Chart of the Day XAUUSD (Gold)

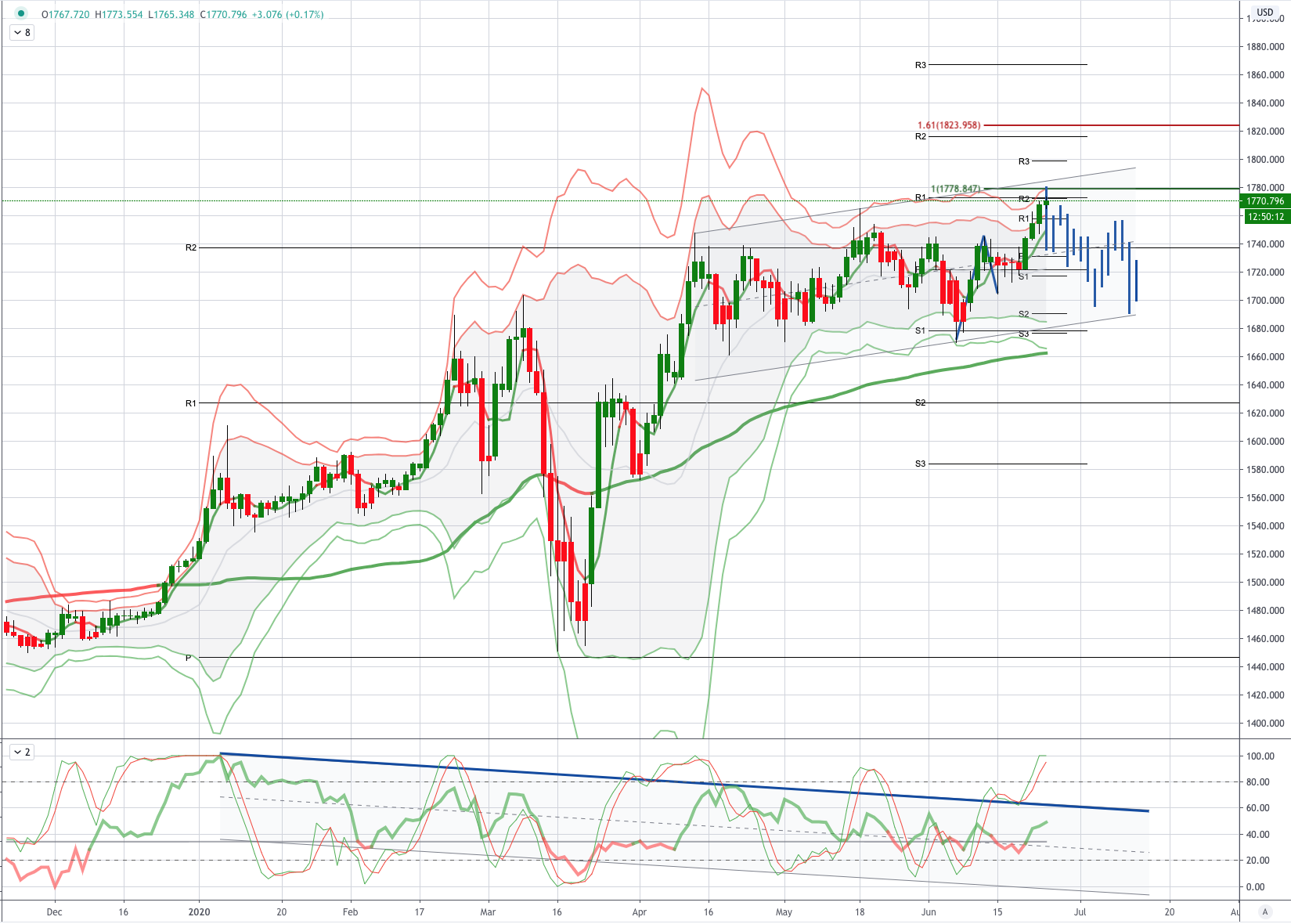

XAUUSD (Gold) Potential Reversal Zone - Probable Price Path

Is the US-China Phase 1 trade deal on or off – that is the question. Markets nearly had a heart attack when White House adviser Peter Navarro said in a Fox News interview that “it’s over”, but this was quickly overridden by Trump’s tweet that the China trade deal is fully intact. The market jitters suggest that investor confidence may be vulnerable to pullbacks in the nearterm. This is despite the relatively upbeat manufacturing PMI data that suggested many countries are restarting their economic engines again. The WTO also said its worst case scenario of global trade falling 32% may be avoided this year after merchandise trade fell 3% and 18.5% in 1Q and 2Q20 respectively and 2021 may see a 5-20% rebound if fiscal, monetary and trade policies keep pulling in the same direction. The S&P500 gained 0.43% amid hopes more US fiscal stimulus while VIX eased to 31.37 overnight. UST bonds reversed initial gains to close mixed with a steepening bias and the 10-year yield at 0.71% amid a strong 2-year auction. The 3-month LIBOR eased to 0.2969% (lowest since 2015). MSCI added 137 and deleted 181 names from its MSCI World Index. Gold also hit its highest since 2012.

Gold prices surged to their highest in nearly eight years on Wednesday, while global shares cooled as signs of an acceleration in coronavirus cases kept investors on edge. Fuelling concerns about sustained weakness in the pace of the economic recovery was data showing several U.S. states seeing record infections and the death toll in Latin America passing 100,000, according to a Reuters tally. The European Union is even prepared to bar U.S. travellers because of the surge of cases in the country, putting it in the same category as Brazil and Russia, the New York Times reported. All that and softness in the dollar, along with endless cheap liquidity from central banks, helped spot gold gain 0.2% to $1,770.92 per ounce after touching $1,773, its highest level since October 2012 in early Asian trade. GOL/ Global stocks were 0.3% lower and have been moving sideways in recent weeks after rising more than 40% from March lows on hopes the worst of the pandemic was over.

From a technical and trading perspective, Gold looks set to test ascending trendline resistance and the interim equality objective at 1778/85, with persistent divergence noted on the momentum studies and a very crowded market on the long side. A daily rejection/reversal pattern from this potential reversal zone would encourage a shakeout of newly minted longs playing for a breakout, this should see bearish exposure setting up a move to retest ascending trendline support back towards 1700. A daily close through 1790 would negate the corrective thesis

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!