Chart of The Day GBPJPY

GBPJPY Probable Price Path & Potential Reversal Zone

GBP: Later today, the Bank of England (BoE) will deliver its first policy announcement of the year (12:00 GMT). No immediate policy changes are expected, which means Bank Rate is likely to remain at 0.10%, while the target size of the asset purchase scheme is also forecast to remain at £895bn. However, since the last update in December, plenty has happened – even more so since the BoE last updated its economic forecasts in November.

Today’s update, therefore, provides the MPC with a key opportunity to update the market on its latest thinking for the economy and ultimately what this may mean for future changes in monetary policy. On a positive note, it will report that last year’s fall in GDP - while still very large – is likely to have been less than previously expected. However, the current lockdown, which now seems likely to last for most of the quarter, means that GDP will probably fall in Q1 whereas the BoE was previously forecasting a rise. That suggests they will have to cut their GDP forecast for 2021 unless they now forecast a substantially faster recovery in the coming quarters. There are some grounds for doing so, given the vaccine rollout, but uncertainty about the timetable means the BoE may be reluctant to go too far down that road. What MPC members may feel more confident in saying is that they are now less concerned about the downside risks for the economy. However, they may still sound a note of caution on the potential longer-term damage from the pandemic.

The BoE is also due to provide an update on their recent discussions with banks about the feasibility of a cut in Bank Rate below 0%. Recent speeches by various members suggest that the MPC is divided on its potential effectiveness. Some of the external members see it as an effective tool in boosting the economy, while Bailey and some of the other internal members are seemingly more concerned about the potential negative effects on the financial sector. Even if the report concludes that a move below 0% is technically possible, it is likely to highlight that the financial system would also need time to prepare for such a move. In the meantime, the Committee will have to confirm the weekly pace of asset purchases for the immediate future. Maintaining them at £4.4bn per week would mean that the current tranche will last until September.

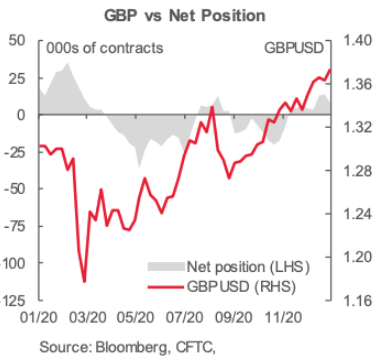

According to CFTC data speculative sentiment turned less bullish on the GBP as both longs and shorts rose but the former’s increase of 1.5k contracts was no match to the 7.2k increase in gross shorts, for a combined decline in the net GBP long of USD484mn to move back below the billion mark at USD684mn

JPY: The Yen has extended declines on the resurgence in risk appetite. Meanwhile, Japan has also extended its state of emergency for another month and it looks like Q1 economic forecasts will be adjusted lower yet again. Japanese Finance Minister Taro Aso's first phone call with U.S. Treasury Secretary Janet Yellen on Monday emphasized close cooperation on a number of issues including FX. The Japanese government may therefore be loath to see USD/JPY much above 105 if only to avoid being considered a currency manipulator by the U.S. Treasury. With Prime Minister Suga also reportedly averse to USDJPY moves below 100, a 102-105 core range within wider 100-107 parameters could remain in place indefinitely pending fresh central bank moves.

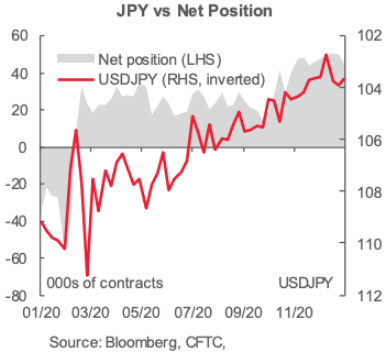

According to CFTC data the net JPY long saw the biggest weekly adjustment as accounts decreased their net bullish exposure to the currency by USD590mn, or roughly a tenth of where the net long stood last week, to USD5.4bn; the move was driven by a sizeable 4.4k increase in short contracts while long contracts dropped by 680. The JPY was the worst performing G10 currency over the period, but still managed to eke out a 0.2% gain versus the dollar. All things considered, bullish JPY sentiment remains elevated, sitting only about USD700mn from its cycle peak in early-Jan (highest since late-2016)

From a technical perspective the GBPJPY appears to be in the process of completing and ABC correction, this pattern has seen prices retreat to test projected ascending trendline support and the monthly pivot, where the decline appears to be stalling, bullish exposure will be warranted on a close back through 143.15 using the days low as a protective stop targeting a test of the projected ascending trendline resistance at 144.50 through here sets up a test of the weekly projected range resistance and the psychological 145 level

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!