Daily Market Outlook, April 23, 2021

Daily Market Outlook, April 23, 2021

Stumped by US President Biden’s plans to nearly double the capital gains tax for the top marginal income tax bracket earning US$1mn or more to 38.6%, risk sentiments pulled back overnight. The S&P 500 declined 0.92% in its biggest slide in five weeks, while VIX rose to 18.71, even though the initial jobless claims fell to a new post-pandemic low of 547k. UST bonds traded mixed in a choppy session, with the 10-year yield lower at 1.54%. The USD rose, while on the corporate earnings front, Intel, AT&T, Southwest and American Air all beat estimates. Meanwhile, Biden has pledged to cut US greenhouse gas emissions 50-52% from 2005 levels by end-2030, and Japan pledged to cut 46% by 2030 compared to 2013 levels, but China and India kept to existing targets.

The ECB kept its monetary policy settings unchanged, but affirmed the front-loading of its PEPP purchases, with Lagarde suggesting that “any phasing out was not discussed and it is just premature” even though “medium term risks remain more balanced”. The EURUSD extended higher amid Lagarde’s presser, but retraced lower subsequently. Relative to expectations, Lagarde was quite neutral and not leaning hawkish at this point. There are soundbites for both hawks and doves to take away, but gave very little in terms of concrete policy direction. Wait for the formal assessment of the PEPP in June. Overall, this ECB release is not an upside catalyst for the EUR. Near-term, the focus shifts to global preliminary PMIs later today for a gauge of how EZ economic activity held out during the latest round of virus resurgence. ECB’s comments that “any phasing out was not discussed and it is just premature” did not add much information on the potential path to withdrawing support; expectation remains that the “step-up” of weekly PEPP will not be extended beyond this quarter. The recent weekly net purchases have not been spectacular either, with a 4-week average at EUR18bn (leaving out the Easter week). The run-rate is around EUR17.5bn weekly for the existing envelope to be used up by March 2022. It does not appear to be much “front-loading” so far.

In the US existing home sales fell 3.70% to a 7-month low of 6.01 million units in March amid surging prices and limited inventory. In the EU, France will begin a “cautious” re-opening of its economy in mid-May. Oil rebounded 0.1% yesterday and managed to stay above the $65 handle. We think oil will likely continue to grind out gains for the rest of the month if it does not break below the $65 support level. Gold again came agonisingly close to the $1800 level but failed to break above the resistance level, ultimately closing 0.5% lower on the day. It will likely continue to move in negative correlation with US Treasury yields for now

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: $1.1900-05(E714mln), $1.1980-90(E1.2bln-EUR puts)

GBP/USD: $1.3900(Gbp650mln-GBP puts), $1.4000(Gbp494mln-GBP puts)

USD/CAD: C$1.2440-50($1.7bln-USD puts), C$1.2500-10($1.2bln-USD puts), C$1.2545-55($575mln), C$1.2580-85($1.3bln-USD puts), C$1.2600-10($786mln)

USD/CNY: Cny6.65($630mln)

---------------

Larger FX Option Pipeline

EUR/USD: Apr27 $1.1935-50(E1.0bln); Apr28 $1.1900(E2.0bln), $1.1980-85(E1.7bln-EUR puts), $1.2000(E2.6bln, E2.35bln of EUR puts), $1.2030-41(E1.1bln), $1.2130-45(E1.0bln); Apr29 $1.1850(E1.5bln), $1.1875-85(E1.1bln), $1.1890-1.1905(E1.4bln-EUR puts)

USD/JPY: Apr27 Y108.74-75($1.5bln-USD puts), Y109.00-10($1.3bln-USD puts), Y109.70-85($1.8bln); Apr28 Y108.10-15($982mln-USD puts); Apr29 Y106.60-70($1.3bln-USD puts), Y106.85-107.00($1.15bln), Y108.45-50($1.1bln), Y109.00($1.0bln-USD puts)

