Daily Market Outlook, 20 November, 2023

Daily Market Outlook, November 20, 2023

Munnelly’s Market Commentary…

Asia - Most Asia-Pacific stocks were positive, but gains were limited due to a lack of fresh catalysts over the weekend. Investors are waiting for key risk events this week, including the release of FOMC minutes on Tuesday. Nikkei 225 swung between gains and losses, reaching its highest level since 1990 before wiping out all gains. Hang Seng and Shanghai Comp outperformed due to resilience in tech and support pledges for the property sector. China's latest benchmark loan rates were maintained.

Europe - The previous week saw a positive change in market dynamics as optimism grew about the possibility of early interest rate cuts in the UK, US, and Eurozone. The unexpected decrease in October CPI inflation in both the UK and US boosted market sentiment in the first half of the week. Later on, an increase in US unemployment claims raised hopes that the slowdown in US economic growth could lead to interest rate reductions by the Federal Reserve in the near future. As a result, the market now predicts that the first US rate cut will likely happen by May, with March also being a significant possibility. Currently, market expectations include around 100 basis points of cuts in 2024. Similarly, in the UK, there is now a probability of over 50% for a rate cut by early May, and a March cut is seen as a possibility with about a 20% chance. In the Eurozone, there is an increased expectation of at least one rate cut by April, with a 50% probability. Today, market participants will closely watch for comments from various central bank speakers to gain more insights into the future of interest rates. ECB members Vujcic, de Cos, and Villeroy are scheduled to speak separately throughout the day. However, there is heightened attention on Bank of England Governor Andrew Bailey's evening speech as he delivers the Henry Plumb memorial lecture in London (18:45 GMT). Despite recent discussions, Bailey has emphasised that it is too early to start discussing interest rate cuts.

US - Stateside, On Friday, US stocks ended the day with minimal changes as the market experienced difficulty in finding a clear direction. Meanwhile, Treasuries showed a mix of results, with a bear flattening trend observed following the release of higher-than-anticipated US Housing Starts and Building Permits data, along with some hawkish comments from Federal Reserve officials. The Federal Reserve's meeting minutes are the main event in a quiet week for important economic data, as the US prepares for Thanksgiving on Thursday. Investors will examine the minutes for confirmation that the Fed has finished raising interest rates, after recent expectations of a more cautious approach following weaker-than-anticipated US CPI figures. The only significant US data releases this week are existing home sales, durable goods and University of Michigan consumer sentiment. Additionally, the S&P Global flash November PMIs will be published.

FX Positioning & Sentiment

The most recent data from the Commodity Futures Trading Commission (CFTC) reveals that the net short position on the British Pound (GBP) has surged to its highest level since January. In the week ending November 14, there was a notable increase in net GBP shorts, reaching 27,730 contracts. This marks the eleventh week out of the last twelve in which bearish GBP bets have been on the rise. The current net short position is the largest since January, when it reached 16,252 in the week ending November 7. Notably, there has been a significant shift in market sentiment toward the GBP, as prior to this period, speculative investors had a net long position on the currency from mid-April to early October. The reversal in sentiment suggests a growing bearish outlook on the British Pound.

CFTC Data As Of 17-11-23

USD net long up as JPY sales trump EUR buys, in Nov 8-14 period, $IDX -1.42%

Specs broadly long feeling pain as USD slips in new period on lwr Fed view

EUR$ 1.69%, specs +19,851 contracts now +108,907 on lwr Fed rate view

$JPY +0.01%, specs -26,209 contracts, now -130,249 contracts; pair lower

GBP$ +1.63% in period, specs -11,478 contracts now -11,478 contracts

AUD$ (+1.11%), $CAD (-0.53%) saw specs sell into strength

BTC +0.27%, specs +333 contracts now -1,344; specs sell near BTC 2023 highs (RTRS)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0850-55 (1BLN), 1.0880-90 (520M), 1.0900-10 (1.1BLN)

1.0930 (643M)

USD/CHF: 0.8900 (701M). GBP/USD: 1.2400 (254M) , 1.2515-25 (269M)

EUR/GBP: 0.8730 (300M)

AUD/USD: 0.6500-10 (1.1BLN), 0.6550 (508M)

NZD/USD: 0.5925 (682M), 0.6050 (563M)

AUD/NZD: 1.0800 (324M), 1.0900 (550M)

USD/CAD: 1.3550 (1BLN), 1.3630 (330M), 1.3825 (1BLN)

USD/JPY: 149.25-35 (1BLN), 150.00 (1.2BLN), 150.60 (480M), 152.00 (521M)

