Daily Market Outlook, April 12, 2024

Daily Market Outlook, April 12, 2024

Munnelly’s Macro Minute…

“Data Dump Over, CB Speakers & Bank Earnings Eyed ”

Most Asian stock markets are experiencing a decline in trading on Friday, despite the positive performance of Wall Street on the previous day. This is due to concerns about the US Fed's interest rates and the release of producer price inflation data, which showed relatively mild results compared to the previous day's consumer price inflation data. Federal Reserve Bank of Boston president Susan Collins and New York Fed president John Williams stated that it might require additional time to build the confidence needed to start adjusting policy. After experiencing losses in the last two trading sessions, the Japanese stock market is showing significant gains in volatile trading on Friday, following the mostly positive trends from Wall Street the previous night. The benchmark Nikkei 225 is comfortably above the 39.7 handle, with increases in export and technology stocks as the Japanese yen fell to its lowest level in 34 years.

The UK's monthly GDP for February aligns closely with consensus forecasts, indicating a month-on-month rise of 0.1%, surpassing expectations that had anticipated no change. Furthermore, January's figures were revised upward from a 0.2% increase to a 0.3% increase. February saw a notable growth of 1.2% in manufacturing output, exceeding expectations, while construction output experienced a sharp decline of 1.9%. The service sector, which holds significant sway over the UK economy, saw a modest increase of 0.1%. These numbers suggest a return to positive growth in Q1, following a slight recession towards the end of the previous year. This performance is likely to outstrip the Bank of England's forecast, which projected a 0.1%q/q increase. Meanwhile, the much-anticipated report by former US Fed Chair Bernanke on the Bank of England's forecasting and related processes is set to be unveiled at midday. The focal point of this review is likely the role of forecasts in guiding policy decisions and enhancing communication. The objective seems to be reinforcing the Bank of England's core message on policy while addressing the challenge of communicating forecast uncertainties and the diverse viewpoints within the Monetary Policy Committee (MPC). Potential changes could encompass adjustments to economic forecast conditioning assumptions, such as the interest rate trajectory, and possibly replacing the fan chart with scenario analysis. While the Bernanke review isn't expected to alter the UK interest rate outlook significantly, improved communication could mitigate market volatility and lower risk premia. Overall, the review underscores the importance of transparent and effective communication in shaping market expectations and supporting monetary policy effectiveness.

The markets are anticipating potential indications of policy direction from officials of the European Central Bank such as Pablo Hernandez de Cos, Luis de Guindos, and Frank Elderson at various events throughout the day. Additionally, the Federal Reserve's Jeffrey Schmid, Raphael Bostic, and Mary Daly are also scheduled to speak. Currently, traders are predicting a cut in ECB rates in June, a potential easing by the Bank of England in August, and a reduction by the Federal Reserve in September. This shift in expectations is reflected in the currency market, with the dollar holding near multi-month highs against both the euro and sterling. Meanwhile, the yen remains close to a 34-year low against the dollar since Thursday, leading to renewed warnings about intervention from Japan's finance minister.

Stateside, starting today, corporate news will play a more significant role in determining the direction of the stock market, as major banks such as JPM, Wells Fargo, and Citigroup begin reporting their earnings. The upcoming University of Michigan consumer survey is poised to draw significant attention, particularly regarding its latest reading on US consumer sentiment and inflation expectations. Moreover, today's remarks from several Federal Reserve speakers will be closely monitored, especially in light of recent upside surprises in inflation. Market participants will be keen to gauge how policymakers interpret and respond to the evolving inflationary dynamics.

Overnight Newswire Updates of Note

Japan’s PM Kishida: Discussed Strengthening Supply Chains

Japan’s Suzuki: Weak Yen Has Pros And Cons

Japan's Industrial Output Down By 0.6% In February

New Zealand Manufacturing Suffers Longest Contraction Since 2009

Bank Of Korea Stands Pat, Keeping Guard Up Against Inflation

Iran Signals It Will Limit Response To Israel Attack To Avoid Escalation

Japanese Yen Bears Retain Control Near Multi-Decade Low

Treasuries Gain, Gold Hits Another Record On Data

Oil Rebounds As Mideast Tensions Persist, But Set For Weekly Loss

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0600 (681M), 1.0620 (257M), 1.0655-65 (382M)

1.0700 (3.43BLN), 1.0720-30 (1.7BLN), 1.0735 (280M)

1.0750 (1.7BLN), 1.0775-80 (1.18BLN), 1.0790-00 (1.25BLN)

1.0820-30 (953M

USD/CHF: 0.9150 (300M), 0.9200 (200M)

EUR/CHF: 0.9850 (656M)

GBP/USD: 1.2400 (594M), 1.2500 (640M) 1.2525 (260M)

1.2550 (202M), 1.2590-00 (1.04BLN), 1.2650 (644M)

