Copper Rally Resumes - What to Watch

Fund Inflows Boosting Copper

Copper prices are pushing higher again on Thursday following a brief correction lower in recent days. The fresh uptick has been attributed to sizeable fund inflows as money managers continue to buy into the metal. Along with heavy fund inflows, supply shortages continue to underpin bullish sentiment. Goldman Sachs is projecting a global copper deficit this year of nearly half a million tonnes, forecasting copper to end the year at around $12,000. Notably, BlackRock said in a note this week it will take copper hitting prices of around $12,000 to incentivise new mines and bring bigger supply back into the market. In light of this, $12k looks to be the longer run bull target.

Weak USD

A weaker US Dollar is also helping revive copper prices through the back end of the week. Softer US data in recent days has taken the steam out of the USD rally for now. Both services and manufacturing PMI readings for last month were seen undershooting forecasts on Tuesday. Yesterday, despite a beat on the headline reading, core retail sales were also seen falling short of forecasts.

US GDP Data Due

Looking ahead today, traders will be closely watching advance US GDP data, forecast at 2.5% down from 3.4% prior. If confirmed, the fall in growth should give little reason for a fresh USD rally at this point, keeping copper prices supported. The better outcome for copper bulls would of course be a weaker reading which would see USD push deeper. On the other hand, a strong reading might see some USD recovery, capping the copper rally for now.

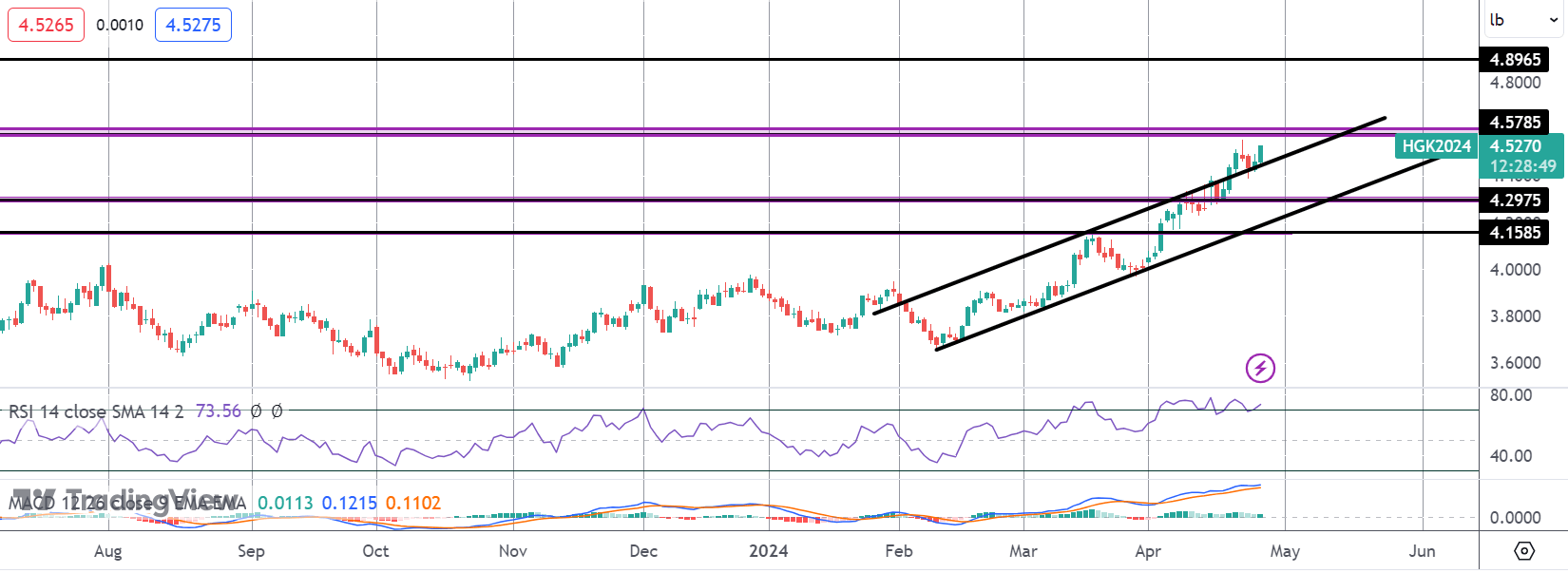

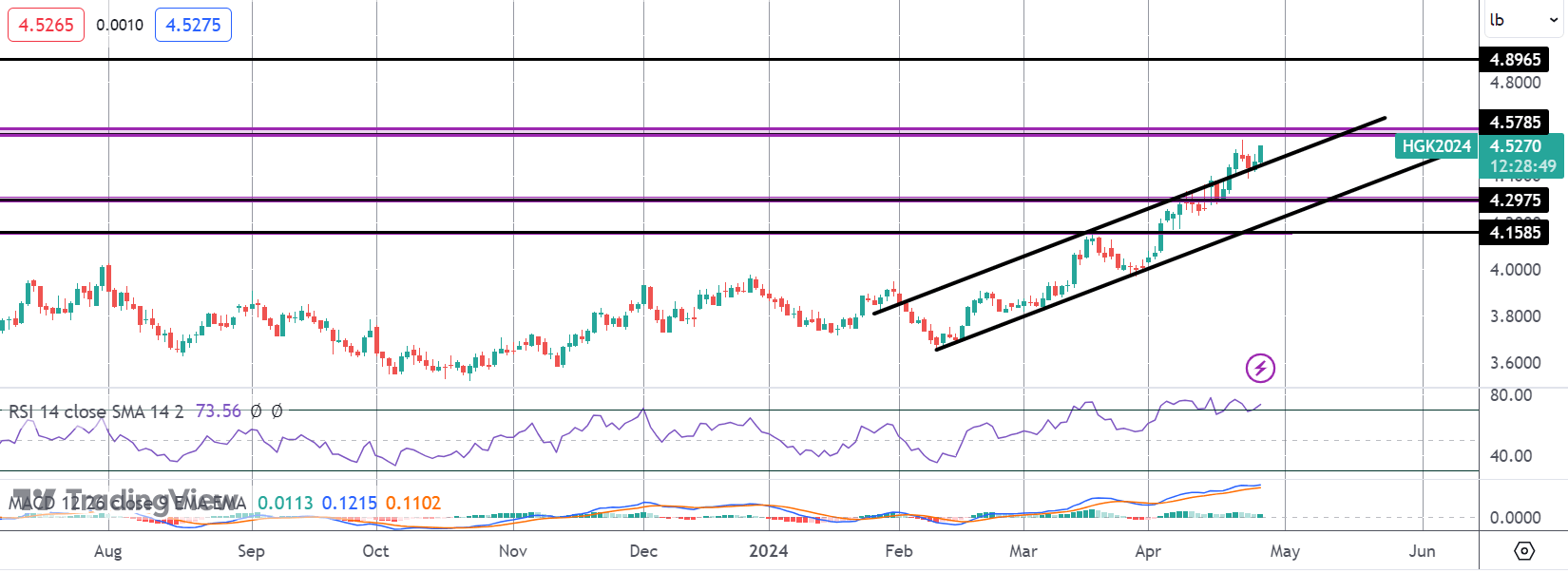

Technical Views

Copper

Following a brief correction lower, copper found support into a retest of the bull channel highs and is now pushing higher once more. 4.5785 is the key resistance to watch with bulls looking for a break higher here to open a test of 4.8965 next. To the downside, 4.2975 and the bull channel lows will be main support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.