Bitcoin Bulls Biding Time

BTC Holds Near Highs

Bitcoin prices continue to hover below all-time highs as move through the back end of the week. Price have been rotating within a sideways range recently with the market stuck in consolidation mode following the pullback from the $105k highs. A weakening of institutional inflows has stifled the rally for now though bulls are looking at current price action as merely an interim period before a fresh rally next year as Trump takes office. Indeed, recent comments from Trump have underscored that bullish outlook.

Trump Pledges Crypto Support

Appearing at the NYSE opening bell this week, Trump was asked about the prospect of a US strategic Bitcoin reserve. While he didn’t answer the question out-right he did promise support for the crypto sector as a whole. As such, traders are now keenly awaiting him taking office to get a first glance at what this support will look like.

Texas Bitcoin Reserve

There was a further milestone for Bitcoin this week with legislation being introduced in Texas aimed at establishing a strategic Bitcoin reserve for the state. Given that Texas is the second largest economy in the US and has the largest percentage of crypto miners, the move is significant and further encourages expectations that a nation-wide strategic reserve is likely to be actioned under Trump.

Technical Views

BTC

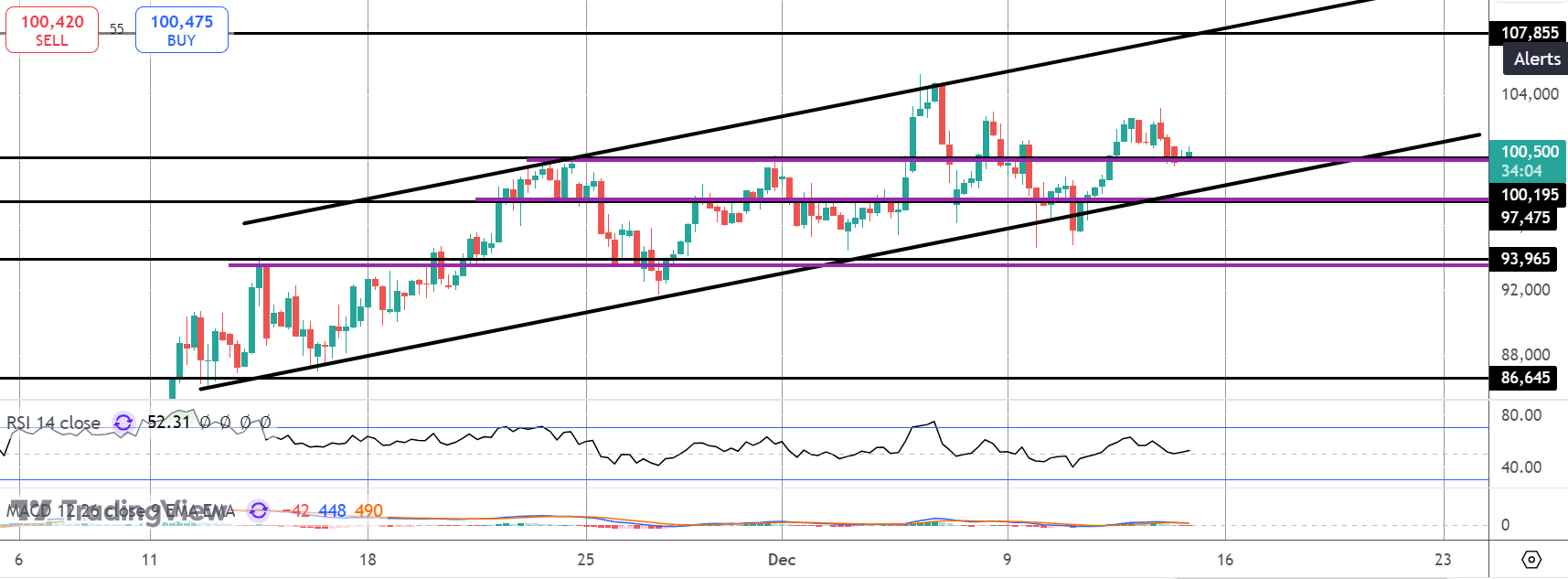

For now, BTC remains atop the $100k level and still within the bull channel, keeping focus on a fresh push higher. Momentum studies have flattened out, reflecting the loss of a clear directional push recently, meaning we could still see a correction lower before a fresh ascent. If we break below the channel and the $97,475 support, $93,965 will be the next support to watch. Topside, $107,85 will be the next bull target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.