Daily Market Outlook, August 1, 2024

Daily Market Outlook, August 1, 2024

Munnelly’s Macro Minute…

“BoE Takes Center Stage Ahead of Apple & Amazon Earnings ”

The optimistic sentiment from global markets overnight has helped Asian stock markets trade mainly higher on Thursday. This optimism results from the anticipation that the US Federal Reserve would decrease interest rates in September, which follows the Fed's monetary policy decision in which interest rates were left unchanged as expected but with a hint of future rate cuts in the accompanying statement. Despite the generally optimistic signs from global markets overnight, the Japanese market has given up all of the gains from the previous three sessions and is substantially lower on Thursday. With weakening in all sectors following the Bank of Japan's hawkish turn of raising short-term policy rates and announcing plans to cut back on monthly bond purchases, the Nikkei 225 is down 3% to below the 37,900 mark.

UK trader's attention will be focused on the Bank of England today, following the Bank of Japan's second interest rate increase in 17 years and the clearest signal yet from the U.S. Federal Reserve that it could lower rates in September. Most economists anticipate Britain's central bank will cut rates from their 16-year high. Markets estimate the likelihood at a more modest 58%, with the uncertainty not surprising given policymakers have not spoken publicly for over two months due to rules ahead of Britain's July 4 election.

Manufacturing surveys for the UK, Germany and France, as well as eurozone unemployment data, are also due today. Any weakness in these indicators would support the case for another interest rate reduction in Europe.

Stateside the Nasdaq experienced a tech-induced ramp, Nvidia saw a 13% increase, and Meta's earnings beat estimates, sending its shares up 7% following the bell. Later today focus will shift to the results from Apple and Amazon.

Overnight Newswire Updates of Note

BoE Tilted Toward First Rate Cut Since Pandemic

Australia’s Trade Surplus narrows to 5,589M (M/M)

EU And US Race To Prevent Mideast War

Multilateral Cooperation, To Deter Beijing In South China Sea

Alternative Investors Shifting Assets Into Japan

World Should Take Note, New Trade & Climate Change Deal

Germany Accuses China Of 2021 Cyberattack

Japan Ex-FX Chief Kanda Appointed Special Adviser

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

.EUR/USD: 1.0775-85 (2.1BLN), 1.0800 (1BLN), 1.0825-30 (1.1BLN)

1.0850 (3BLN), 1.0855-60 (1BLN), 1.0875-80 (1.6BLN)

USD/CHF: 0.8720 (300M), 0.8840 (209M)

GBP/USD: 1.2800 (518M), 1.2825 (230M), 1.2850 (753M), 1.2875 (257M)

1.2900 (293M).

EUR/GBP: 0.8420 (1BLN), 0.8450 (320M)

AUD/USD: 0.6450 (1.2BLN), 0.6500 (276M), 0.6530 (316M), 0.6560 (811M)

AUD/NZD: 1.0950 (228M), 1.1000 (621M), 1.1050 (553M)

USD/CAD: 1.3725 (554M), 1.3795 (580M), 1.3850 (282M)

USD/JPY: 148.00 (715M), 149.30-40 (277M), 150.00 (386M), 151.00 (1.1BLN)

152.00 (842M). AUD/JPY: 97.50 (200M), 98.20 (580M)

CFTC Data As Of 23/7/24

Equity fund managers cut S&P 500 CME net long position by 2,812 contracts to 994,529

Equity fund speculators trim S&P 500 CME net short position by 89,786 contracts to 280,356