EUR/JPY: Apr29 Y129.85-95(E1.1bln-EUR puts)

GBP/USD: May03 $1.3700(Gbp1.3bln)

USD/CHF: Apr29 Chf0.9200($930mln-USD puts)

AUD/USD: Apr27 $0.7710-25(A$1.35bln-AUD puts), $0.7830-35(A$1.1bln-AUD puts)

AUD/JPY: Apr29 Y81.00(A$1.1bln-AUD calls)

AUD/NZD: May04 N$1.0855-65(A$1.9bln-AUD puts)

USD/CAD: Apr28 C$1.2600($1.1bln-USD puts)

USD/MXN: Apr30 Mxn19.50($1.4bln)

USD/ZAR: Apr29 Zar14.20($930mln-USD puts)

Technical & Trade Views

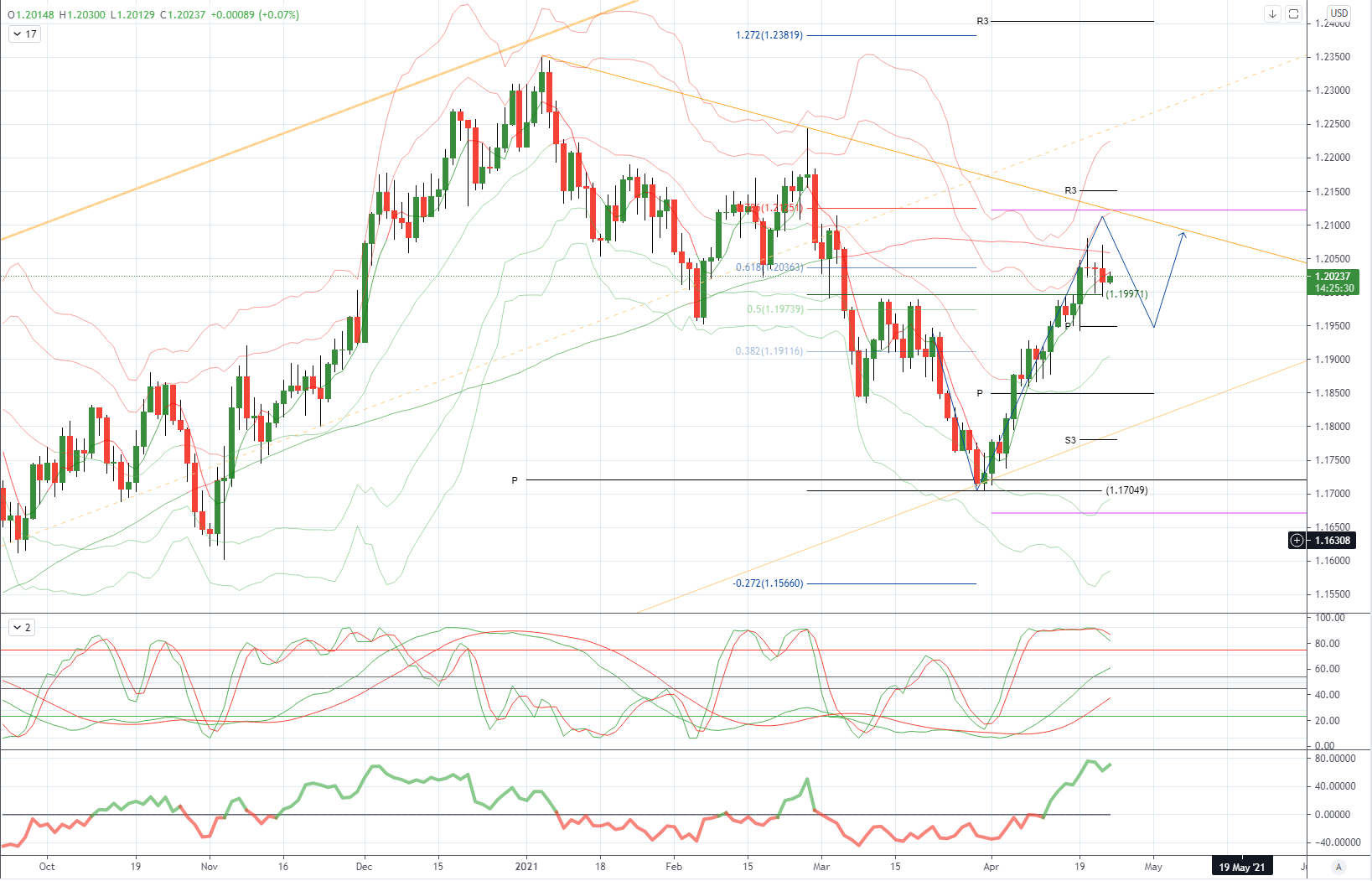

EURUSD Bias: Bearish below 1.1950 bullish above

EURUSD From a technical and trading perspective, the breach of 1.20 resistance opens a test of 1.2090/1.21, as 1.1950 supports look for a test of trendline resistance at 1.2125

Flow reports suggest topside offers start to increase on a move through the 1.2080 area before weak stops appear around the 1.2120 level and given the perchance of some banks to call a move to fade the Euro above the 1.2000 possibly starting to cause pain as option hedges go could see a squeeze higher and into the Feb ranges before seeing offers coming in above the 1.2150 level and increasing. Downside bids light through to the 1.1980 level with weak stops on a breakthrough to the medium congestive 1.1950 and therefore exposing the stronger bids 1.1900 level through to the 1.1880 and strong stops

