Daily Market Outlook, April 29, 2024

Daily Market Outlook, April 29, 2024

Munnelly’s Macro Minute…

“JPY Intervention Sees A Volatile Open To FX Trading”

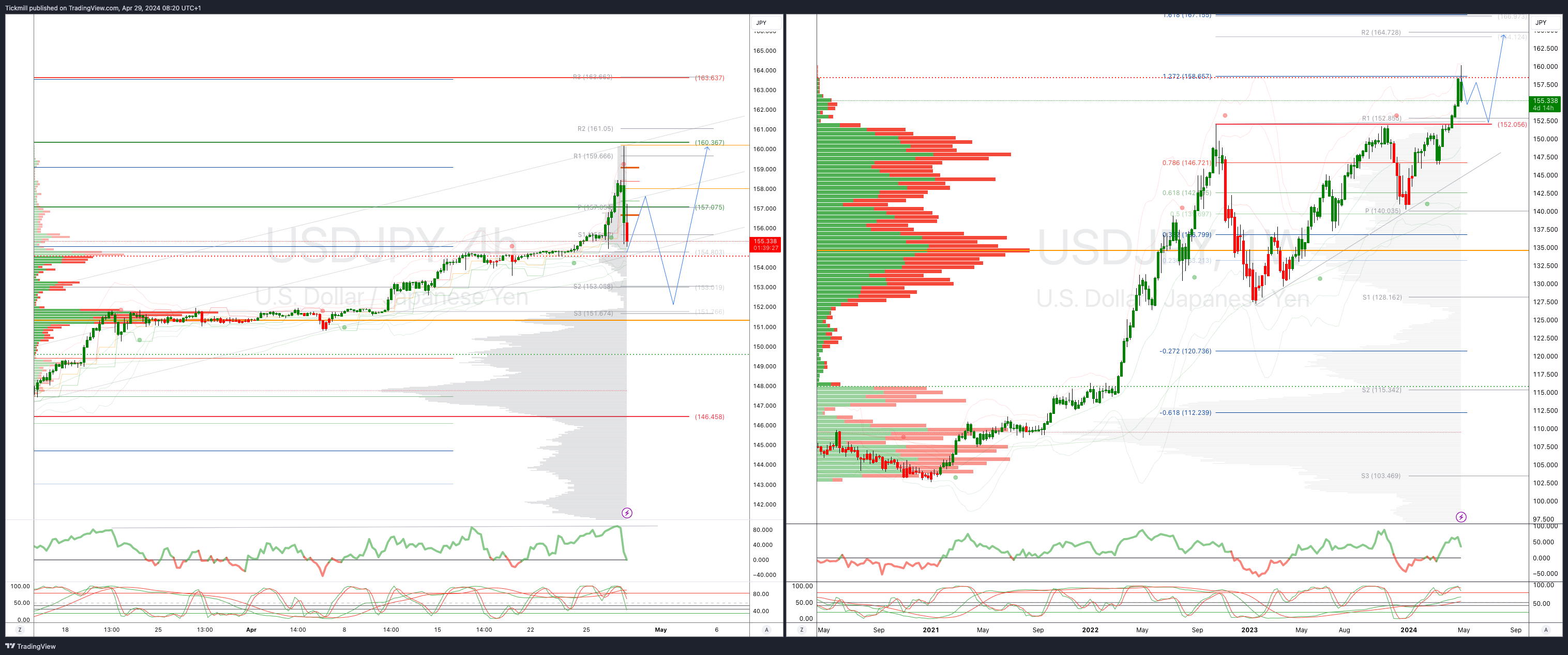

In early trading, the JPY experienced significant volatility, rallying strongly after reaching its lowest point in 34 years. Initially dropping below the 160 per US dollar mark for the first time since 1990, the yen's decline was attributed to thin liquidity due to a public holiday in Japan. However, it has since staged a partial recovery, hinting at possible intervention by Japanese authorities to bolster the currency. Meanwhile, equities in the Far East are generally seeing supportive sentiment.

Eurozone data shows a rebound in early 2024 activity, but inflation trends differ from the US, possibly leading to an interest rate cut by the European Central Bank (ECB) in June. German inflation figures expected today are likely to show a modest increase in both headline and core inflation, which may not change the ECB's view on disinflation. Comments from ECB members are expected to confirm this stance.

