Daily Market Outlook, August 14, 2024

Daily Market Outlook, August 14, 2024

Munnelly’s Macro Minute…

“UK Inflation Continues to Soften, US Data On Deck Later”

Following the generally positive signals from Wall Street overnight, Asian markets are mostly up on Wednesday. Data indicating a less significant than anticipated increase in U.S. producer prices reinforced expectations of a 50 basis point interest rate drop by the US Fed in September. Later in the day, markets await the publication of the more eagerly anticipated report on US consumer price inflation for July. Currently, the FedWatch Tool from the CME Group indicates a 54.5% chance of a rate decrease of 50 basis points and a 45.5% possibility of a rate cut of 25 basis points.

The Japanese stock market was noticeably higher. Index heavyweights and financial stocks are leading the gains across most sectors as the Nikkei 225 continues to rise above the 36,400 handle. The market leader SoftBank Group is up almost 3%, while Fast Retailing, the company that runs Uniqlo, is up about 1%. Honda is up about 4% and Toyota is up nearly 4% among automakers. The announcement that Japanese Prime Minister Fumio Kishida would resign in September, capping a three-year tenure characterized by surging costs and tainted by political scandals, added to the hectic news stream across Asia. The benchmark Nikkei gave up gains to be down 0.04%, as the currency marginally rose in response to political unpredictability.

Further indications of improvement were seen in the UK's July inflation statistics, which showed prices slightly declining by -0.2% m/m and a projected increase in headline inflation somewhat less than the 2.2% y/y from 2.0% in June. While problematic services fell to 5.2% y/y from 5.7%, well below forecast and the best result since June 2022, core CPI continued to slide, slowing to 3.3% y/y from 3.5% (median 3.4%), the lowest reading since September 2021. With services prices in July contrasting favorably to both the 5.3% estimate for year-end and the 5.6% July services forecast included in the August MPR, the data offers some immediate vindication for the BoE following its rate decrease earlier in the month. The improvement was fueled by a decline in the inflation of hotels and restaurants as well as additional downward pressure from recreation. But such gains are unlikely given base effects throughout the remaining months of the year (see chart), and as Tuesday's employment and pay figures showed, there is still strong underlying demand inside an expanding economy, which poses some upside risks to the price profile. Therefore, even while this development is positive, MPC's perspective on the likelihood of more UK rate decreases should not be considerably altered by it alone.

Stateside, according to Goldman Sachs they expect a 0.16% increase in July US core CPI (vs. 0.2% consensus), corresponding to a year-over-year rate of 3.20% (vs. 3.2% consensus). SP500 implied move through today’s close is +/-1.05%, The research team's scenario analysis and market reaction are shared below.

0.07%-0.12% SPX +1.00%

0.13%-0.18% (GSe 0.16%) SPX +0.75%

0.19%-0.24% SPX +/-0.40%

0.25%-0.29% SPX -1.25%

0.30%-0.34% SPX -1.75%

>0.35% SPX -2.50%

Overnight Newswire Updates of Note

RBNZ 25bps OCR Ease To 5.25%, Inflation Target Converges

Eurozone Rate Cut Questioned As German Wages Soar

Japan PM Kishida Plans For No Re-Election In Sept Race

PM Kishida: Japan Must Promote Wage, Investment Growth

Kiwi, Aussie Falls After The Surprise Rate Cut By RBNZ

Commodities On Defensive Repositioning, Ahead Of US CPI

Asian Shares Rise, Kiwi Slumps As New Zealand Cuts Rates

US Considers Rare Antitrust Move: Breaking Up Google

Astrazeneca Vaccine Pjt Doubts, UK Treasury Seeks Aid Cut

Fitch Ratings Downgrades Ukraine To ‘RD”

US Approves $20B Israel Weapons Package

Iranian Officials: Only Gaza Ceasefire Will Delay Retaliation

Hamas: Will Not Attend New Cease-fire Talks With Israel

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.1035 (EU1.57b), 1.0805 (EU815.6m), 1.0800 (EU753.1m)

USD/JPY: 146.25 ($1.16b), 150.50 ($1.05b), 157.70 ($888.3m)

USD/CAD: 1.3900 ($945.1m), 1.3700 ($504.4m), 1.3640 ($469.7m)

AUD/USD: 0.5615 (AUD660m), 0.5720 (AUD420m), 0.6670 (AUD350.3m)

