Daily Market Outlook, August 22, 2024

Daily Market Outlook, August 22, 2024

Munnelly’s Macro Minute…

"Dovish Fed Minutes Send Dollar To One-Year Lows”

Following the generally positive signals from global markets overnight, Asian stock markets are mostly up on Thursday. The Japanese market reversed the losses from the previous session and is now much higher on Thursday. The Nikkei 225 is trading back above the 38k handle supported by financial, technology, and exporter firms. The market leader SoftBank Group is flat, while Fast Retailing, the company that runs Uniqlo, is up about 3%. Among automakers, Honda is slightly increasing by 0.1% while Toyota is losing 1.5%. However, traders are cautious after revised data revealed that US job growth was lower than previously reported in the year ending in March 2024, raising some growth concerns. Nonetheless, it is anticipated that the US Federal Reserve will lower interest rates next month. The minutes of the US Federal Reserve's most recent meeting on monetary policy appeared to lend further credence to predictions of a September interest rate reduction. Following the release of the minutes, interest rate cuts by the Fed are expected to occur next month. According to CME Group's FedWatch Tool, there is a 61.5 percent likelihood of a quarter point rate drop and a 38.5 percent chance of a half point rate cut.

Since U.S. short-term rates are currently on the back foot, traders have been gradually selling the dollar, believing that they still have more room to fall. By year-end, the markets have priced in 161 basis points of easing in Europe and 135 bps in Britain, compared to 222 bps in the United States. The euro and sterling have both breached significant resistance, and the dollar has reached one-year lows as investors speculate about the possibility of a cyclical decline in the currency. The relative momentum in each economy may be determined by purchasing managers' index data for the United States and Europe, which are expected later on Thursday.

The purchasing managers indexes shocked last month when the manufacturing sector experienced a steeper decline than anticipated. Germany continued to be the pressure point. The UK, on the other hand, has shown itself to be resilient; in May, manufacturing resumed its expansionary trajectory. It is anticipated that the increase in production (52.0 from the 52.1 reading in July) will continue. An crucial factor will be whether or not the decline in services activity happens again this month. According to the median forecast, services will increase in Britain while falling a few percentage points in the Eurozone. It is possible, though, that UK activity will also weaken (52.4 from 52.5) as part of the (short) bounce in post-election activity unwinds. Less weight is given to the US PMIs, which are thought to be a worse indicator than the more reliable ISM surveys. However, the disparity between better and worse services and manufacturing should also be apparent. Given the enduring weakness of manufacturing and the dependence of service firms on the production side (manufacturing should lead services in a business cycle), it is worthwhile to contemplate the longevity of this imbalance. That point of risk is reinforced by the fact that this disparity is worldwide.

Overnight Newswire Updates of Note

Fed Minutes Point To ‘Likely’ Rate Cut Coming In September

Dollar Doldrums Deepen On Dovish Fed Minutes

Hawkish RBA Struggles To Sway Market That Expects Rate Cuts

Strong Australian PMI Data Argues Against RBA Rate Cuts

BoJ’s Ueda Is Set To Face Intense Scrutiny After Market Chaos

PBoC Warnings On Long-dated Bonds To Curb Systemic Risks

US Job Growth In Year Till March Was Far Lower Than Estimated

Deutsche Bank Sees €430M Gain After Deal In Postbank Case

Ford Slows EV Production Plans To Cut Costs

PwC Braced For 6-month Ban In China Over Evergrande Audit

Rise In Tech And Mining Stocks Extend ASX’s Winning Streak

Oil Prices Slow Sell-off As Expectations Of Fed Rate Cut Grow

Oil Tanker On Fire And Adrift In Red Sea After Multiple Attacks

China’s Plunging Coal Plant Approvals Signal Energy Policy Pivot

New Binance CEO: No IPO Need, Plots 100Y Exchange Strategy

Global Investors Pile Into Chinese Bank Bonds

Enbridge CEO Ebel Sees ‘Colossal’ AI Power To Double LNG Use

Israeli Strikes In Gaza, Blinken Visits Shows No Breakthrough

Biden, In Call With Israel’s PM, Stresses Urgency Of Gaza Ceasefire

Zelenskiy: Ukraine Is Boosting Its Forces To Resist Russian Advance

EU Top Diplomat Calls For Lifting Weapons Restrictions For Ukraine

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.1040-50 (1.3B), 1.1060-70 (1.0B), 1.1100-10 (2.6B), 1.1160 (350M)