In the week ahead the U.S. Federal Open Market Committee meeting and April jobs report are expected to have a significant impact on market sentiment. This follows a series of strong U.S. data and hawkish comments from Fed officials, leading to a shift in expectations since the March FOMC meeting. It is widely anticipated that the Fed will maintain its current stance during the meeting on Wednesday. The market's probability of a 25 basis-point rate cut at the June meeting has decreased to just 10%, compared to nearly 85% after the March meeting. The market will closely monitor the Fed's accompanying statement and Chair Jerome Powell's press conference for indications of the Fed's data-dependent approach and its stance on policy easing. The bond market's reaction to the Fed's tone is expected to influence movements in other asset classes. Attention will then turn to Friday's U.S. jobs report, with expectations of 210,000 non-farm payrolls being added to the economy, a steady unemployment rate of 3.8%, and a 0.3% month-on-month increase in average hourly earnings. In addition to these key events, a packed week for data includes U.S. ISM manufacturing and non-manufacturing reports, S&P Global final PMIs, consumer confidence, factory orders, international trade, and ADP jobs data.

The UK has only final April PMIs scheduled, with no significant Bank of England speeches planned for the week.

Japan will release industrial production, employment, and retail sales data in a holiday-shortened week. The minutes of the March Bank of Japan meeting will be overshadowed by Friday's BOJ decision and press conference. China's official April PMIs and Caixin manufacturing PMI will be closely watched ahead of the Labour Day break from May 1-3.

Overnight Newswire Updates of Note

Fed’s Powell Poised To Keep US On Higher-For-Longer Path

US Debt-Sale Plan To Benefit From Fed That ‘Stops Hurting’

Israel May Delay Assault On Rafah In Exchange For Hostages

Hamas Says No Major Truce Issues, Delegation Due In Cairo

Split BoE Faces Political Heat On Calls For Interest Rate Cuts

Tory Rebels Aim To Oust Sunak If Party Suffer Election Losses

German Economy Sees Signs Of Life But Industry Struggling

Macron Dodges Debt Warning As Firms Hold Views On France

Yen Rebounds After A Slide Past 160 For First Time Since 1990

Oil Declines As US Steps Up Efforts To Secure Truce In Gaza

BHP To Consider Improved Anglo Proposal After Bid Rejected

Deutsche Bank To Assess For Possible Postbank Settlement

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0645-50 (1.2BLN), 1.0695-1.0700 (574M), 1.0710-15 (824M)

1.0720-25 (1BLN), 1.0750 (1.4BLN), 1.0775 (450M), 1.0800 (441M)

GBP/USD: 1.2600 (532M)

AUD/USD: 0.6480-85 (440M), 0.6500-05 (604M)

AUD/NZD: 1.0900 (1.1BLN), 1.1100 (866M)

USD/CAD: 1.3700 (613M), 1.3835 (939M)

USD/JPY: 157.00 (365M). AUD/JPY: 100.00 (410M)

FX options are ready for potential volatility related to the Federal Reserve and Non-Farm Payrolls (NFP) reports. Shorter-term FX option volatility is supported by the anticipation of significant events. The market is cautious about the possibility of increased actual volatility resulting from the Federal Reserve meeting and NFP release this week. One-week expiration options have gained interest following the Federal Reserve meeting on Thursday and the NFP report on Friday. Implied volatility for one-week options in major G10 currencies is at its highest level since January. One-month contracts are positioned between recent lows and highs. The USD/JPY stands out due to intervention and volatility risk, reaching its highest level since July.

CFTC Data As Of 26/04/24

Japanese yen net short position is -179,919 contracts

Euro net short position is -9,989 contracts

Swiss Franc posts net short position of -42,562 contracts

British Pound net short position is -26,233 contracts

Bitcoin net position is 0 contracts

Equity fund managers cut S&P 500 CME net long position by 16,969 contracts to 833,074

Equity fund speculators trim S&P 500 CME net short position by 9,927 contracts to 183,864

