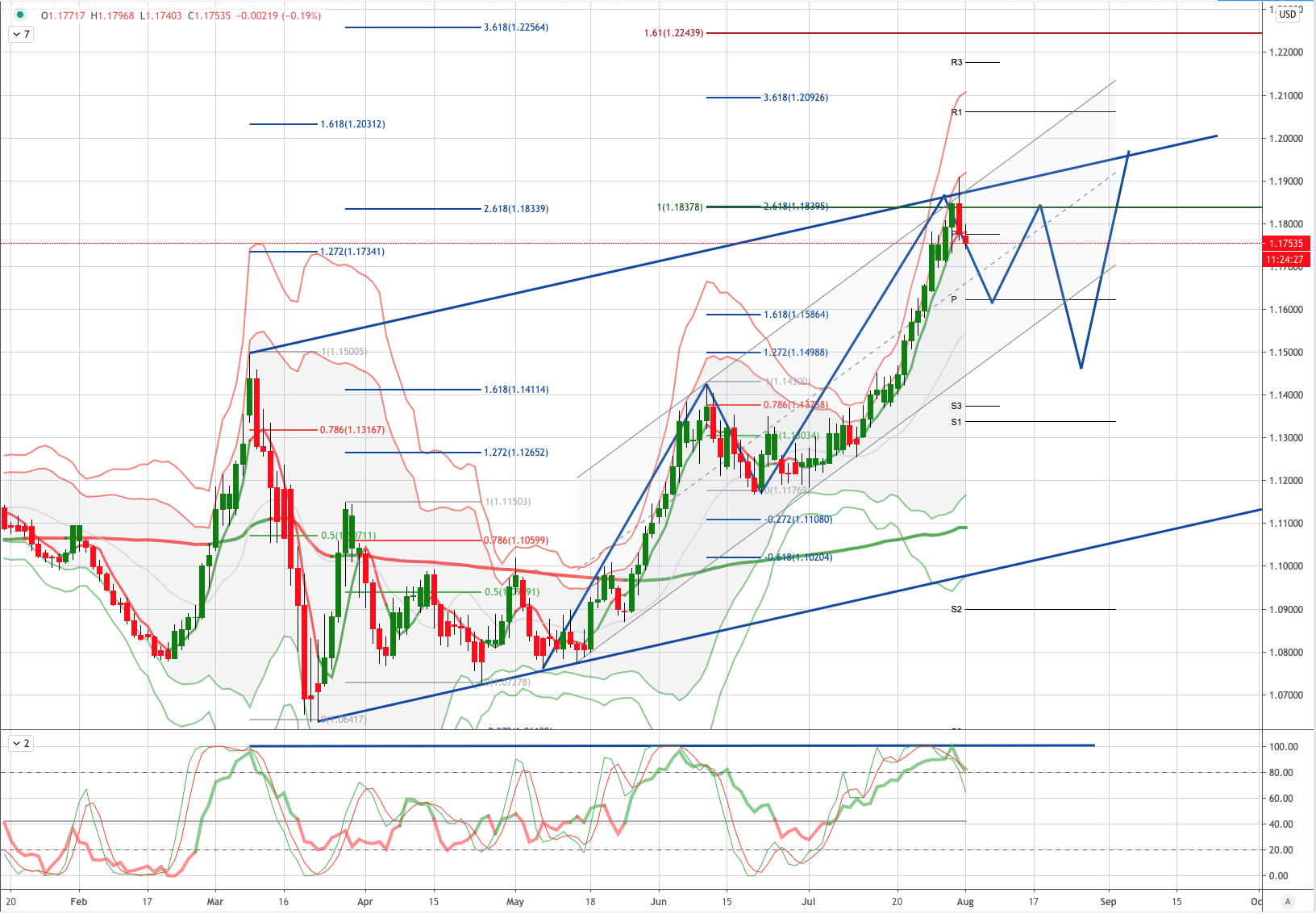

Chart of the Day EURUSD

EURUSD Potential Reversal Zone - Probable Price Path

EUR: Eurozone economy saw largest contraction on record; core inflation improved: Advance report showed that Eurozone real GDP contracted by a whopping 12.1% QOQ in the second quarter of 2020 (1Q: -3.6%), its largest decline on record as member states across the continent imposed social distancing measures to contain the Covid-19 pandemic since March. YOY, GDP fell 15% (1Q: -3.1%). The HICP inflation recorded a smaller 0.3% MOM decline in July according to flash estimates. This led the annual inflation rate to increase to 0.4% YOY in July (Jun: +0.3%) thanks to a smaller decrease in prices of energy and the surge in cost of non-energy industrial goods. Underlying inflation surged to 1.2% YOY (Jun: +0.8%), its largest gain in five months. Services inflation however eased to 0.9% YOY (Jun: +1.2%).

USD: Mixed US consumer data as country struggled to contain pandemic: Personal spending, a gauge of US consumer consumption rose for the second month, recording a 5.6% MOM growth in June, following the 8.5% rebound in May. The cumulative increase has not reversed the hefty declines seen in March and April during the onset of the Covid-19 pandemic in the US. Outlook for consumer spending was rather bearish as the country still struggles to contain the virus. The University of Michigan Consumer Sentiment Index, a popular leading indicator for consumer spending slipped to 72.5 in July (Jun: 78.1), following the resurgence of the virus. Personal income fell for the second month by 1.1% MOM in June (May: -4.4%) as the effect of the one-off stimulus boost (+12.1%) in April has dissipated. A separate release of the employment cost index registered a mere 0.5% QOQ growth (1Q: +0.8%). This showed that wage growth is likely to be battered as the labour market remained depressed amid economic reopening. This is evident in the second consecutive weekly gain in initial jobless claims. Meanwhile, the core PCE price index, the Federal Reserve’s key inflation gauge rose 0.2% MOM in June (May: +0.2%); the annual rate eased to 0.9% YOY (May: 1%), further away from the Fed’s 2% target. The MNI Chicago PMI surged to 51.9 in July (Jun: 36.6), marking its first above-50 reading in 13 months following the reopening of the economy. The jump was a recovery following the three successive months of below-40 readings.

From a technical and trading perspective,the EURUSD spiked the 1.1830/50 cofluent resistance zone discussed in last week's live analysis session, with sentiment and positioning stretched in the near term. Friday’s key reversal candlestick pattern has flipped the daily chart bearish, as such bearish exposure should now be rewarded on a breach of overnight lows, using overnight highs as an invalidation point, bears will now initially target a test of symmetry swing support sighted at 1.1620.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

In the Chart of the Day, our market expert provides details on a high probability trading set up for the day ahead!!

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!