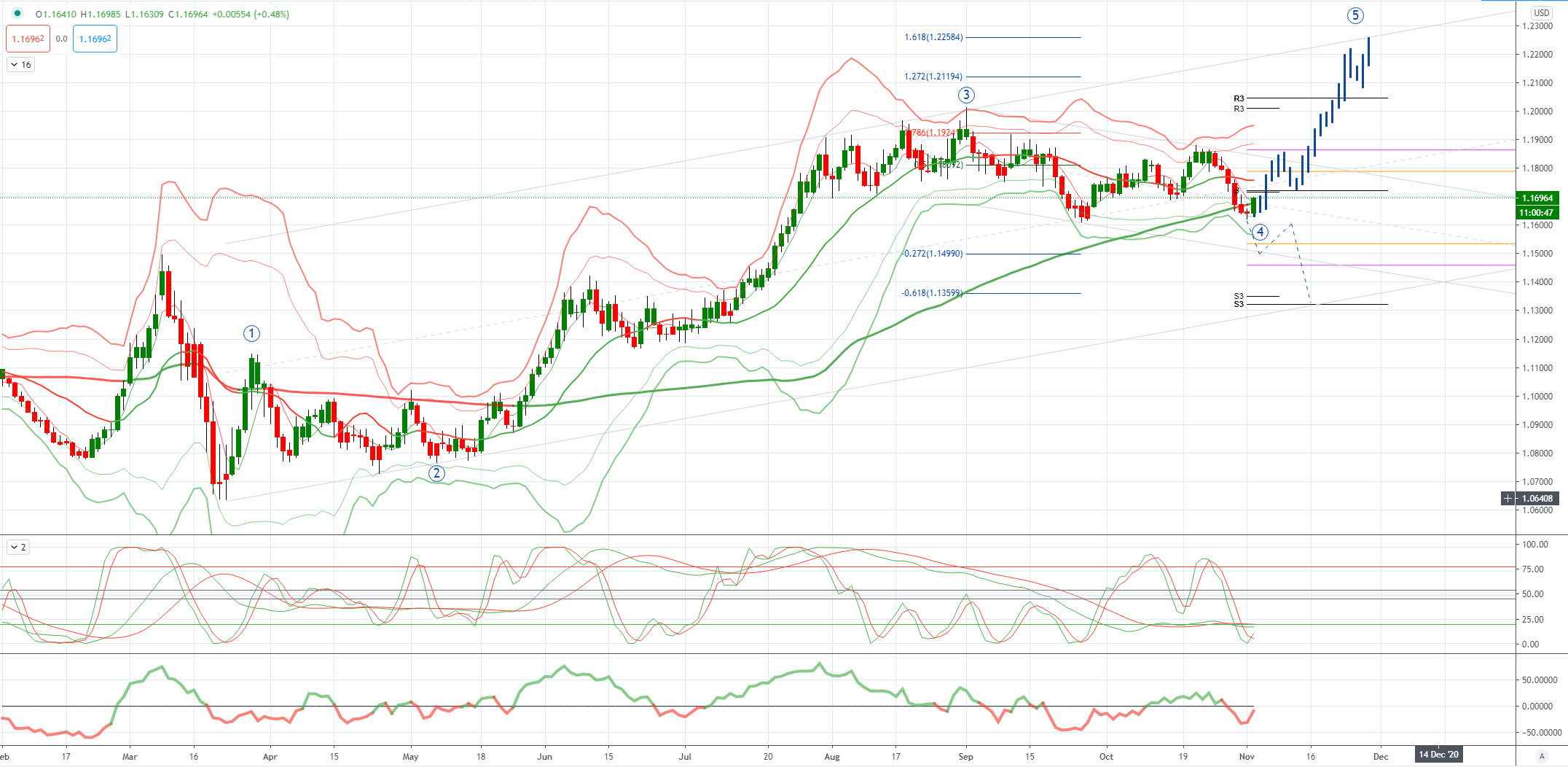

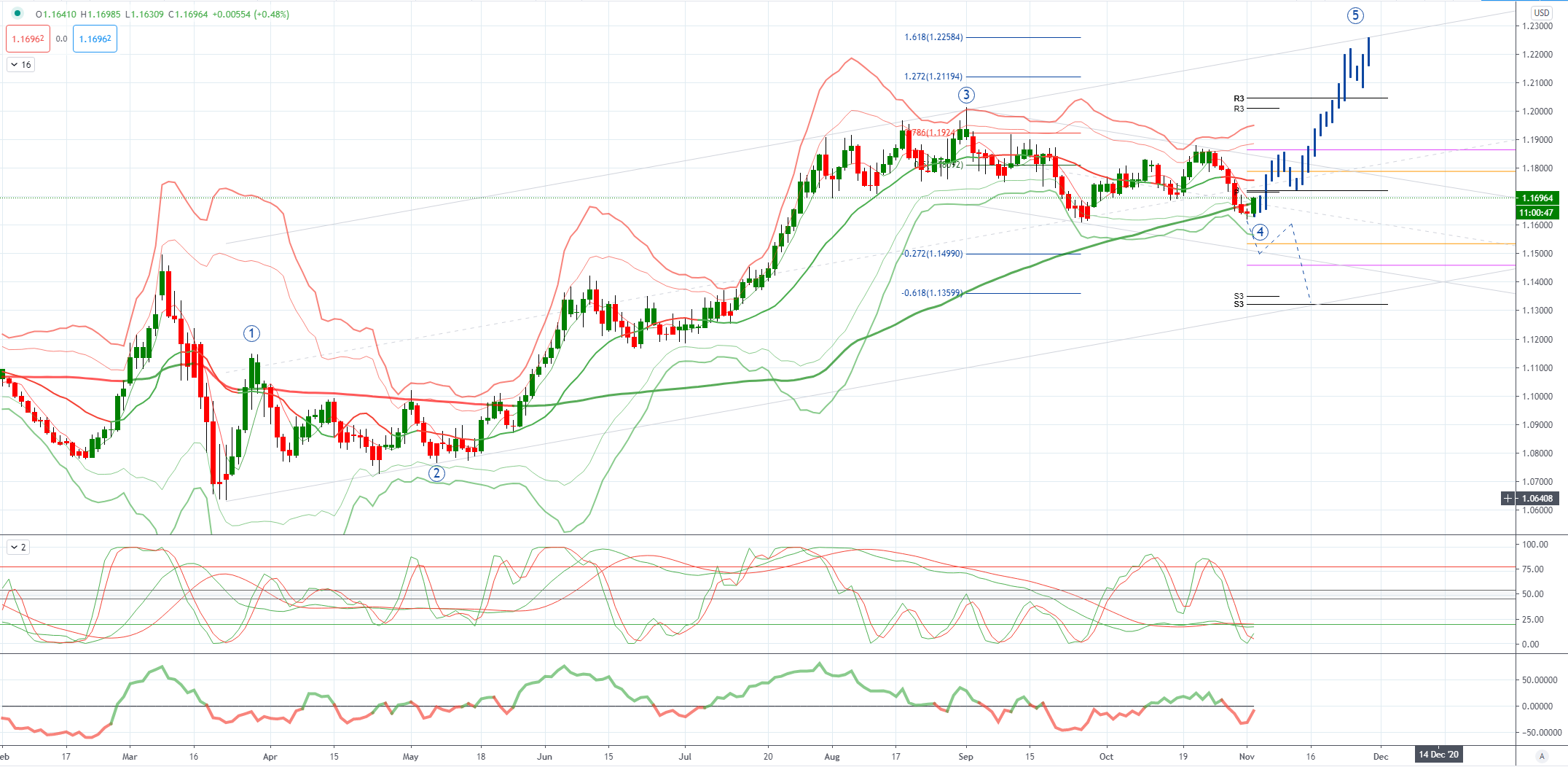

Chart of The Day EURUSD

EURUSD Potential Reversal Zone & Probable Price Path

EUR: The European Central Bank (ECB) will not extend the flexibility of its crisis-fighting Pandemic Emergency Purchase Programme (PEPP) to other bond buying schemes, which must remain bound by the bank’s “red lines”, ECB board member Yves Mersch said on Monday. German manufacturing PMI rose to 58.2 in October, the highest since February 2018, while that for the Eurozone also climbed to 54.8 (highest since July 2018), which bodes well for the recovery story despite the recent partial lockdowns

USD: Expect the broad USD to be largely sideways today until the initial responses to the US elections start to flow through. Playbook for the elections as follows. Early indicators, Texas and Florida, may be cue for shifts in market positioning. A Biden win in Texas – Blue Wave trades to be priced back in, contested outcome trades reversed, translating to a likely knee-jerk USD weakness; A Trump win in Florida – Trump remains in the fray, may increase odds of the contested elections, translating to a bid for traditional havens JPY, CHF, while cyclicals like AUD potentially sell-off. On the final election outcome itself, if signs point to an unlikely Trump re-election, expect a USD-positive initial response. A Biden win coupled with a Republican Senate may see the political deadlock persist, leaving the USD to muddle lower in a flat-to-softer posture. In a Blue Wave case, the mainstream view is for the USD to see further downside. While I wouldn't dispute this as a potential knee jerk reaction, think this may already have been priced in as a baseline. Moreover, it should not be expected that a strong, multi-month weak USD trend will automatically materialize. Note also the increasing chatter of a risk whereby a section of the population refuses to acknowledge the results and take to the streets. Such a scenario should be akin to the contested outcome picture.

From a technical and trading perspective, the EURUSD appears once again to be carving out a wave four low above 1.16 support, a failure to hold 1.16 opens an immediate test of 1.15 pivotal trend support. Bulls will be watching some key levels to gauge the strength of sentiment and momentum, we have a cluster of weekly and monthly pivot points sited at 1.1730, beyond here interim trend channel resistance comes in just above 1.18 if price can overcome those upside hurdles then look for attest of prior cycle highs at 1.20 enroute to a test a fifth wave objective to 1.22 before a significant profit taking pull back may develop.

NOTE: Overnight expiry EURUSD implied volatility doubled to 22.0 (mid rate), a premium of 107 from 54 USD pips for a simple vanilla straddle. Traded in conjunction with a cash hedge to monetise the actual volatility, holders would need to capture 107 USD pips in either direction before generating any profit

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!