Copper Rallies on US Shutdown Optimism

Shutdown Optimism

Copper prices saw a sharp move higher yesterday as risk assets cheered an expected end to the US govt shutdown. News that a compromise bill achieved enough bipartisan support to pass the Senate this week and will now go before the House has raised hopes that the US federal govt will soon be reopened. Pressure to agree a deal looks to be building with the Thanksgiving holiday looming and the prospect of travel chaos if flights remain disrupted. As such, a deal now looks likely to be announced in the coming days and should see commodities prices rebounding further.

Better China Data

Copper prices have also been helped this week by Chinese data showing that deflation has eased there recently. PPI data was seen rising last month above forecasts, moving back into positive territory. With a US/China trade deal now in place, near-term expectations are improving which should continue to bolster the copper demand outlook.

Fed Easing Expectations

Fed easing expectations should also remain an underpinning factor for copper here. With the market pricing a roughly 65% chance of a cut in December, there is room for this figure to jump, putting fresh pressure on USD while lifting commodities prices. Once the shutdown ends and postponed data from the period starts to feed through, any fresh downside in jobs and inflation data should see a jump in dovish pricing, creating stronger upside in risk assets.

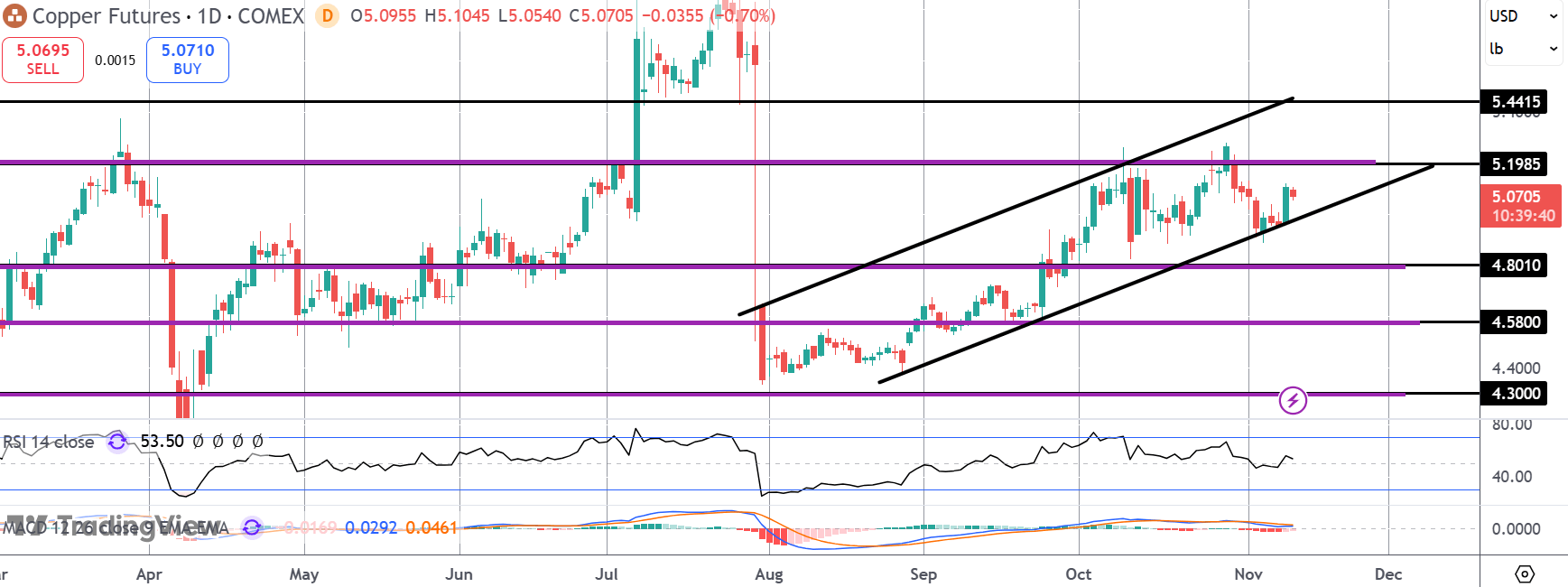

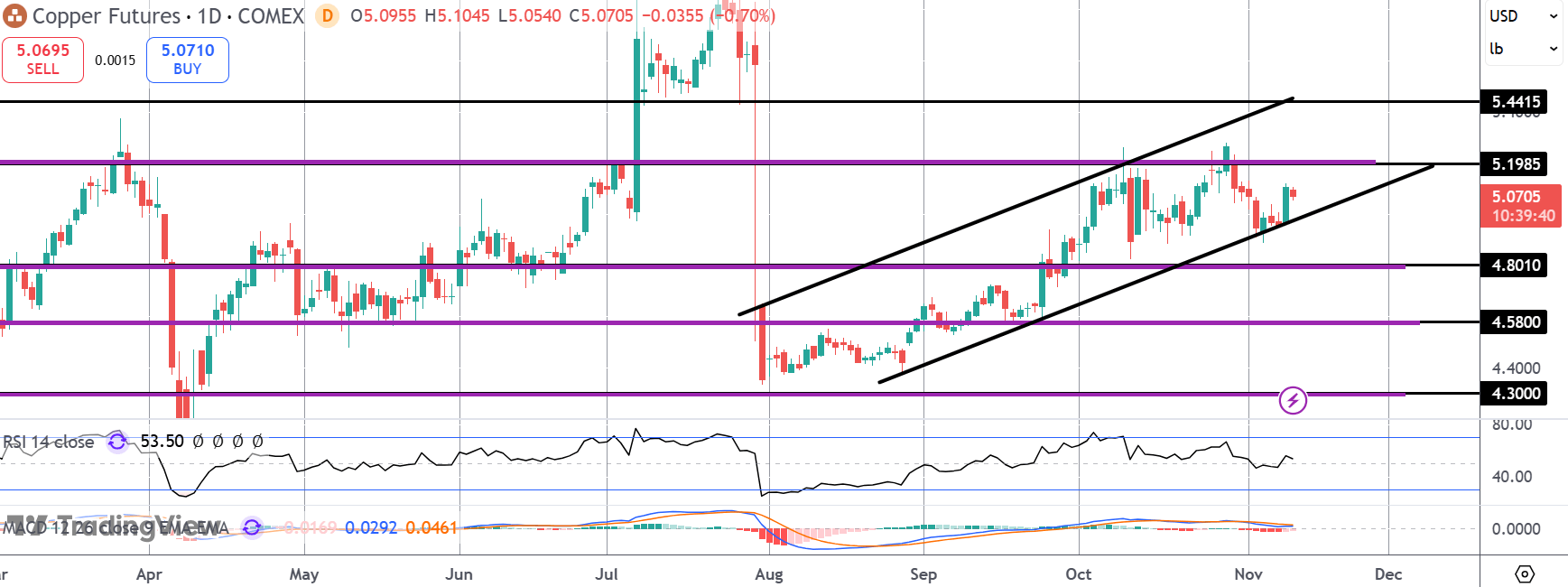

Technical Views

Copper

The sell off in copper has stalled for now into a retest of the bull channel lows, with price turning higher again. While the channel holds, focus is on a fresh test of the 5.1985 level with 5.4415 above as the higher target to note. If the channel lows break, 4.8010 is key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.