan Stocks Rebound 10% As Yen Falls Against Dollar

Bitcoin Bounces To $55K After Brutal Sell-off

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0815-20 (2.18BLN), 1.0830-40 (1.1BLN)

1.0885 (628M), 1.0895-00 (828M), 1.0920 (352M)

1.0935 (786M), 1.0965-75 (437M)

USD/JPY: 144.00 (680M), 144.30 (380M), 144.50 (220M)

150.00 (1.071BLN)

EUR/JPY: 156.00 (660M), 162.00 (1.12BLN)

USD/CHF: 0.8535 (238M), 0.8960 (650M)

GBP/USD: 1.2595-00 (442M), 1.2750 (400M), 1.2910-20 (600M)

AUD/USD: 0.6580-90 (482M), 0.6600 (245M), 0.6625 (297M)

AUD/NZD: 1.0950 (382M), 1.0975 (386M), 1.1000 (280M)

NZD/USD: 0.5890 (284M)

USD/CAD: 1.3675 (426M), 1.3700 (500M), 1.3840-50 (563M)

CFTC Data As Of 30/7/24

Equity fund managers CUT S&P 500 CME net long position by 55,687 contracts to 938,842

Equity fund speculators trim S&P 500 CME net short position by 32,188 contracts to 248,167

Euro net long position is 17,799 contracts

Japanese yen net short position is -73,460 contracts

Swiss franc posts net short position of -34,520

British pound net long position is 111,471 contracts

Bitcoin net short position is -1,002 contracts

Technical & Trade Views

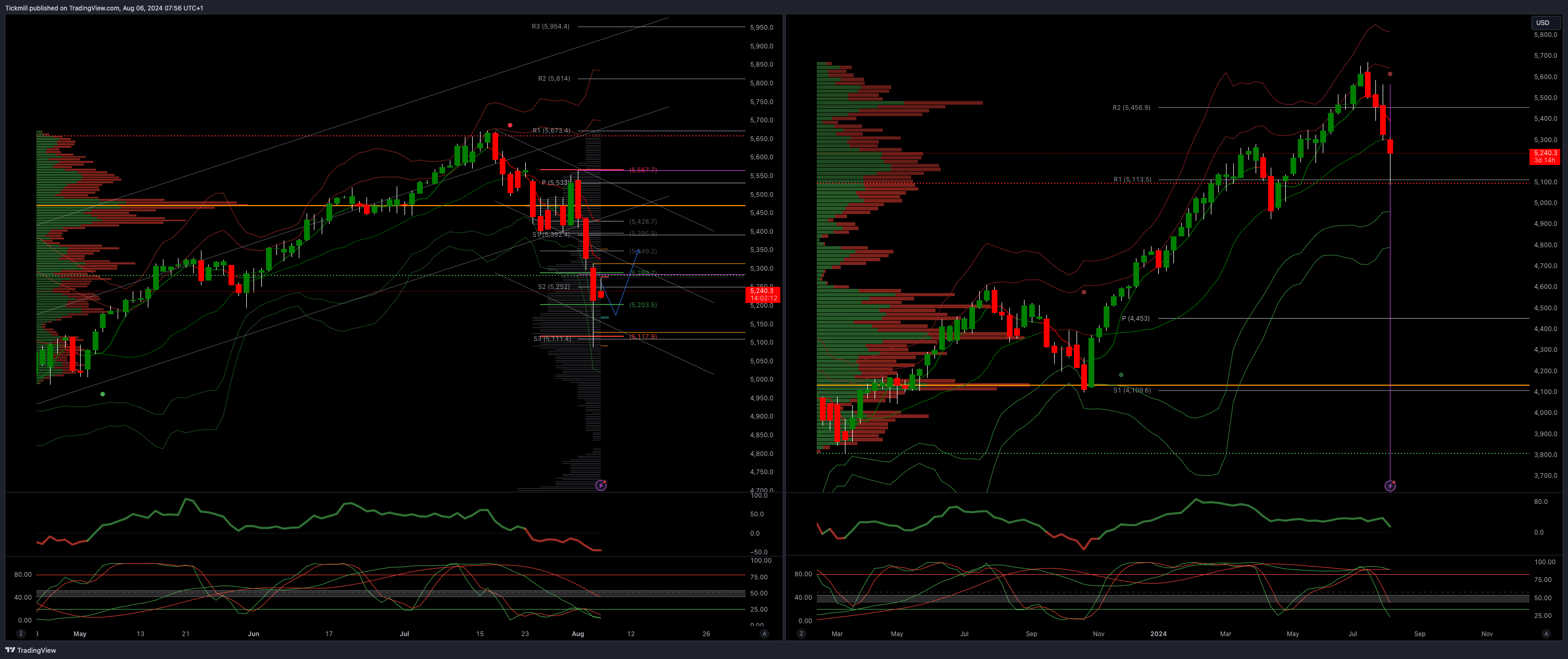

SP500 Bullish Above Bearish Below 5350

Daily VWAP bearish

Weekly VWAP bearish

Below 5400 opens 5289

Primary resistance 5470

Primary objective is 5000

