BofA Crypto Flows to know

BofA Crypto Flows to know

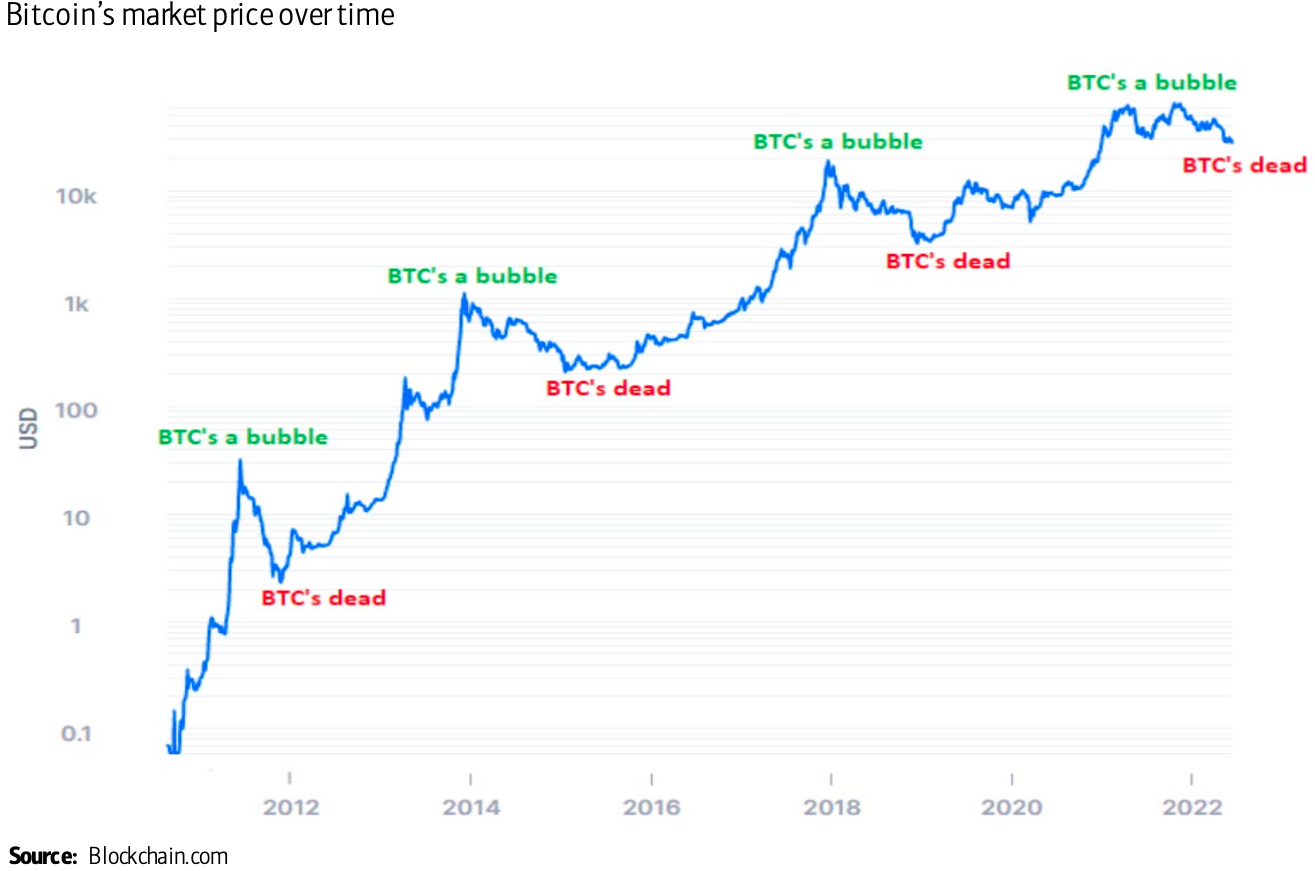

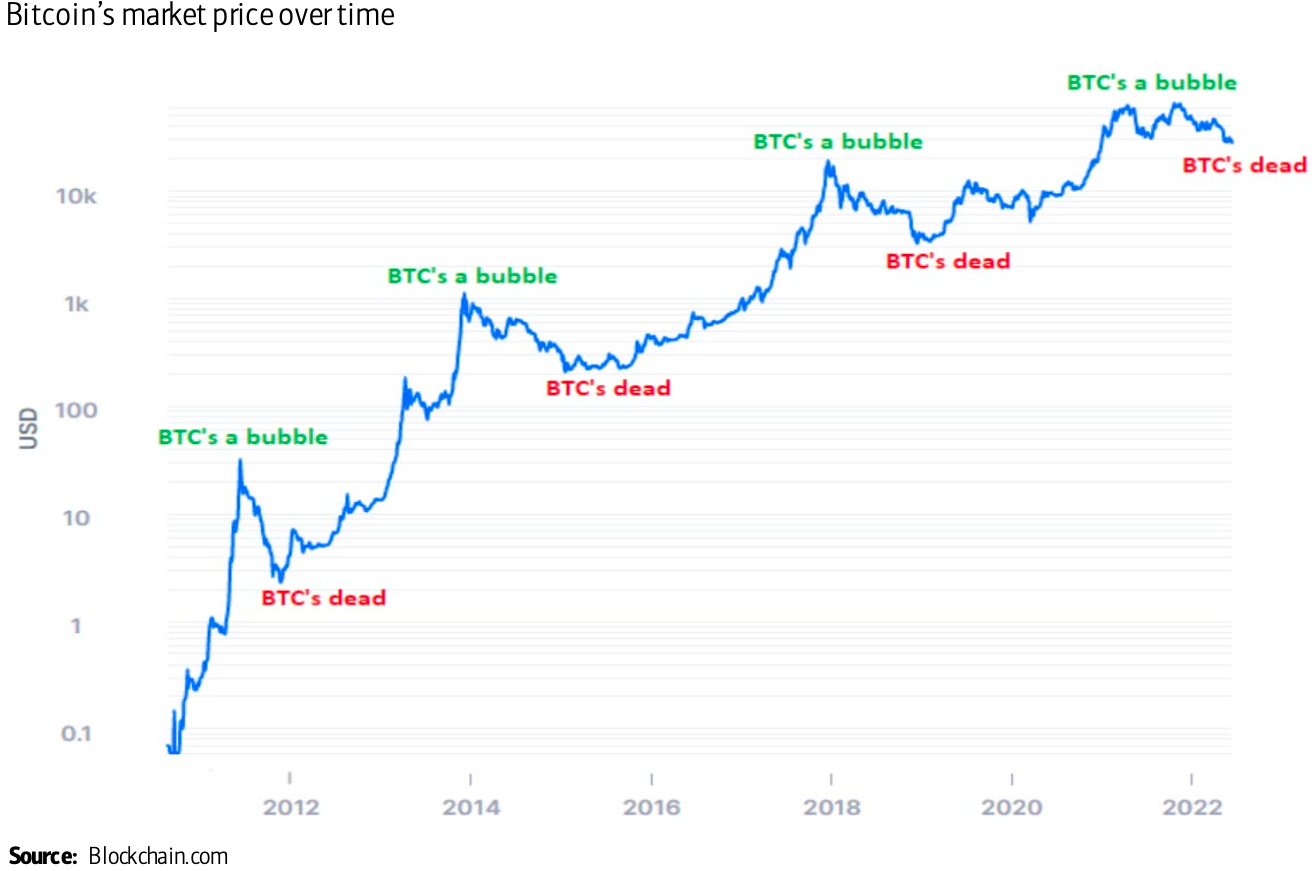

According to a report by BofA Digital asset's bearish positioning persists: Investors are continuing to position defensively following last year’s liquidity-driven digital asset bull market. Although painful, removing the sector’s froth is likely healthy as investors shift focus to projects with clear road maps to cash flow and profitability vs purely revenue growth. The digital asset ecosystem is an emerging high-growth speculative asset class with tokens that are exposed to similar risks as tech stocks. The upside is likely capped until risks associated with rising rates, inflation, and recession are fully discounted.

Weekly Flows: Large and continuous BTC exchange net outflows for 18 of the 23 weeks this year and tight supply with 65% of tokens in circulation last moved over 1 year ago indicate investors are increasingly HODLing as the Net Unrealized Profit/Loss (NUPL) ratio turned negative for the first time since Mar’20 (bullish). ETH saw exchange net inflows for the 4th consecutive week with last week’s net inflows 8.8x larger than the prior week’s (bearish). The top 4 stablecoins saw exchange net outflows last week that was 4.5x larger than the prior week’s and follow net outflows for 8 of the prior 10 weeks, indicating that investors remain defensive (bearish)

What can flows tell us about investor sentiment?

Tokens: transfer to exchange wallets means an increase in sell pressure

Investors generally prefer to hold tokens in their personal digital asset wallets and frequently transfer them to digital asset exchange wallets (net outflow) when they intend to sell them, indicating a potential increase in sell pressure. Large inflows into exchange wallets can quickly put downward pressure on prices. Conversely, investors transfer tokens from exchange wallets to their personal wallets (net inflow) when they intend to hold them (or “hold on for dear life” (HODL)), indicating a potential decrease in sell pressure.

Stablecoins: transfer to exchange wallets means a decrease in sell pressure

Stablecoins are digital assets pegged to another asset such as a fiat currency (like the US dollar), a commodity (like gold), other digital assets or a combination of assets with the goal of maintaining a stable value. Digital asset holders and traders use stablecoins to transfer funds between exchanges or between exchanges and personal wallets, reduce exposure to more volatile digital assets without converting digital assets back to a fiat currency, lock in gains from trading and as a safe haven if expecting a downturn or during a pullback.

My Technical Take on BTCUSD & ETHUSD

You can access my technical views on BTCUSD here & ETHUSD here

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!