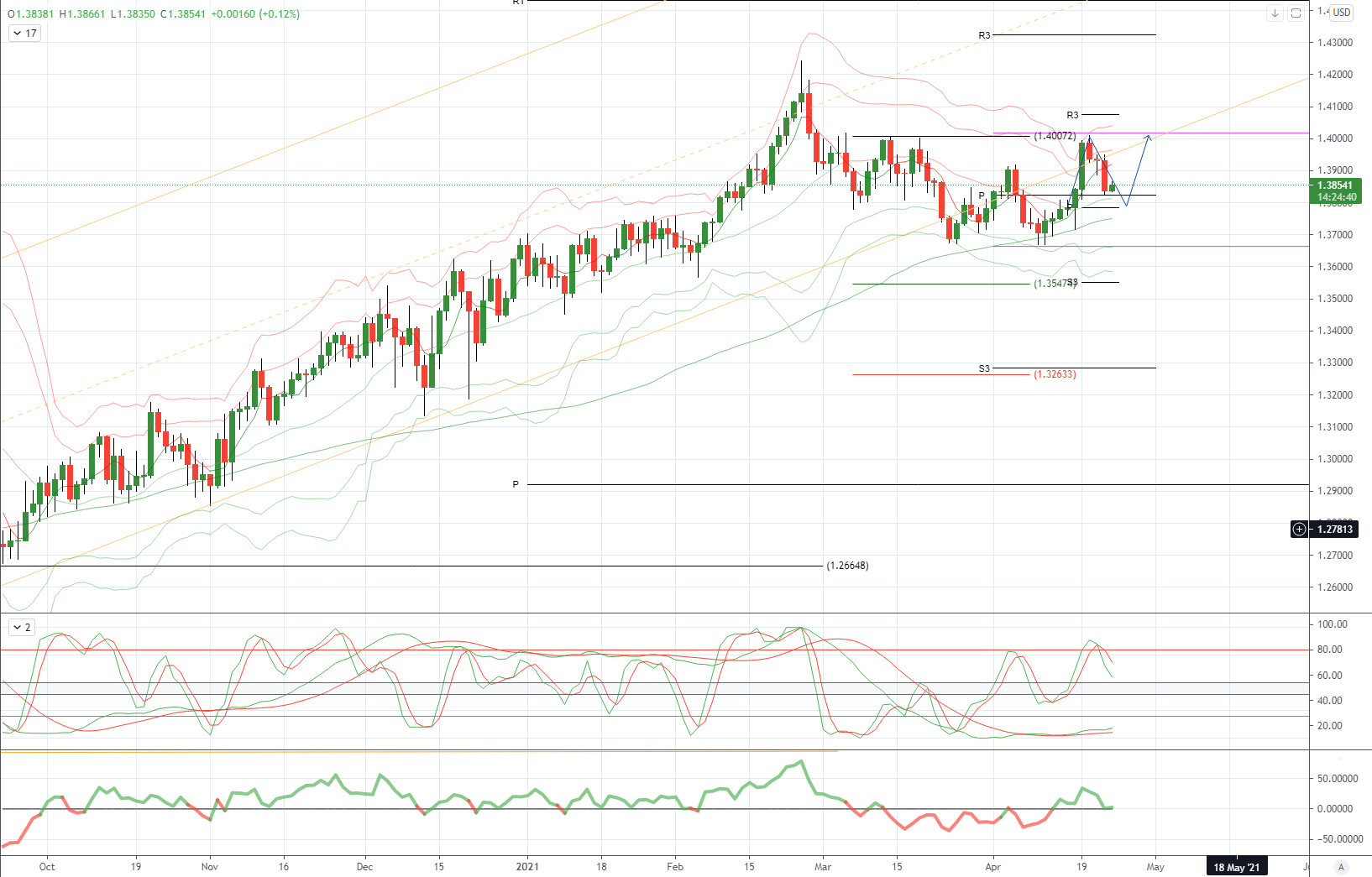

GBPUSD Bias: Bullish above 1.39 bearish below

GBPUSD From a technical and trading perspective, as 1.39 now acts as support bulls will target a test of prior cycle highs at 1.4240 UPDATE the downside breach of 1.39 opens another test of range support 1.3650/1.37

Flow reports suggest downside congestion into the 1.3800 level with that congestion lightening on a push through the 1.3780 area and then increasing through the 1.3760 area as the bids deepen from 1.3720-00 level weak stops likely on a move through the 1.3700 area however, late Mar and early Apr has shown that bids are likely to lurk just below the area with breakout stops likely to be below the 1.3650 level. Topside offers light through the 1.3900 level and open quickly for the moment to the 1.4000 level before stronger offers start to appear around the level, sentimental levels may have light offers however, they are still building having come off so quickly leaving the market filling gaps still.

USDJPY Bias: Bullish above 108 targeting 112

USDJPY From a technical and trading perspective, as the equality objective at 108 continues to attract demand bulls will look for a test of 112. A failure below 108 opens a test of the pivotal trendline support at 107.50

Flow reports suggest downside bids into the 107.80 however, a break through the level is likely to see weak stops and breakout stops appearing and the market free to quickly test 107.50 and an old trendline then nothing until closer to the 107.00 area where stronger bids start to appear but the downside opening to Feb levels, Topside offers appearing through the 108.80 level and increasing into the 109.00 level light offers until the 109.40 area is likely to see strong congestion increasing through to the 110.00 level before stronger stops are likely to appear

