Chart of the Day AUDCHF

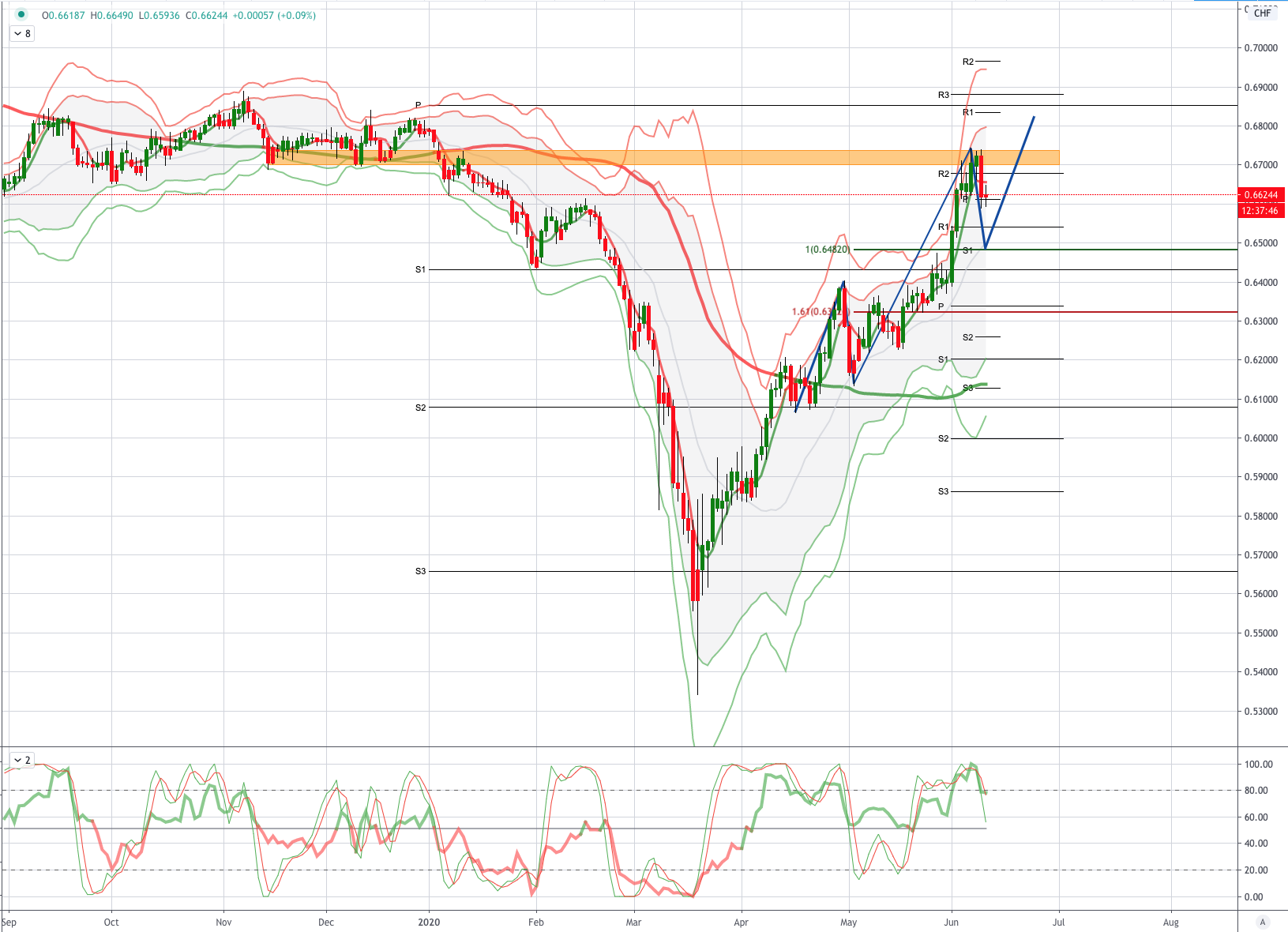

AUDCHF Potential Reversal Zone - Probable Price Path

Buoyant risk appetite has elevated commodity currencies to levels from which they are likely to struggle. The weaker yuan is a powerful force that is sure to undermine risk appetite and riskier currencies. The trade-weighted value of the yuan has dropped a long way, hitting a 2020 low today. The United States is struggling with the coronavirus, so this drop in China's currency will escalate tensions. Oil's recovery is faltering as stockpiles grow, with producers less inclined to cut production. From their own perspectives, the rise of commodity currencies amounts to a significant tightening of monetary policy that will choke economic recoveries. Intervention to support some currencies, such as Australia's dollar, may have been possible a few months ago, but the likely outcome now is a verbal bashing from central bankers intended to halt unwelcome rises. Commodity currencies are more likely to underperform currencies like the euro, yen or Swiss franc, which are deemed safe and profit from weaker oil

AUD: The relationship between Australia and China tends to be tense, which may limit the performance of the Australian dollar in the short term; some technical indicators show that there is an overbought signal. The Ministry of Education of China issued an early warning for studying abroad, indicating that there is a risk of racial discrimination in Australia. It is necessary to make a risk assessment of studying in the country. Currently, it is prudent to choose to go to Australia or return to Australia. Sino-Australian frictions escalated.

CHF: The Swiss unemployment rate in May was 3.4%, lower than the expected 3.6%; the unemployment rate in April was revised downward from 3.3% to 3.1%

From a technical and trading perspective, the AUDCHF has tested the pivotal .6700 handle before printing a sharp daily rejection candle from this area. The engulfing candle pattern consumed the prior four days of trading and suggested significant supply in this area. As such bearish exposure should be rewarded on a breach of yesterday's low, such positioning benefits from the potential of using the overnight highs as an invalidation point for the thesis, offering excellent risk reward metrics, with bearish positioning targeting a test of symmetry swing support at .6480 as highlighted in the chart above

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!