Daily Market Outlook, April 26, 2024

Daily Market Outlook, April 26, 2024

Munnelly’s Macro Minute…

“US Tech Earnings Boost Sentiment In A Whipsaw Week, PCE Next”

Asian equities saw gains today following strong US tech earnings, rebounding from yesterday's sell-off in both US equities and bonds triggered by Q1 GDP data showing slower growth and stronger inflation than anticipated. Overnight, the Bank of Japan kept short-term interest rates unchanged, as expected, maintaining them in the 0%-0.1% range after shifting them out of negative territory last month.

UK GfK consumer confidence for April was released earlier, with the headline index rising to -19 from -21, slightly surpassing forecasts. This uptrend over the past year suggests modest improvements in consumer fundamentals, supported by peaking interest rates and real wage growth. Eurozone money supply and credit growth data, expected to confirm subdued credit dynamics due to past monetary policy tightening, will be released alongside the ECB's consumer expectations survey, offering insights into household inflation expectations.

Stateside, the focal point of the day will be the US PCE inflation figures for March, following yesterday's Q1 GDP report, which revealed weaker-than-expected growth but stronger core PCE inflation, indicating potential upside risks to March's inflation data. This may also entail upward revisions to January and February figures. Consequently, look for the March core PCE deflator at 0.4%m/m, higher than the consensus of 0.3%m/m. Despite disappointing GDP growth, this inflationary pressure suggests the Fed may hesitate to implement interest rate cuts.

Overnight Newswire Updates of Note

Bank Of Japan Holds Rates Steady, Expects Inflation To Stay Around 2%

Tokyo Inflation Slows Sharply On Education Subsidy Impact

UK Consumers Get Spring In Step As Confidence Mounts

Trump Allies Draw Up Plans To Blunt Fed’s Independence

ECB Will Need More Rate Cuts If Fed Holds Back, Says Policymaker

China Warns Blinken ‘Negative Factors’ Building In US Relations

Yen Drops To Fresh 34-Year Low As BoJ Keeps Key Rate Unchanged

Oil Prices On Track To Snap Two-Week Losing Streak

Microsoft Sales And Profit Beat Expectations On Robust AI Demand

Alphabet To Pay Its First Dividend After Strong Quarterly Revenue

Intel Slides After Tepid Forecast Shows Comeback Challenges

There is increased demand for USD/CNH FX option strikes, with buyers showing interest in topside strikes around 7.5000 at the start of the week. Implied volatility for 1-month expiry was paid at 3.0 on a good size. There was also good demand for 1-month expiry 7.2000 strikes on Friday, with trading between 3.425 and 3.55 implied vol on over $500 million. Currently, 1-month expiry implied volatility is trading around 3.3. Additionally, 1-month risk reversals rallied to neutral to 0.7 USD calls/CNH puts in mid-April but have since settled around 0.35 USD calls/CNH puts, indicating that the market is still wary of further USD gains/CNH losses.

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0675-85 (1.9BLN), 1.0700 (1BLN), 1.0725-30 (1.4BLN)

1.0750 (1.7BLN), 1.0785 (1.1BLN), 1.0800 (548M)

USD/CHF: 0.9100-10 (765M), 0.9200 (276M). EUR/CHF: 0.9775 (357M)

GBP/USD: 1.2430 (1.1BLN), 1.2490-1.2505 (1.1BLN)

AUD/USD: 0.6500 (469M), 0.6515-25 (390M), 0.6540-50 (556M), 0.6570 (377M)

NZD/USD: 0.5905 (329M), 0.5925 (229M), 0.5940 (385M)

USD/CAD: 1.3560-65 (600M), 1.3650 (259M), 1.3770-85 (1.1BLN)

USD/JPY: 155.00 (1.5BLN), 156.00 (376M), 156.25 (320M), 156.50 (530M)

Increased demand for USD/CNH FX option strikes was observed this week, with buyers targeting topside strikes around 7.5000. The implied volatility for the benchmark 1-month expiry was paid at 3.0 on a good scale. On Friday, there was significant demand for 1-month expiry 7.2000 strikes, with trading occurring between 3.425 and 3.55 implied vol on over $500 million. Currently, the 1-month expiry implied volatility is trading around 3.3. Additionally, the 1-month risk reversals showed a rally to neutral at 0.7 USD calls/CNH puts in mid-April, but have since settled around 0.35 USD calls/CNH puts, indicating that the market is still cautious about further USD gains/CNH losses.CFTC Data As Of 19/04/24