Japanese yen net short position is -107,108 contracts

Swiss franc posts net short position of -42,237 contracts

British pound net long position is 142,183 contracts

Euro net long position is 35,906 contracts

Bitcoin net short position is -661 contracts

Technical & Trade Views

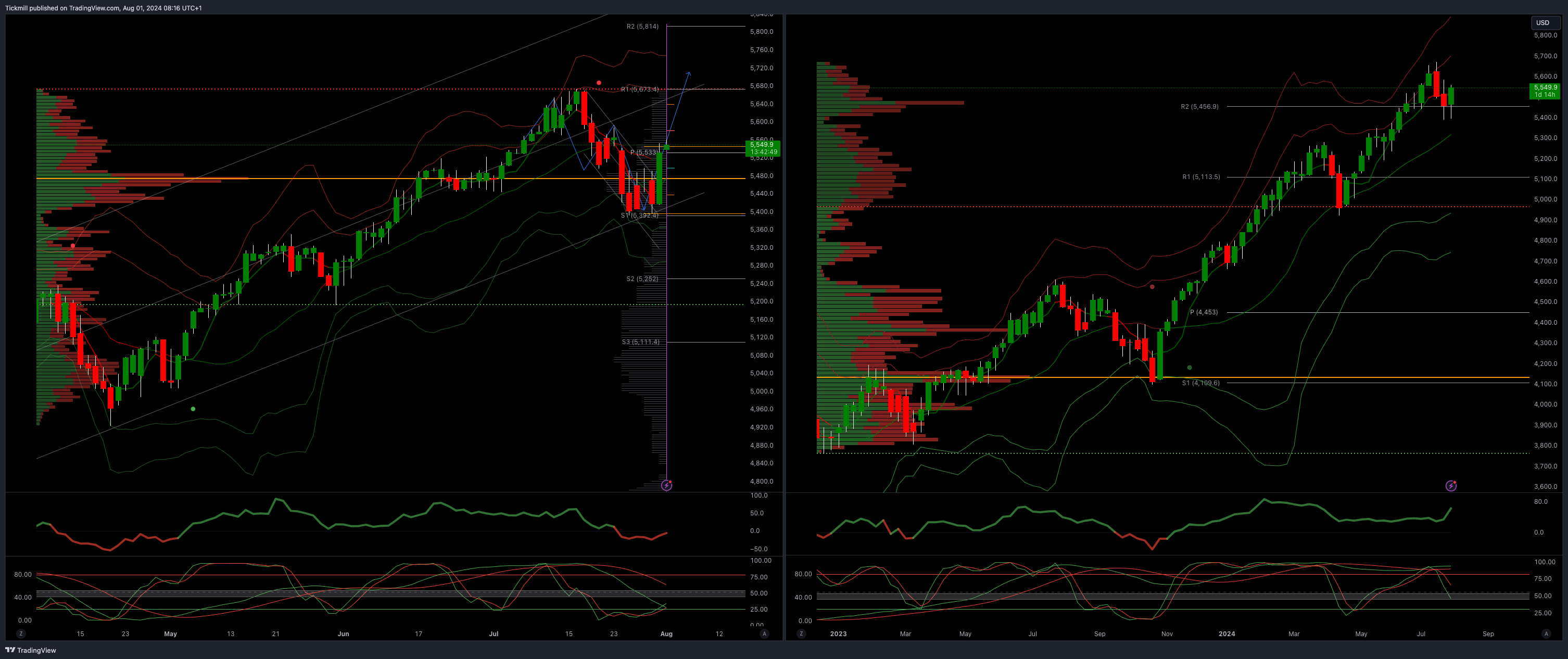

SP500 Bullish Above Bearish Below 5480

Daily VWAP bullish

Weekly VWAP bearish

Below 5400 opens 5350

Primary support 5400

Primary objective is 5700

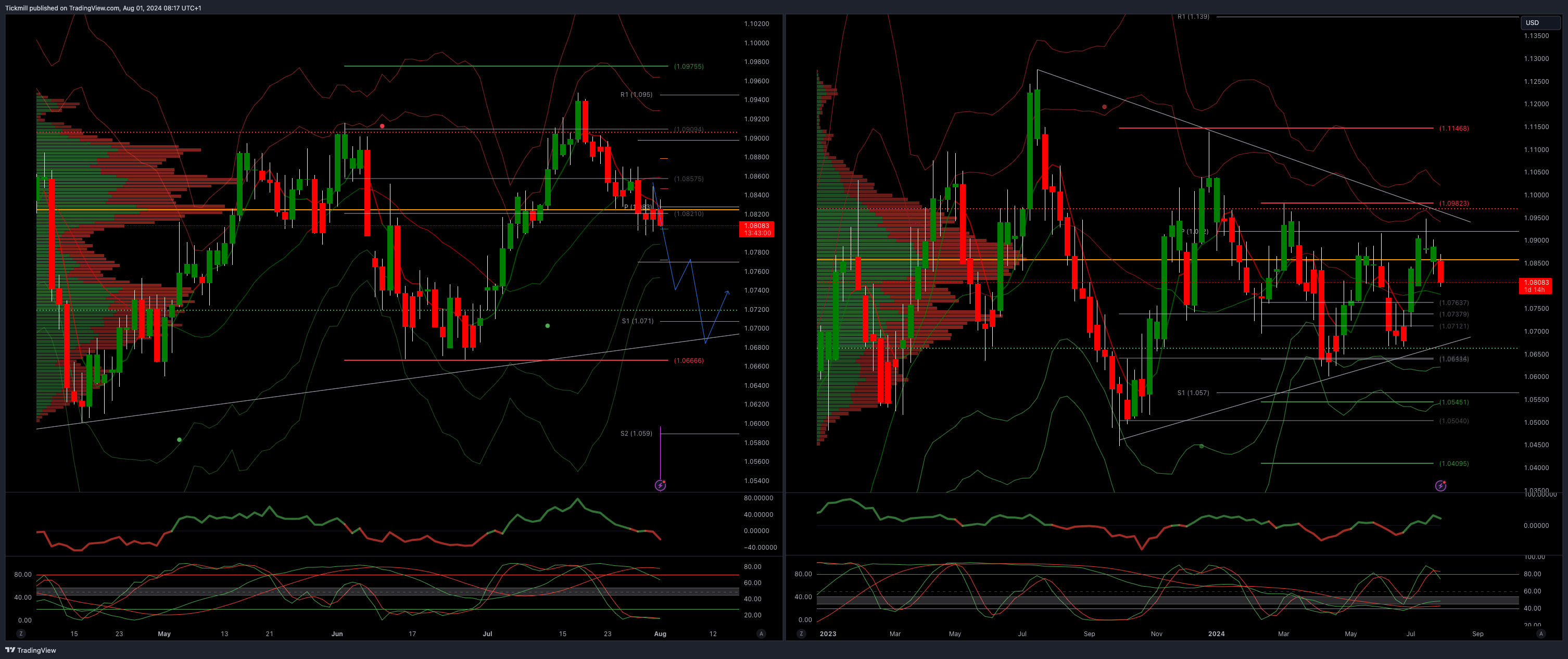

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Above 1.880 opens 1.0940

