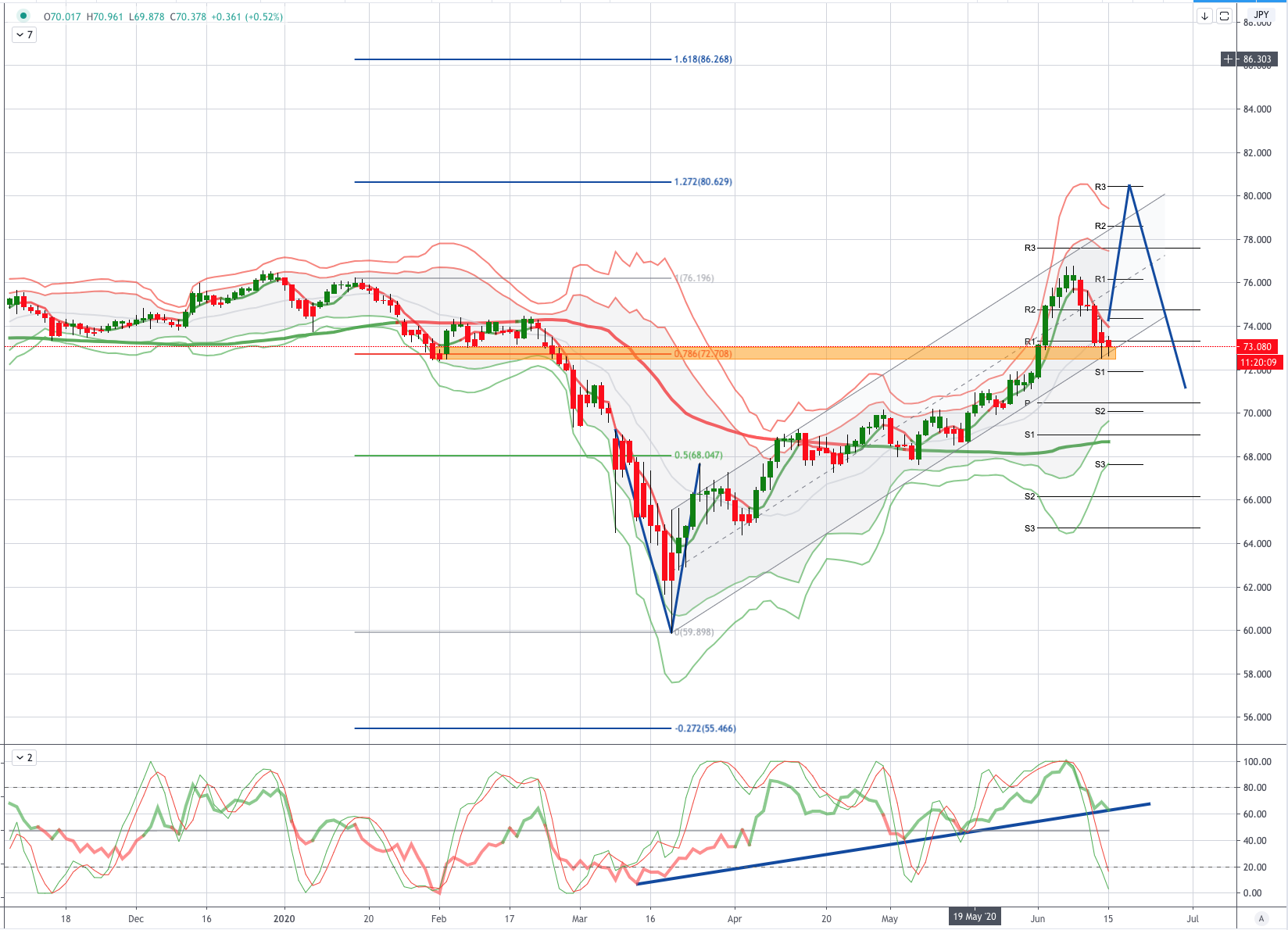

Chart of the Day AUDJPY

AUDJPY Potential Reversal Zone - Probable Price Path

Risk appetite remained supported on Friday despite the IMF warning that it will downgrade its 2020 global growth forecast again later this month. The S&P500 index gained 1.31% on Friday amid choppy trading by the Down Jones index, while VIX slipped to 36.09. UST bonds bearsteepened with investors unwinding Thursday’s flattening bias amid stabilizing equity markets, and the 10-year yield closed at 0.7%. The 3- month LIBOR edged up to 0.32088% and may remain supported ahead of the quarter end with funding conditions tipped to tighten amid increased supply of Treasury bills. White House economic advisor Kudlow said that the $600-a-week payments will end in July as planned as “we are reopening, and businesses are coming back, and therefore jobs are coming back”

AUD: Could Australia be in for a positive surprise when it updates its jobs numbers for May on Wednesday? That seems to be the pattern of late across some countries like the US and Canada. After losing 594,000 jobs in April and after having watched surprises above, a slim minority of four economists in a sample of 25 thinks that a gain could be in store. The median estimate is a drop of 75k. Depending on the outcome, it could be a fresher take on conditions than Monday’s minutes to the RBA meeting on June 2nd .

JPY: The Bank of Japan is expected to leave most if not all of its policy measures unchanged on Tuesday, but consensus is roughly evenly divided on whether the BoJ will enhance support for bank lending. Japanese media reported that the central bank may expand its corporate financing plan to more than 100 trillion yenJapan also updates exports during May (Tuesday) and CPI for the same month (Thursday).

From a technical and trading perspective, the AUDJPY is sitting on trend support both price channel and momentum support. A close today back through 73.70 would leave a tweezer tail pattern and should see bullish exposure rewarded ona move back through 74.00 opening a retest of the offers and stops above 76.60 en route to a grind higher to test the psychological 80.00 level which also represents the 127 extension of the 2020 decline. On the day a closing breach of Friday's low would negate the bullish thesis and suggest a move back to test bids towards the 70.00

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!