Gold NC Net Positions: $201.9K vs previous $202.4K

Technical & Trade Views

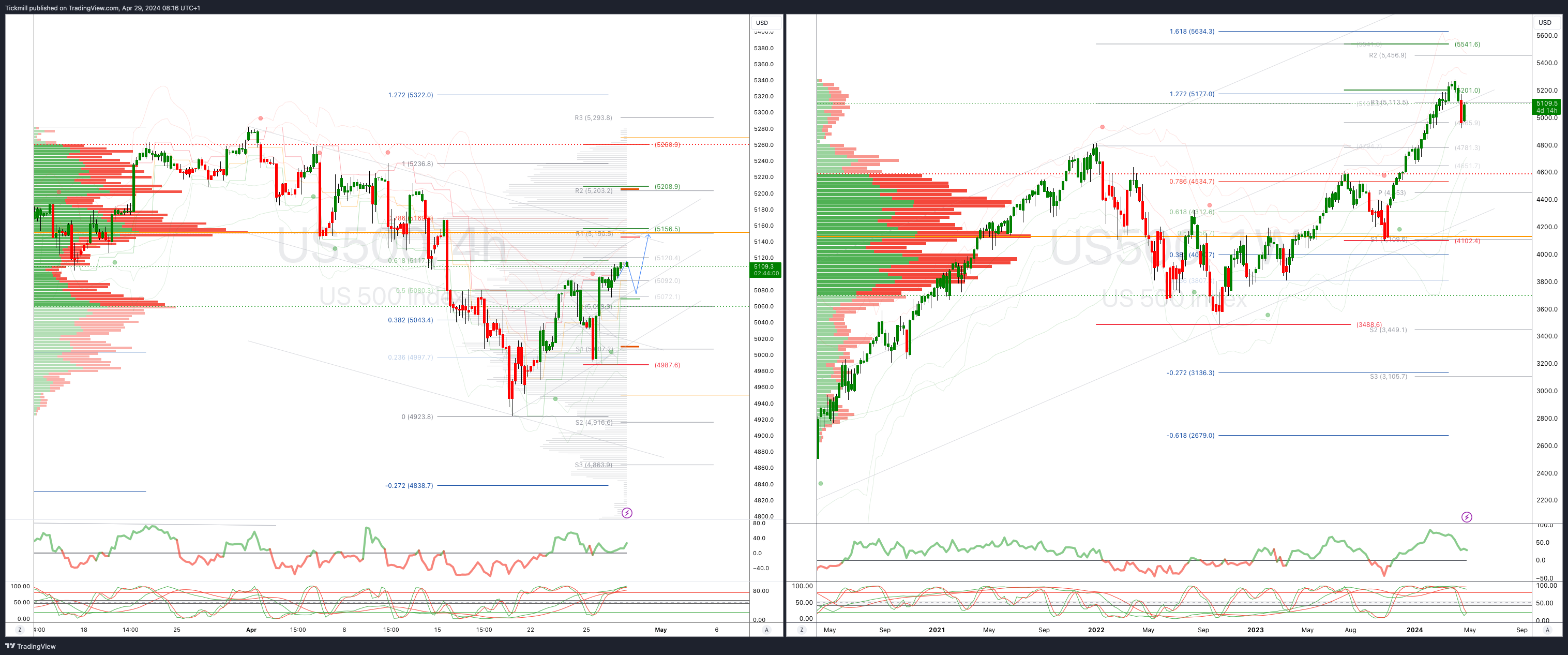

SP500 Bullish Above Bearish Below 5070

Daily VWAP bullish

Weekly VWAP bearish

Below 5060 opens 5020

Primary support 4987

Primary objective is 5150

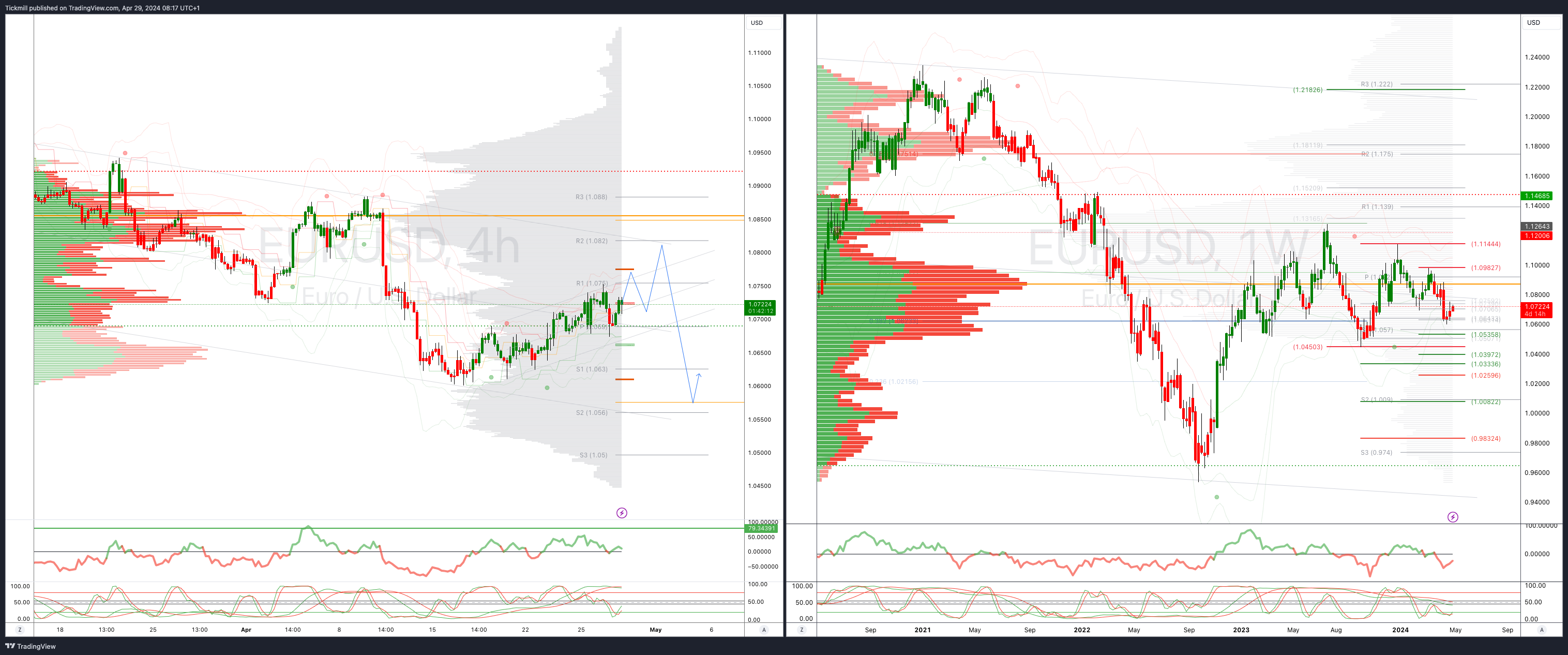

