Daily Market Outlook, April 24, 2024

Daily Market Outlook, April 24, 2024

Munnelly’s Macro Minute…

“Tesla Short Squeeze On Expected Earnings Miss, Meta On Deck Later”

On Wednesday, Asian stock markets are experiencing widespread gains, following positive sentiment in global markets. This comes after data showed a slowdown in U.S. manufacturing activity for April, leading to speculation that the US Fed may consider lowering interest rates. Traders are also taking advantage of lower stock prices following recent sell-offs. Traders are now looking forward to upcoming economic data, such as the release of first-quarter U.S. GDP figures and the core personal-consumption expenditures (PCE) price index, which is closely watched by the Fed as a measure of inflation.

Today's German IFO survey for April will offer further insights into whether economic activity in the Eurozone's largest economy is rebounding. Yesterday's April PMI data revealed improvements in the composite indices for both Germany and the Eurozone overall. In Germany, the index surpassed the crucial 50 expansion threshold for the first time since June 2023, while the Eurozone reading marked the second consecutive reading above 50 and the highest since May 2023. Both indices indicated a continued decline in manufacturing activity alongside a pickup in services. Anticipations are that the IFO readings will also reflect an increase. It is projected that the current conditions index will have recorded a second consecutive rise, reaching its highest level in 2024, albeit still expected to fall below last year’s Q4 average. Meanwhile, the expectations reading is forecasted to have risen for the third consecutive month, hitting its highest level since last April. The trajectory of the Eurozone economy's recovery and its strength will be pivotal factors for European Central Bank policymakers as they deliberate on potential interest rate cuts in June and beyond.

Stateside, durable goods orders for March will offer insights into whether manufacturing activity is rebounding. Recent data have shown some indications of improvement, and today's expectations include a monthly increase in orders of 3.0%. However, it's worth noting that a significant portion of this rise will likely stem from a substantial increase in the volatile transport sector, particularly Boeing orders, with ex-transport orders expected to grow more modestly by 0.5%. Additionally, data on capital goods shipments within the release will influence expectations for tomorrow’s Q1 GDP release. Traders will also be on earnings report watch after a significant short squeeze developing overnight post the Tesla earnings report, this evening markets will hear from Meta parent of facebook.

Overnight Newswire Updates of Note

BoJ To Discuss Impact Of Yen's Rapid Slide At This Week's Policy Meeting

Australia’s Hot Inflation Suggests Higher-For-Longer Rates

New Zealand First-Quarter Imports Fall Amid Sluggish Economy

China Repeats Criticism Of US Taiwan Aid As Bill Passes Senate

Australian Dollar Extends Gains On Upbeat CPI Figures, Tepid US Dollar

USD/JPY Sticks To 34-Year High Near 154.90 As Intervention Risks Loom

Oil Prices Inch Up As Market Weighs US Stocks Decline, Mid East Conflict

Tesla Aims To Release Cheaper Cars By 2025 After Sales Miss

Visa Profit Surges 17% As Consumer Card Spending Climbs

Texas Instruments Gives Solid Forecast In Sign Of Comeback

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0600-10 (1.5BLN), 1.0650 (1.06BLN)

1.0685-90 (426M), 1.0700-10 (3.07BLN), 1.0715-25 (1.3BLN)

1.0730 (260M, 1.0750 (230M)

USD/JPY: 153.00 (452M), 153.50 (1.53BLN), 154.00-10 (1.24BLN)

154.15-25 (570M), 154.50 (232M), 155.00 (298M), 155.40 (1.05BLN)

156.00 (421M)

GBP/USD: 1.2450 (613M). EUR/GBP 0.8525 (342M), 0.8600 (351M)

USD/CHF: 0.8970 (320M), 0.9050 (335M), 0.9150 (765M)

0.9200 (320M)

AUD/USD: 0.6325 (500M), 0.6400 (472M), 0.6440-50 (356M)

0.6475-85 (287M), 0.6500-10 (359M), 0.6525 (335M)

0.6630 (348M)

USD/CAD: 1.3565-75 (1.35BLN), 1.3590-1.3605 (1.4BLN)

1.3650 (625M), 1.3680 (914M)

USD/ZAR: 18.8470 (1.0BLN), 19.40 (196M), 19.60. (303M)

CFTC Data As Of 19/04/24

Japanese yen net short position is -165,619 contracts

Swiss franc posts net short position of -36,212 contracts

British pound net long position is 8,619 contracts

Euro net long position is 12,224 contracts

Bitcoin net short position is -363 contracts

Equity fund managers cut S&P 500 CME net long position by 89,326 contracts to 850,042