USD/JPY: 145.60-70 (1.4B), 146.20 (1.2B), 147.00-10 (1.3B), 148.00 (1.6B)

USD/JPY: 148.65 (1.7B). EUR/JPY: 159.95-160.00 (1.6B)

AUD/JPY: 98.83 (300M), 101.75 (300M)

USD/CHF: 0.8800 (396M), 0.8950 (382M)

EUR/CHF: 0.9400 (750M), 0.9500-10 (1.3B)

EUR/GBP: 0.8350 (1.3B), 0.8475 (833M), 0.8485 (395M)

AUD/USD: 0.6600 (422M), 0.6630 (1.2B), 0.6650 (1.4B), 0.6650-60 (2.5B)

AUD/USD: 0.6670 (794M). NZD/USD: 0.5920 (500M), 0.5940 (1.3B), 0.5955 (307M)

AUD/NZD: 1.0920-25 (451M), 1.1050 (513M)

USD/CAD: 1.3625-35 (1.1B), 1.3650 (500M)

CFTC Data As Of 16/8/24

Japanese Yen net long position is 23,104 contracts

Euro net long position is 26,983 contracts

Bitcoin net long position is 395 contracts

British Pound net long position is 47,812 contracts

Swiss Franc posts net short position of -21,664 contracts

Equity fund speculators increase S&P 500 CME net short position by 63,926 contracts to 286,781

Equity fund managers raise S&P 500 CME net long position by 70,558 contracts to 952,091

