Daily Market Outlook, April 11, 2024

Daily Market Outlook, April 11, 2024

Munnelly’s Macro Minute…

“US Inflation Aftershocks, USD Bid, Euro Traders Eye ECB ”

After receiving mostly negative signals from Wall Street on Wednesday, Asian stock markets are mostly trading down on Thursday. This comes as hopes for a quick interest rate cut by the US Fed diminish following the release of data showing a larger than anticipated rise in US consumer price inflation in March. The inflation data also led to a sharp increase in treasury yields. The Japanese market is experiencing a significant decline on Thursday, continuing the losses from the previous session. This is in response to the overall negative trends seen on Wall Street the previous night. The Nikkei 225 has dropped below the 39.4k handle, with declines in major index components and technology stocks being partially balanced by gains in financial stocks.

In the UK, the RICS survey shows continued growth in housing activity, with the headline price balance reaching its highest level since October 2022 for the sixth consecutive month. No further UK releases are scheduled until tomorrow's release of monthly GDP data, where a flat month-on-month outcome is expected for overall GDP in February. Despite this, a positive Q1 performance is likely, given January's 0.2% GDP growth, indicating a return to growth post a mild recession late last year. A scheduled address by Bank of England MPC member Greene will also be monitored by traders. Positioned on the more hawkish end of the MPC policy spectrum, Greene cautioned in the Financial Times today that rate cuts are not a done deal just yet.

Today's focus is on the European Central Bank's monetary policy update. It is expected that the interest rates will remain unchanged at 4.00% for the fifth consecutive meeting. There are no anticipated revisions to the economic forecasts during this session. Following the policy decision, the press conference will be monitored by Euro traders. In the Eurozone, headline CPI inflation dropped to 2.4% in March, the lowest since July 2021, while the core measure (excluding energy and food) reached a two-year low of 2.9%. President Lagarde may suggest a potential interest rate cut at the next meeting on June 6th, depending on sustained evidence of declining inflation, particularly in wage growth and service prices. Market attention will also focus on any indications of further policy easing in the latter half of the year, with three ECB rate cuts fully priced in by markets.

Stateside, the latest producer price inflation figures will provide insights into pipeline pressures. Expectations point towards above-consensus outcomes for today's data, including a 0.5% month-on-month increase for the headline measure incorporating energy. Market focus will also include speeches from several Fed policymakers in the aftermath of yesterday’s inflation print.

Overnight Newswire Updates of Note

US Warns Of Imminent Attack On Israeli Assets By Iran Or Proxies

China Consumer Prices Stall With Industry Stuck In Deflation

Japan's Top Currency Diplomat Kanda Says Recent Yen Moves Rapid

Japan's Suzuki Won't Rule Out Steps To Respond To Excessive FX Moves

BoE's Greene: UK Services Inflation Remains Much Higher Than In The US

UK Estate Agents Report Third Consecutive Monthly Rise In Demand

Yen Tumbles To 153 Against Dollar On US Inflation

Oil Prices Rise 1% As Traders Brace For Possible Iran Strike Against Israel

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0700 (2.53BLN), 1.0720-25 (607M), 1.0745-55 (1.7BLN)

1.0775-85 (1.03BLN), 1.0800-10 (2.63BLN), 1.0815-25 (2.0BLN)

1.0850-55 (1.0BLN), 1.0865 (1.54BLN)

USD/JPY: 151.00-05 (2.54BLN), 151.20 (373M), 151.50-60 (480M)

152.00-10 (2.0BLN), 152.50-55 (740M), 153.00 (505M)

USD/CHF: 0.9000-10 (460M), 0.9025 (340M), 0.9070 (249M)

0.9200 (240M). EUR/CHF: 0.9825-35 (273M)

GBP/USD: 1.2515-25 (860M), 1.2540-50 (564M), 1.2570-75 (600M)

1.2650 (397M), 1.2775 (350M)

AUD/USD: 0.6430 (940M), 0.6475-85 (768M), 0.6520-25 (400M)

0.6580-85 (520M), 0.6600 (590M), 0.6625-35 (765M)

NZD/USD: 0.5955 (1.42BLN), 0.6105 (2.94BLN), (588M)

USD/CAD: 1.3540-55 (1.08BLN), 1.3560-75 (588M)

1.3600-10 (807M), 1.3765 (567M)

