Bitcoin Whipsaw Continues As Traders Struggle for Direction

BTC Attempting to Recover

Bitcoin is attempting to recover this week following heavy selling last week which saw the futures market slip more than 10%. The bulk of last week’s downside action came as the Dollar failed to break lower on the latest US jobs report. Despite the headline NFP undershooting forecasts, stronger wage growth and a lower unemployment rate saw USD ultimately trading higher on the back of the data, showing that the barrier to further downside in the greenback has been raised in the wake of July/August selling.

ETF Outflows

It's been a frustrating period for BTC bulls recently with the market grinding lower within the range which has framed price action over the last six months. The dynamics of the market have shifted materially following the launch of spot-BTC ETFs earlier this year, opening the market to institutional flows. Recently, industry data has reflected a strong spate of ETF outflows, keeping BTC pressured lower. Additionally, selling of seized crypto assets by US and European governments has also been a negative factor, as has the bankruptcy selling of the Mt. Gox BTC holdings. These sales have created a supply overhang which has weighed heavily on BTC, pulling the market lower by around 20% from the July highs.

Risk Aversion Hurting BTC

A large part of the downturn in BTC, however, can be explained through the pull-back we’re seeing in the broader risk complex. The emergence of US recessionary fears through August have seen US stock markets shedding gains. Lower trending US jobs data has seen traders focusing on downturn risks, taking the shine off expected Fed easing. Indeed, with traders now grappling with the prospect of more aggressive Fed action, the main focus seems not to be on easier financial conditions but on heightened economic uncertainty. Against this backdrop, BTC looks likely to continue to struggle near-term while traders await initial Fed action followed by the upcoming US elections in November.

Technical Views

BTC

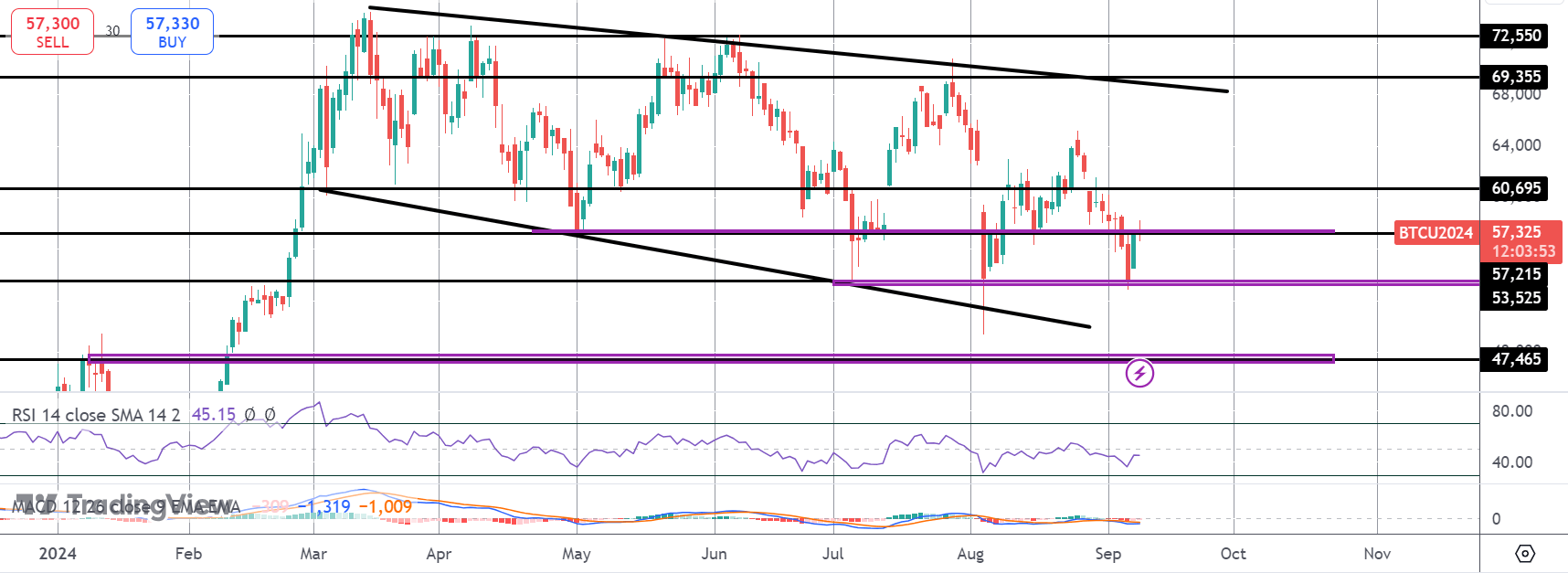

For now, the sell off in BTC has stalled into support at the 53,525 level. Price has since bounced and is now attempting to get back above the 57,215 level. This is an important pivot for the market and bulls need to reclaim this level to put focus on a fresh range-rotation higher or risk a deeper breakdown towards the channel lows and 47,465.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.