Equity fund speculators trim S&P 500 CME net short position by 139,497 contracts to 193,791

Technical & Trade Views

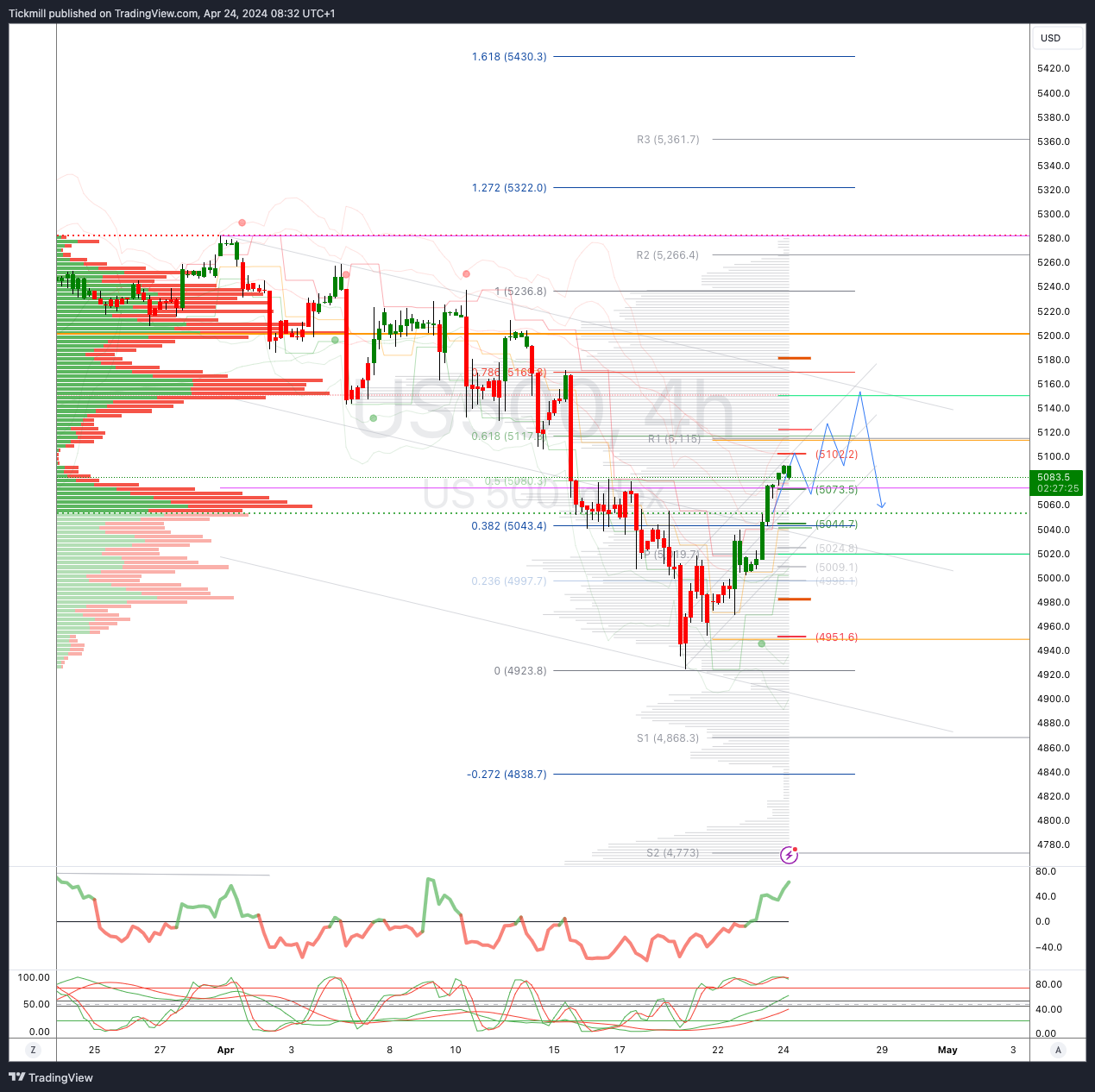

SP500 Bullish Above Bearish Below 5070

Daily VWAP bullish

Weekly VWAP bearish

Below 5070 opens 5045

Primary support 5040

Primary objective is 5150

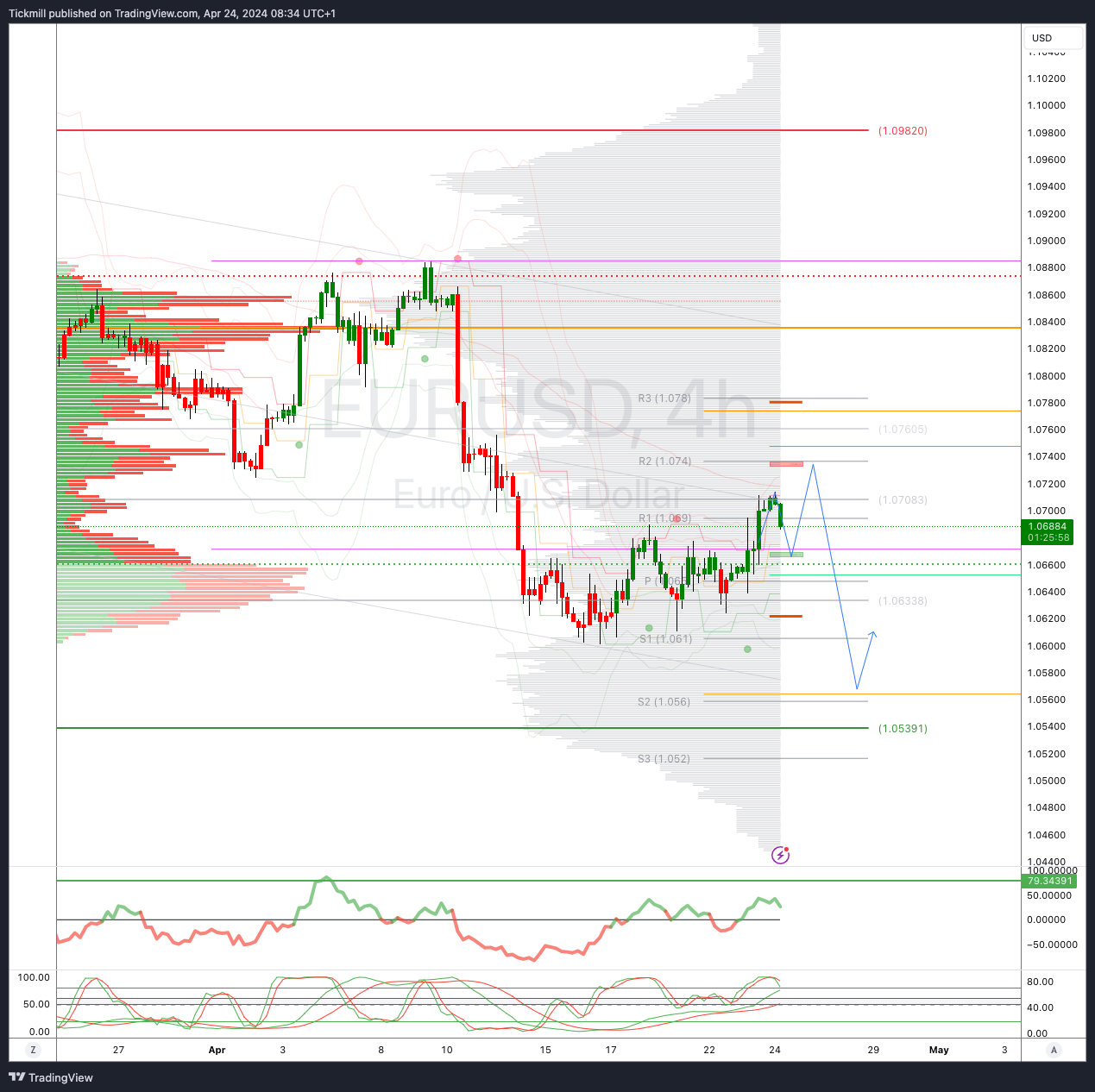

EURUSD Bullish Above Bearish Below 1.0720

Daily VWAP bullish

Weekly VWAP bearish