Technical & Trade Views

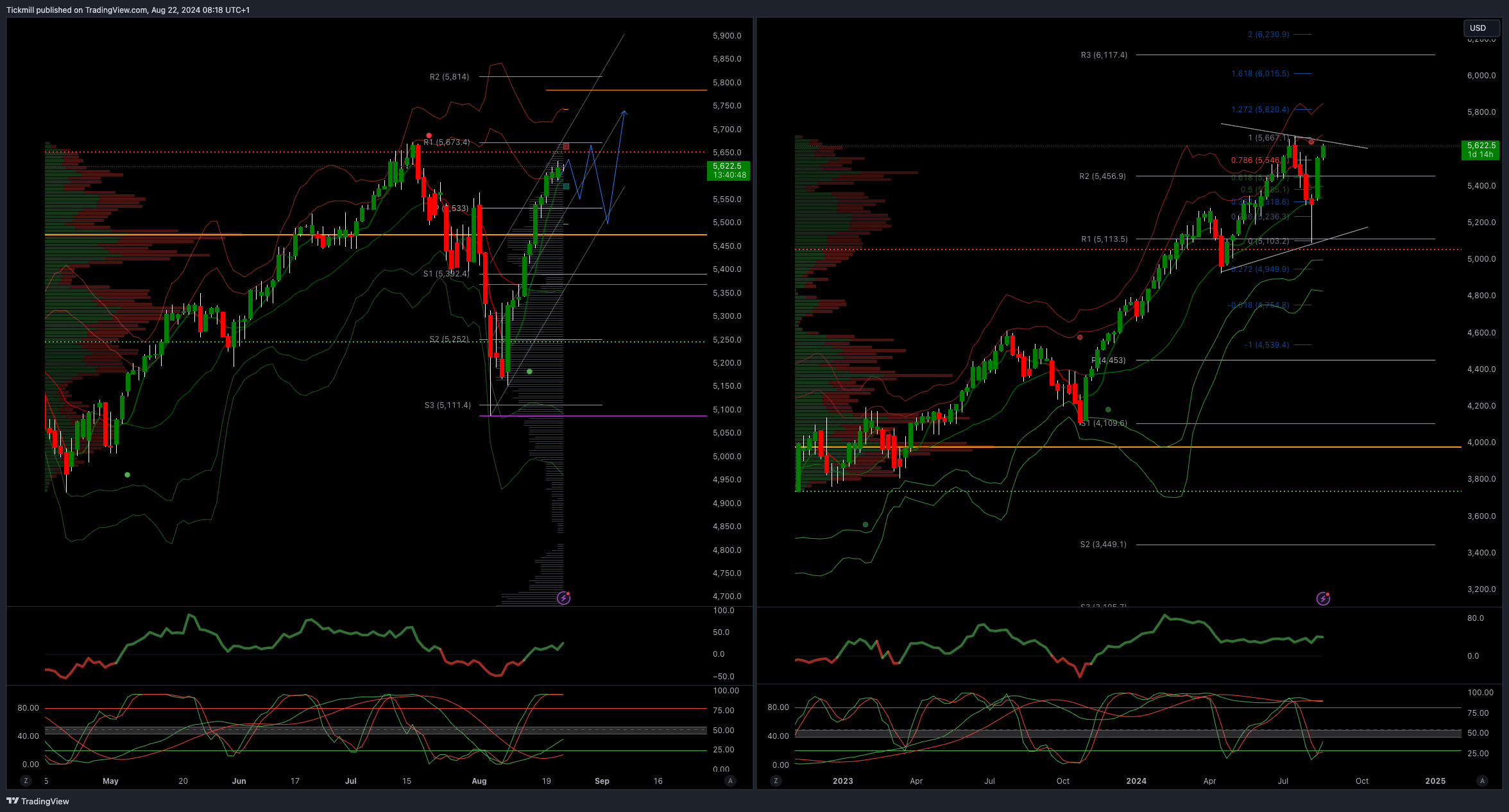

SP500 Bullish Above Bearish Below 5550

Daily VWAP bullish

Weekly VWAP bullish

Above 5470 opens 5670

Primary support 5480

Primary objective is 5670