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bullish

Weekly VWAP bearish

Above 1.0730 opens 1.088

Primary resistance 1.850

Primary objective is 1.0550

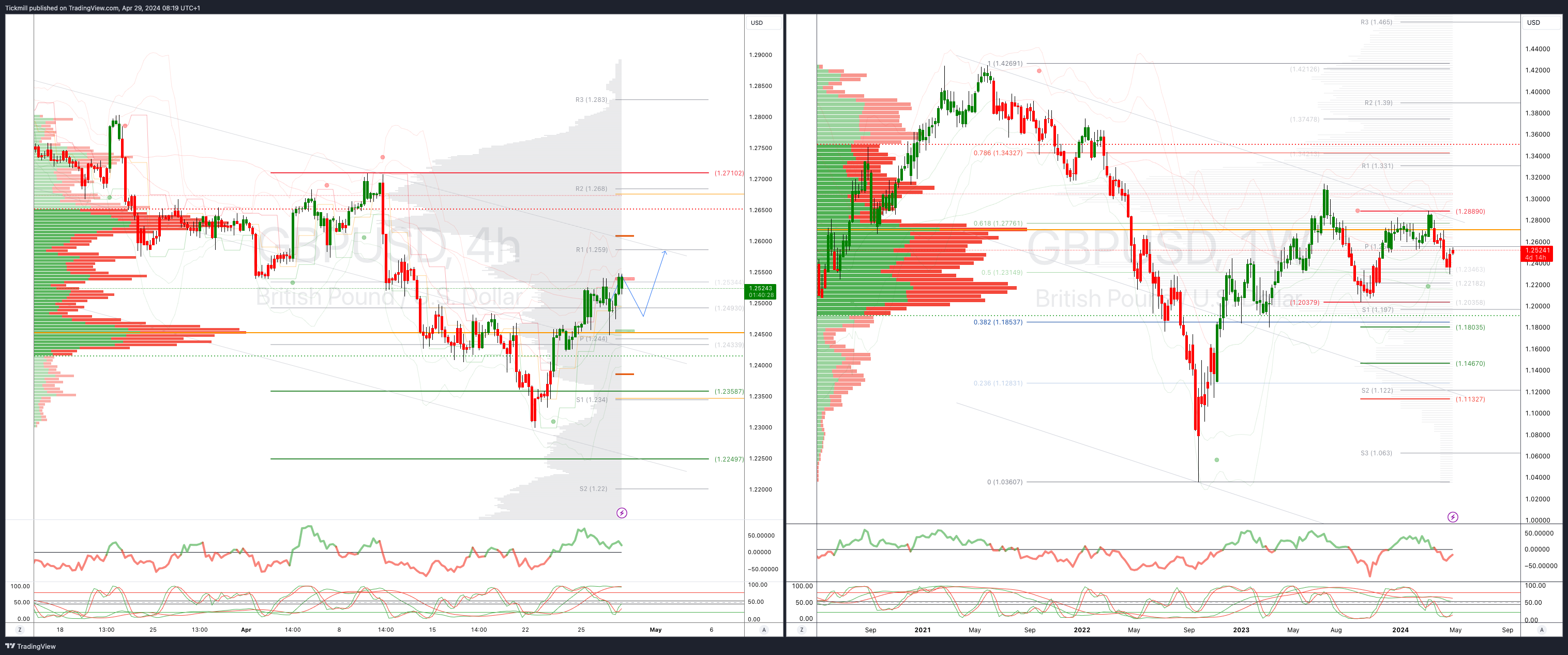

GBPUSD Bullish Above Bearish Below 1.2450

Daily VWAP bullish

