Can Bitcoin Avoid A Rotation Lower Here?

BTC Holds Near-Highs

Bitcoin prices have softened again mid-week following a surge higher yesterday. The futures market was seen around 3% higher off Friday’s lows before meeting selling interest yesterday to take price back down into the middle of the week’s range. Price is still down almost 6% from the record highs printed last week with the market seemingly waiting on a fresh directional catalyst.

Bull Top?

Much has been made of the recent failure at the $108,85 level with some players suggesting that the market is vulnerable to a heavy rotation lower, as we’ve seen from previous tests of the level. However, while price holds above the $100k mark, focus is on a fresh push higher next.

Institutional Demand

Following the approval of Bitcoin ETFs earlier this year, institutional demand is now a key driver (and signpost) for BTC. Unsurprisingly, the move lower from last week’s highs has been accompanied by a streak of BTC ETF outflows, likely linked to bigger names taking profit on a fresh test of the prior all-time highs.

New ETF Activity

Despite these recent outflows, overall institutional appetite remains strong with ETF inflows recently hitting record levels. News this week of fresh applications for BTC ETF approval, including one from Trump’s own Truth Social network, suggests that institutional activity is likely to increase over the rest of the year. This is in line with the trend being seen currently where corporates around the world are adding more BTC to their balance sheets. As such, pullbacks like this likely offer a good opportunity to position for a fresh leg higher in coming weeks/months.

Technical Views

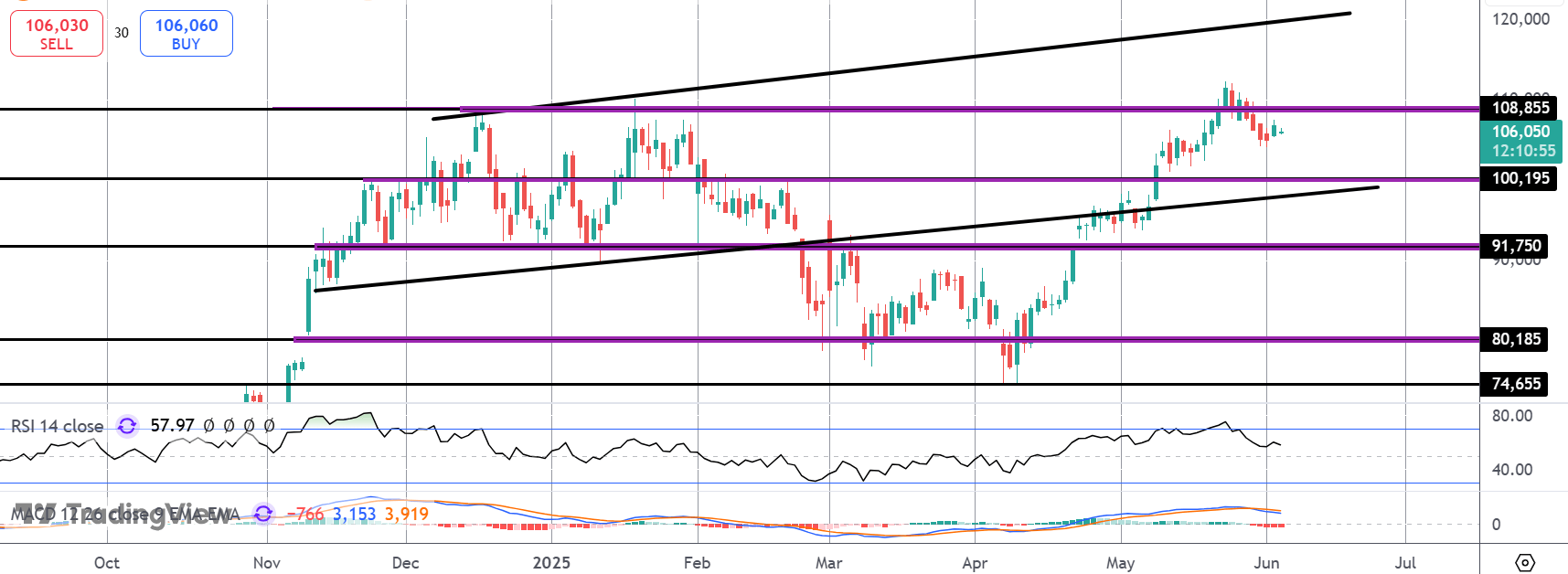

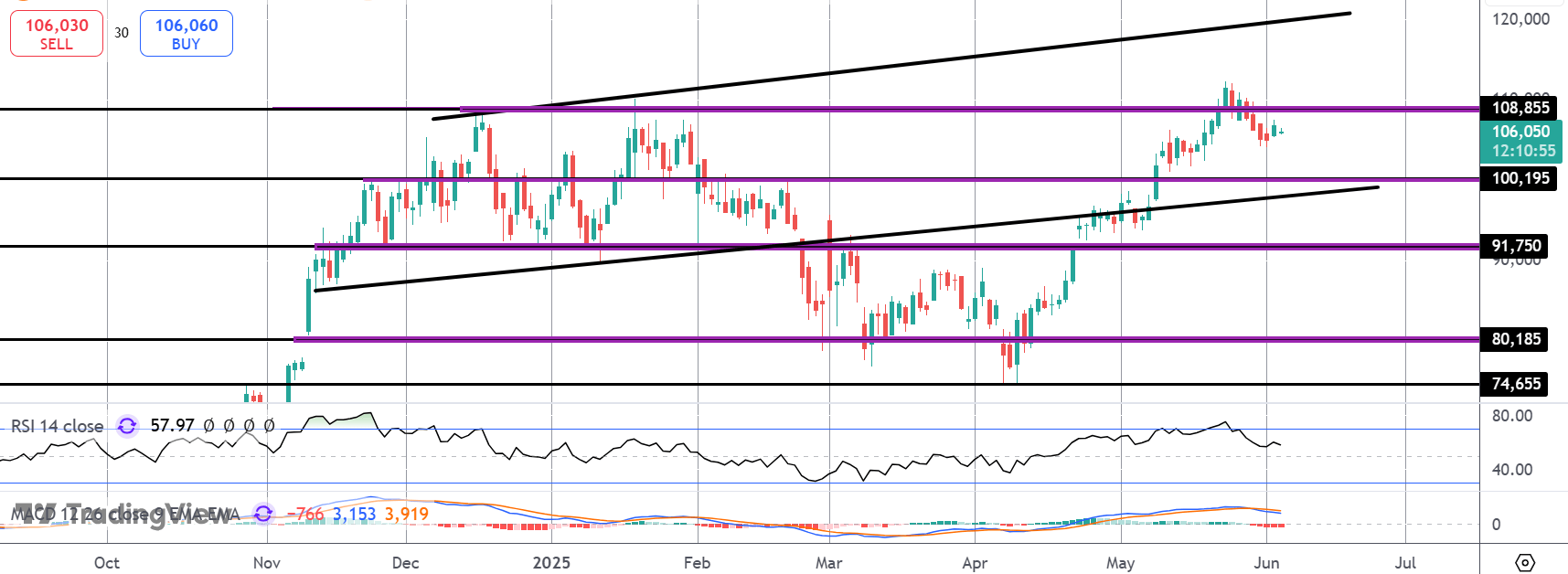

BTC

The rally in BTC has stalled for now with price pulling back under the $108,85 level. However, while the market holds above the $100k mark, and remains within the bull channel, focus is on a fresh break higher with a test of the channel top around the $120k mark the next objective for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.