Daily Market Outlook, August 5, 2024

Daily Market Outlook, August 5, 2024

Munnelly’s Macro Minute…

“Monday Market Massacre”

Following the massive sell-off in global markets on Friday, Asian stock markets are a sea of red on Monday as traders react to weak monthly jobs data from the United States and recent weak manufacturing activity data from the US that fueled fears that the largest economy in the world may enter a recession as the US Fed appears to have waited too long to cut interest rates. Taiwan, South Korea, and Japan's markets are all down more than 5%.

Investors are expecting that a worldwide version of the Fed put will come to the rescue through central banks. According to futures, there is a 73% likelihood that the Fed will reduce rates by 50 basis points in September and 115 basis points overall by Christmas. By the end of the following year, rates will be close to 3%.

Markets have factored in an additional 74 basis points of ECB and 47 basis point of BoE rate reduction. Additionally, it is doubtful that the Bank of Japan would raise rates once more in October—less than a week after shifting to a more aggressive stance. Consequently, JGBs recovered all of their previous losses, bringing 10-year rates back to their April levels.

There is market chatter of a Fed inter-meeting relaxation seems to be wishful thinking on the part of investors in the negative. Along with San Francisco President Daly, the Fed's Goolsbee downplayed the significance of the payrolls number on Friday. He will have another opportunity to do so on Monday. At 4.25 percent, the unemployment rate is still historically low, and experts predict that it will decline again in August. People who use the Sahm rule should keep in mind that, despite its best efforts, economics is not a science. Negative interest rates were thought to be unattainable not too long ago.

Stateside, U.S. ISM services index is due today, which analysts are expecting to rebound from June's unexpected decline. Given the size of the workforce in the industry, it is obvious that its jobs index would be closely watched. If there are any indications of lending hardship, the Fed's survey of senior loan officers will receive greater attention than normal. It is noteworthy that the massive surge in Treasuries on Friday has not continued, with 10-year rates returning to 3.78% after earlier hitting a low of 3.723%. Additionally, early gains in Fed fund futures were trimmed, especially in the 2025 contracts.

Overnight Newswire Updates of Note

BoJ Made Hawkish Tilt, Debated Inflation Risk In June

Asian Stocks Plunge Into Bear Market Territory

EU Capitals Set To Back Tariffs On Chinese Electric Cars

UK Chancellor To Court Investors In New York Visit

Ex-Trump White House Officials Endorse Harris

Growth Scare Sets Up Markets For Fresh Bout Of Volatility

RBNZ To Ease Rates In October And November 2024

New Zealand Scraps Green Policies To Boost Economy

China On Edge Over US Missile Deployment In Asia

Ukraine Intensifies Strikes, Sinks Russian Submarine

Yemen’s Houthi Rebels’ Attack On Cargo Ship In Gulf Of Aden

Iran Rebuffs Restraint Calls, Response To Killing Hamas Leader

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0775 (275M), 1.0790-00 (383M)

1.0810-20 (1.04BLN), 1.0850 (241M), 1.0900-10 (820M))

1.0930 (275M), 1.0975 (802M), 1.1075 (677M)

USD/CHF: 0.8395 (525M), 0.8700 (270M)

GBP/USD: 1.2720-25 (352M), 1.2750 (264M), 1.2915 (300M)

1.3000 (580M)

EUR/GBP: 0.8425 (635M), 0.8550 (222M)

AUD/USD: 0.6600 (3.56BLN). NZD/USD: 0.5800 (300M)

AUD/JPY: 93.20 (600M), 95.00 (356M)

USD/CAD: 1.3650 (450M), 1.3950 (432M), 1.3990 (243M)

CFTC Data As Of 30/7/24

Equity fund managers CUT S&P 500 CME net long position by 55,687 contracts to 938,842

Equity fund speculators trim S&P 500 CME net short position by 32,188 contracts to 248,167

