Daily Market Outlook, 3 November, 2020

Daily Market Outlook, November 3, 2020

Risk sentiment was positive ahead of the US elections, supported by yesterday’s strong US ISM manufacturing report. Still, markets remain wary of a contested election result which could lead to significant market volatility. The Reserve Bank of Australia overnight cut the cash rate to 0.1% and announced $A100bn of QE.

The US gives its verdict on President Trump today. National opinion polls which give Joe Biden, the Democratic candidate, a big lead, and suggest that Trump will be defeated. Despite that, there are still doubts given that the polls were so wrong in in 2016, and because the vote looks very close in some crucial swing states. However, Biden is the clear favourite and a win for him is the result that markets are expecting.

The outcome would normally be known by early Wednesday UK time (in 2016 it was called at about 7.30am). However, this time it may take longer and markets could be left in limbo for several days particularly if the loser disputes the result.

Congressional elections that are taking place at the same time are also important. The Democrats currently control the House of Representatives and the Republicans the Senate. The Democrats are almost certain to retain the House. They need a swing of 4 seats to win the Senate and the consensus is that they will probably achieve this, but that it is a close call. If they win both houses as well as the Presidency then Biden will be in a strong position to enact his agenda. Republican retention of the Senate will make life much more difficult. A key near-term priority, whoever wins, will be to sort out a fiscal stimulus package. Republicans and Democrats have failed to reach an agreement on measures ahead of the election, but markets are expecting some action afterwards. However, that does leave room for disappointment, whoever wins.

President Trump has promised an early package but he will still have to get that through a Congress partly controlled by the Democrats. Biden will be in a stronger position to eventually pass a bill if the Democrats also win the Senate. However, he will not actually enter office until January and, in the meantime, uncertainty around further fiscal support may remain.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1590-1.1600 (720M), 1.1650 (622M), 1.1700 (236M), 1.1725 (585M), 1.1740-50 (440M

- GBPUSD: 1.2850 (684M), 1.3000 (456M), 1.3100 (630M)

- USDJPY: 104.50-55 (550M), 104.70 (220M), 105.00 (425M), 105.50 (1.1BLN)

- AUDUSD: 0.7000 (705M), 0.7035 (373M), 0.7055 (462M)