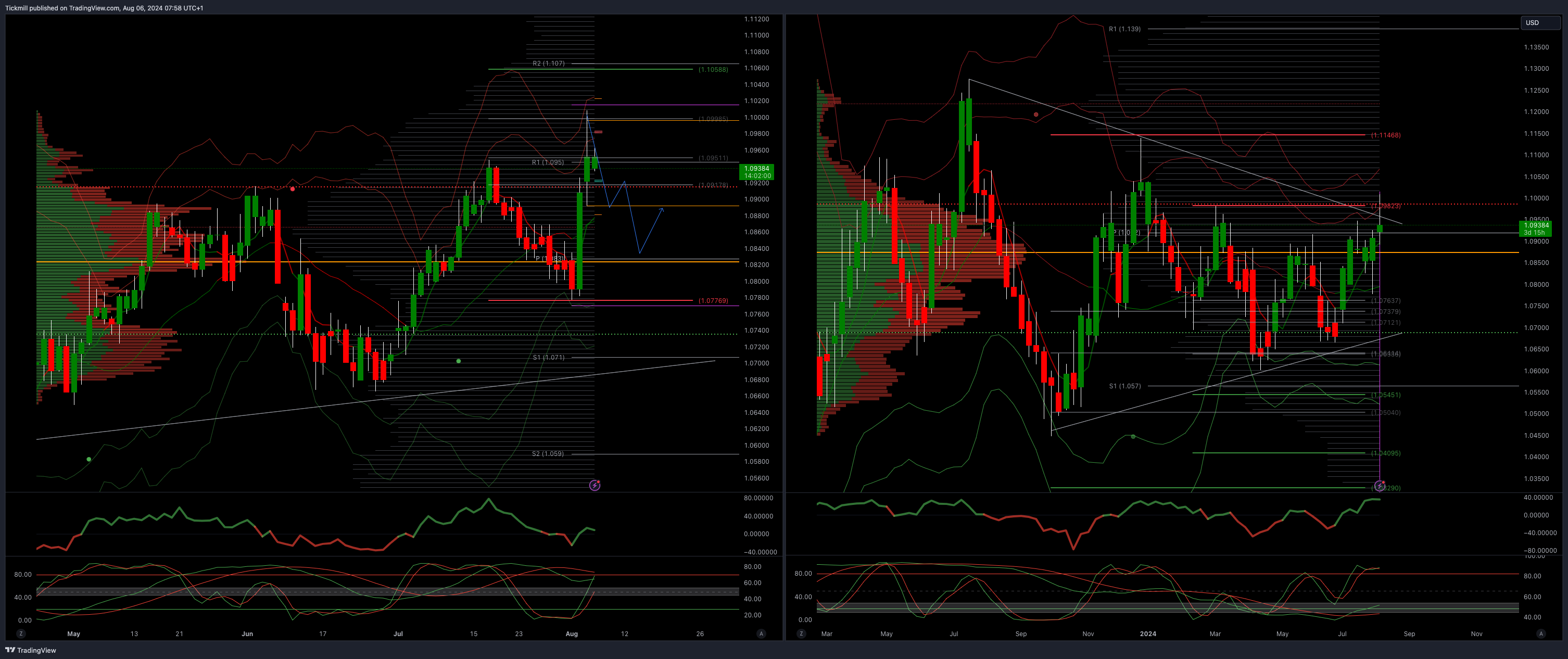

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0975 opens 1.1075

Primary resistance 1.0981

Primary objective is 1.07

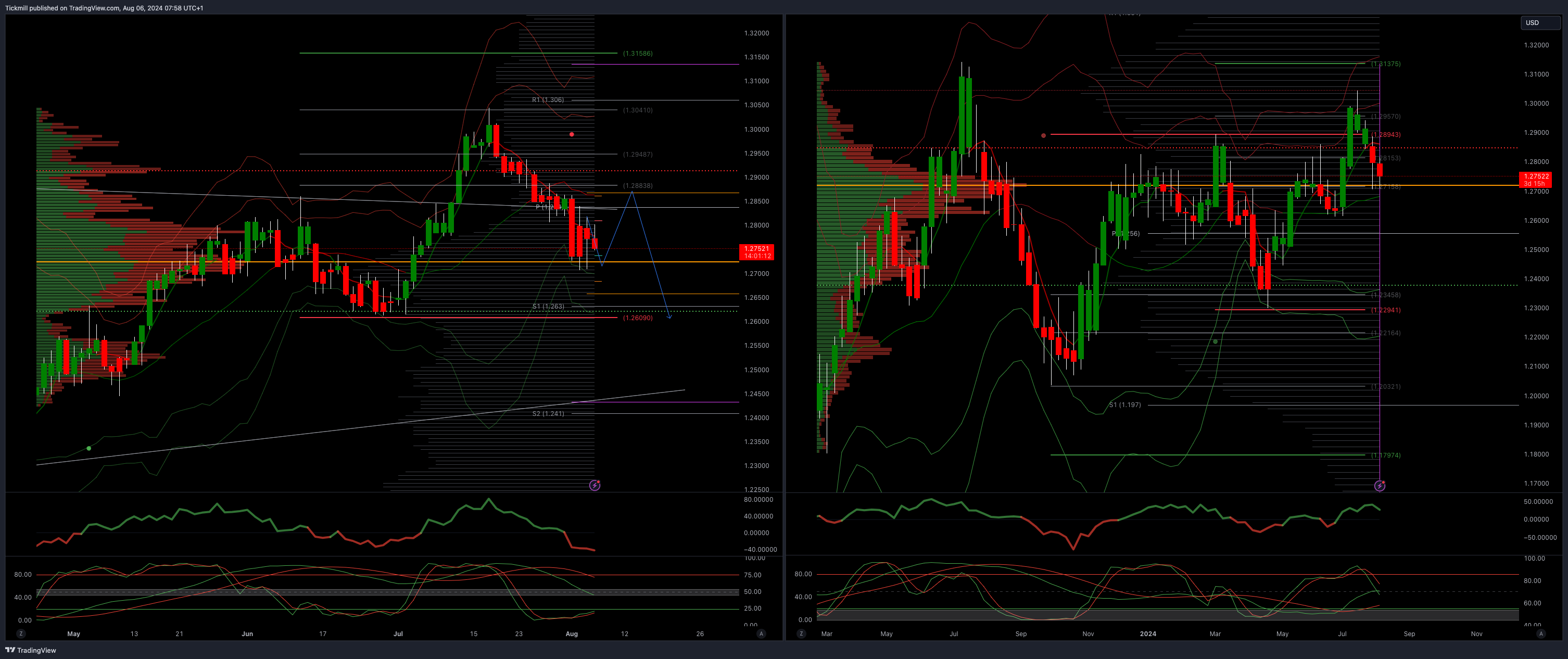

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bearish

Weekly VWAP bearish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.2450

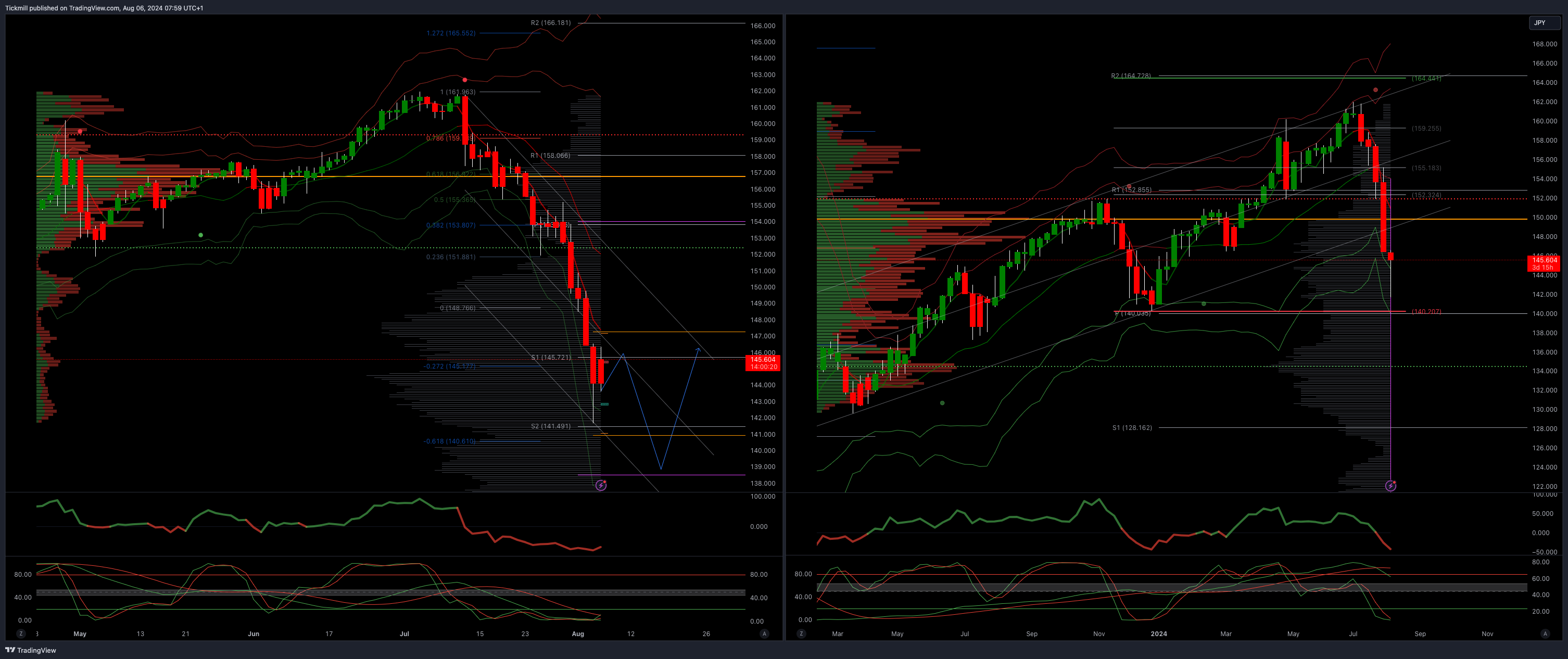

USDJPY Bullish Above Bearish Below 149

Daily VWAP bearish