Euro net long position is 17,799 contracts

Japanese yen net short position is -73,460 contracts

Swiss franc posts net short position of -34,520

British pound net long position is 111,471 contracts

Bitcoin net short position is -1,002 contracts

Technical & Trade Views

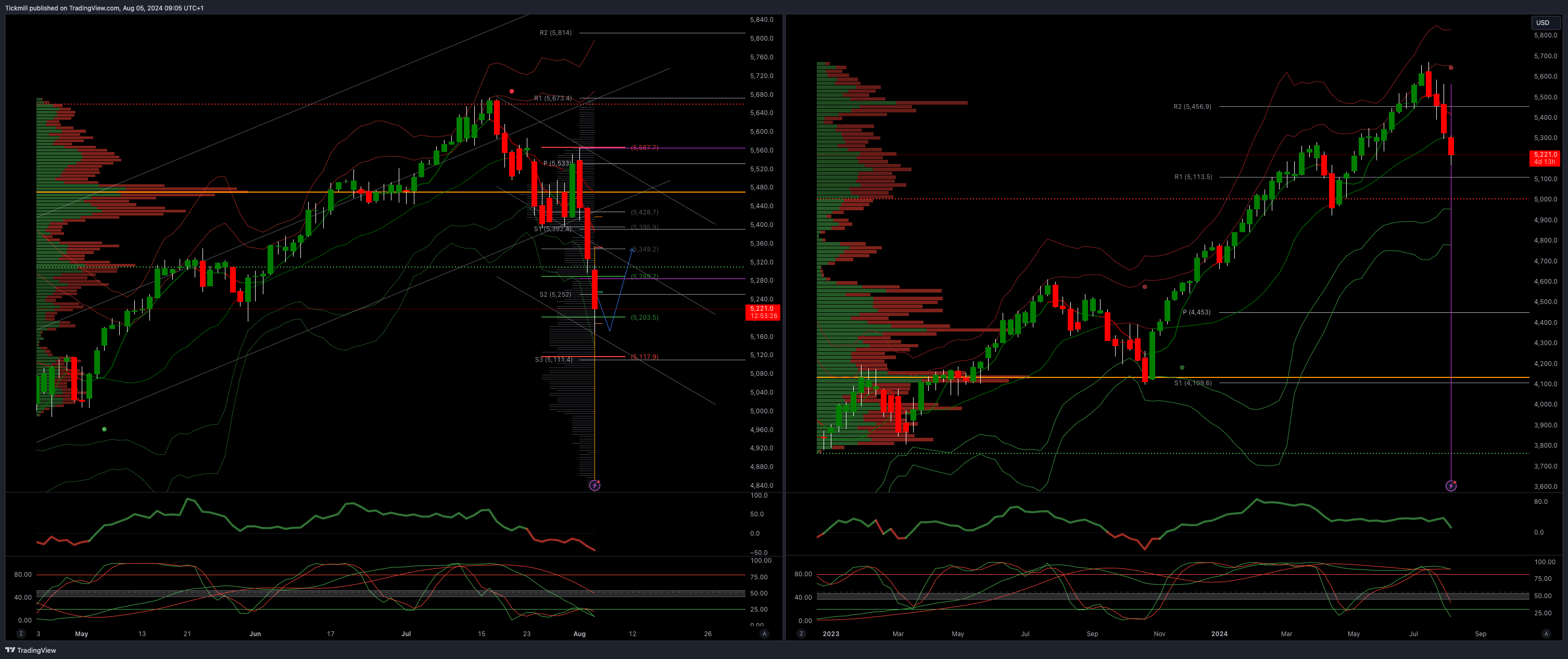

SP500 Bullish Above Bearish Below 5350

Daily VWAP bearish

Weekly VWAP bearish

Below 5400 opens 5289

Primary resistance 5470

Primary objective is 5000

