Chart of the Day AUDUSD

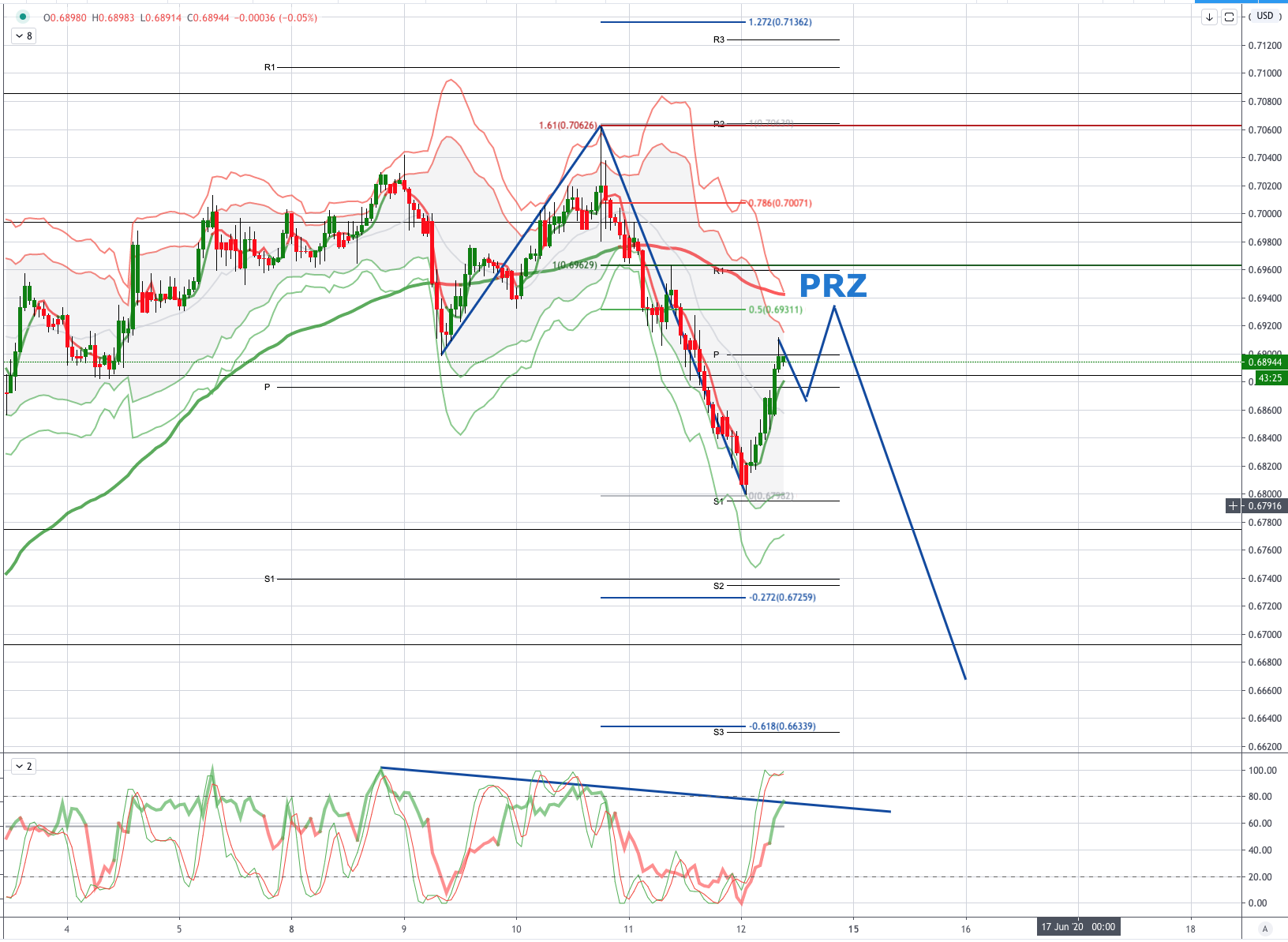

AUDUSD Potential Reversal Zone - Probable Price Path

A number of reasons have been put forward for the aggressive sell-off in risk assets, high on the list are the sobering economic outlook from the Fed yesterday, a reality check, and concern about the spread of COVID19 in the US. But the plunge in US equities should also be seen in the context of their recent rapid and significant recovery,with high participation by retail investors, that took technical indicators off the charts, including the widely followed 14-day relative strength indicator. The Put/Call ratio fall to a 9-year low was also signalling that a pullback was overdue. The big question now is whether this is just a short-term correction in risk assets from an overbought level or the beginning of a much nastier correction.