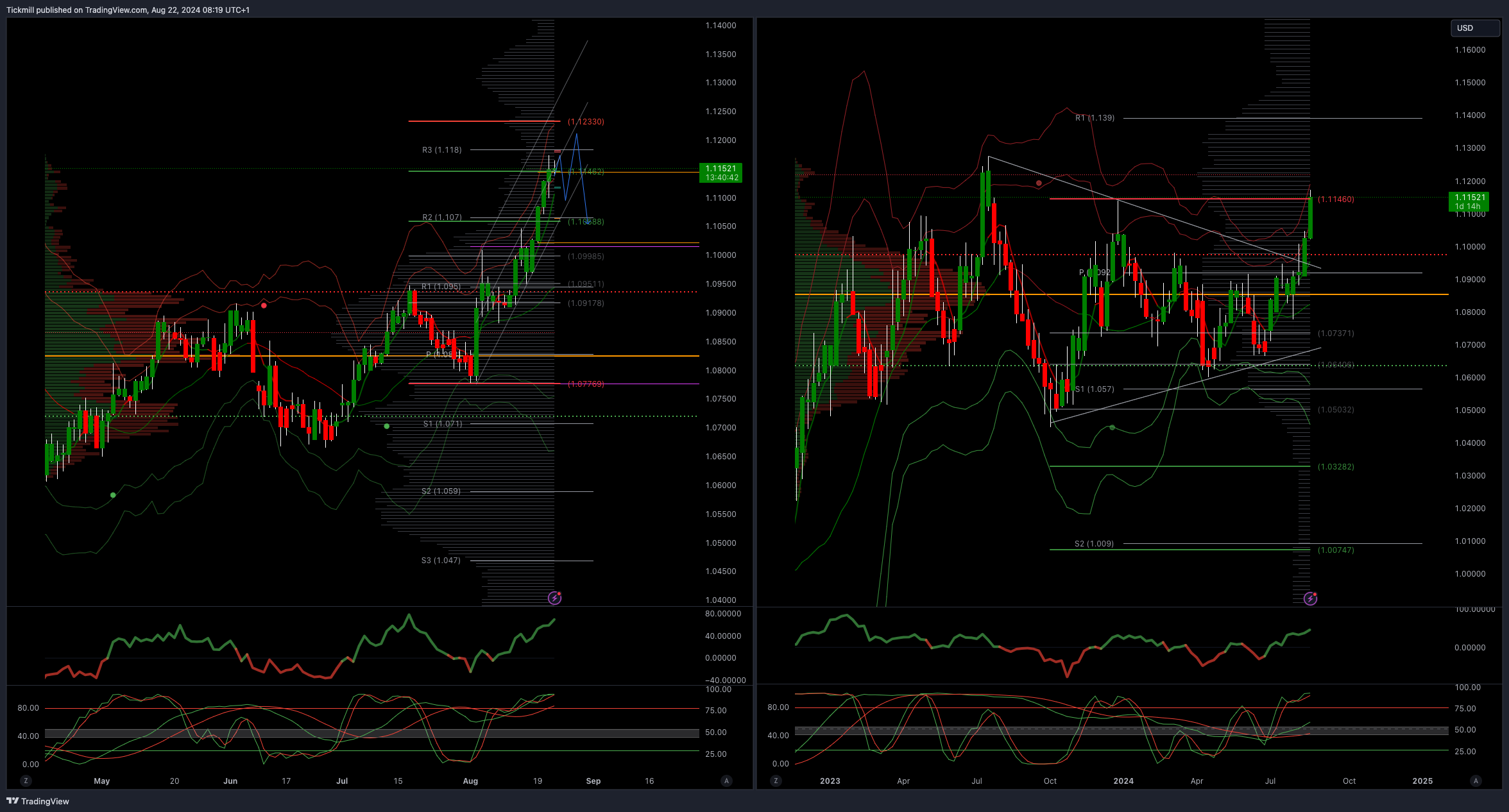

EURUSD Bullish Above Bearish Below 1.10

Daily VWAP bullish

Weekly VWAP bullish

Below 1.10 opens 1.0950

Primary resistance 1.0981

Primary objective is 1.1150 - Target Hit New Pattern Emerging

