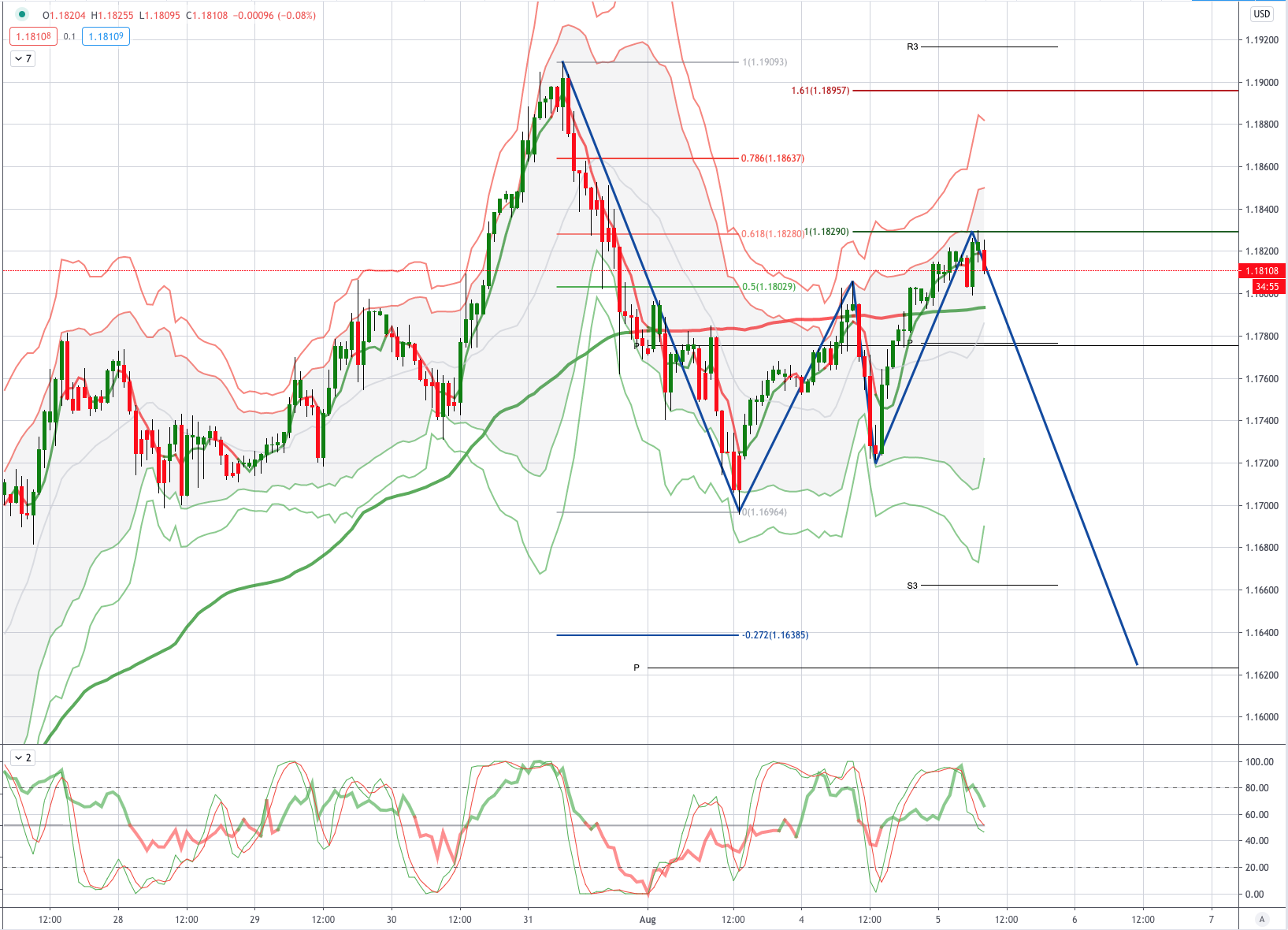

Chart of the Day EURUSD

EURUSD Potential Reversal Zone - Probable Price Path

EUR: Eurozone producer prices rebounded in June: Producer prices index recovered by 0.7% MOM in June, from the 0.6% decline in May . This was mainly driven by the rebound in energy prices as prices of other goods mostly recorded only slight increases. This led the annual decline in PPI to narrowed to 3.7% YOY compared to the sharp 5% decline prior. Factors supporting: Solid fiscal support on confidence, recovering economy. Factors against: Risk aversion, 2nd wave of Cov id-19 infections

USD: US factory orders recovered further in June: Headline factory orders rose for the second month by 6.2% MOM in June (May : +7.7%), following the more than 10% fall in March and April at the onset of the pandemic. Looking at details, orders of durable goods also increased 7.6% MOM (May : +15%), of which core capital orders (a gauge of capex) recorded a 3.4% growth. Factors supporting: Risk aversion, US-China relations. Factors against: Complacent markets, positive developments from global policy makers, poor US economy

From a technical and trading perspective, the EURUSD spiked the 1.1830/50 cofluent resistance zone discussed in last week's live analysis session, with sentiment and positioning stretched in the near term. Friday’s key reversal candlestick pattern has flipped the daily chart bearish, as such bearish exposure should now be rewarded on a breach of overnight lows, using overnight highs as an invalidation point, bears will now initially target a test of symmetry swing support sighted at 1.1620. UPDATE On the intraday H1 timeframe EURUSD is potentially offering an opportunity to add to bearish exposure, price has tested the confluent equality and retracement objectives at 1.1829/28, additional bearish exposure should now be rewarded on a breach of 1.18 using today's high as an invalidation point for the trade. A close back through 1.18 intraday will set bearish sights on the corrective equality objective at 1 1620

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!