Technical & Trade Views

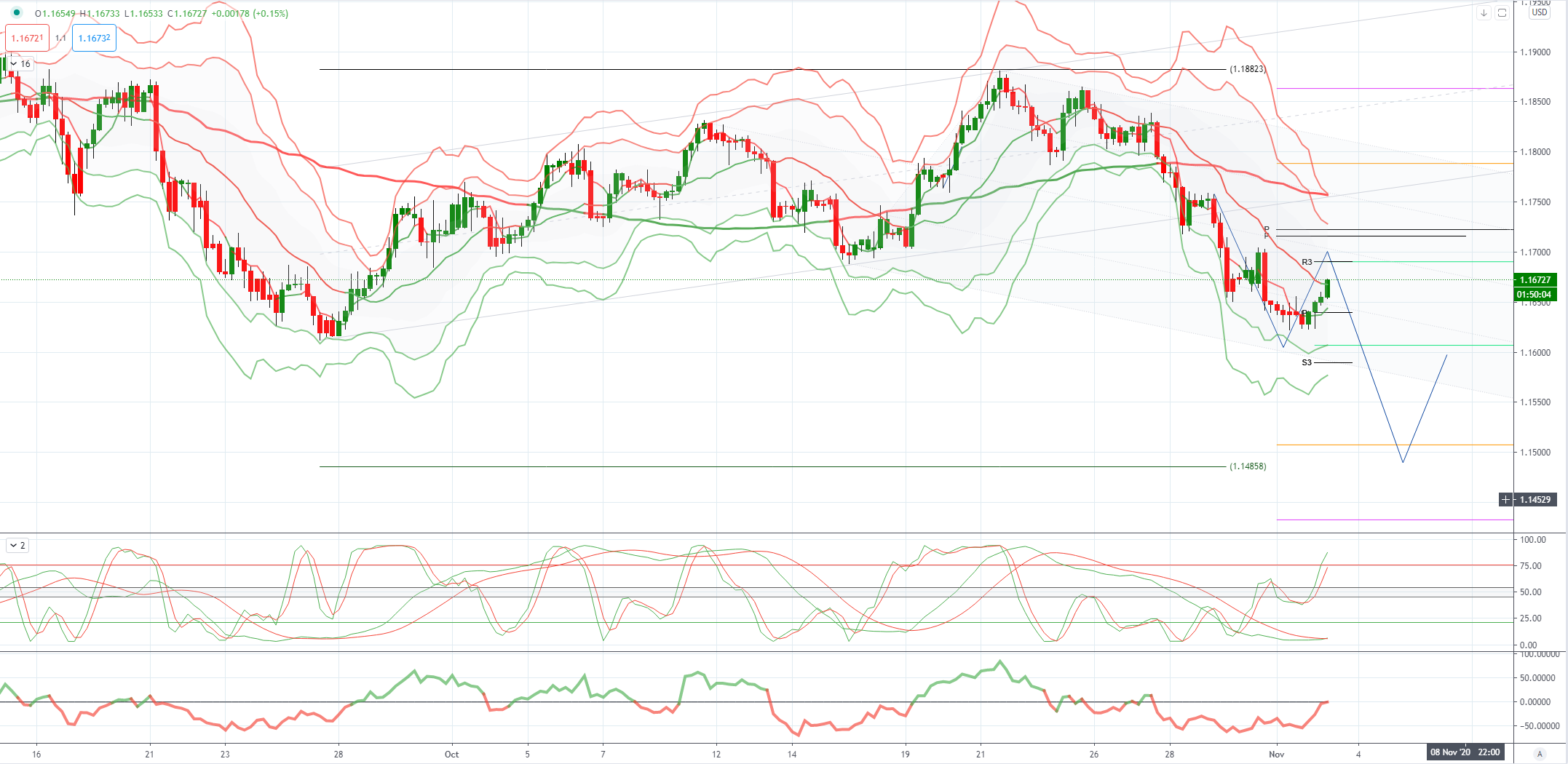

EURUSD Bias: Bullish above 1.1780 bearish below targeting 1.15

EURUSD From a technical and trading perspective, the failure to hold 1.1687 lows opens quick move to test 1.1610 as 1.1780 contains upside attempts look for a test of the pivotal 1.15

Flow reports suggest topside offers light through to the 1.1750 area with weak stops likely on a push through the 1.1760 area before running into further light stops from the 1.1780-1.1820 area with stronger stops above the level, downside bids light through to the 1.1650 area where strong bids are likely to be present with the market likely containing further buyers through to the 1.1600-20 area, weak stops likely on a break of the 1.1580 area with some mild breakout stops likely to appear however, downside bids then start to improve and the market has to be concerned with Virus runs in other countries not just Europe.

GBPUSD Bias: Bullish above 1.2861 targeting 1.3266

GBPUSD From a technical and trading perspective, while 1.2950 attracts sufficient bids look for a test of primary equality objective at 1.3264 UPDATE a failure to find sufficient bids ahead of 1.2850 opens a test of 1.27 next

Flow reports suggest downside bids light through to the 1.2900 area where stronger bids remain, with weak stops likely through the level and opening the downside only to the 1.2850 where stronger bids are likely to move through and the support growing for the moment at each sentimental level. Topside offers light through to the 1.3100 level before limited offers move in, only once the market tests towards the 1.3200 level do the offers increase with strong stops suspected through the level

USDJPY Bias: Bearish below 104.30 bullish above

USDJPY From a technical and trading perspective, as 104.30 supports look for a test of descending trendline resistance at 105.50

Flow reports suggest downside bids strengthen into the 104.20-00 level with possibly bottom pickers appearing below the figure level however weak stops through the 103.80 area could see a quick stab lower through to the 102.00 level before bids start to reappear. Topside offers light on a push through the 105.00 level with limited offers into the 105.80-106.20 area and the possibility of congestion then continuing through to the 106.40-80 area. And stronger offers thereafter