Weekly VWAP bearish

Above 1.25 opens 1.2570

Primary resistance is 1.2710

Primary objective 1.26

USDJPY Bullish Above Bearish Below 152

Daily VWAP bullish

Weekly VWAP bullish

Below 155 opens 152

Primary support 152

Primary objective is 165

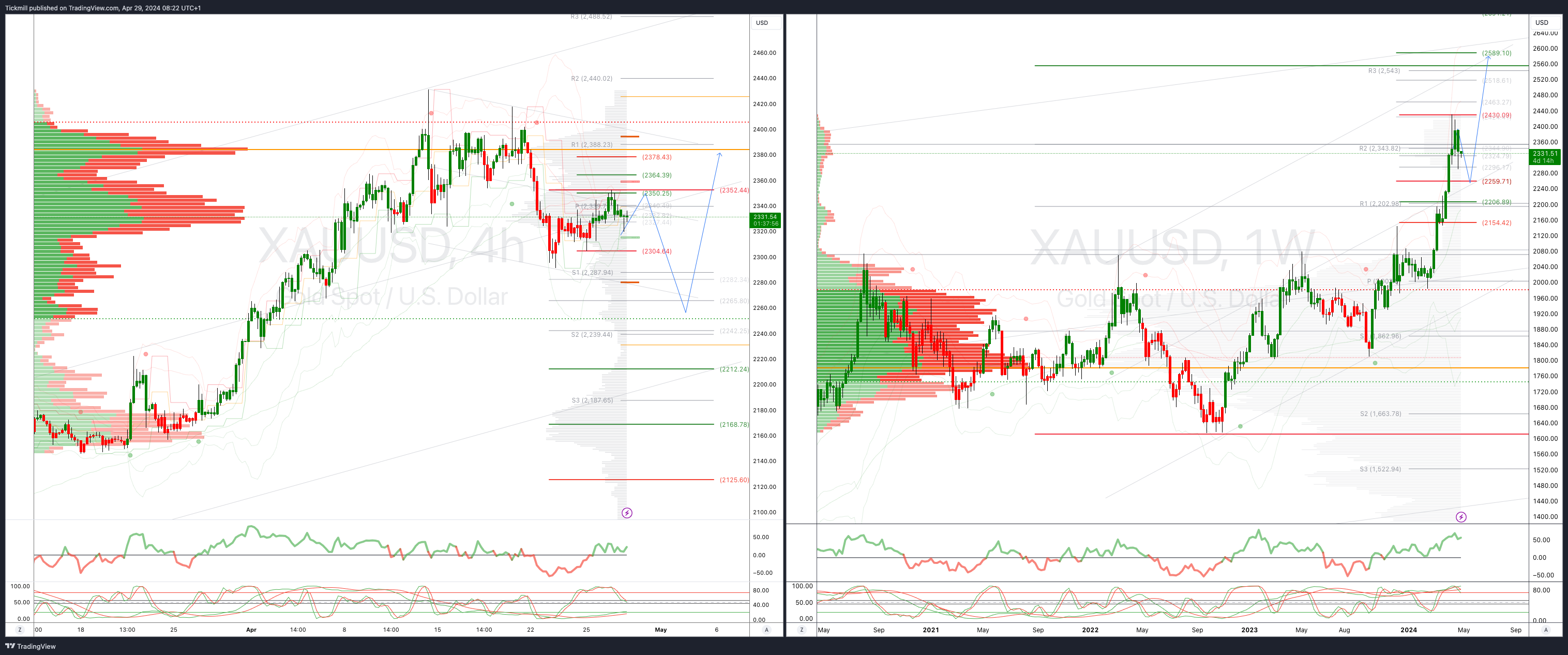

