Bitcoin Bulls Hoping For A Break Tomorrow

BTC Stays Stuck… For Now

Following a recovery rally over last week, Bitcoin momentum has faded for now with the futures market settling into a tight range ahead of tomorrow’s FOMC meeting. While earlier in the year, Bitcoin had been trading a lot more like a typical risk asset, rallying on USD weakness and fading on USD strength, this dynamic has weakened over recent months. Part of this is due to the supply overhand created through the government selling of seized BTC in both the US and Europe. Additionally, the return of BTC held by collapsed broker Mt. Gox to its creditors has also distorted order flow recently.

Fed Impact

Looking ahead, however, there is room for BTC to push higher if we see a decisive move lower in USD linked to Fed easing tomorrow. A larger .5% cut and a firm signal that further easing is coming should be enough to drive new lows in DXY and a fresh rally in the risk complex. Ultimately, this should help BTC rally near-term.

US Elections Uncertainty

One further issue creating headwinds for BTC near-term, however, is the upcoming US elections. BTC had been rallying through early summer on increased expectations of a Trump win. Seen as a pro-crypto candidate, Trump’s promises to ease back regulatory restriction on the crypto sector fuelled speculation that a new ‘crypto boom’ was coming. However, with Trump’s polling results since trailing off and Harris gaining across the board, this ‘crypto boom’ looks less likely to materialise.

Technical Views

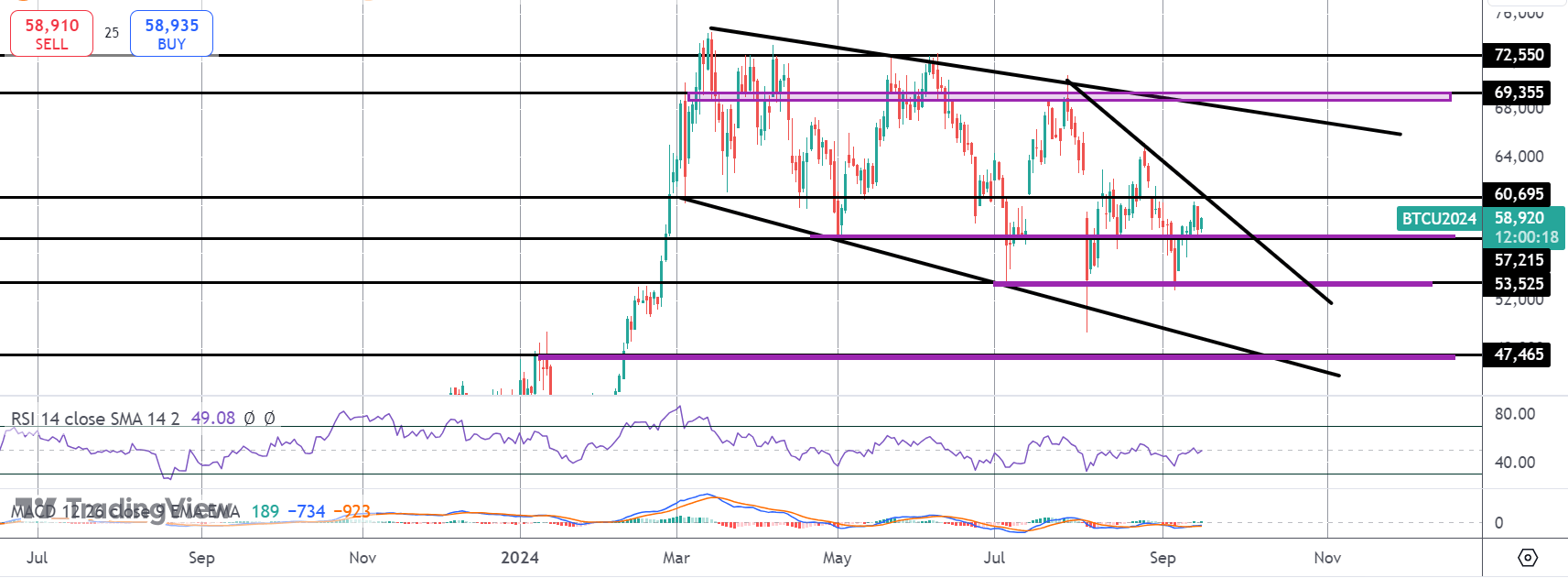

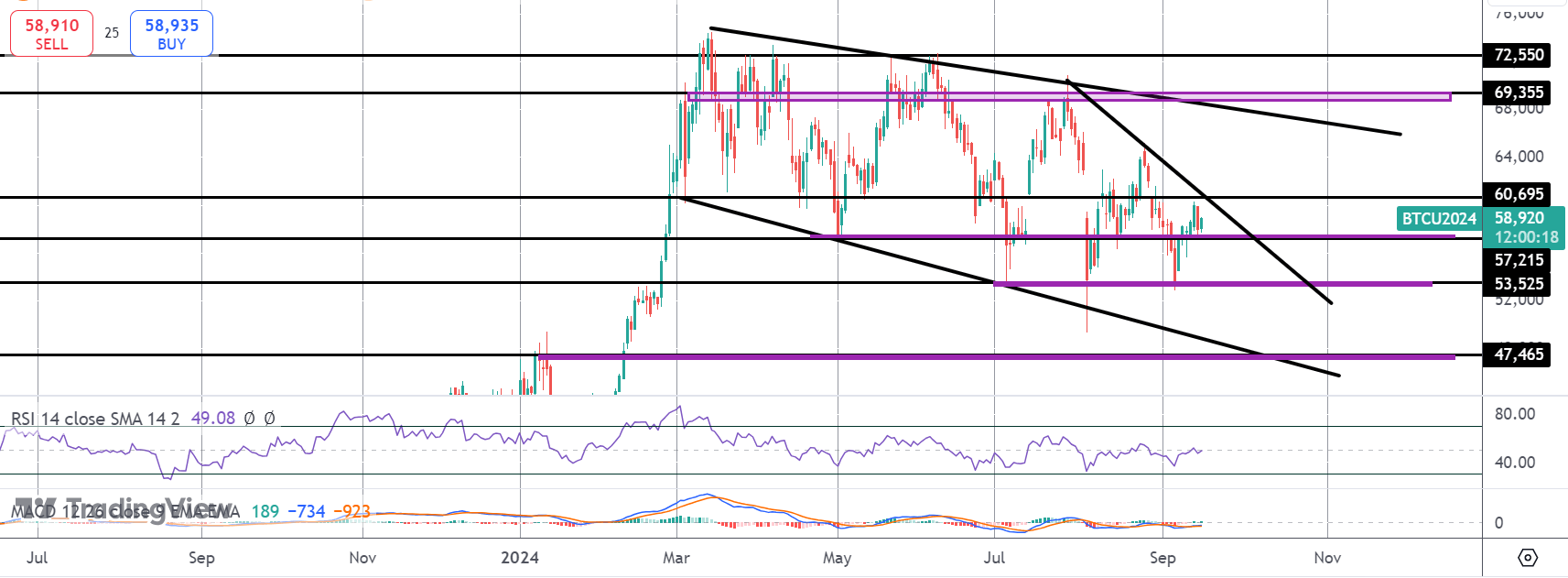

BTC

While BTC has continued to track the bear channel lower, 53,525 has remained strong support. While this level holds, the correction lower from YTD highs can be viewed as a bull flag, keeping focus on a n eventual upside break and continuation higher. Above 60,695, the channel highs and 69,355 level will be the next bull objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.