Japanese yen net short position is -165,619 contracts

Swiss franc posts net short position of -36,212 contracts

British pound net long position is 8,619 contracts

Euro net long position is 12,224 contracts

Bitcoin net short position is -363 contracts

Equity fund managers cut S&P 500 CME net long position by 89,326 contracts to 850,042

Equity fund speculators trim S&P 500 CME net short position by 139,497 contracts to 193,791

Technical & Trade Views

SP500 Bullish Above Bearish Below 5070

Daily VWAP bullish

Weekly VWAP bearish

Below 5020 opens 5000

Primary support 5010

Primary objective is 5150

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bullish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

GBPUSD Bullish Above Bearish Below 1.24

Daily VWAP bullish

Weekly VWAP bearish

Above 1.25 opens 1.2570

Primary resistance is 1.2650

Primary objective 1.2350 TARGET HIT NEW PATTERN EMERGING

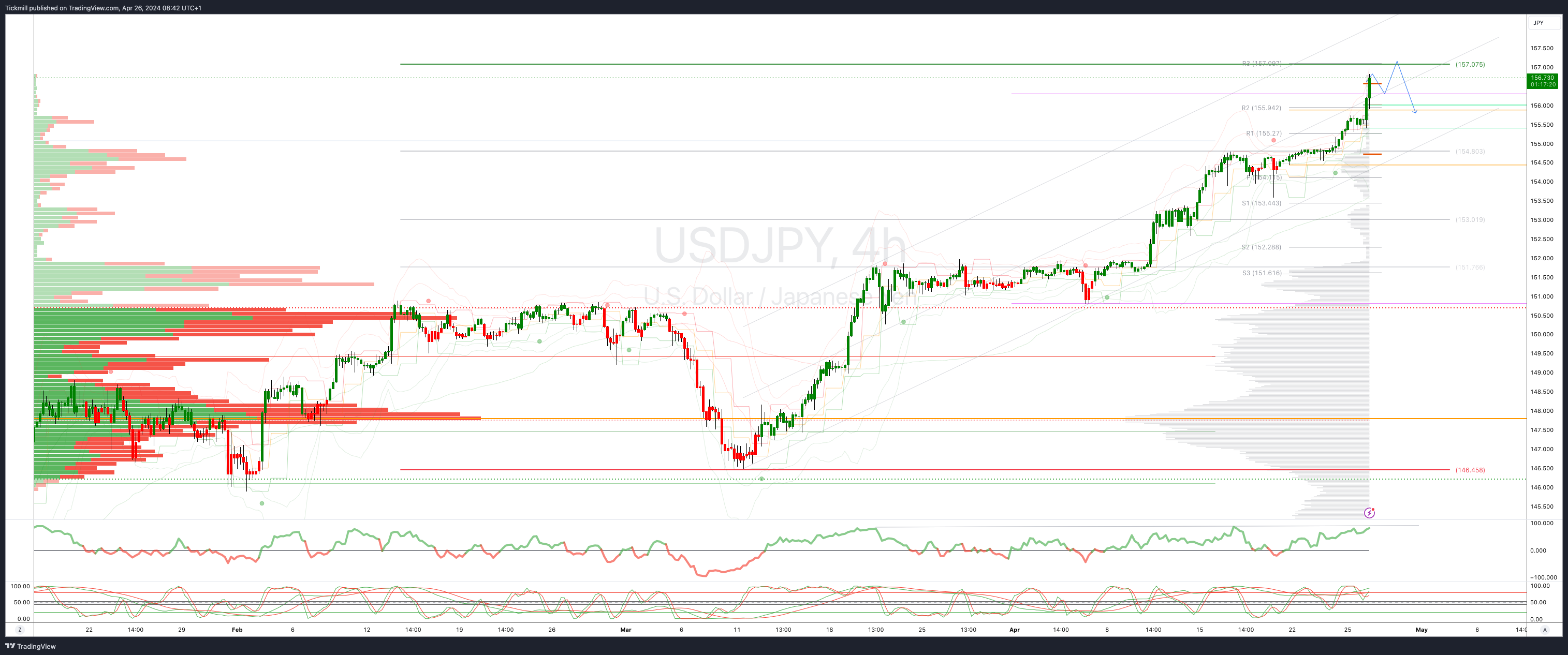

USDJPY Bullish Above Bearish Below 154.60

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 155 TARGET HIT NEW PATTERN EMERGING