AUD/JPY: 100.50 (351M)

The uncertainty surrounding U.S. interest rates will boost the dollar, as it is the highest yielding major currency and a secure place to hold cash while waiting for clearer signals on rate direction. Expectations for interest rates have fluctuated greatly in the past nine months, with initial beliefs in high rates lasting long, but now a projected gradual decrease starting in March 2023. Following the March CPI report, less than 50 basis points of easing is expected this year, with the first cut not anticipated until September. The view that rates would remain high for an extended period, as predicted last summer, has proven to be accurate, making the U.S. interest rate remaining above 5% throughout 2024 appealing. Dollar buyers are attracted to its liquidity and its status as the world's reserve currency, making it a safe haven in uncertain times. However, the main risk for dollar investors is the increasing speculation on its rise, which could lead to a sudden drop if there is intervention by the Bank of Japan.

CFTC Data As Of 29/03/24

Bitcoin net long position is 160 contracts

Swiss Franc posts net short position of -22,370 contracts

British Pound net long position is 43,414 contracts

Euro net long position is 16,794 contracts

Japanese Yen net short position is -143,230 contracts

Equity fund managers cut S&P 500 CME net long position by 26,140 contracts to 930,132

Equity fund speculators trim S&P 500 CME net short position by 83,217 contracts to 365,684