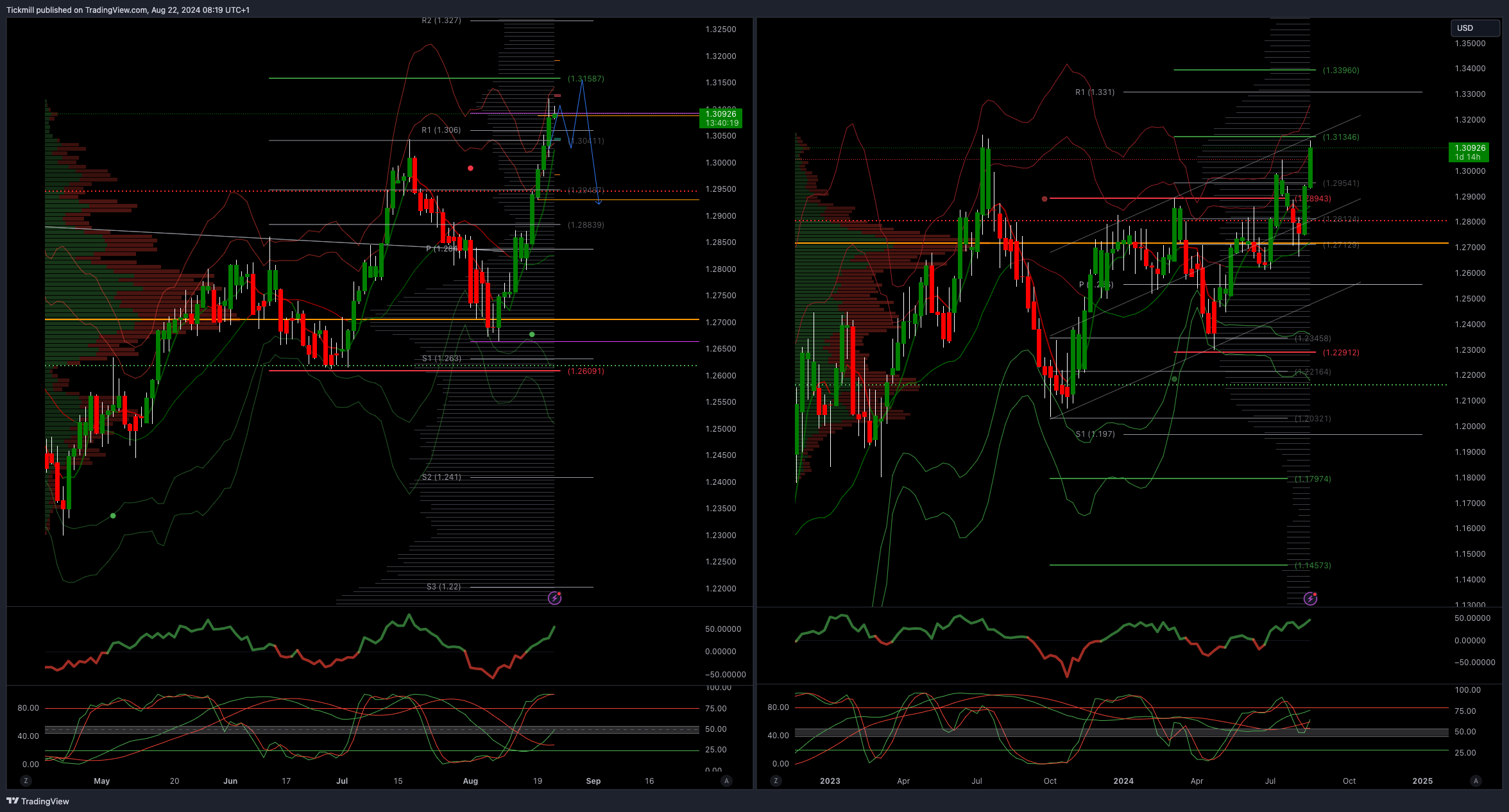

GBPUSD Bullish Above Bearish Below 1.30

Daily VWAP bullish

Weekly VWAP bearish

Below 1.2950 opens 1.2850

Primary support is 1.2690

Primary objective 1.3150

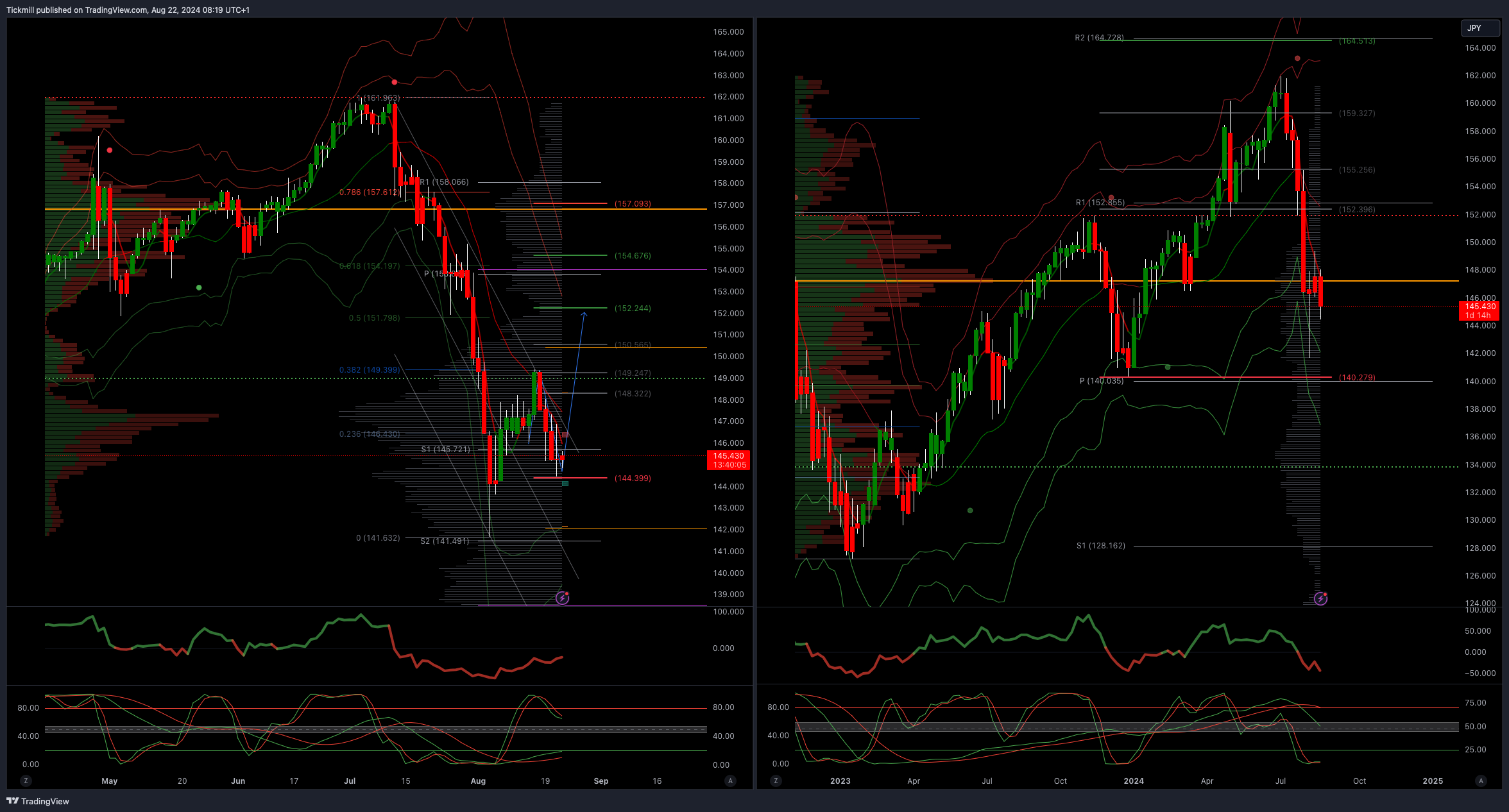

