Daily Market Outlook, April 28, 2021

Daily Market Outlook, April 28, 2021

.Asian equity markets are mostly slightly higher this morning. Concerns about Covid-19 cases remain a factor in many markets. However, in the UK, cases continue to fall in most areas. Reports suggest that ministers will meet next week to decide whether the next loosening in restrictions in England will go ahead on 17th May, which seems on track.

In Australia, Q1 CPI inflation was weaker than expected at 1.1% y/y only modestly up from 0.9% in Q4. The UK’s BRC shop index dropped 1.3%y/y in April, a smaller fall than the 2.4% decline in March. The latest measure of German consumer confidence was -4.4, up from -6.6 previously.

Today’s update from the US Federal Reserve seems certain to leave monetary policy unchanged. The only real question is over whether the Fed will make any adjustments to its forward guidance given the increasingly positive news on the economy. That is unlikely given that Fed policymakers have repeatedly said in recent weeks that policy needs to remain very supportive of the economic rebound. In particular, Fed Chair Powell has reiterated that it is too early to even start talking about ‘tapering’ asset purchases.

Given that the Fed usually prefers to prepare markets for a policy move, it would be a big surprise to see a change in direction. So expect it to stick with a very dovish message for now. Nevertheless, recent developments do suggest that the Fed may soon start to prepare markets for a scaling down of its asset purchases from the end of 2021, and this may begin as soon as the next update in early June.

This is not one of the occasions when Fed policymakers update their economic forecasts. However, Fed Chair Powell will hold a press conference at 7.30pm BST, a half hour after the policy announcement and any change to the message is most likely to emerge during that.

Early tomorrow morning UK time, President Biden will give his first State of the Union address to a joint session of Congress. He will emphasise the need for national unity, but the tight security due to fears over a repeat of the scenes seen in January will point to the continued divisions in the country. There is also unlikely to be much cross-party support for Biden’s policy agenda, which includes not only further fiscal changes but also some moves on climate change and gun control.

Today’s data calendar is very light. Any surprises in the US March advanced trade report may lead to some last minute changes in forecasts for tomorrow’s Q1 GDP update. A small rise in the monthly trade in goods deficit is expected.

CITI: Month-end FX Hedging prelim: Today is month-end value, often seeing US corporate USD demand emerge, position adjustments ahead of tonight's FOMC/Powell/Biden.

The preliminary estimate of month-end FX hedge rebalancing flows points to a greater than average USD selling need this month.

· US equities and bonds have out-performed in April, meaning that foreigners’ needs to hedge gains in US assets will likely dominate this month-end’s rebalancing. Both bond and equity investors are likely to be USD sellers, although equities hedge rebalancing contributes 86% to the signal.

· The signal exceeds 1.5 standard deviations in all crosses except GBP where good performance of UK equities and bonds creates some offsetting GBP selling needs.

· Average signal strength across all USD crosses measures 1.7 standard deviations. Signals of this magnitude have occurred only 5% of the time since 2004.

· There are plenty of data releases and central bank speakers scheduled for Friday, 30 April, albeit most of them fall hours ahead of the 4pm Ldn fix.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.1980-85 (1.8BLN), 1.2000 (2.5BLN), 1.2030-40 (1.1BLN), 1.2045-50 (450M), 1.2075-80 (1.2BLN), 1.2100-05 (1.4BLN), 1.2125-35 (1.1BLN), 1.2140-50 (1.5BLN) USD/CHF: 0.9050 (375M)

GBP/USD: 1.3795-1.3805 (291M), 1.4000 (362M)

AUD/USD: 0.7700 (535M), 0.7730-35 (566M), 0.7745-50 (313M), 0.7800 (493M)

USD/CAD: 1.2600 (1.1BLN)

USD/JPY: 108.10-15 (1BLN)