Primary resistance 1.0981

Primary objective is 1.07

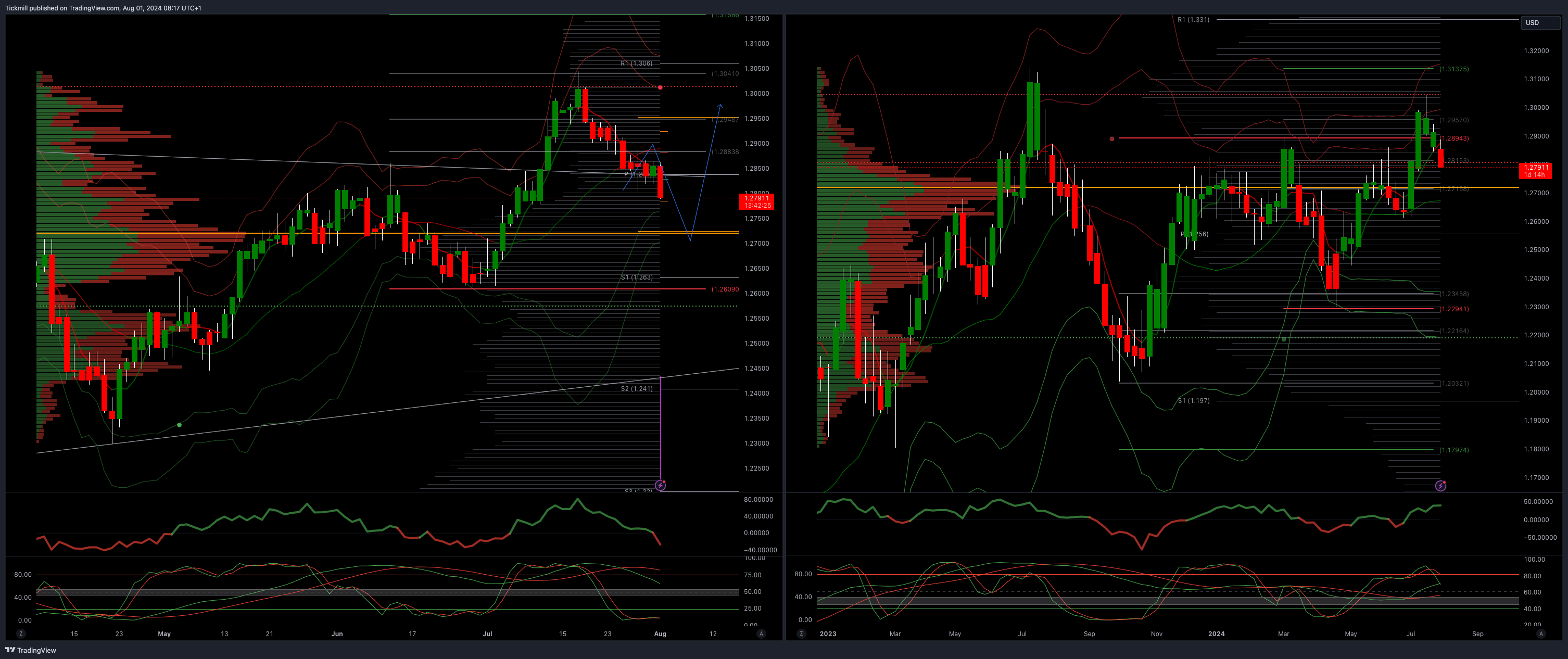

GBPUSD Bullish Above Bearish Below 1.29

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2670 opens 1.2450

Primary support is 1.2690

Primary objective 1.3160

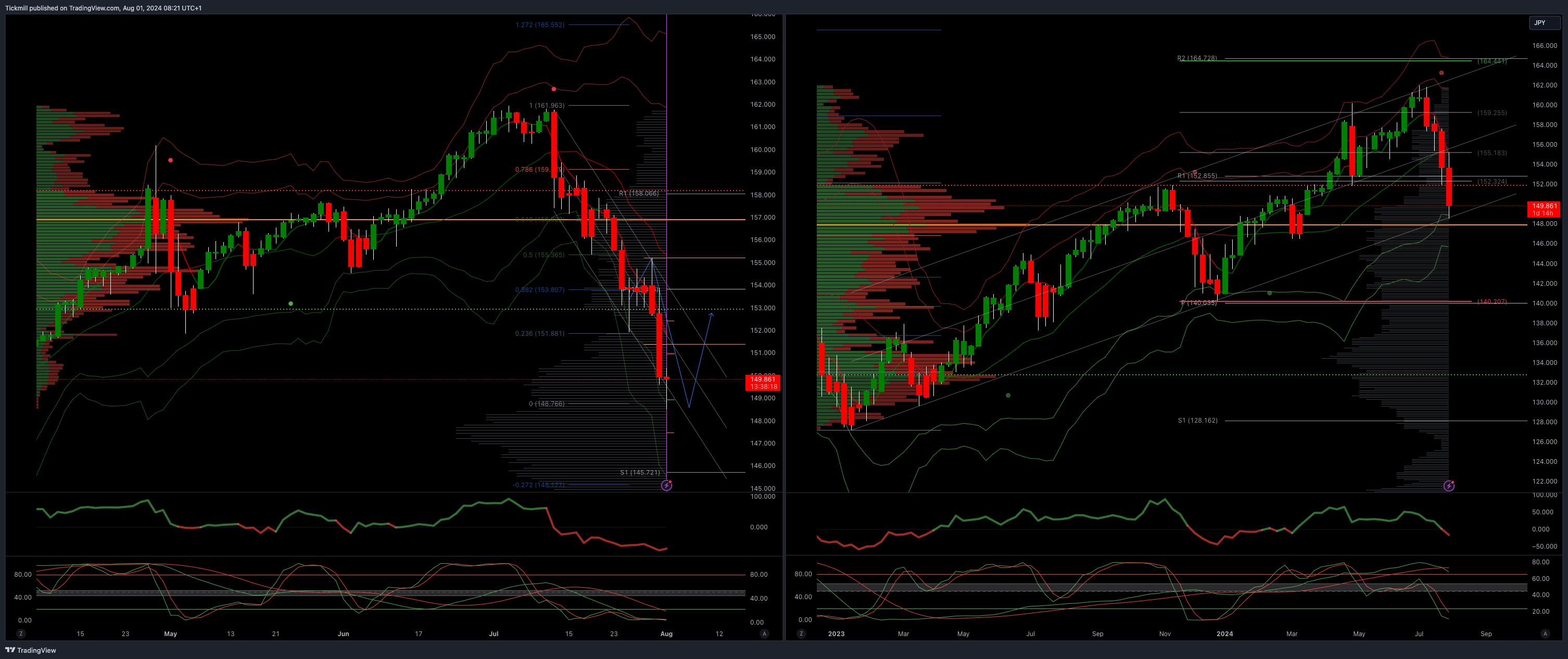