USD/CNY: 7.5000 ($480.1m), 8.0000 ($454.8m), 7.2000 ($446m)

GBP/USD: 1.1055 (GBP675m), 1.2725 (GBP480.3m), 1.2800 (GBP333.6m)

USD/MXN: 18.10 ($820.8m), 17.51 ($579.4m)

EUR/GBP: 0.8755 (EU329m), 0.8515 (EU300m)

NZD/USD: 0.6090 (NZD958.1m), 0.5240 (NZD360m), 0.6000 (NZD308.5m)

CFTC Data As Of 09/8/24

Equity fund speculators trim S&P 500 CME net short position by 25,312 contracts to 222,856

Equity fund managers cut S&P 500 CME net long position by 57,309 contracts to 881,533

Swiss franc posts net short position of -22,073 contracts

British pound net long position is 74,399 contracts

Euro net long position is 33,580 contracts

Japanese yen net short position is -11,354 contracts

Bitcoin net long position is 538 contracts

Technical & Trade Views

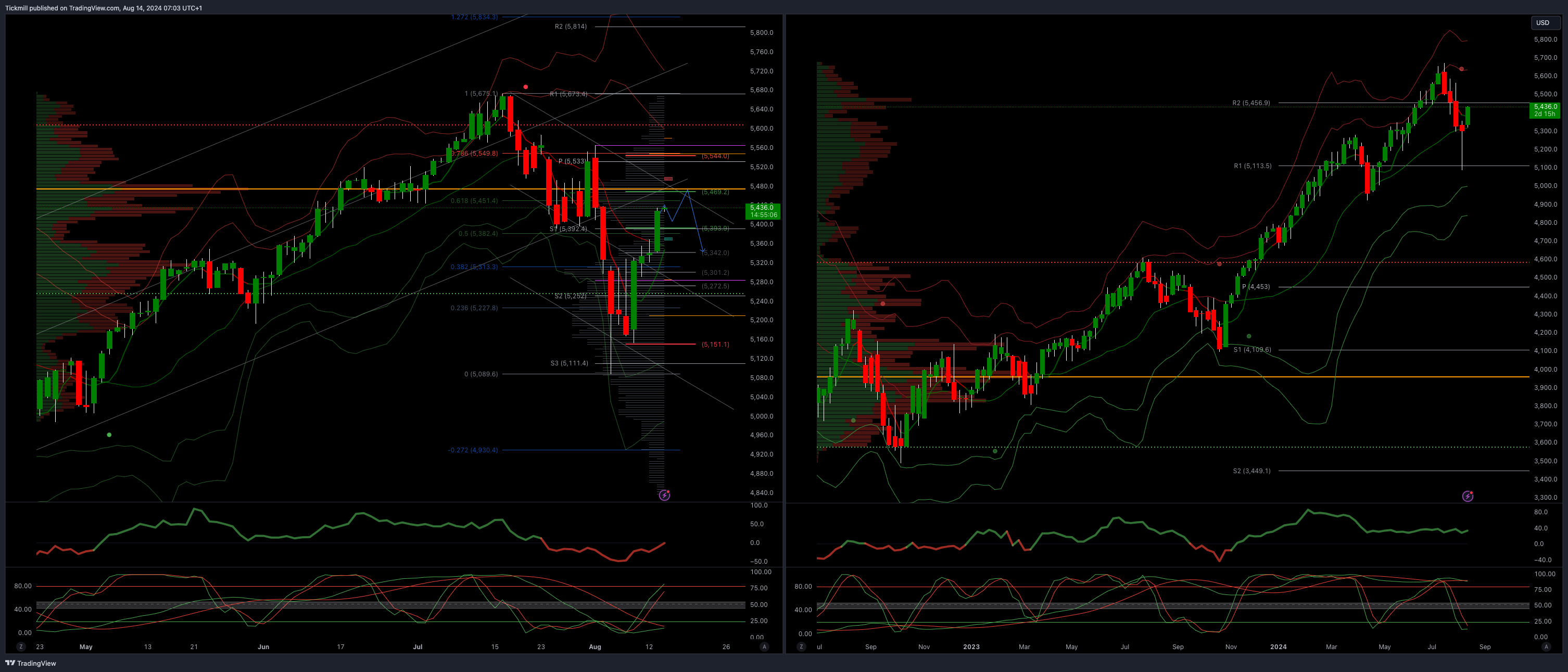

SP500 Bullish Above Bearish Below 5150

Daily VWAP bullish

Weekly VWAP bearish

Above 5388 opens 5470

Primary resistance 5470

Primary objective is 5000

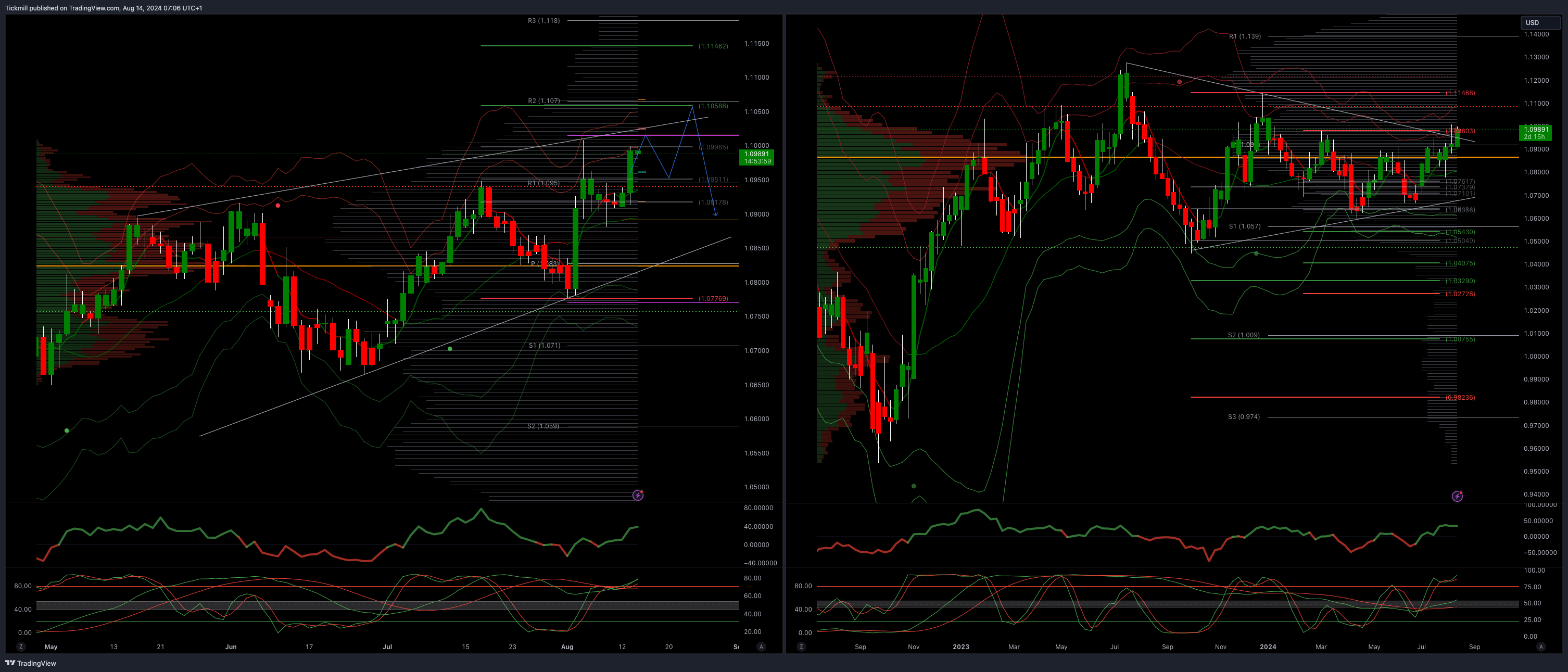

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0975 opens 1.1058