USDJPY Bullish Above Bearish Below 149

Daily VWAP bearish

Weekly VWAP bearish

Below 145 opens 144

Primary support 140

Primary objective is 151.80

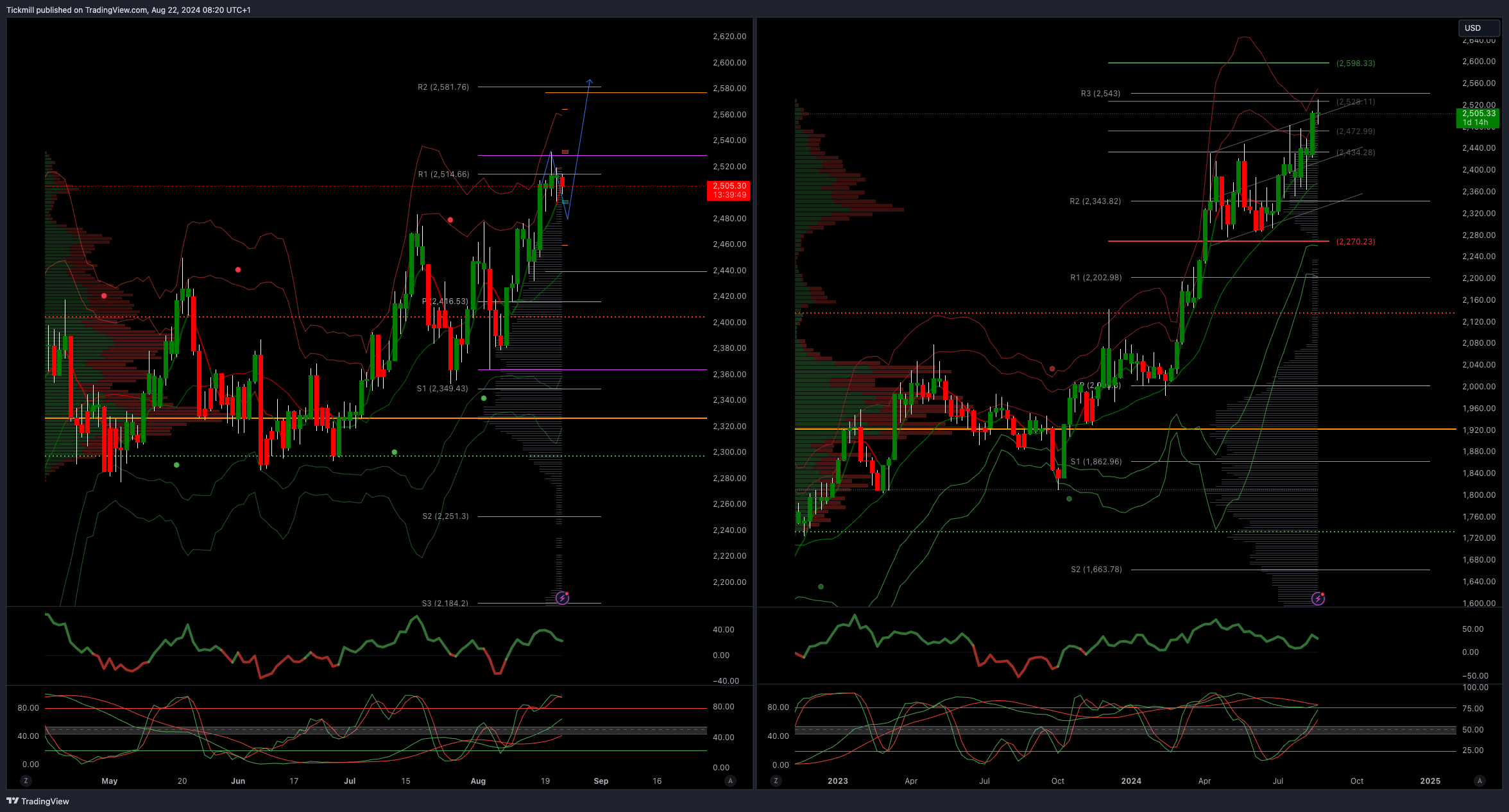

XAUUSD Bullish Above Bearish Below 2480