Weekly VWAP bearish

Above 150 opens 153

Primary support 140

Primary objective is 153

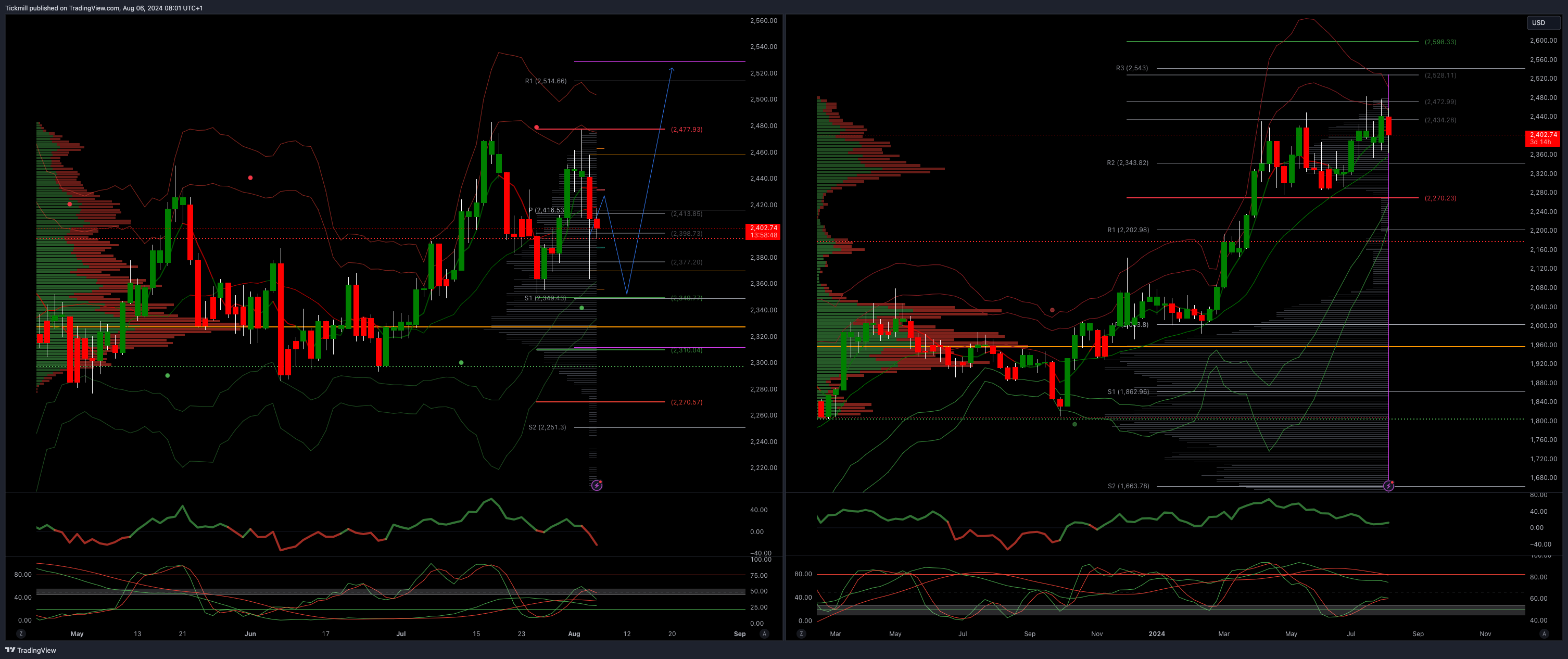

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bearish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

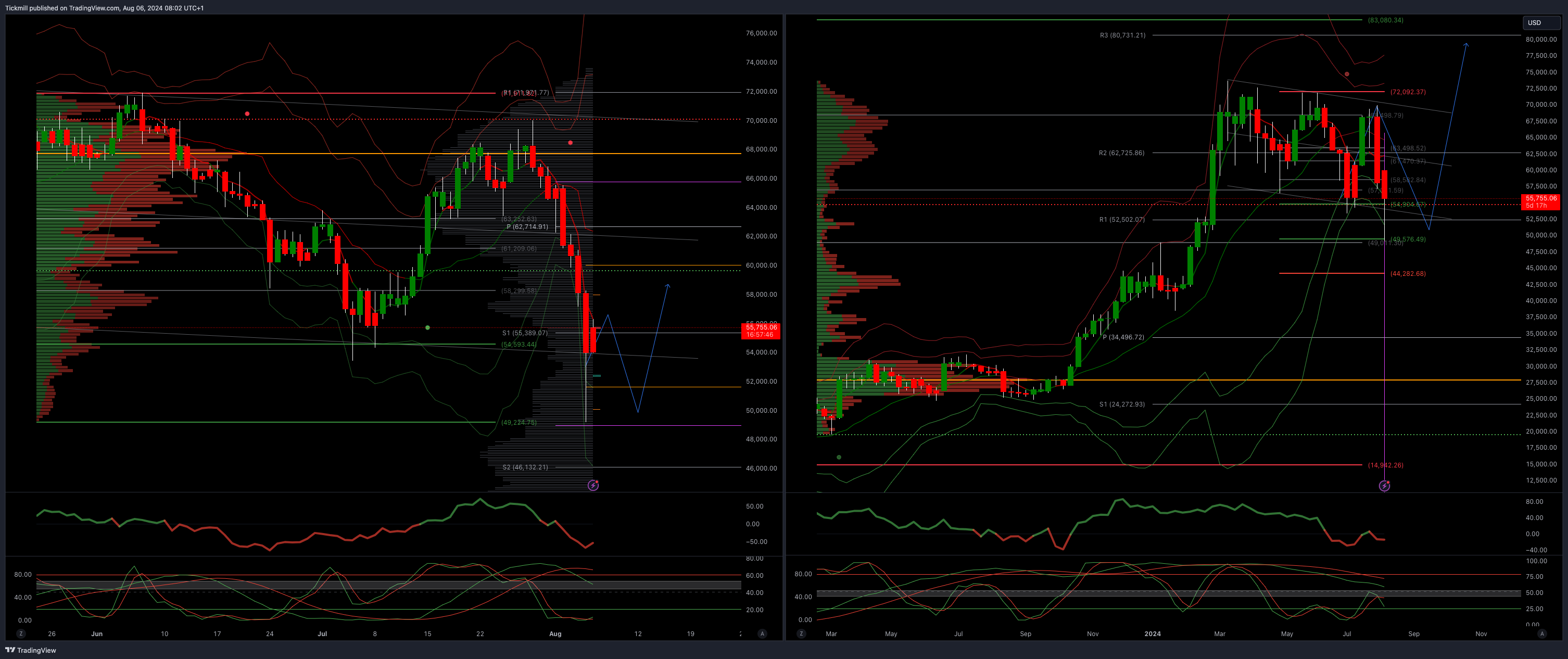

BTCUSD Bullish Above Bearish below 55000

Daily VWAP bearish

Weekly VWAP bearish

Above 61000 opens 68000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!