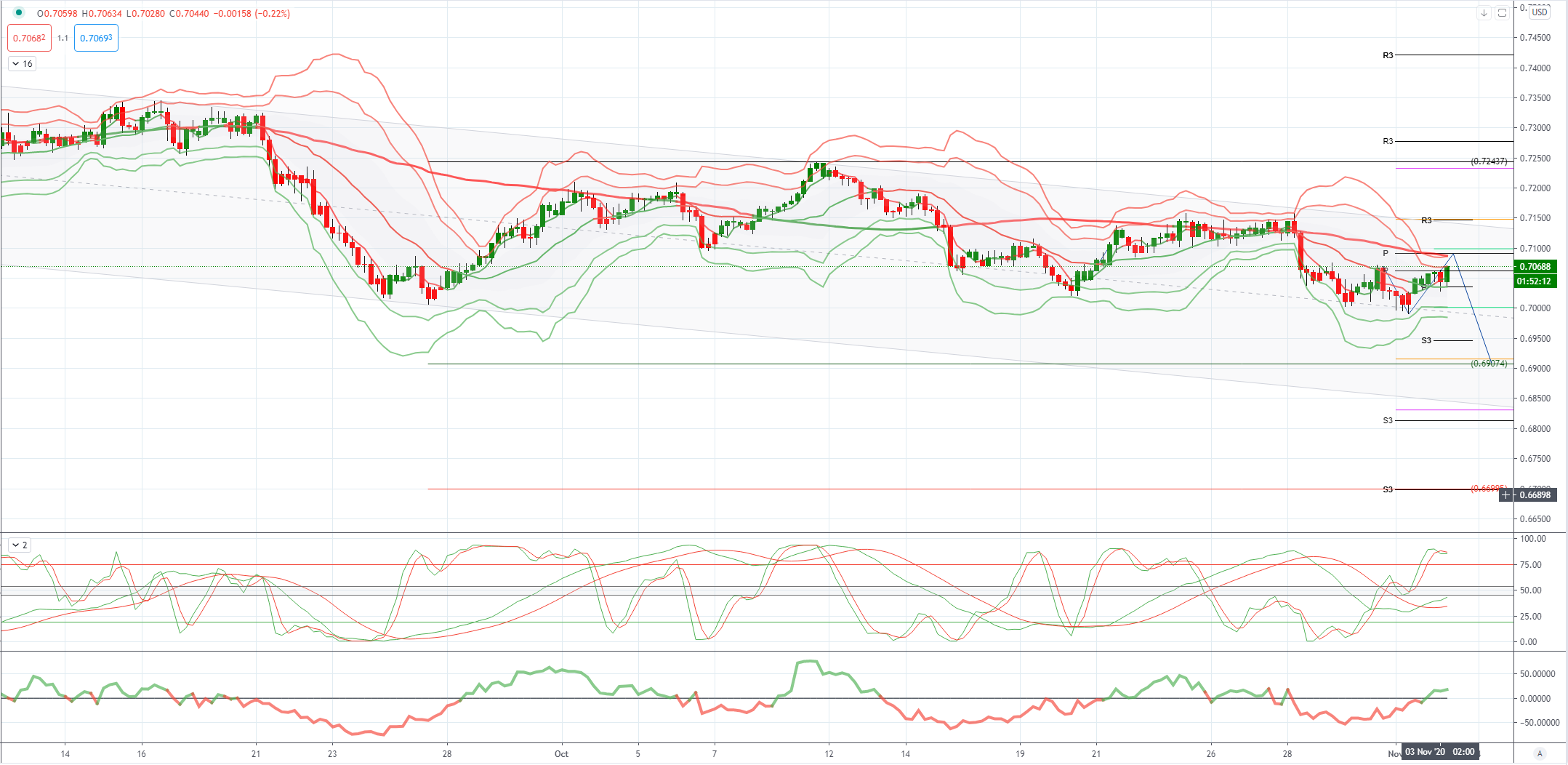

AUDUSD Bias: Bearish below .7243 targeting .6907

AUDUSD From a technical and trading perspective, as .7170 caps upside attempts look for decline to resume to expose bids and stops towards .6900

Flow reports suggest topside offers into the 0.7140-60 area unchanged before some light weakness appears however, 0.7180-0.7200 area sees stronger offers and 0.7220 level likely to see some congestion with stop losses through the level to open a quick move to stronger offers around the 0.7250 area. Downside bids light through to the 0.7060-40 area with stronger bids likely to appear on any move to test the 0.70000 areas, while there may be some weak stops on a move through the 0.6980 area the market is likely to see plenty of congestion into the 0.6950 area and increasing bids beyond

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!