Crude Hits Six Month Highs On Middle East Fears

Middle East Impact

Oil prices spiked to their highest level since January today following news overnight of Israeli military attacks on Iran. The strikes saw key Iranian nuclear sites destroyed as well as leading military figures, including the head of the Iranian army. Iran, in turn, launched drone counter attacks this morning and has vowed to take further action with Israel declaring a state of emergency. The news has sparked major concern over the prospect of all-out war in the Middle East with risk sentiment evaporating today and safe-havens seeing strong inflows.

Market Implications:

Bullish

The threat to oil supply in the region is a major upside risk to oil prices given the many oil producing sites in the Persian-Gulf region. If the conflict escalates oil prices look poised to trade back up towards the $100 mark within day. As such, incoming news flows will be closely monitored over the weekend with any further attacks set to drive prices prices higher.

Bearish

On the other hand, if the situation is brought under control and traders sense that a full-scale military conflict can be avoided, we’re likely to see oil prices soften back. However, with the situation in the Middle East remaining highly volatile, near-term prices shocks look likely to be a key theme for energy traders to navigate.

Technical Views

Crude

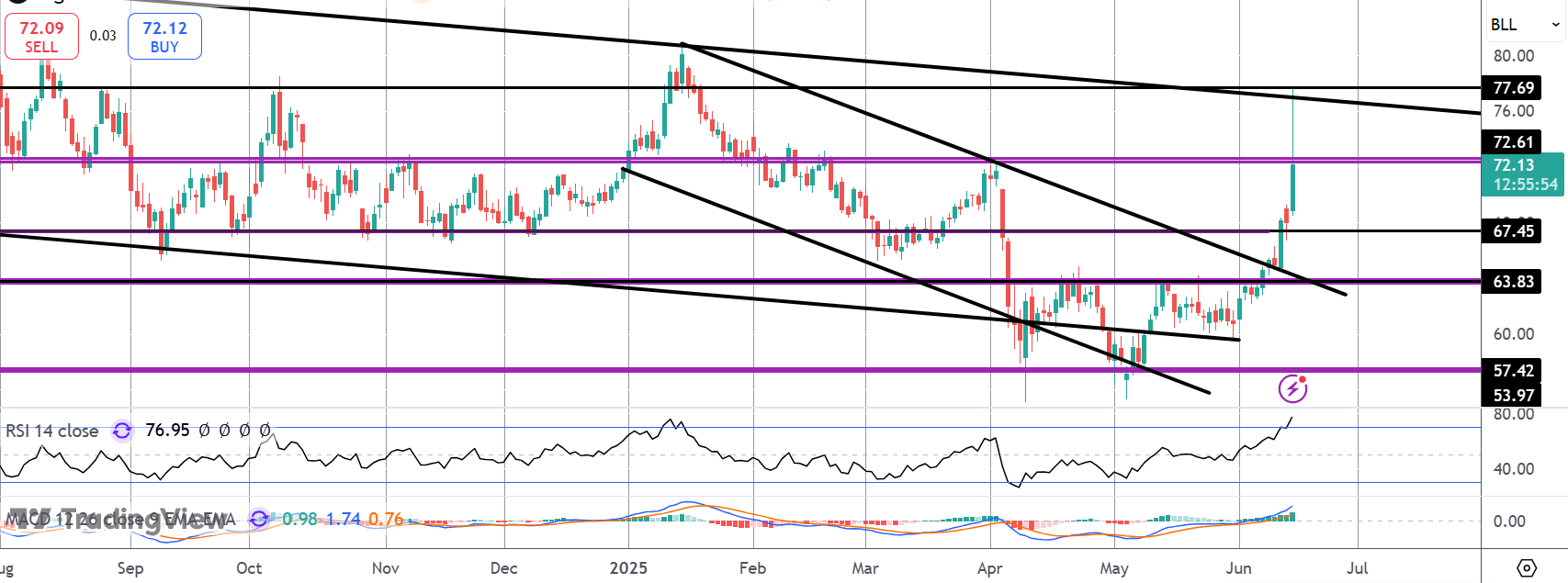

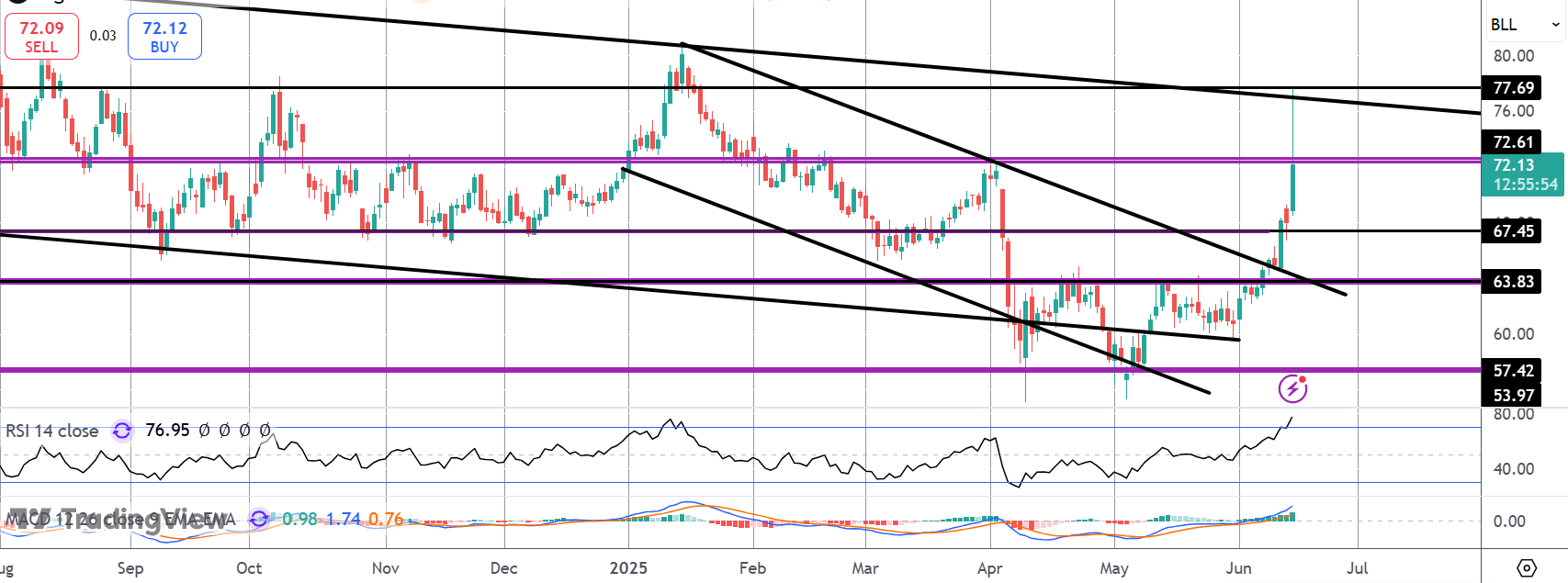

The rally in crude has seen the market spiking into the 77.69 highs, levels last seen in January. The initial move has cooled for now with price trading back down below 72.61 for now. While above 63.83, and with momentum studies bullish, focus remains on further upside.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.