AUD/USD: 0.6450 (676M), 0.6500-05 (1.44BLN), 0.6515-25 (1.5BLN)

0.6550 (592M)

NZD/USD: 0.6000 (339M), 0.6050 (400M)

USD/CAD: 1.3620 (319M), 1.3645-50 (733M), 1.3685 (943M)

1.3700-10 (536M), 1.3725 (812M)

USD/JPY: 151.00 (1.04BLN), 151.40-50 610M), 152.00 (1.03BLN

152.50-55 (459M), 152.70 (320M), 152.85-90 (512M)

153.00 (406M), 153.35 (520M)

Japan's Finance Minister Suzuki stated that the weak yen has both advantages and disadvantages, acknowledging the reality of a strong USD. He emphasized the negative effects of a weak yen, such as higher import prices and its impact on the economy. Suzuki also mentioned that rapid currency movements are undesirable and that they are closely monitoring the market. He did not rule out taking action to address disorderly FX movements and indicated that FX may be discussed at the next G20 meeting. However, he also noted that FX rates should reflect fundamentals. Fast Retailing's Yanai expressed concerns about the weak yen and called for intervention, as his company heavily relies on imported materials. Despite increasing calls for government action, the Ministry of Finance is currently hesitant to take a stance.

CFTC Data As Of 29/03/24

Bitcoin net long position is 160 contracts

Swiss Franc posts net short position of -22,370 contracts

British Pound net long position is 43,414 contracts

Euro net long position is 16,794 contracts

Japanese Yen net short position is -143,230 contracts

Equity fund managers cut S&P 500 CME net long position by 26,140 contracts to 930,132

Equity fund speculators trim S&P 500 CME net short position by 83,217 contracts to 365,684

