Bitcoin Breaks Out on Fed Rate Cut

Fed Cut Boosts Bitcoin

Bitcoin prices have broken out to their highest level in three weeks on the back of yesterday’s FOMC meeting. Trading higher amidst the broad pick up in risk appetite on the back of the Fed’s .5% rate cut, BTC is now up around 18% off the September lows. The pickup in demand suggests that ETF inflows are back in action following a lull over recent weeks as trader’s braced for the Fed meeting.

BTC Shrugs Off Downside Risks

There was plenty of speculation ahead of the meeting regarding how a larger Fed rate cut might impact BTC. One view was that a larger cut would signal a higher level of concern among Fed policymakers, spooking markets and sending BTC lower amidst a drop in risk appetite. However, Powell’s reassurance around the health of the labour market and his insistence that larger cuts are not to be expected appear to have smoothed any negative impact from a larger cut. Traders instead are focusing on the projected 1.5% of easing within the update dot plot forecasts through the next year which should keep risk appetite well supported provided jobs data doesn’t spiral lower.

Trump Headlines

Alongside the developments at the Fed, BTC is also receiving a boost today from the latest headlines around Trump. The presidential candidate was seen paying with Bitcoin at a University burger bar in New York last night, a publicity move as part of his ongoing attempts to woo the crypto community. The move reaffirms Trump’s commitment to Bitcoin, raising the prospects of a fresh ‘crypto gold rush’ should he win in November.

Technical Views

BTC

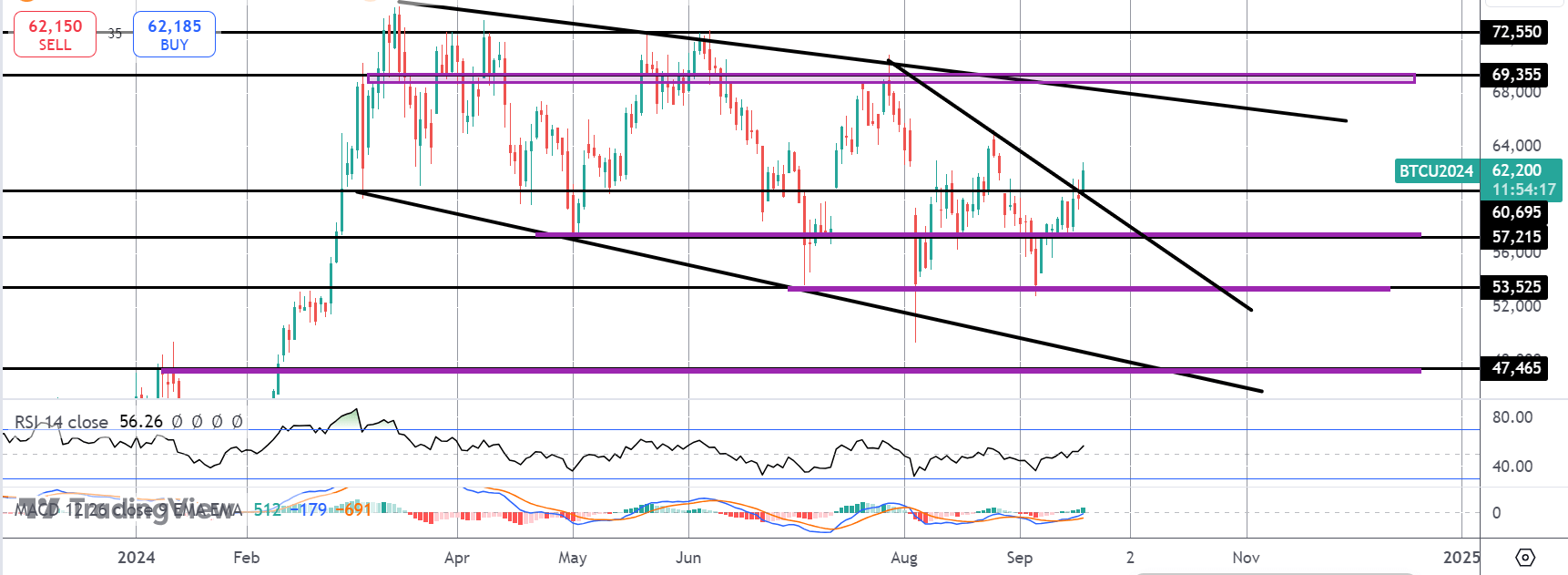

The rally in BTC has seen the market breaking out above the 60,695 level and above the bear trend line from July highs. While above here, the focus is on a continued push higher and a test of the bear channel highs next, with 69,355 above. To the downside, 60,695 and 57,215 remain key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.