---------------

Larger FX Option Pipeline

EUR/USD: Apr28 $1.1900(E2.0bln), $1.1980-85(E1.8bln-EUR puts), $1.2000(E2.6bln, E2.35bln of EUR puts), $1.2030-41(E1.1bln), $1.2100-05(E1.3bln), $1.2130-45(E1.1bln-EUR puts); Apr29 $1.1850(E1.5bln), $1.1875-85(E1.1bln), $1.1890-1.1905(E1.4bln-EUR puts)

USD/JPY: Apr28 Y108.10-15($1.0bln-USD puts); Apr29 Y106.25($1.3bln), Y106.60-70($1.5bln-USD puts), Y106.85-107.00($1.5bln), Y108.45-50($1.2bln-USD puts), Y109.00($1.0bln-USD puts)

EUR/JPY: Apr29 Y129.85-95(E1.1bln-EUR puts)

GBP/USD: May03 $1.3700(Gbp1.3bln)

USD/CHF: Apr29 Chf0.9200($1.1bln-USD puts)

AUD/USD: May04 $0.8000(A$1.1bln)

AUD/JPY: Apr29 Y81.00(A$1.1bln-AUD calls)

AUD/NZD: May04 N$1.0855-65(A$2.0bln-AUD puts)

USD/CAD: Apr28 C$1.2600($1.1bln-USD puts); Apr29 C$1.2550($1.15bln-USD puts)

USD/MXN: Apr30 Mxn19.50($1.4bln)

USD/ZAR: Apr29 Zar14.20($1.0bln-USD puts)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1990 bullish above

EURUSD From a technical and trading perspective, as 1.1990 supports look for a test of trendline resistance at 1.2125.

Flow reports suggest topside offers start to increase on a move through the 1.2080 area before weak stops appear around the 1.2120 level and given the perchance of some banks to call a move to fade the Euro above the 1.2000 possibly starting to cause pain as option hedges go could see a squeeze higher and into the Feb ranges before seeing offers coming in above the 1.2150 level and increasing. Downside bids light through to the 1.1980 level with weak stops on a breakthrough to the medium congestive 1.1950 and therefore exposing the stronger bids 1.1900 level through to the 1.1880 and strong stops.

GBPUSD Bias: Bullish above 1.39 bearish below

GBPUSD From a technical and trading perspective, as 1.3960 contains upside attempts look for a test of range support towards 1.37.

Flow reports suggest downside congestion through to the 1.3840-50 area and then likely to find stronger support into the 1.3800 level with light congestion through the level mixed with weak stops before further support appears around the 1.3750 area and increasing bids into 1.3700 level with strong stops likely through to the 1.3680-60 area. Topside bids light through the congestive 1.3900 area with weak stops limited, with some increasing offers through the 1.3950 area and that increase likely to double for the 1.4000 level and strong stops likely on a strong move through the level.

USDJPY Bias: Bullish above 108 targeting 112

USDJPY From a technical and trading perspective, as 107.50 acts as support there is potential for a test of the pivotal 108.50, through here will open another look at 110. Failure below 107 would be a significant bearish development

Flow reports suggest downside bids into the 107.80 however, a break through the level is likely to see weak stops and breakout stops appearing and the market free to quickly test 107.50 and an old trendline then nothing until closer to the 107.00 area where stronger bids start to appear but the downside opening to Feb levels, Topside offers appearing through the 109.00 level light offers until the 109.40 area is likely to see strong congestion increasing through to the 110.00 level before stronger stops are likely to appear.