USDJPY Bullish Above Bearish Below 150

Daily VWAP bearish

Weekly VWAP bearish

Above 150 opens 153

Primary support 148.70

Primary objective is 164.30

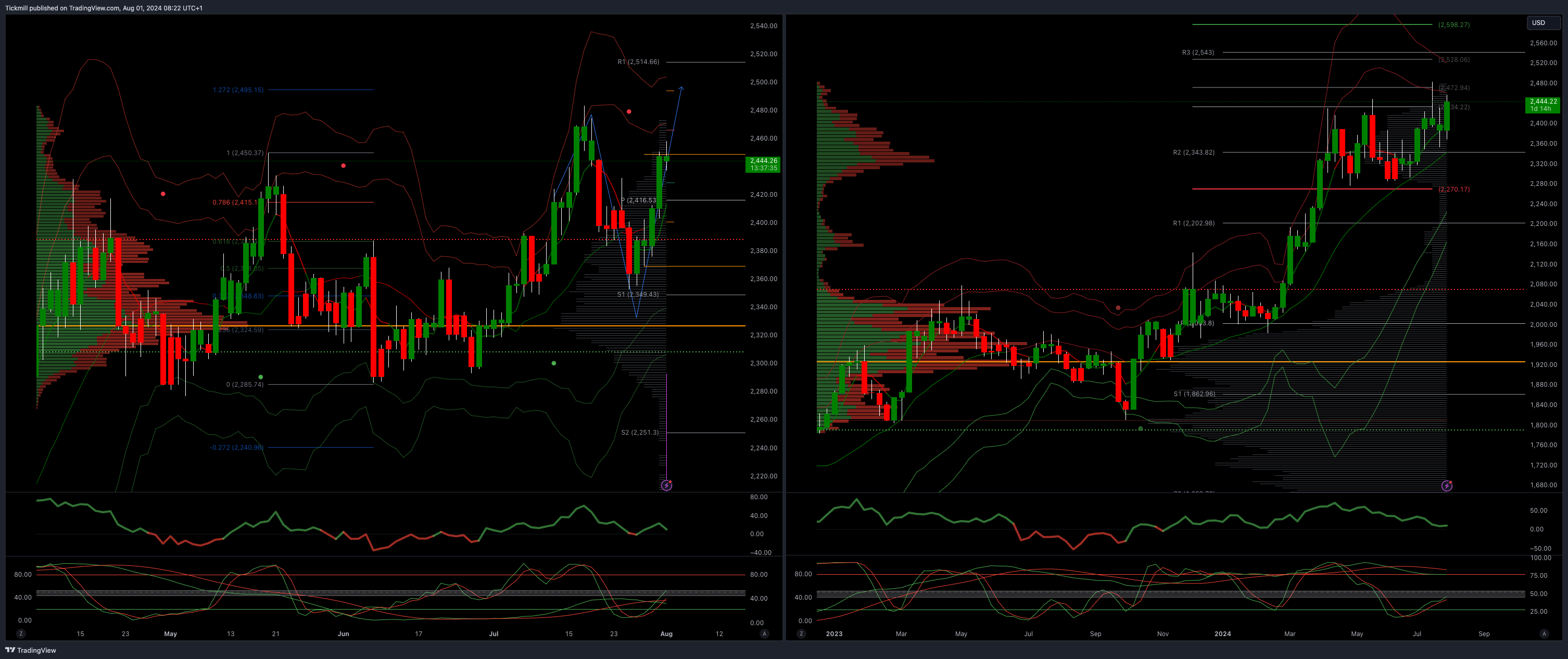

XAUUSD Bullish Above Bearish Below 2345

Daily VWAP bullish

Weekly VWAP bullish

Below 2400 opens 2330