Technical & Trade Views

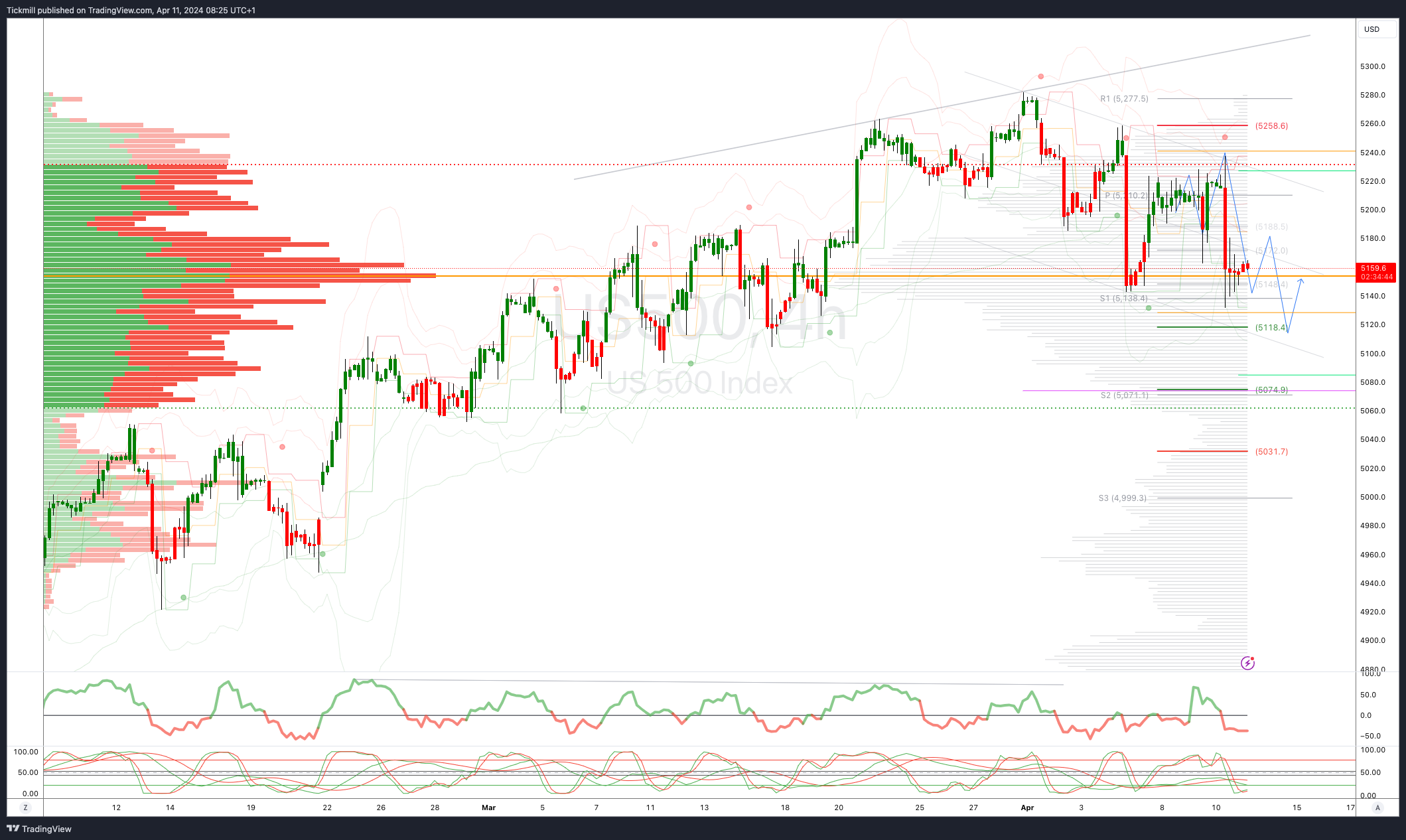

SP500 Bullish Above Bearish Below 5200

Daily VWAP bearish

Weekly VWAP bullish

Below 5140 opens 5118

Primary resistance 5230

Primary objective is 5118

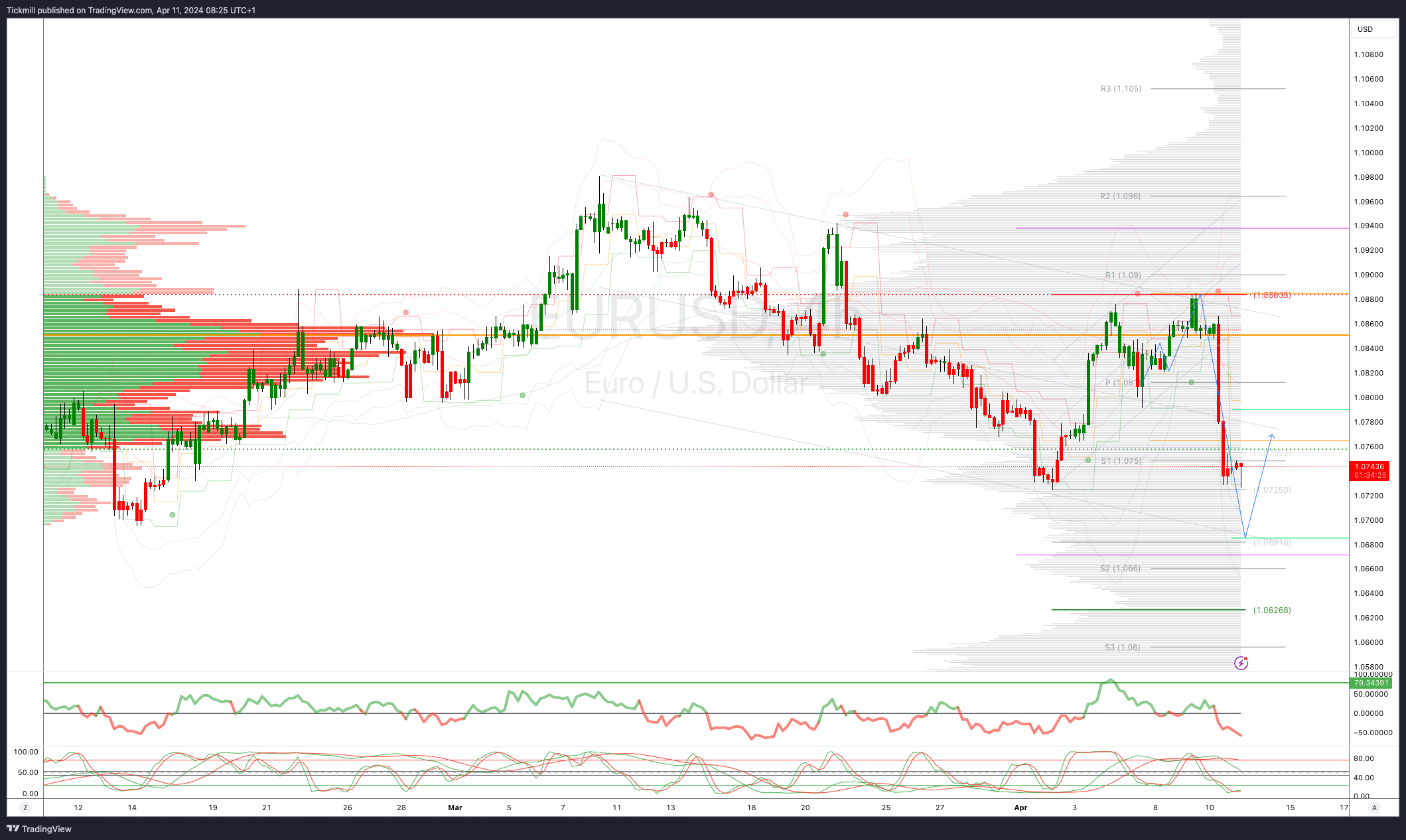

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bearish

Weekly VWAP bearish

Below 1.0690 opens 1.0630

Primary support 1.0690

Primary objective is 1.0685

GBPUSD Bullish Above Bearish Below 1.2620

Daily VWAP bullish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Primary support is 1.25