XAUUSD Bullish Above Bearish Below 2360

Daily VWAP bullish

Weekly VWAP bullish

Above 2360 opens 2400

Primary support 2260

Primary objective is 2560

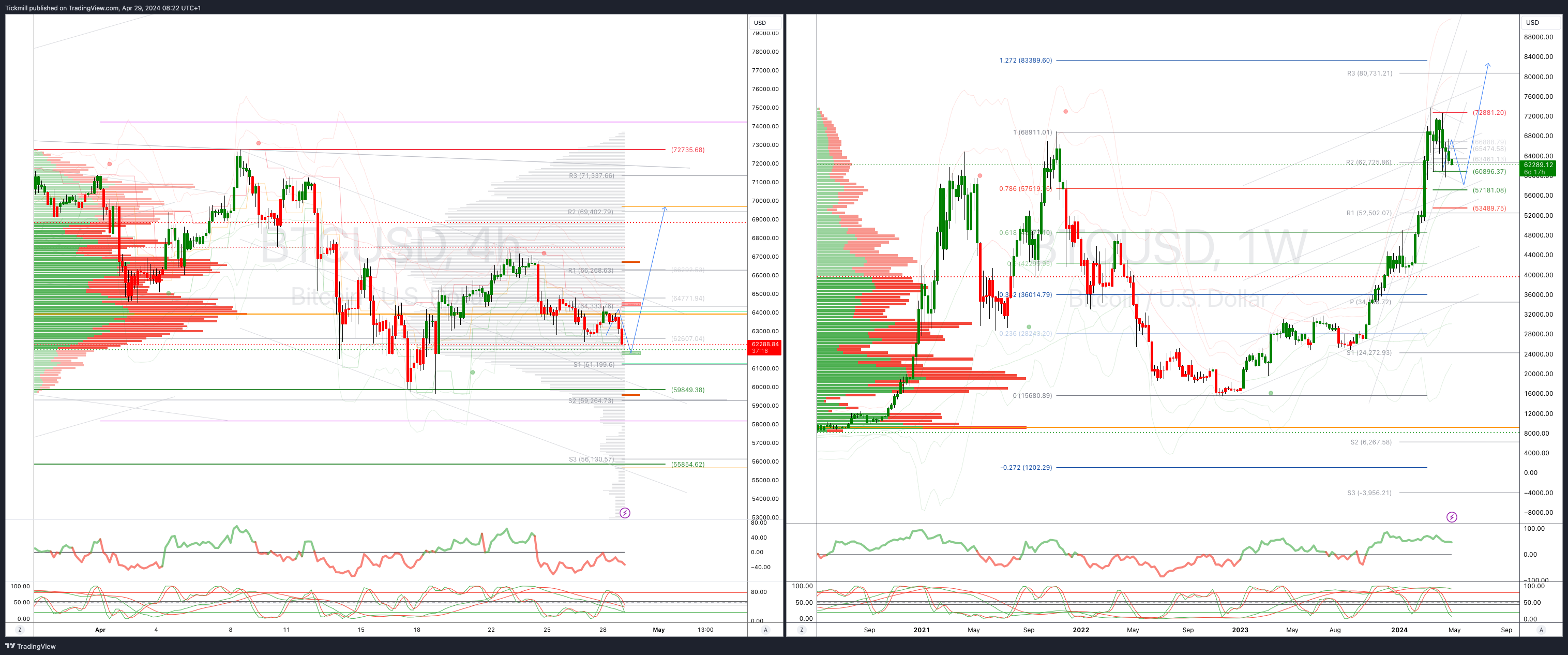

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bearish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!