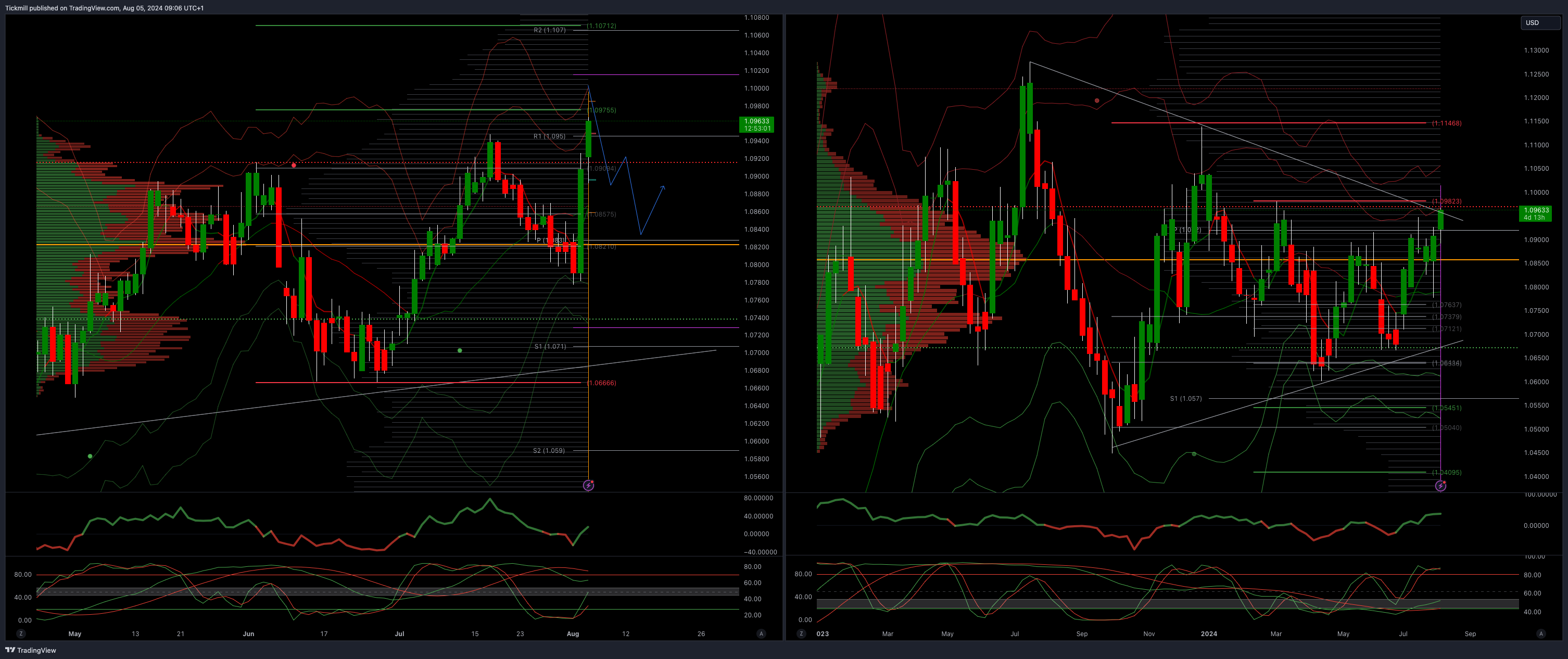

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0975 opens 1.1070

Primary resistance 1.0981

Primary objective is 1.07

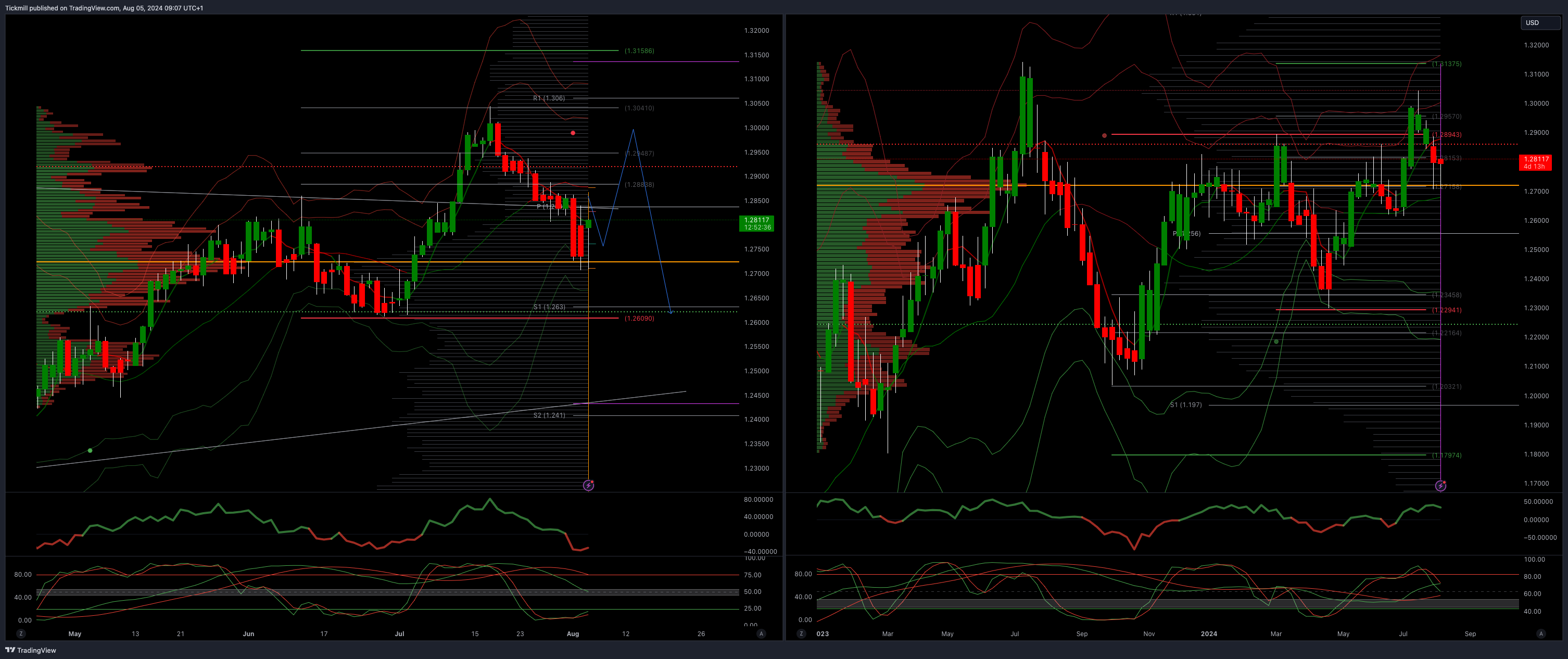

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.2450