Primary objective 1.25

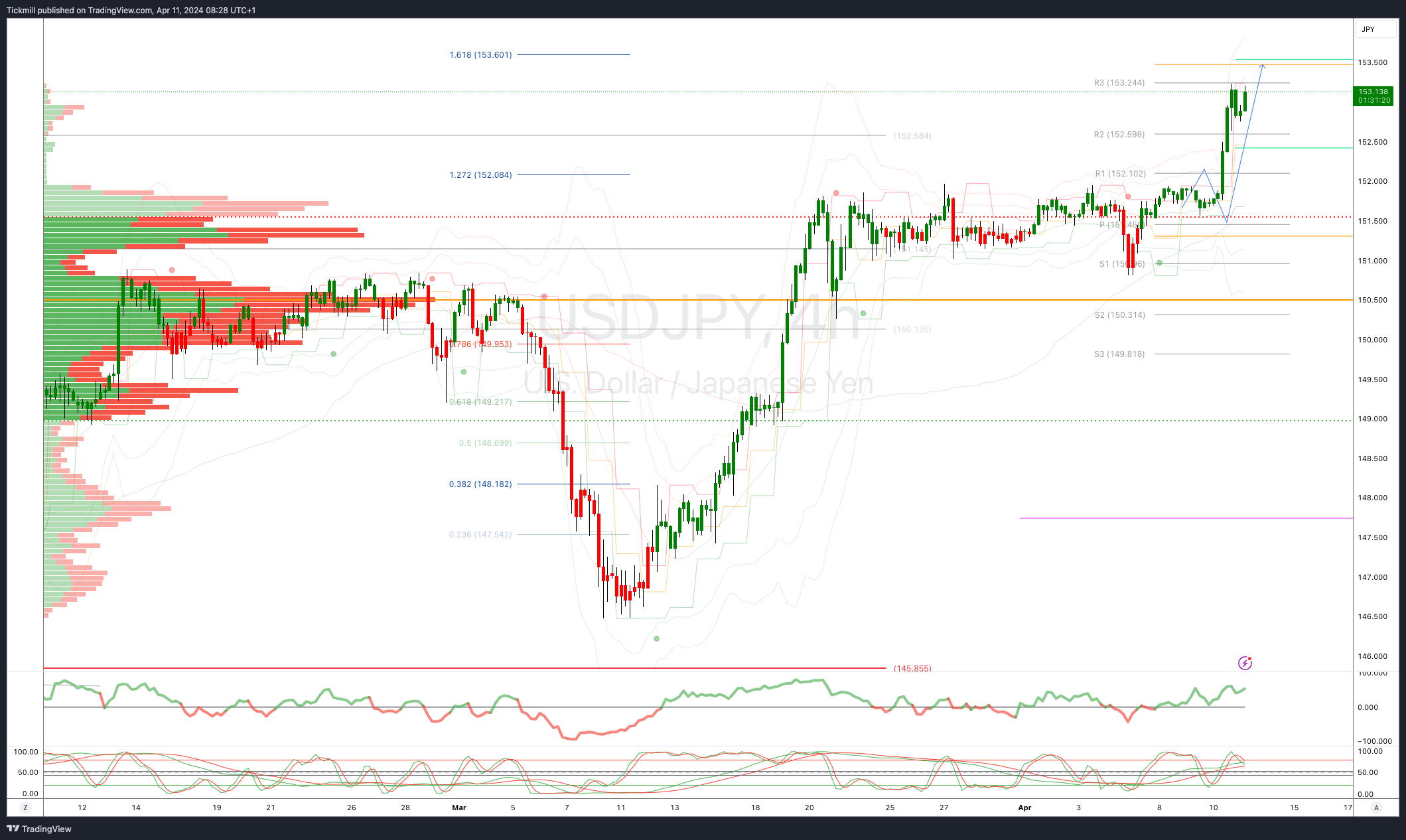

USDJPY Bullish Above Bearish Below 151.50

Daily VWAP bullish

Weekly VWAP bullish

Above 152 opens 153.50

Primary support 145.85

Primary objective is 153.50

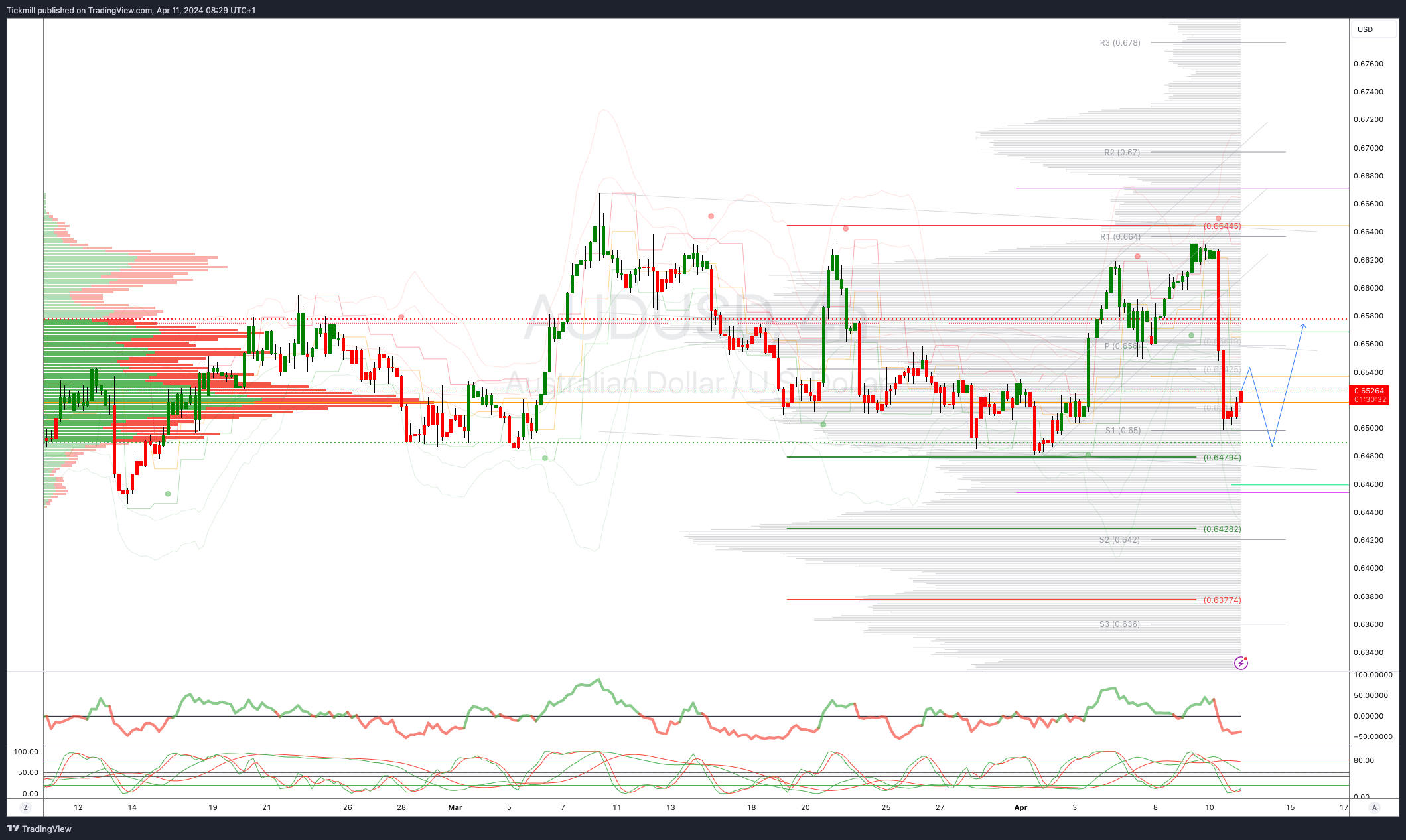

AUDUSD Bullish Above Bearish Below .6600

Daily VWAP bullish