Technical & Trade Views

SP500 Bullish Above Bearish Below 5220

Daily VWAP bearish

Weekly VWAP bullish

Above 5220 opens 5240

Primary resistance 5258

Primary objective is 5118

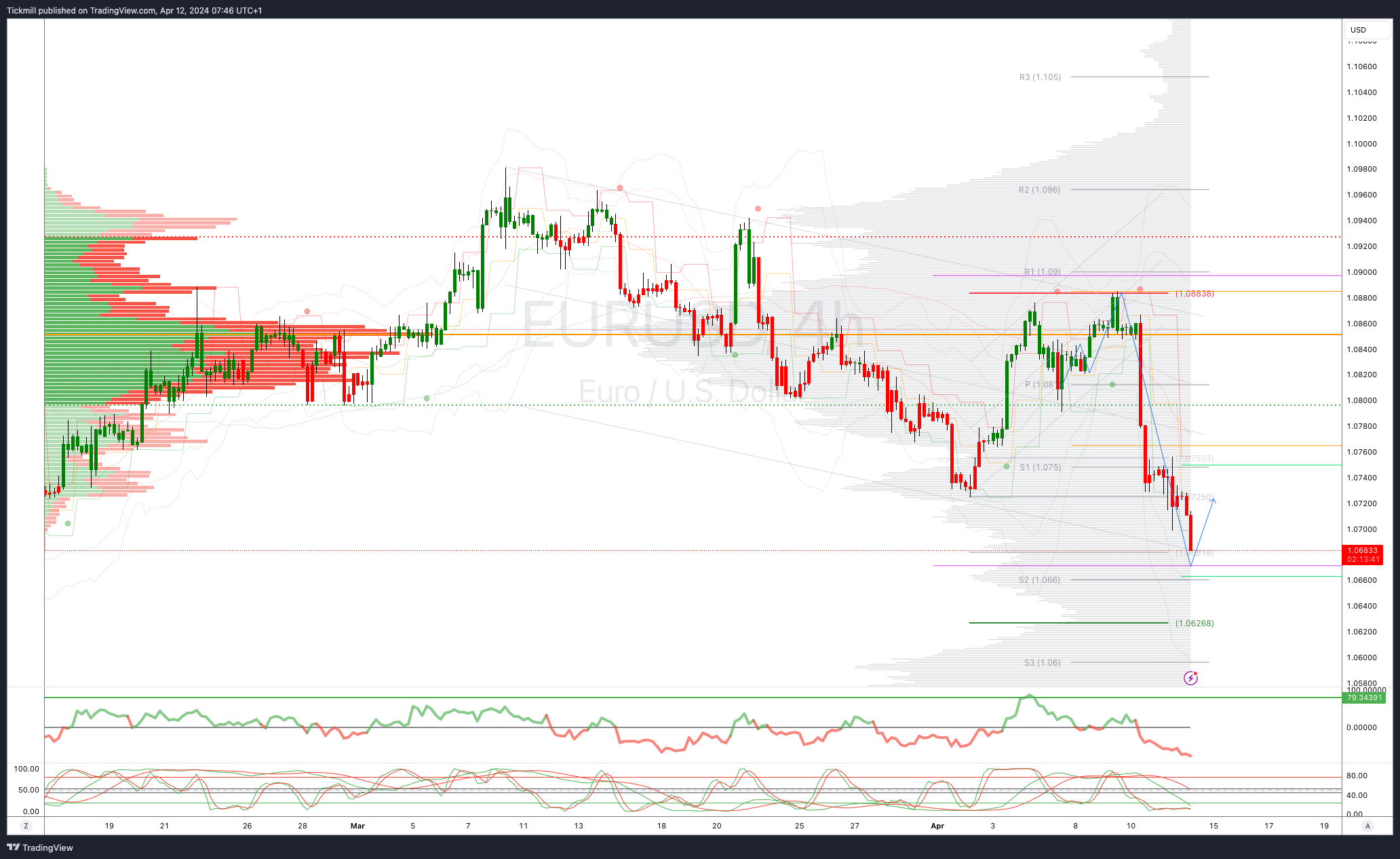

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bearish

Weekly VWAP bearish

Below 1.0690 opens 1.0630

Primary support 1.0690

Primary objective is 1.0685 - TARGET HIT NEW PATTERN EMERGING

GBPUSD Bullish Above Bearish Below 1.2620

Daily VWAP bearish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Primary support is 1.25

