AUDUSD Firms On Hawkish RBA Comments

AUD Firmer on Tuesday

The Aussie Dollar is starting the week on a slightly firmer footing. Following the breakdown below the .6520 level in the middle of the month the sell off has since stalled with the pair consolidating below the level for now. On the back of the heavy decline from the .6857 level in July, the outlook remains bearish for AUDUSD while below .6520.

RBA Governor-Designate Warns Over Climate Impact

Comments from RBA governor-designate Bullock have helped underpin the Aussie today. Bullock warned that extreme weather scenarios might have an upward impact on inflation, reducing supply in the market. However, Bullock was clear to stress that the impact on inflation was not clear and as such volatility could be seen in either direction.

Falling RBA Tightening Expectations

AUD has weakened recently on falling expectations of further RBA tightening this year. Currently, the market pricing for an ‘unchanged’ decision in September is sitting around 95%. However, the bank has warned it will remain data dependent going forward meaning, should we see any surprise uptick in inflation, further rate hikes might still be seen. Should inflation continue lower, however, AUD looks likely to continue to depreciate near-term.

Technical Views

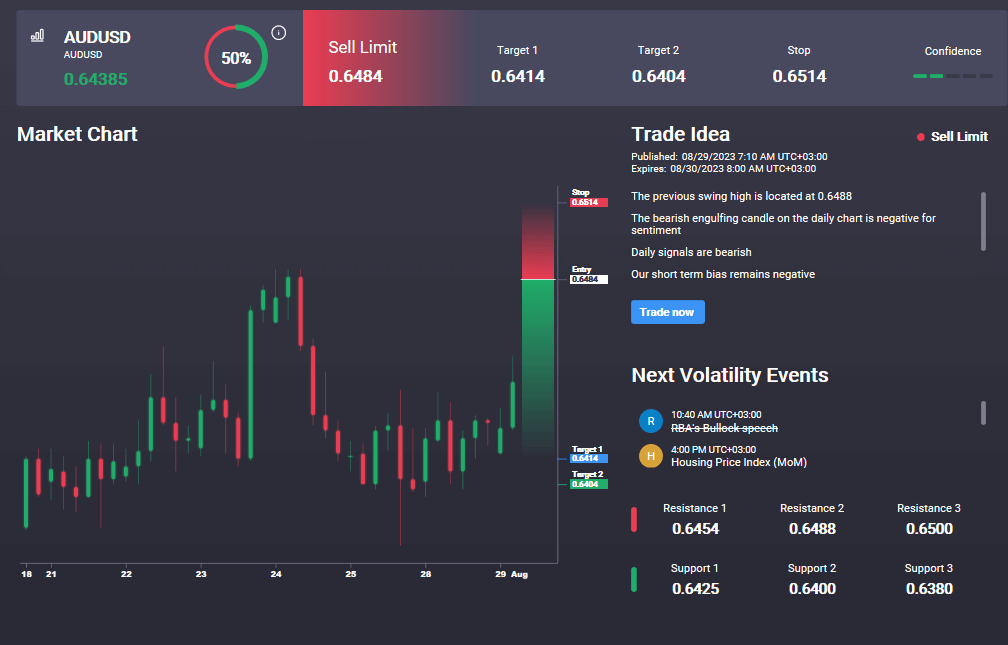

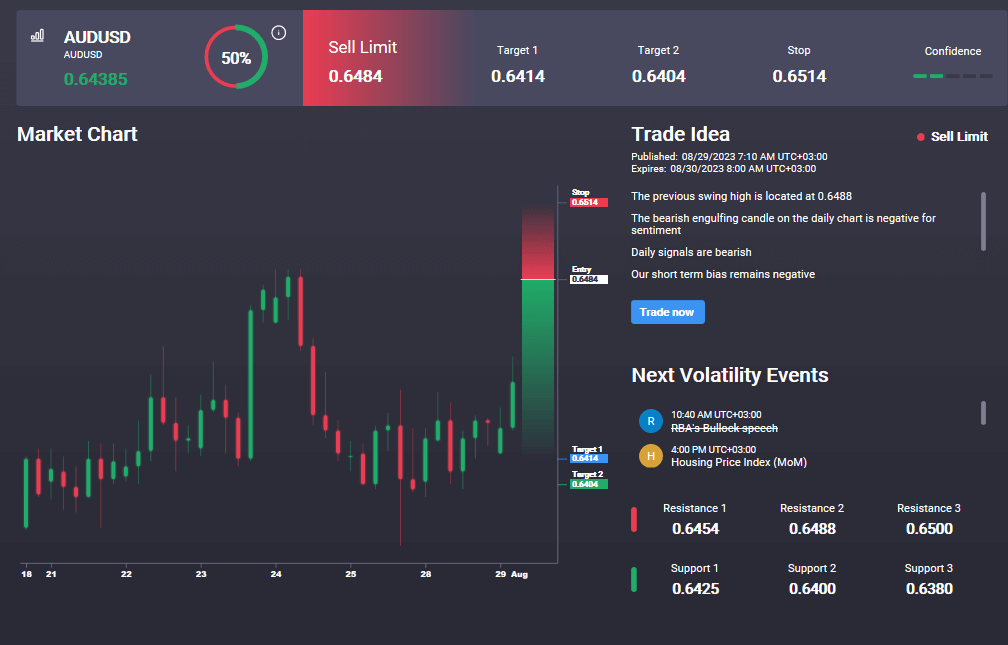

AUDUSD

The break below the .6520 level is a firmly bearish development for the pair. While below here, the focus is on a continuation lower towards the .6275 level next. Only a break back above .6520 will alleviate near-term bearishness, in which case focus will turn back to a test of the .6681 level and the bearish trend line. In the Signal Centre today we have a sell signal in the pair set above market at .6484 targeting a move back down through .64.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.