Weekly VWAP bearish

Below .6580 opens .6520

Primary support .6477

Primary objective is .6700

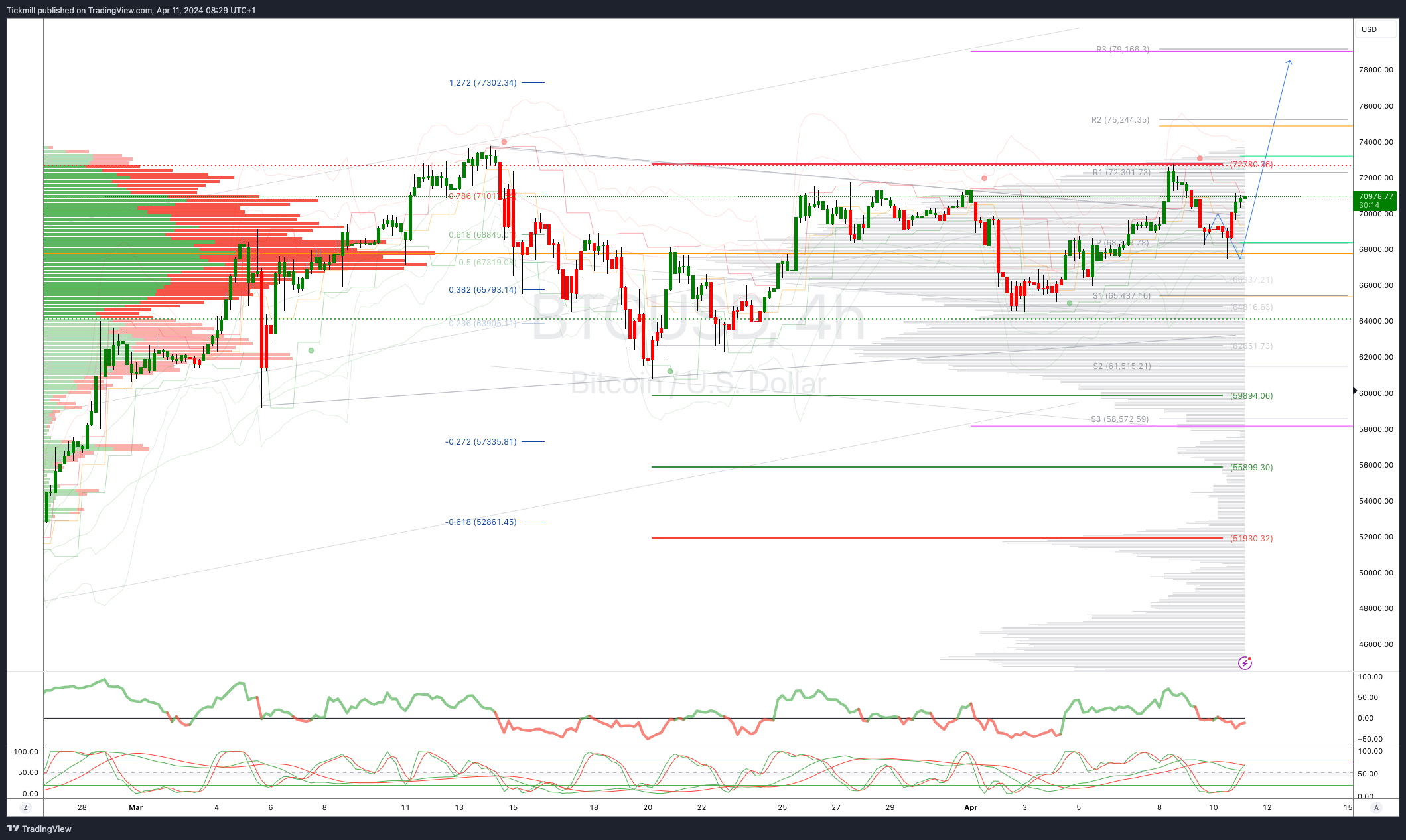

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bearish

Weekly VWAP bullish

Below 68000 opens 67250

Primary support is 63000

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!