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

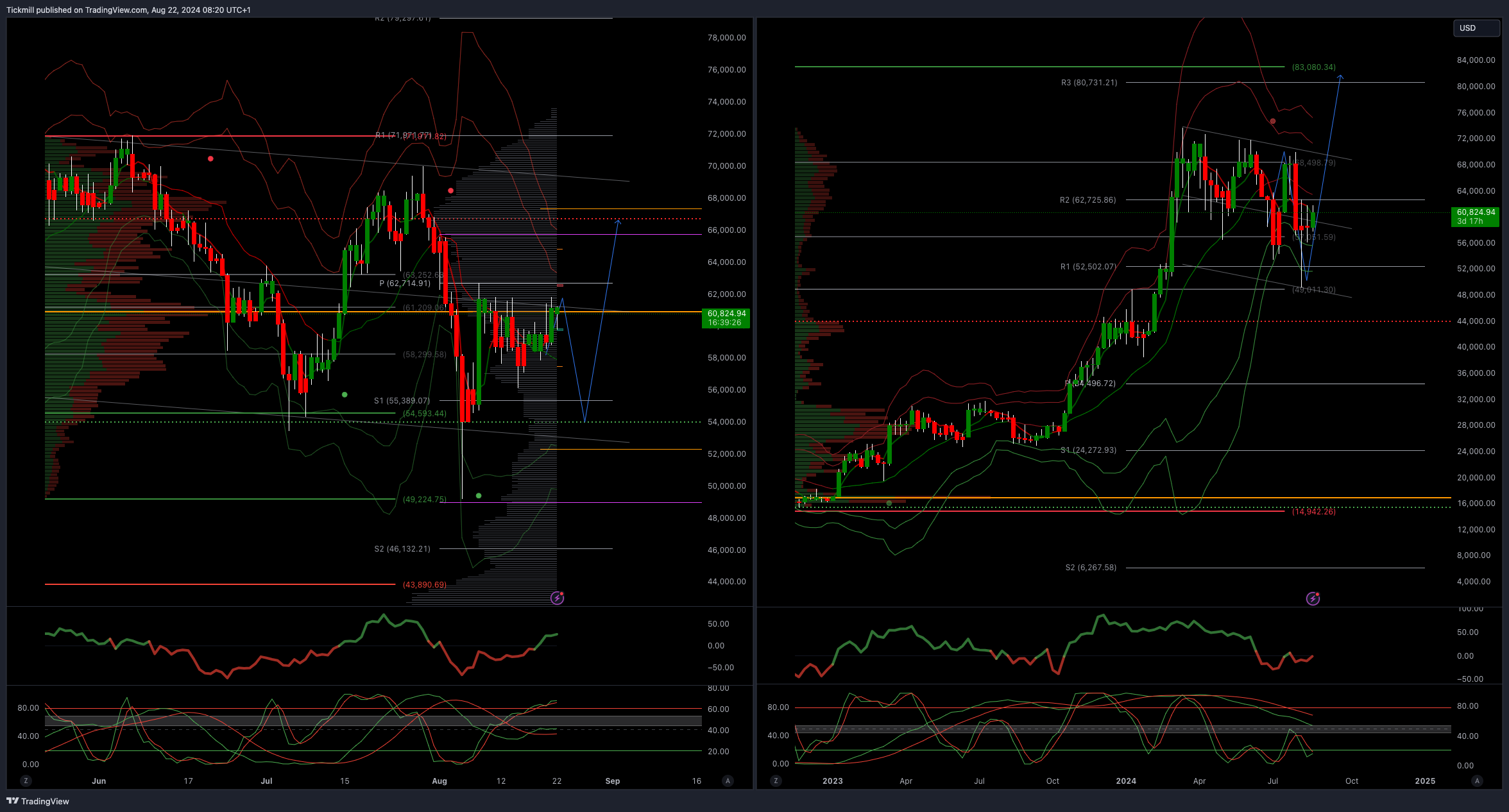

BTCUSD Bullish Above Bearish Below 58000

Daily VWAP bearish

Weekly VWAP bearish

Above 61000 opens 68000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!