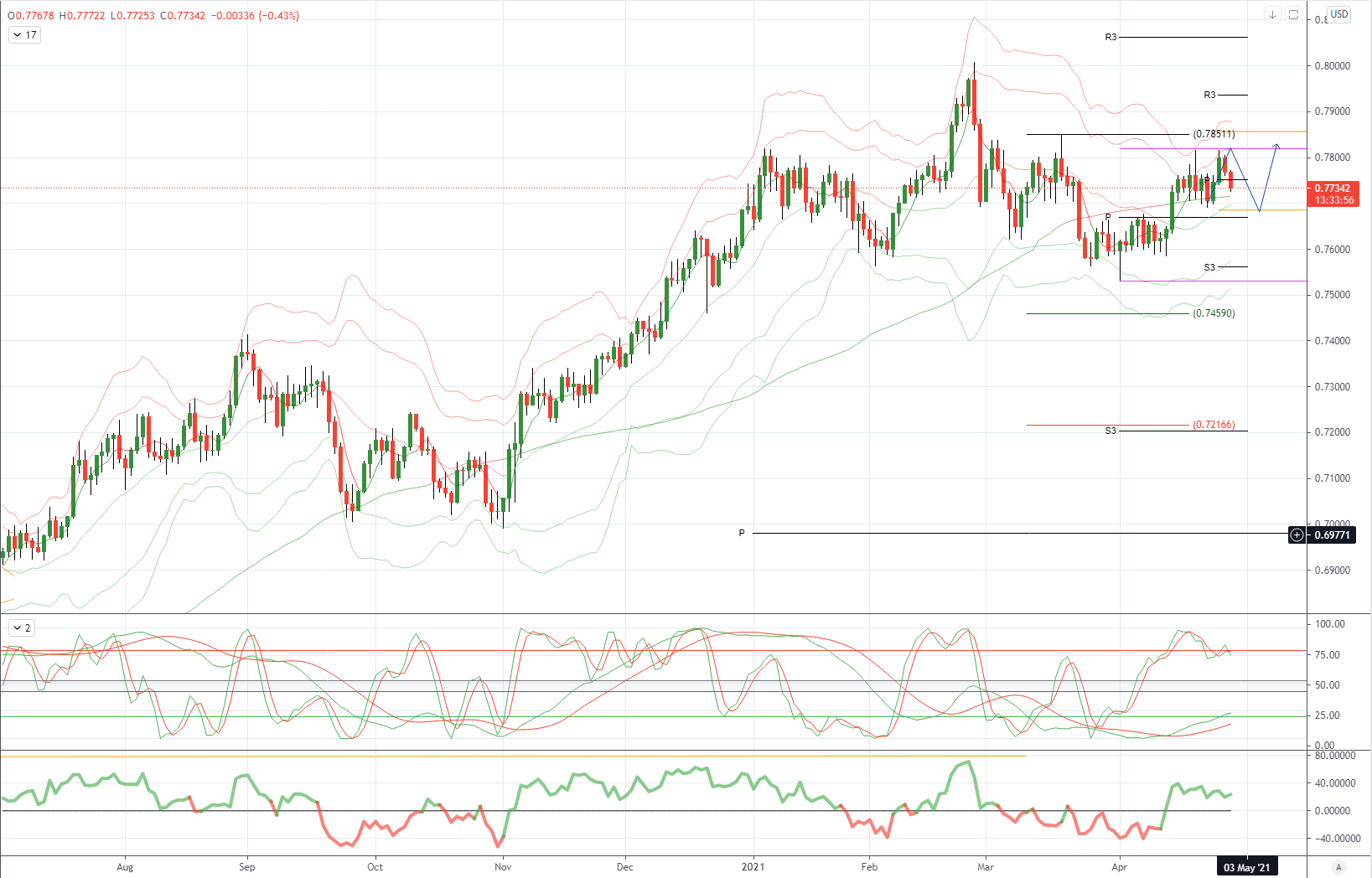

AUDUSD Bias: Bearish below .7700 bullish above

AUDUSD From a technical and trading perspective, the closing breach of .7730 has relieved downside pressure opening a move to test offers towards .7820

Flow reports suggest topside offers continue through the 0.7800 area with a break through the 0.7820 area likely to see weak stops and a test towards the sentimental 0.7850 area however, while there maybe some offers in the area the market looks to be fairly open through to the 79 cents level and ultimately ranges from the end of Feb, downside bids light through the 0.7700 level with weak stops likely on a move through the 0.7680 before stronger bids around the 0.7650 area and continuing through to the 0.7600 likely increasing in size, any further moves are likely to see strong support into the 0.7550 to calm the situation.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!