Overnight Newswire Updates of Note

PBoC Leaves Loan Prime Rates Unchanged, As Expected

NZ PM-Elect Luxon: Policy Pact Reached With NZ First & ACT Parties

Japan FinMin Suzuki: Bright Signs Emerging In Japan's Economy

Japan PM Kishida’s Support Hits New Lows In Three Major Polls

Trump Pledges To Undo Biden Administration Plan For Asia Trade Deal

UK's Hunt Warns Against Fuelling Infl After Downplaying Income Tax Cuts

Italy's Ratings Affirmed At Baa3, Outlook Changed To Stable From Negative

Portugal's Ratings Upgraded To A3 And Outlook Changed To Stable

Javier Milei Wins Argentine Presidency; Bitcoin Gains Nearly 3%

Oil Ticks Higher After Two-Day Swing As OPEC+ Countdown Begins

US Confident Arab States Will Not Weaponise Oil, Says Biden Adviser

Emmett Shear Becomes Interim OpenAI CEO As Altman Talks Break Down

Microsoft Eyes Seat On OpenAI’s Revamped Board

Germany, France And Italy Reach Agreement On Future AI Regulation

Tesla Beats Lawsuit Claiming It Monopolizes Repairs, Parts

Cruise CEO Kyle Vogt Resigns From GM-Owned Robotaxi Unit

Bayer Told To Pay $1.56 Bln After Losing Roundup Case

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4470

Below 4400 opens 4370

Primary support 4420

Primary objective is 4540

20 Day VWAP bullish, 5 Day VWAP bullish

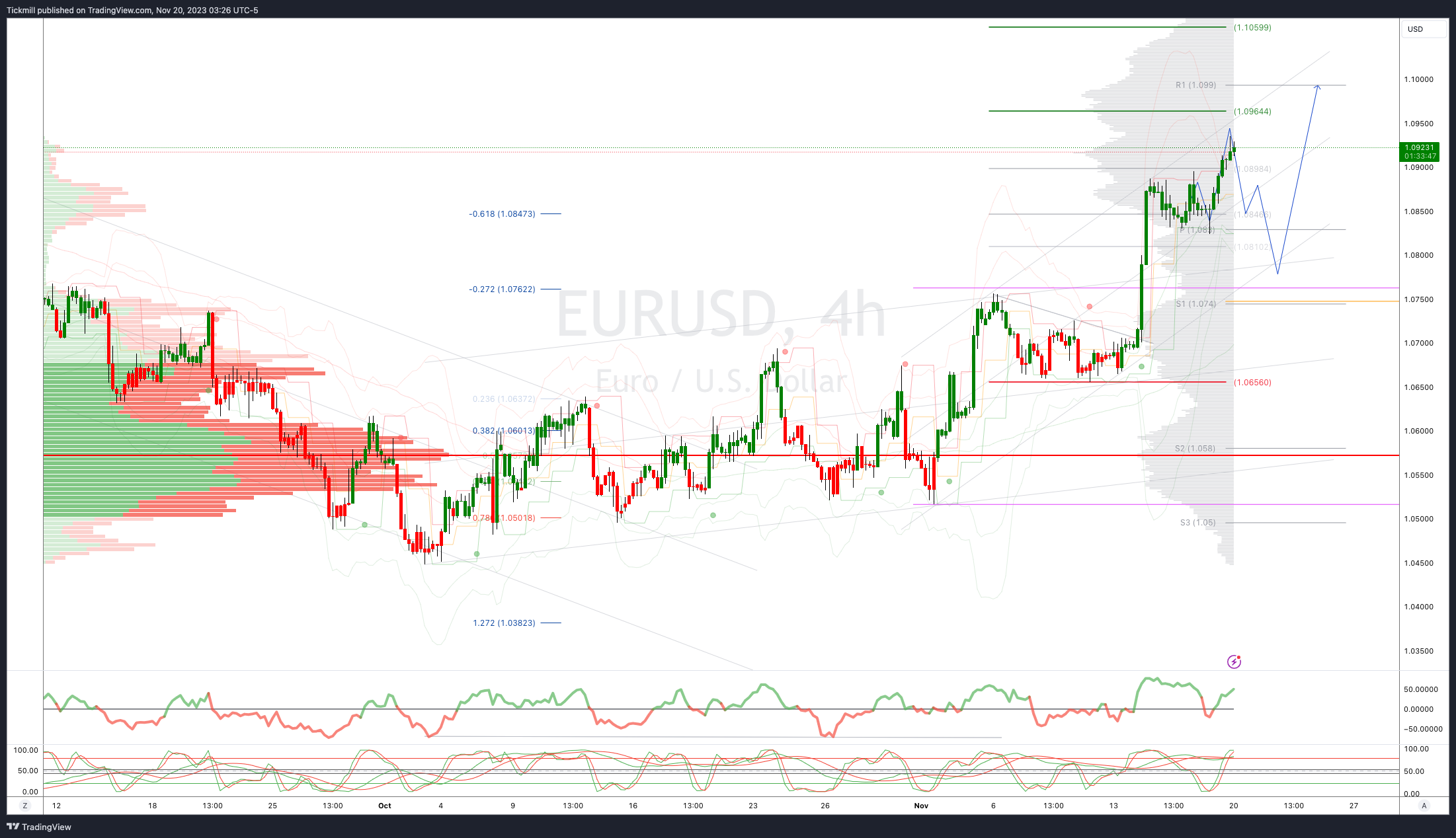

EURUSD Bias: Bullish Above Bearish Below 1.08

Below 1.0650 opens 1.0550

Primary support 1.0650

Primary objective is 1.0964

20 Day VWAP bullish, 5 Day VWAP bullish

GBPUSD Bias: Bullish Above Bearish Below 1.2430

Below 1.24 opens 1.2350

Primary support is 1.2185

Primary objective 1.2570

20 Day VWAP bearish, 5 Day VWAP bullish

USDJPY Bias: Bullish Above Bearish Below 150

Below 149 opens 148.30

Primary support 147.30

Primary objective is 152.50

20 Day VWAP bullish, 5 Day VWAP bearish

AUDUSD Bias: Bullish Above Bearish Below .6450

Below .6290 opens .6250

Primary support .6330

Primary objective is .6590

20 Day VWAP bearish, 5 Day VWAP bullish

BTCUSD Bias: Bullish Above Bearish below 34000

Below 33600 opens 32400

Primary support is 30000

Primary objective is 37000

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!