Primary support 2300

Primary objective is 2598

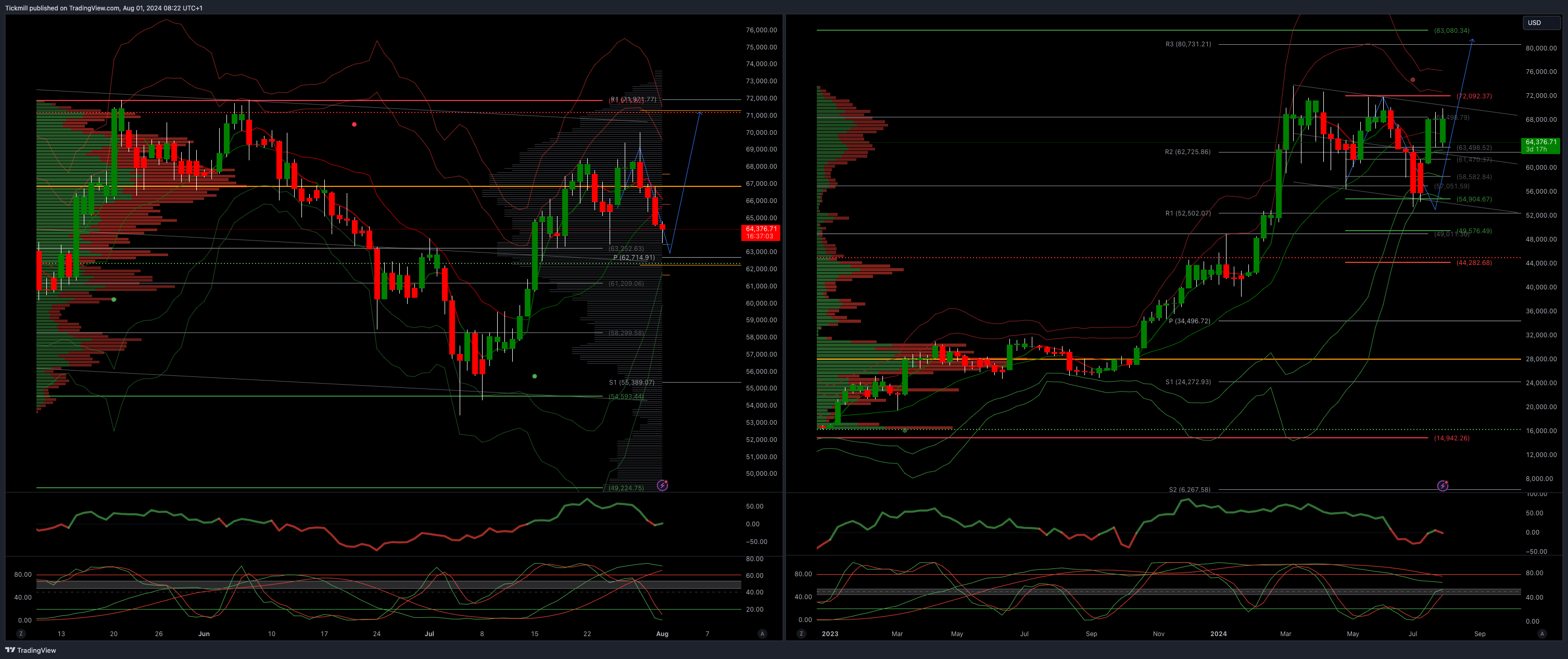

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bearish

Weekly VWAP bullish

Above 67000 opens 70000

Primary support is 50000

Primary objective is 70000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!