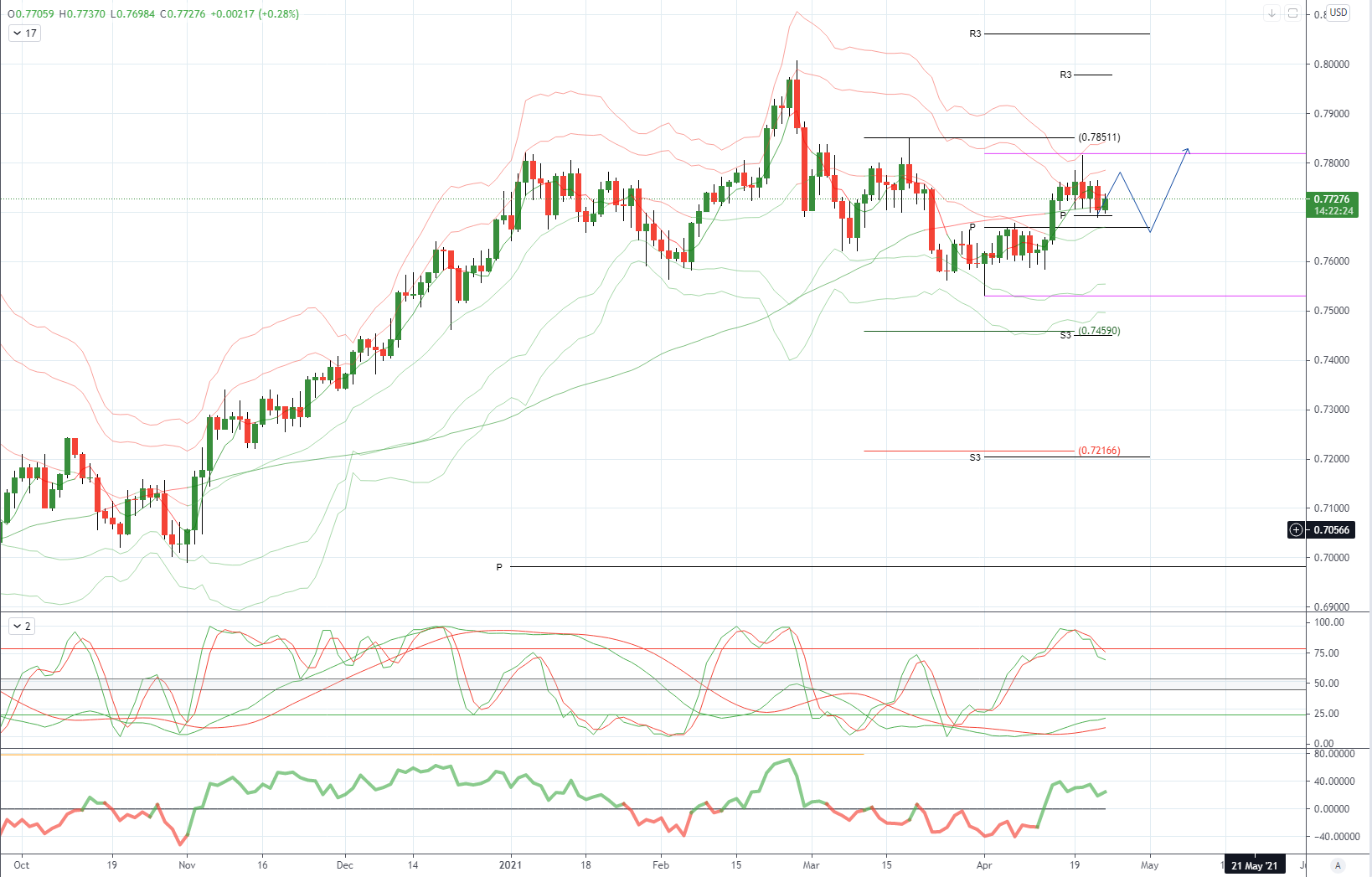

AUDUSD Bias: Bearish below .7700 bullish above

AUDUSD From a technical and trading perspective, the closing breach of .7730 has relieved downside pressure opening a move to test offers towards .7820

Flow reports suggest topside offers continue through the 0.7800 area with a break through the 0.7820 area likely to see weak stops and a test towards the sentimental 0.7850 area however, while there maybe some offers in the area the market Looks to be fairly open through to the 79 cents level and ultimately ranges from the end of Feb, downside bids light through the 0.7700 level with weak stops likely on a move through the 0.7680 before stronger bids around the 0.7650 area and continuing through to the 0.7600 likely increasing in size, any further moves are likely to see strong support into the 0.7550 to calm the situation,

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!