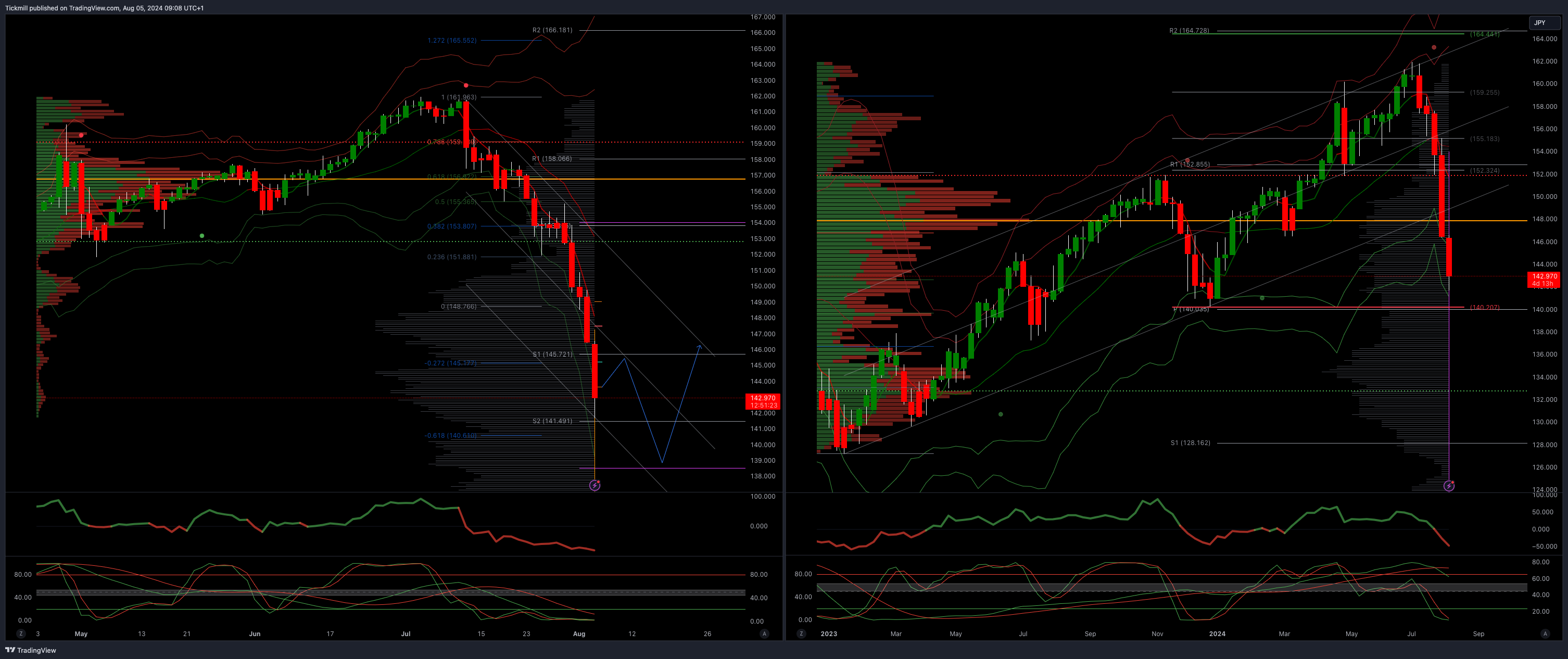

USDJPY Bullish Above Bearish Below 150

Daily VWAP bearish

Weekly VWAP bearish

Above 150 opens 153

Primary support 140

Primary objective is 153

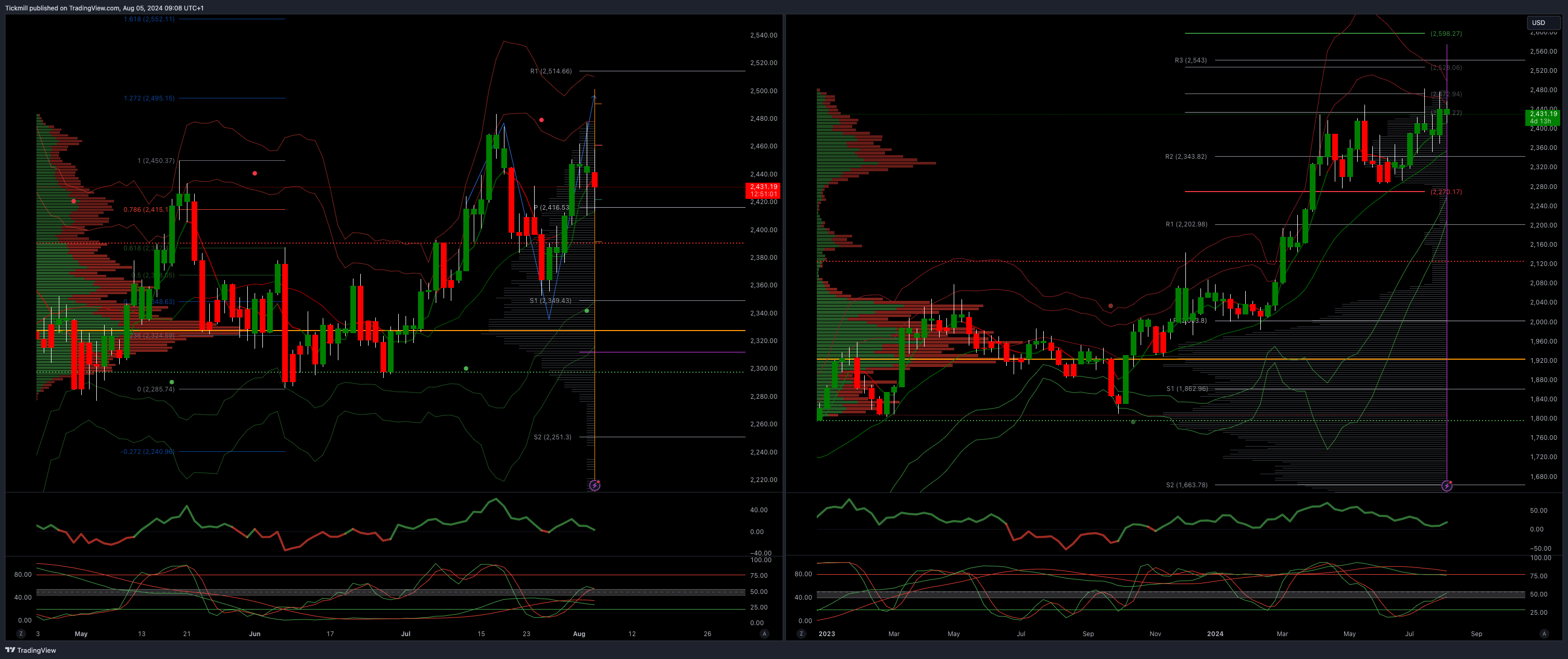

