Big Volatility Risks For USDJPY Into Fed & BOJ Meetings

USDJPY Lower Ahead of Fed

USDJPY is weakening again today ahead of the FOMC decision later today. This will be an important week for the pair with the Fed tonight and the BOJ on Friday. It was central bank week at the end of July which amplified the selling through August following a dovish Fed meeting and a hawkish set of measures by the BOJ which hiked rates and reduced bond purchases simultaneously. Divergence between the Fed and BOJ has been a key driver of the downside we’ve seen in the pair over summer. The recent uptick in dovish Fed expectations has seen the pair pushing lower again in recent weeks to trade fresh lows for the year.

Fed Expectations

This week, expectations are split around whether the Fed will opt for a smaller .25% cut or a larger .5% cut. The risk is that if the Fed goes smaller, dovish market expectations will be underwhelmed leading to a short-covering rally in USD. If this is the case, and the BOJ holds rates steady on Friday as expected, we could see a USDJPY recovery rally near-term. On the other hand, if the Fed opts for a larger .5% cut this could open up fresh downside in the pair, particularly if we hear a hawkish message from the BOJ on Friday. The bank has recently reaffirmed its commitment to further tightening and is widely expected to maintain this tone on Friday.

Technical Views

USDJPY

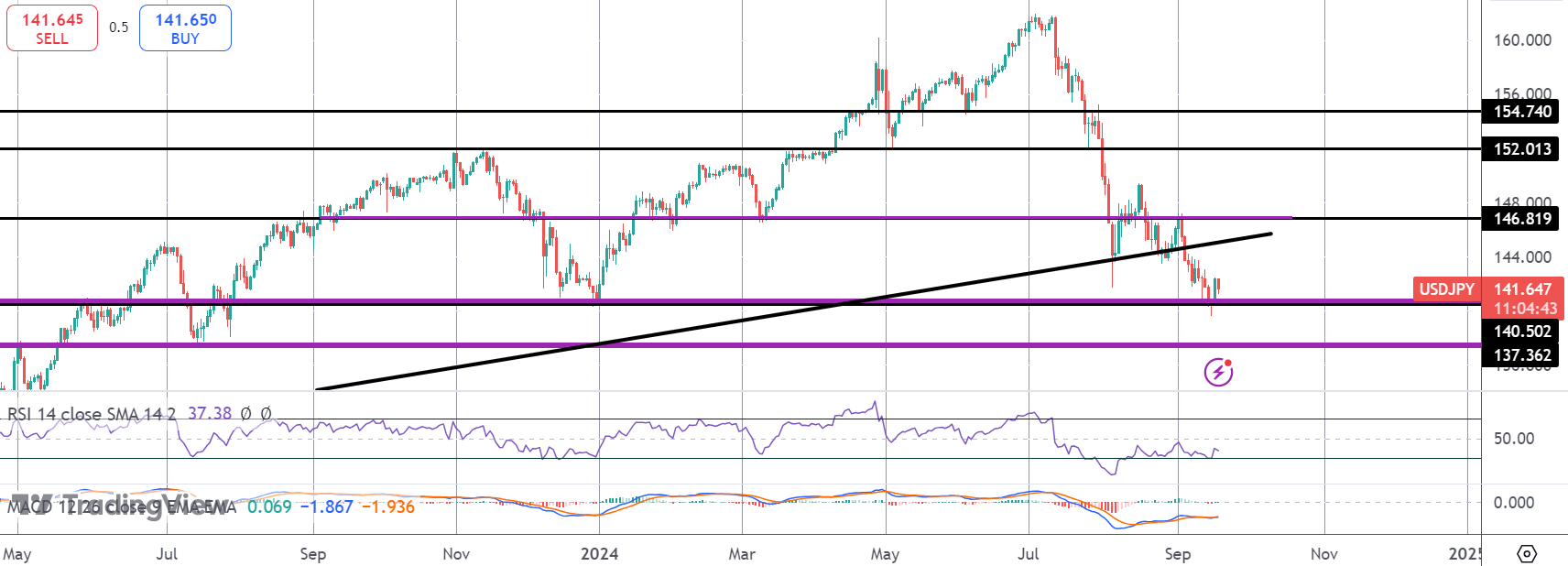

The sell off in USDJPY has seen the market breaking down to fresh YTD lows. Price recently pierced below the 140.50 level, but is holding back above the level for now. On the back of recent losses, the pair remains vulnerable to further downside with 137.36 the next support to watch. Topside, bulls need to get back above the broken bull trend line and the 146.81 level to alleviate near-term bearish risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.