Primary resistance 1.0981

Primary objective is 1.07

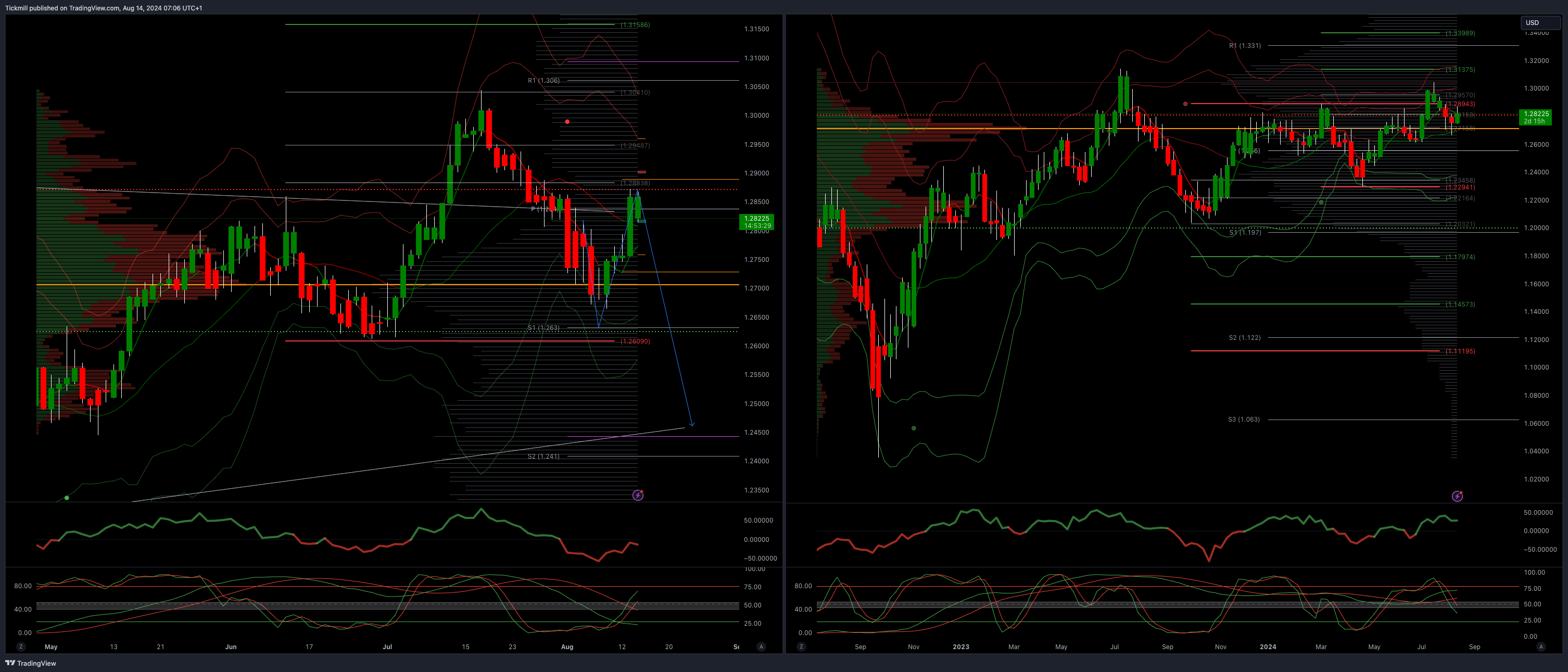

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bullish

Weekly VWAP bearish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.2450

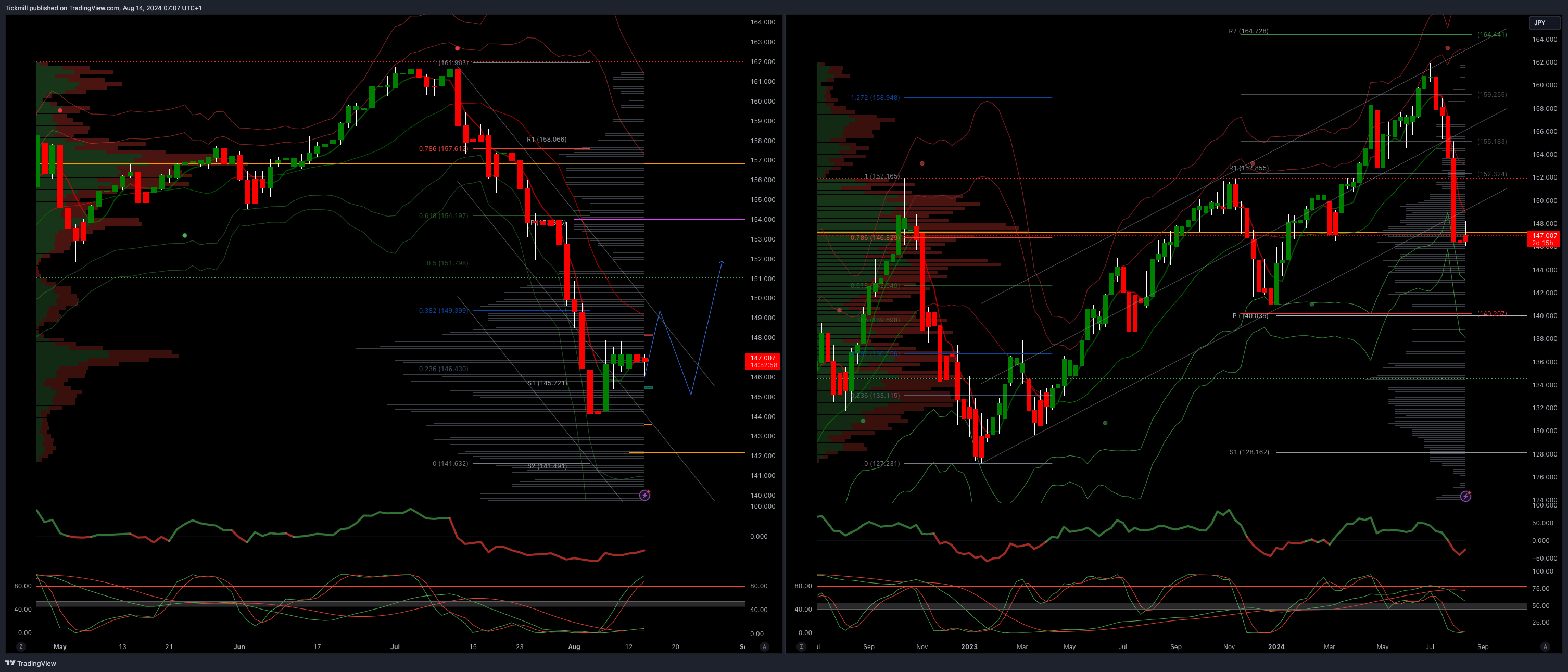

USDJPY Bullish Above Bearish Below 149

Daily VWAP bullish

Weekly VWAP bearish