Yesterday, the number of COVID19 cases in the US broke up through 2 million and the country now has 27% of the world’s cases, even though it makes up just over 4% of the world population. While growth in US cases continues to edge lower, there are a number of localised hotspots, with 18 states seeing an increase, including Arizona, Florida, Texas and parts of California. We’re hesitant to call this a second wave, as it is still part of the first wave. And there seems to be no clear correlation between the easing of lockdown restrictions and case outbreaks which is making experts wonder how easy the spread can be controlled. Even if the much dreaded second wave arrives, there is little appetite to reimpose strict lockdown measures. US Treasury Secretary Mnuchin said that “we cannot shut the economy down again. I think we’ve learned that if you shut down the economy, you’re going to create more damage”.

US initial jobless claims fell for the 10th consecutive week and were in line with market expectations, at just over 1.5m. Still, the figures are dire, with the latest figure being more than double the worst week during the GFC. While the peak in the unemployment rate may have passed, the road to recovery for the labour market remains a long one. Oil prices plunged in the order of 8-9%, driven by the risk of backdrop, as well as data showing that US crude stockpiles rose to their highest level in at least 40 years. After being as high as USD43.40 at the start of the week, Brent crude is now down to USD38 per barrel.

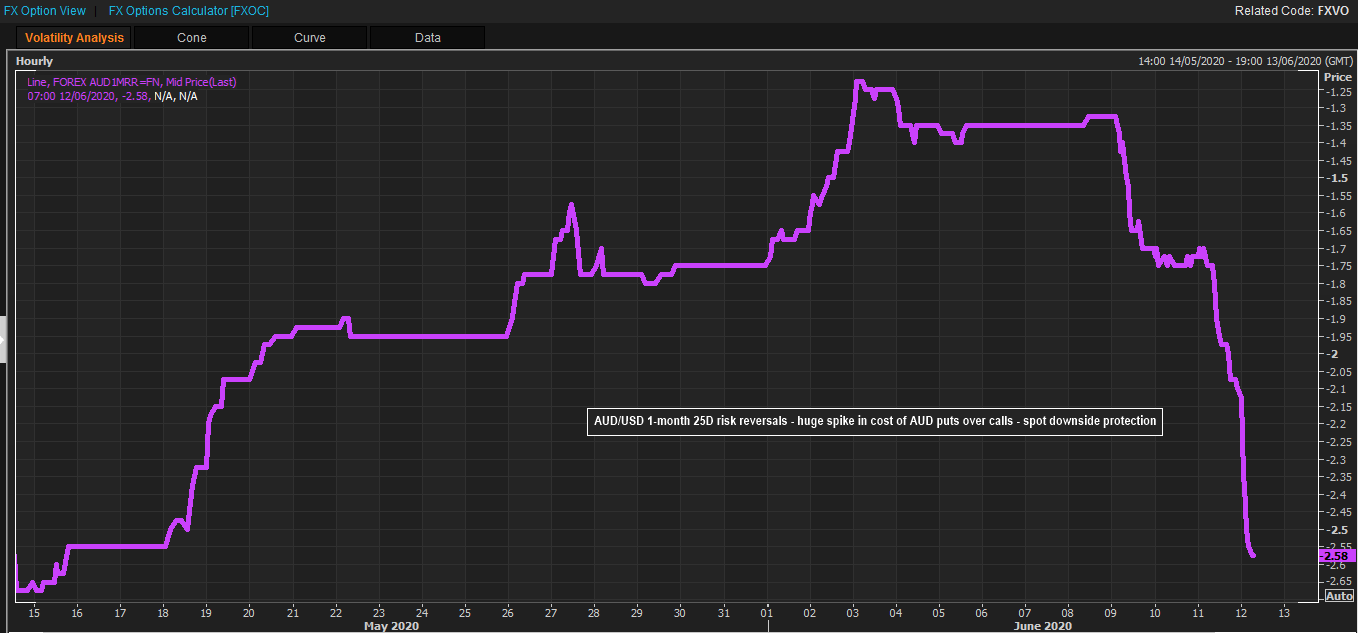

From a technical and trading perspective, the AUDUSD options market warned of downside risk this week. Renewed risk aversion Thur-Fri hits AUDUSD, option protection costs spike one-month 25 delta risk reversals now double where they started Monday AUD put over call (downside) implied vol premium to 2.6 on Friday one-month implied volatility jumps 2.0 vols to 15.75 Friday high since April Was already highest in G10 FX, and clearly justified. Yesterday's decline flipped the daily char bearish as per the near term volume weighted average price. In this context bearish exposure should be rewarded with intraday reversal patterns from the PRZ highlighted on the chart .6930/60, as this area contains upside corrections bears can target aretest of bids to .6800 through here opens a test of .6725 enroute to the primary equality objective at .6660. On the day a close back through .6850 would negate the bearish thesis and suggests a return to trend

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!