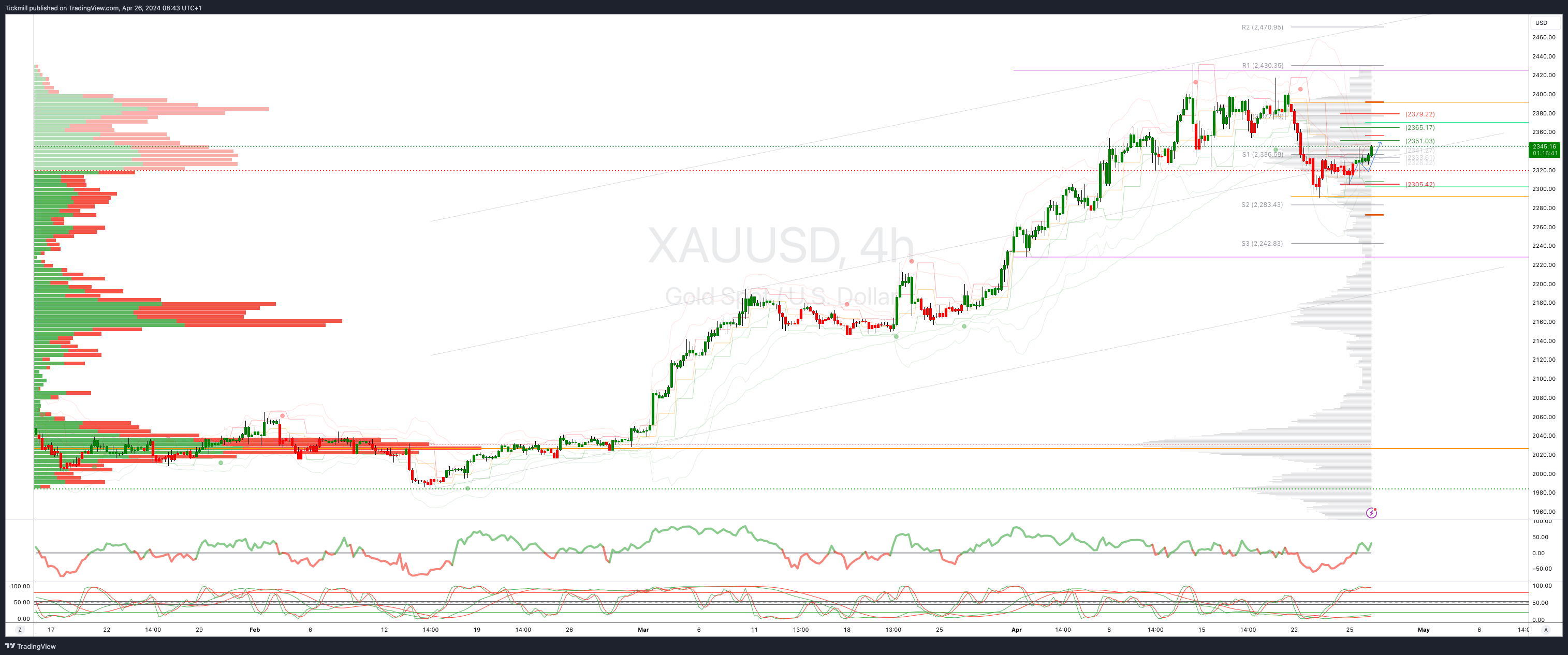

XAUUSD Bullish Above Bearish Below 2379

Daily VWAP bearish

Weekly VWAP bullish

Above 2420 opens 2460

Primary support 2300

Primary objective is 2310 TARGET HIT NEW PATTERN EMERGING

BTCUSD Bullish Above Bearish below 62000

Daily VWAP bearish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!