Above 150 opens 153

Primary support 140

Primary objective is 153

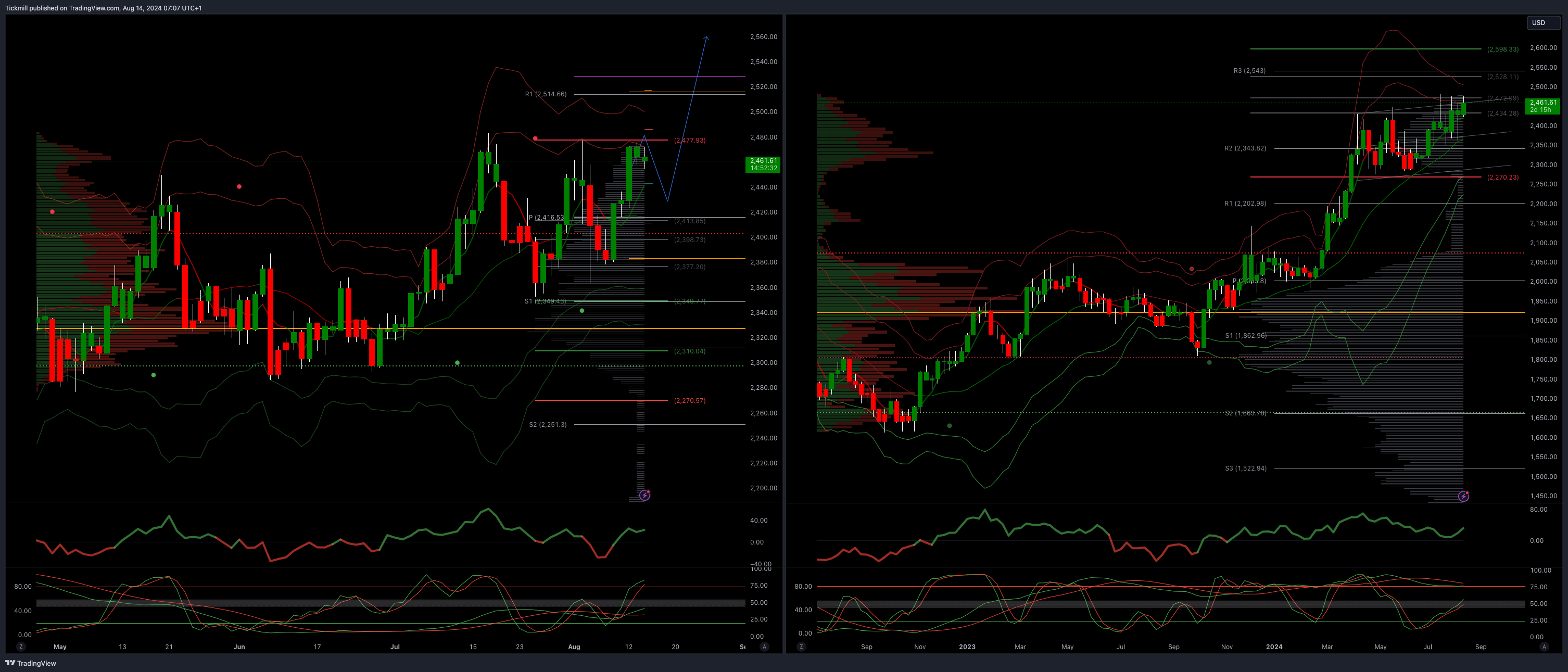

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

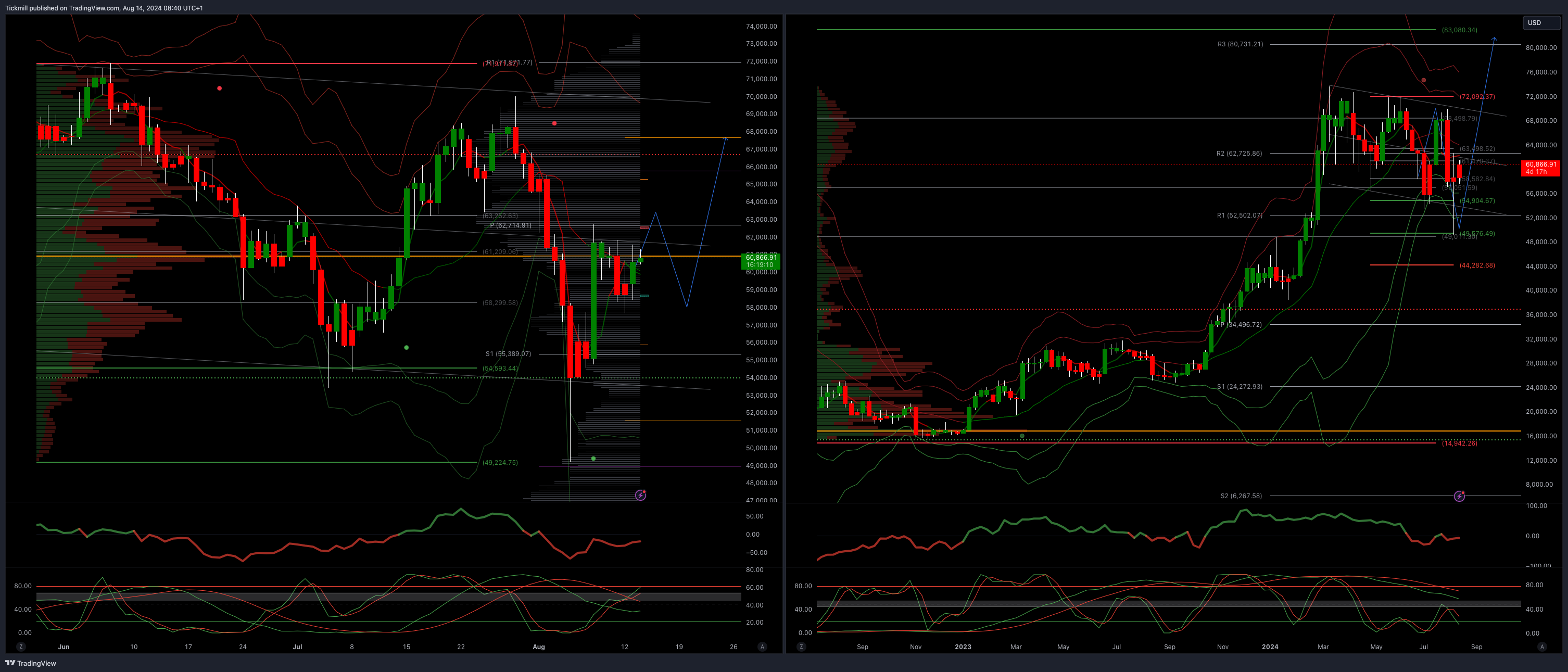

BTCUSD Bullish Above Bearish below 58000

Daily VWAP bullish

Weekly VWAP bearish

Above 61000 opens 68000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!