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

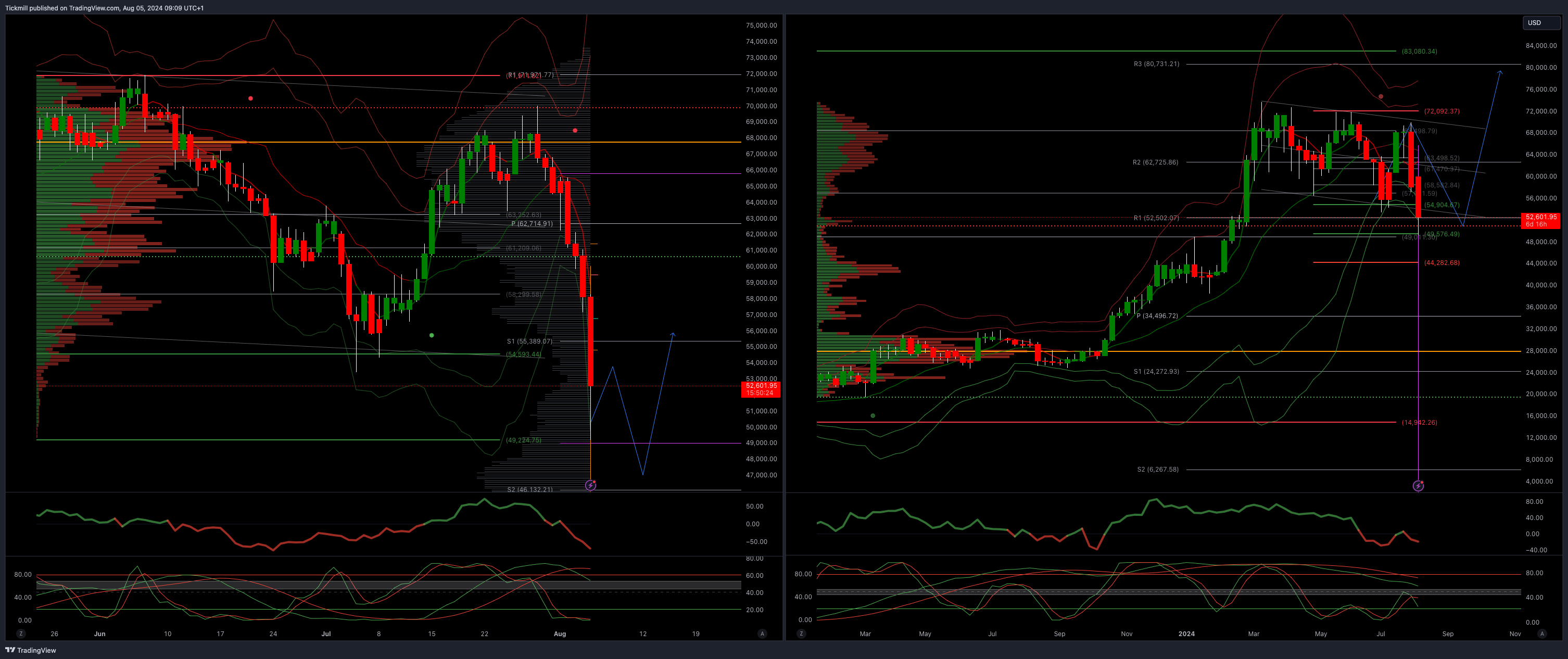

BTCUSD Bullish Above Bearish below 55000

Daily VWAP bearish

Weekly VWAP bearish

Above 61000 opens 68000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!