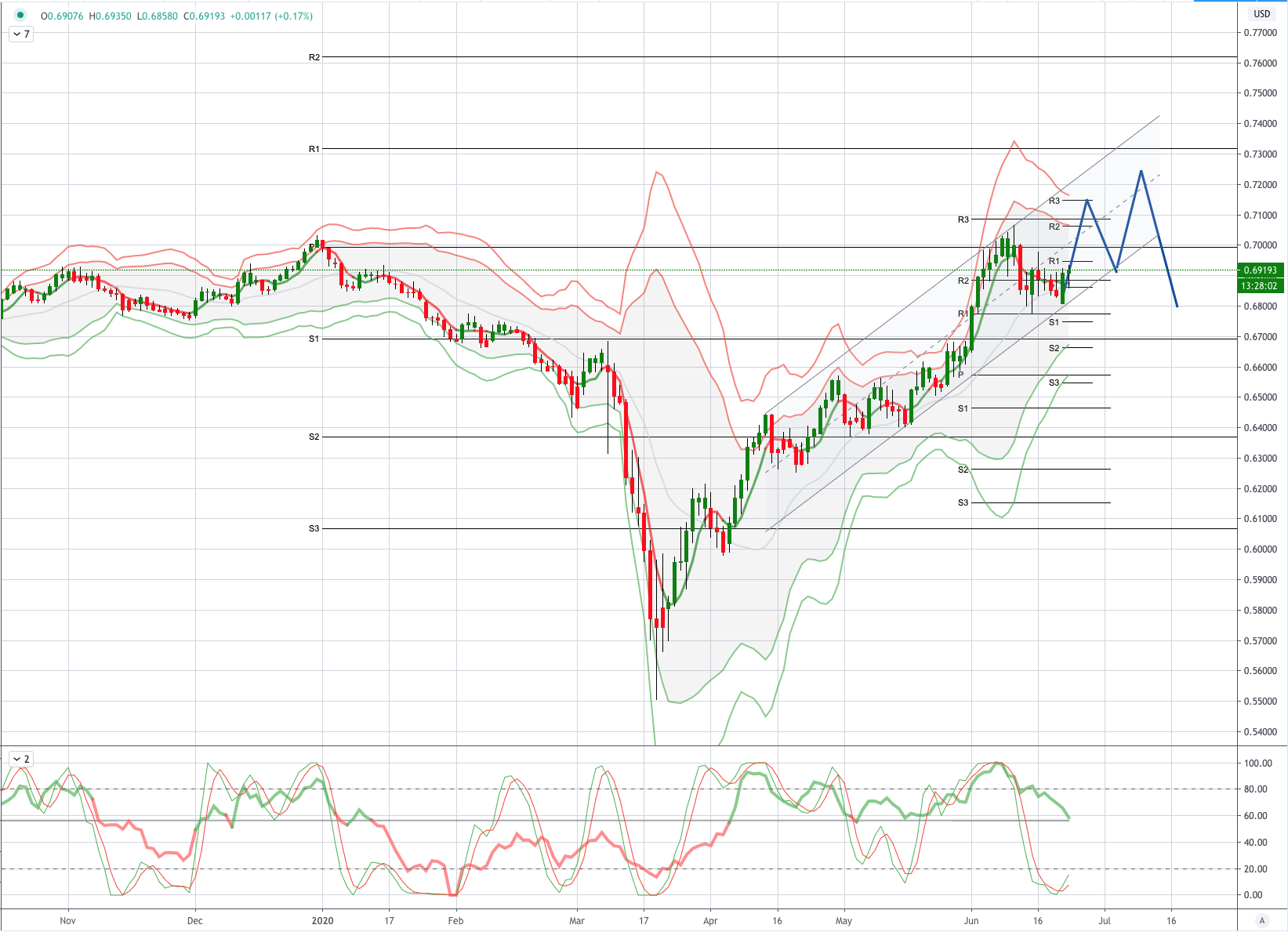

Chart of the Day AUDUSD

AUDUSD Potential Reversal Zone - Probable Price Path

Market sentiment remains steady to positive, with US equities seeing a quick turnaround of opening negativity, with the broader USD coming back under pressure as we head into month and quarter end. Some positivity coming from President Trump tweeting that the Phase 1 trade deal with China is still on track.

AUD:Reserve Bank of Australia Governor Lowe said it is difficult to say that the Australian dollar is overvalued and pointed out that the current strength of the Australian dollar has not caused problems at this stage. Its exchange rate level is based on a solid foundation, a slight economic downturn and a reasonable prospect. The initial value of Australia's CBA manufacturing purchasing managers index rose to 49.8 from 44 in May; the service industry purchasing managers index rose to 53.2 from 26.9 in May. Last week ANZ consumer confidence index remained at 97.5

USD: US’ existing home sales fell more than expected in May by 9.7% mom to 3.91m annual pace, its lowest since October 2010, but the median price rose 2.3% yoy to $284.6k. Meanwhile, the Chicago Fed national activity index rebounded from -17.89 in April to 2.61 in May, led by improvements in production and employment gauges. Meanwhile, the US government has restricted charter flights from India citing “unfair and discriminatory practices”.

From a technical and trading perspective, in line with FX majors and as discussed in my weekly market outlook the USD printed a bearish key reversal pattern yesterday from the symmetry swing resistance area. As yesterday's highs contain any further upside attempts it is reasonable to expect a retest for current cycle lows. The ADUSD is benefitting from the advance in risk sentiment and as such after yesterday's bullish key reversal pattern, bullish exposure should now be rewarded on a breach of overnight highs opening a window for a retest of the .7050 level and then on towards .7150

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!