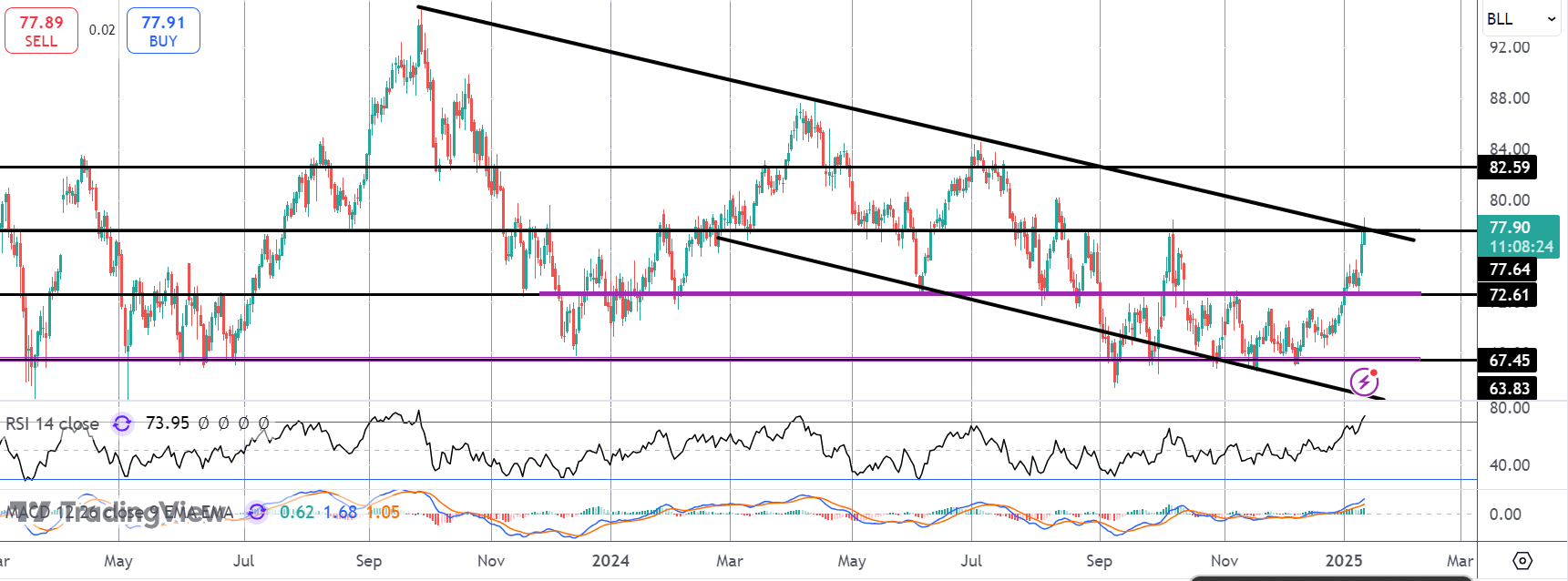

Crude Testing Major Breakout Level

.png)

Crude Rally Continues

Crude oil has become the market to watch at the start of 2025. A surge in futures prices in January has seen the market breaking out to levels not seen since August 2024. CL is now up around 16% from the December lows and is currently testing the bear channel highs, a crucial pivot for the market. The driver behind the rally in crude looks to be a shift in supply/demand expectations for the year ahead.

Russian Sanctions Impact

This week, news of fresh US sanctions on Russian oil, aimed at limited supply to top consumers China and India, has rocked the market. Broader sanctions against specific Russian suppliers and specific Russian ships are expected to have a significant impact on Russian output with China and India to turn increasingly to the Middle East for their supply. In a sign of how impactful these new sanctions are, Chinese refiners have held emergency meetings while Indian refiners are citing the potential for months of disruption ahead.

Banks Raising Price Targets

In reaction to these latest developments, Goldman Sachs has issued a note this week revising its near-term crude price forecasts higher. The US IB now cites strong upside risks to its near-term $70 - $85 range. Commerzbank too has noted upside risks for oil prices in light of these supply issues while demand is set to rise as a result of robust economic activity in the US and further expected stimulus in China. Against this backdrop, crude prices look vulnerable to further upside near-term.

Technical Views

Crude

The rally in crude has seen the market breaking out above the 72.61 level with price now testing key resistance at the 77.64 level and the bear channel highs. This is a key pivot for the market with a break higher here opening the way for an extended rally towards 82.59 and beyond. In the Signal Centre today we have a buy limit set at 72.60 suggesting a preference to buy into any dips for a continued move higher.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.