Asian equity market is lower on Monday alongside U.S. and European futures. Futures on the S&P 500 slid over 3% at one point, and European contracts were down more than 2%. Japanese, Australian and Hong Kong stocks also slumped, with South Korea slipping 4% plus. Elsewhere, China’s economy continued to recover in May, with accelerating industrial output growth leading the way while consumption remains in contraction.

The dollar climbed along with the yen as the risk-off sentiment is dominating the market. Crude oil crumbled. The moves suggested the stabilization on Wall Street Friday in wake of a near 6% stock slide may be temporary. More than 20 U.S. states are seeing a pick-up in cases, Tokyo reported a jump over the weekend and a fresh outbreak in Beijing prompted officials to close a market there. The risk-on sentiment is getting worse as the equity futures tumbled in the afternoon of Asia trading time.

Copper prices tumbled lower on Monday driven by concerns over a second wave of the Covid-19 spread in China. After weeks of near zero new COVID-19 infections, we are seeing dozens of new cases surged in Beijing as they battle the outbreak linked to a major wholesale food market. In line with our fundamentals, price is facing bearish pressure from our resistance as well.

Gold traded sideways as demand for the safe haven metal is countered by the downward pressure in prices due to the dollar’s strength, with a second wave of risk aversion flooding back into markets. In terms of its technical outlook, price is also facing bearish pressure from our descending trend line as well.

Oil prices dipped further as reports of fresh coronavirus outbreak in Beijing, China and more cases elsewhere starts surfacing. This second wave of infection looks to further threaten nascent economic recovery. In line with the dip in oil prices, CAD weakened further against the USD. The USDCAD thus looks to rise even higher.

Technical & Trade views

USDCAD (Intraday bias: bullish above 1.3729)

We turned bullish as price is approaching our upside confirmation where the 50% fibonacci retracement is. If price could close above upside confirmation, it will open up bigger upside from there. Ichimoku cloud is showing bullish momentum.

UKOIL (Intraday bias: bearish below 38.13)

Price currently holding below long term moving average. MACD indicator also below 0 well within bearish territory and looks poised to go lower. A break below downside confirmation at 36.99 should see a much bigger drop towards 1st support at 34.44. As long as price holds below 1st resistance at 38.13, bearish bias is intact.

XAUUSD ( Intraday bias: Bearish below 1738.917)

Price is facing bearish pressure from our first resistance, in line with our descending trend line, 61.8% Fibonacci extension and 88.6% fibonacci retracement where we could see a further drop to our first support level, in line with our 61.8% fibonacci retracement and horizontal overlap support. Stochastic is approaching our resistance as well, where we could see a reversal below this level.

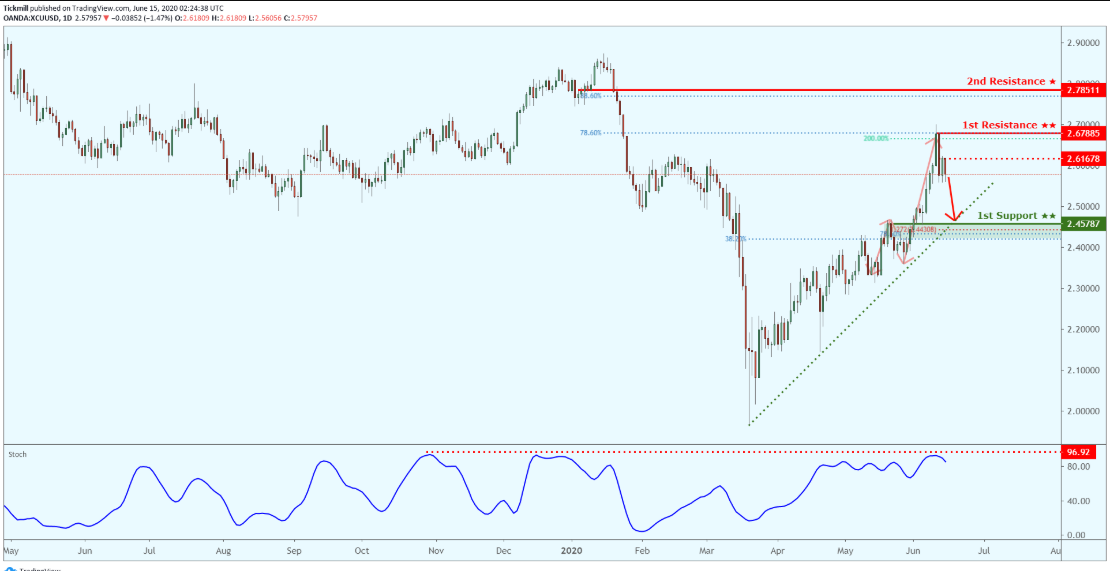

XCUUSD ( Intraday bias: bearish below 2.61678)

Price reversed nicely from our first resistance, in line with our 200% fibonacci extension, 78.6% fibonacci retracement previously. Current price is holding below our intermediate resistance at 2.61678, where we remain bearish below this level and could see a further drop to our first support level. Stochastic is facing bearish pressure from our resistance as well.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Desmond Leong runs an award-winning research firm (The Technical Analyst finalists 2018/19/20 for Best FX and Equity Research) advising banks, brokers and hedge funds. Backed by a team of CFA, CMT, CFTe accredited traders, he takes on the market daily using a combination of technical and fundamental analysis.