Above 1.0730 opens 1.0760

Primary resistance 1.0740

Primary objective is 1.0550

GBPUSD Bullish Above Bearish Below 1.24

Daily VWAP bullish

Weekly VWAP bearish

Below 1.24 opens 1.2340

Primary resistance is 1.2650

Primary objective 1.2350 TARGET HIT NEW PATTERN EMERGING

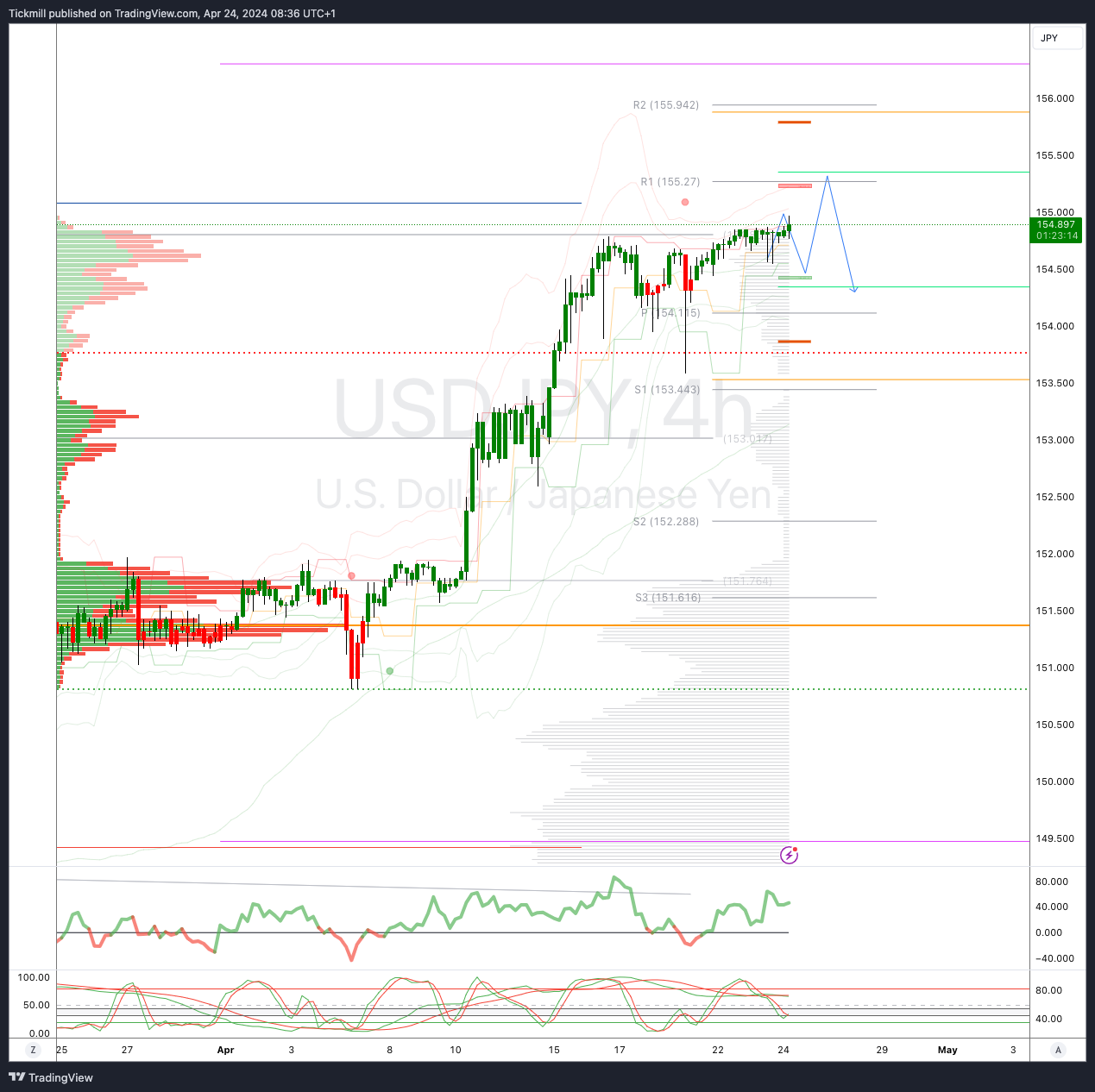

USDJPY Bullish Above Bearish Below 153.40

Daily VWAP bullish

Weekly VWAP bullish

Below 153.40 opens 152

Primary support 152

Primary objective is 15

XAUUSD Bullish Above Bearish Below 2417

Daily VWAP bearish

Weekly VWAP bullish

Above 2420 opens 2460

Primary support 2300

Primary objective is 2310 TARGET HIT NEW PATTERN EMERGING

BTCUSD Bullish Above Bearish below 66000

Daily VWAP bullish

Weekly VWAP bullish

Below 59900 opens 55900

Primary support is 60000

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!