Are Bearish Risks Building in Bitcoin?

Bitcoin Lacking Direction

It’s been a non-eventful week for Bitcoin prices with the futures market stuck in heavy congestion below the $100k mark. Price action has been up and down throughout the week with the market currently sitting just above the weekly opening price. There has been an absence of direct drivers for crypto markets this week with focus falling on developments elsewhere. US inflation and the prospect of Russia-Ukraine peace talks have been the key focus for traders, with one offsetting the other in terms of market impact, adding to the current malaise in Bitcoin.

Trump Trade Fizzles Out

A lack of crypto news from Trump has clearly frustrated bulls though the market continues to find support on any moves lower. The broad view is that at some point Trump will start to make good on the campaign promises he made to the crypto community, at which point the bull trend will resume and BTC will see new highs. However, the risk is that Trump is pushing crypto further down his list of priorities while he tackles big ticket items.

Bearish Risks

The longer we go without any crypto positive news from Trump, the more likely we are to see institutional demand fade and be redeployed elsewhere, leading crypto lower. Additionally, there is a growing risk that Trump doesn’t follow through on those campaign promises and doesn’t pursue a strategic US Bitcoin reserve, which is seen as the main saviour for crypto bulls. If traders get a sense that such a reserve isn’t coming, Bitcoin is vulnerable to a meaningful move lower.

Technical Views

BTC

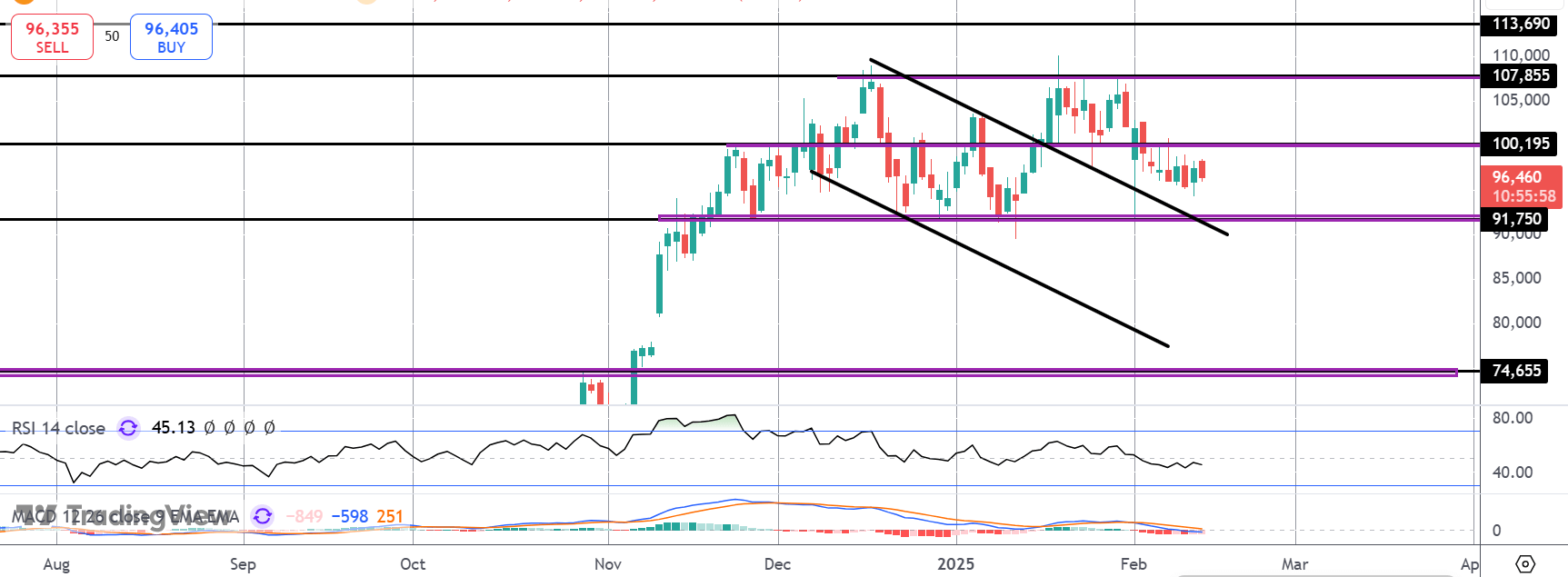

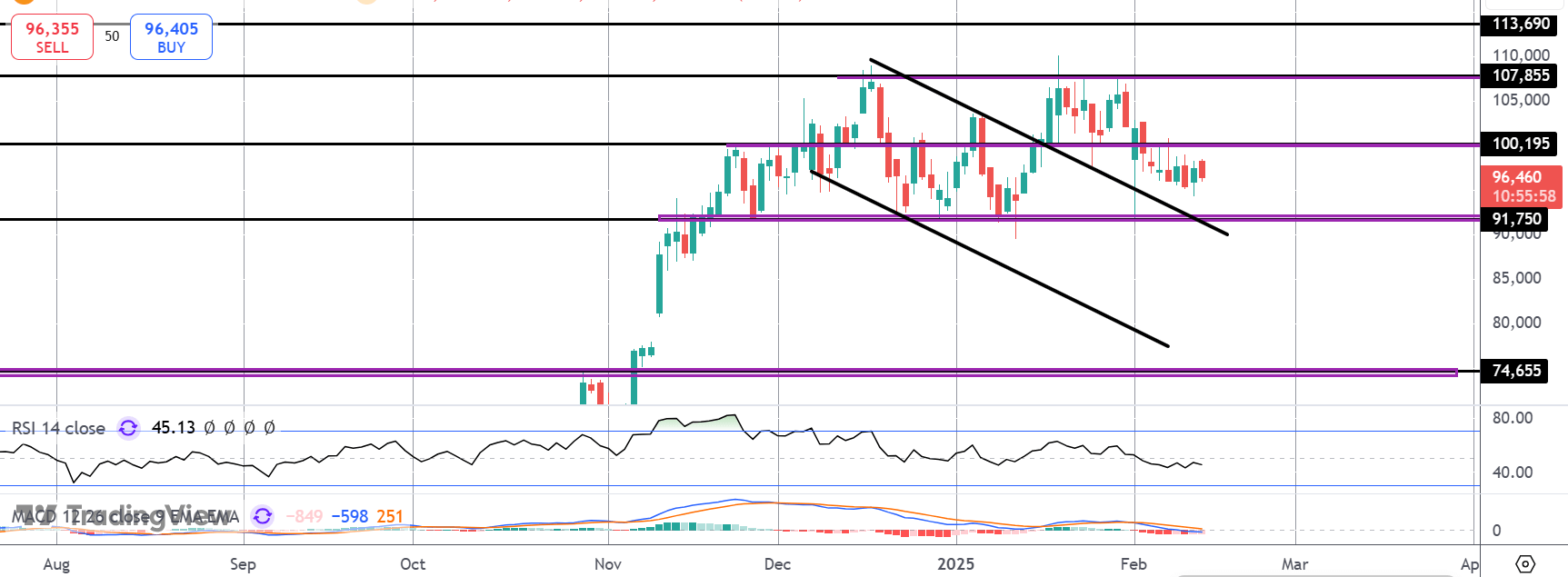

For now, Bitcoin remains in the lower portion of the 91,750 – 107,855 range. While range support holds and price remains above the broken bear channel, focus is on an eventual push higher and a breakout to 113,690 medium-term. If range support fails, however, focus will turn to 74,655 as the longer-run bear target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.