Primary objective 1.25

USDJPY Bullish Above Bearish Below 151.50

Daily VWAP bullish

Weekly VWAP bullish

Above 152 opens 153.50

Primary support 145.85

Primary objective is 153.50

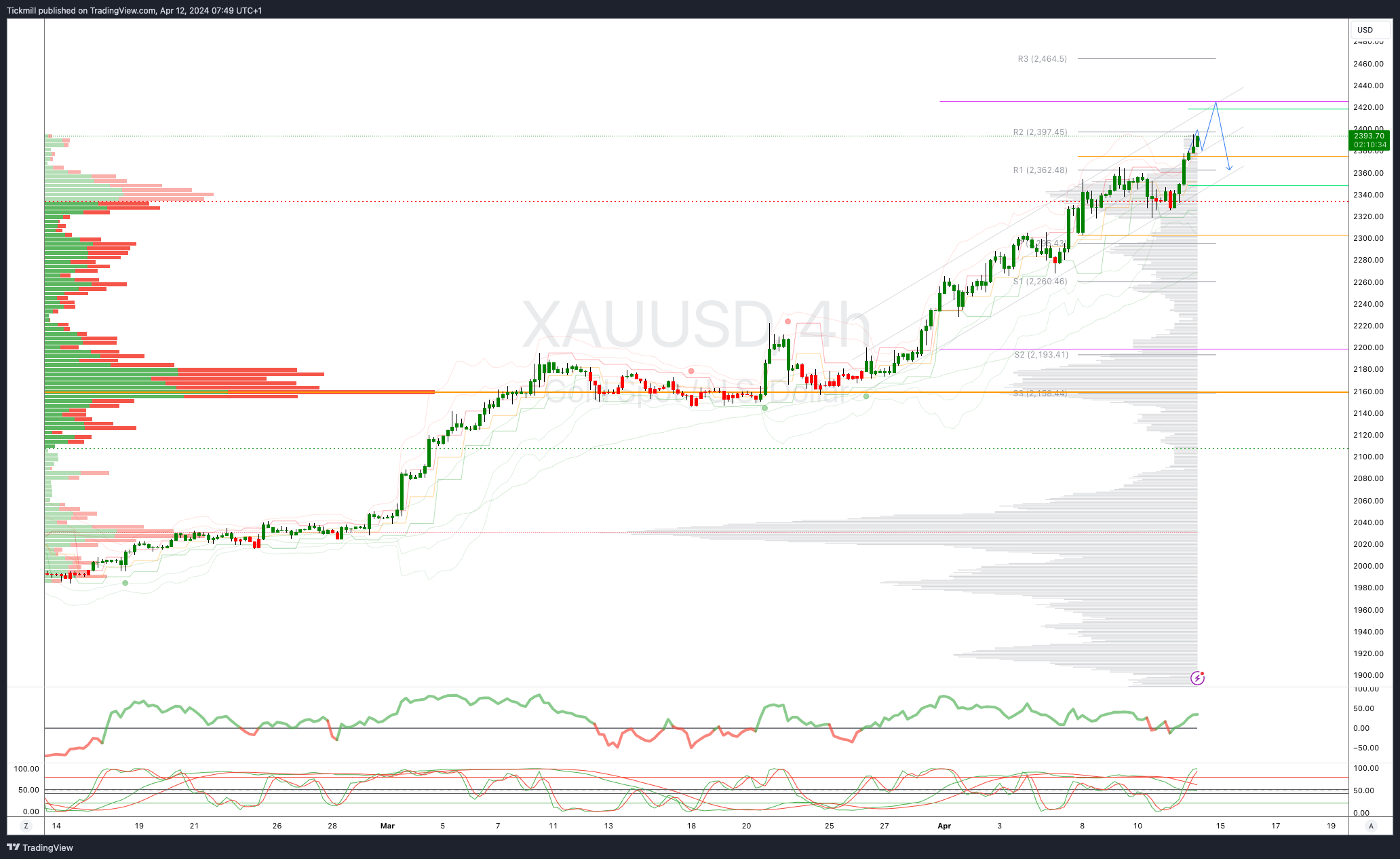

XAUUSD Bullish Above Bearish Below 2380

Daily VWAP bullish

Weekly VWAP bullish

Below 2380 opens 2330

Primary support 2300

Primary objective is 2430

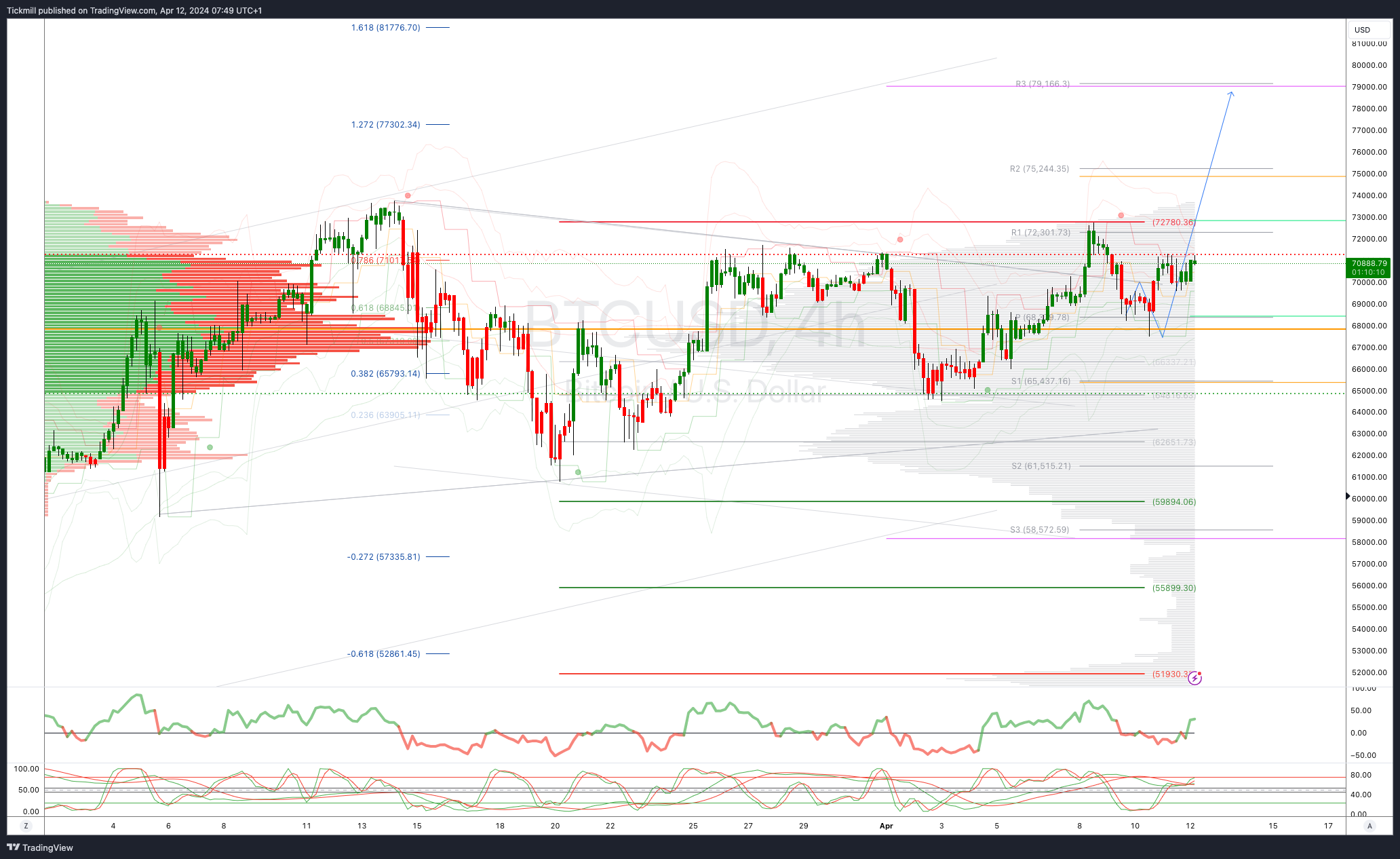

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bullish

Weekly VWAP bullish

Below 68000 opens 67250

Primary support is 63000

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!